FTX.com Review and Tutorial

Last Update:

8th February 2026

FTX.com is one of the largest crypto exchanges worldwide and also has many customers in Germany. We explain here how FTX works and how you can trade Bitcoin and Co. there. In addition, we also give you information about the special features of FTX and the general advantages and disadvantages of this platform. With our link (here) you save another 5% fee when registering.

FTX was founded by Sam Bankman-Fried and Gary Wang and went live in May 2019. Bankman-Fried has a past as a Wall Street trader and Wang worked at Google as a software developer. Prior to FTX, the two founded Alameda Research, an asset manager specializing in cryptocurrencies. In December 2019, the world’s largest crypto exchange Binance joined FTX.com as a strategic partner. With the fresh capital, FTX was able to set its expansion course. FTX.com is registered on the Caribbean island nation of Antigua and Barbuda.

Exchange

Rating

Features

Link

As with other crypto exchanges, you can buy and sell cryptocurrencies normally at FTX. The normal trading of cryptocurrencies, where you end up owning the cryptocurrency, is called spot trading. Well over 100 different cryptocurrencies can be traded via FTX.com.

In addition, there is also an extensive futures market (derivatives). This allows you to trade a large number of cryptocurrencies on FTX via leverage and also short them. In addition to spot trading and futures trading (derivatives), shares and so-called prediction markets can now also be traded on FTX. In the prediction markets you can bet on the outcome of an event, for example, an election. The prediction market was especially popular during the last US election.

Ultimately, FTX became so popular with traders because the platform simply offers a variety of trading instruments that are often not found on other platforms.

As far as deposits are concerned, Euro deposits and withdrawals can now be made via bank transfer and credit card. This is one of the reasons why FTX has established itself more and more as a Binance alternative. While futures trading and deposits and withdrawals via bank transfer are no longer possible for German investors at Binance, investors can use these and other features at FTX without any problems. Thus, FTX currently has some advantages over Binance and almost no disadvantages.

- 2. Verification is not required

- 3. Send crypto assets to the exchange to trade with it

- 4. Now you can already buy coins on FTX

Pros and Cons FTX

Registration at FTX.com

The registration at FTX is kept simple, for the start it is enough to enter an email address and a password and to confirm the account. With this level 0 customer status, however, you can withdraw a maximum of $1,000 or the equivalent in crypto.

Level 1 as a customer at FTX means that you can withdraw up to 2,000 US dollars in crypto daily at FTX. To reach this level, you also need to provide name and the country you reside in. However, this is not verified.

With level 2 you are entitled to withdraw unlimited crypto at FTX.com. For Level 2, you will go through a typical KYC procedure to confirm your identity. You will need a passport or ID card and a recent document such as a bill confirming your home address. Then you upload a photo of yourself holding your ID and a piece of paper with the current date and “FTX” written on it.

For Level 3 and unlimited fiat deposits and withdrawals, you will also need to upload a copy of a recent bank statement from the bank account you wish to connect to FTX during the verification process.

You start the registration process with FTX by clicking on “Register” in the upper right corner of the FTX.com website. Level 0 and Level 1 are usually activated within minutes. The KYC procedure for Levels 2 and 3 is also quick, but confirming them can take a business day or longer.

To increase the security of your customer account at FTX, we recommend activating two-factor authentication. FTX uses the Google Authenticator (GA), which makes the private smartphone the second factor for logging in. Furthermore FTX offers the possibility to set up a second password especially for withdrawals. These options are automatically offered to you during the registration process, but you can also activate them later under your profile.

Video: How to use FTX.com

How FTX works and how you can trade there we explain in the video.

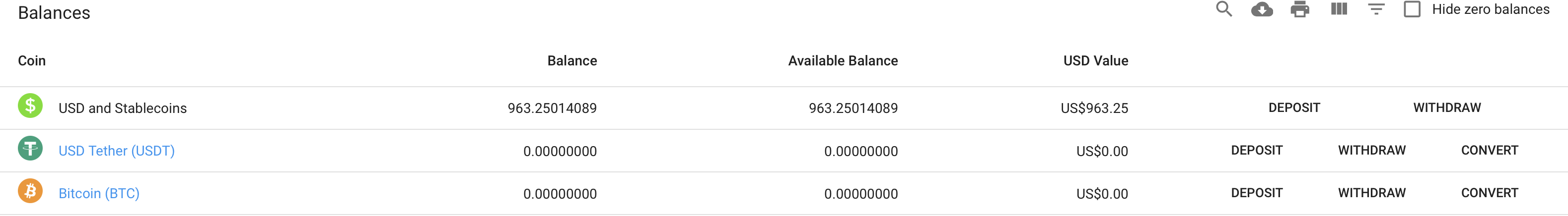

Deposits and Withdrawals at FTX

Basically, FTX.com allows deposits and withdrawals in crypto as well as in fiat (Euro). To deposit Bitcoin and Co., click on “Deposit” under “Wallet” and the desired cryptocurrency. You will then be shown a wallet address to which you can send your crypto funds. Normally, this should be credited to your wallet at FTX in less than an hour and from then on you can start trading. It works the same way with withdrawals in crypto, the transaction fees in this case takes over FTX, which is customer friendly. FTX prefers to trade with the stablecoins TrueUSD (TUSD), USD Coin (USDC), Paxos Standard (PAX), Binance USD (BUSD) and HUSD.

For deposits and withdrawals in fiat you use your bank account. FTX supports SEPA transfers, which results in low fees and acceptable speed. You have to transfer the money to Deltec Bank. The bank is well known for its cooperation with Tether. Fiat deposits are free of charge on the part of FTX, for withdrawals lower than 10,000 US dollars a fee of 75 US dollars is charged. I have also made a video about deposits and withdrawals. In this video I explain everything important again in detail.

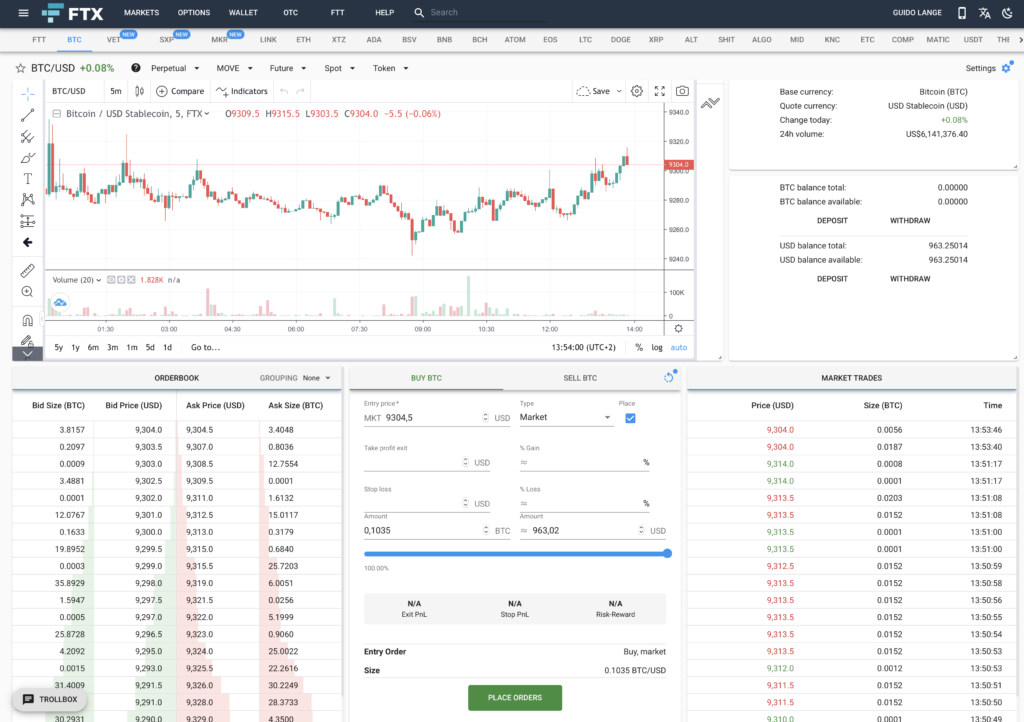

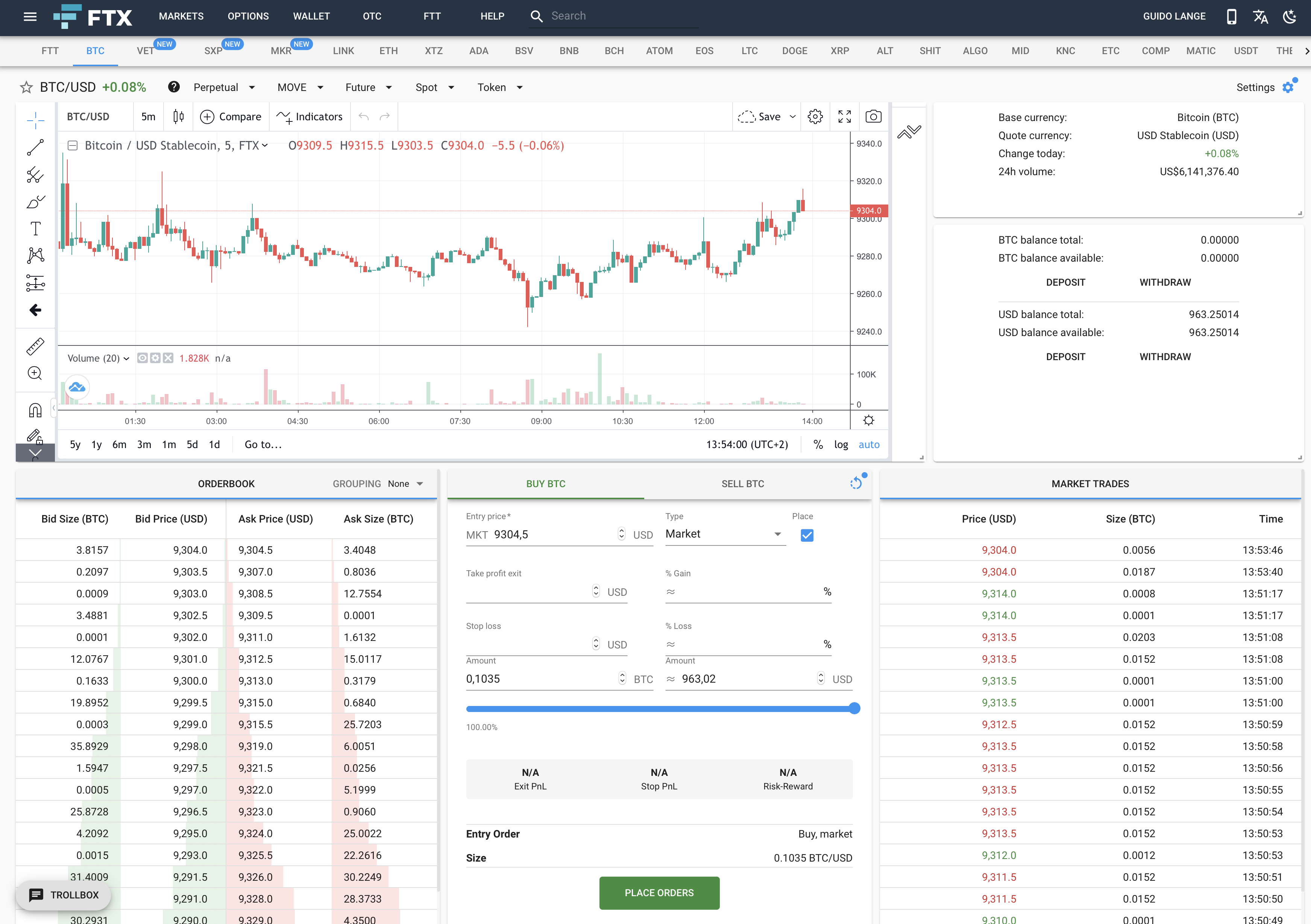

This is how trading on FTX.com works

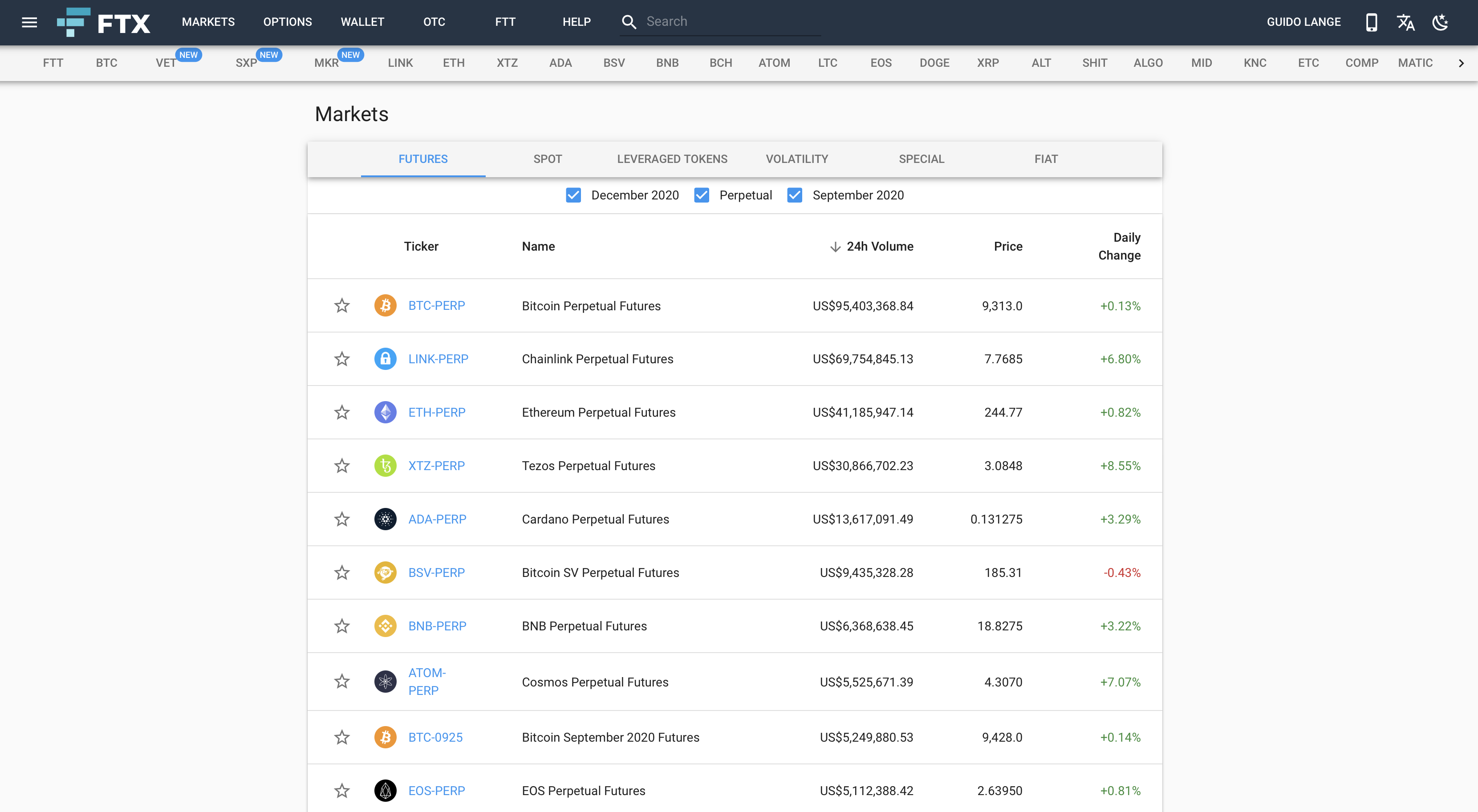

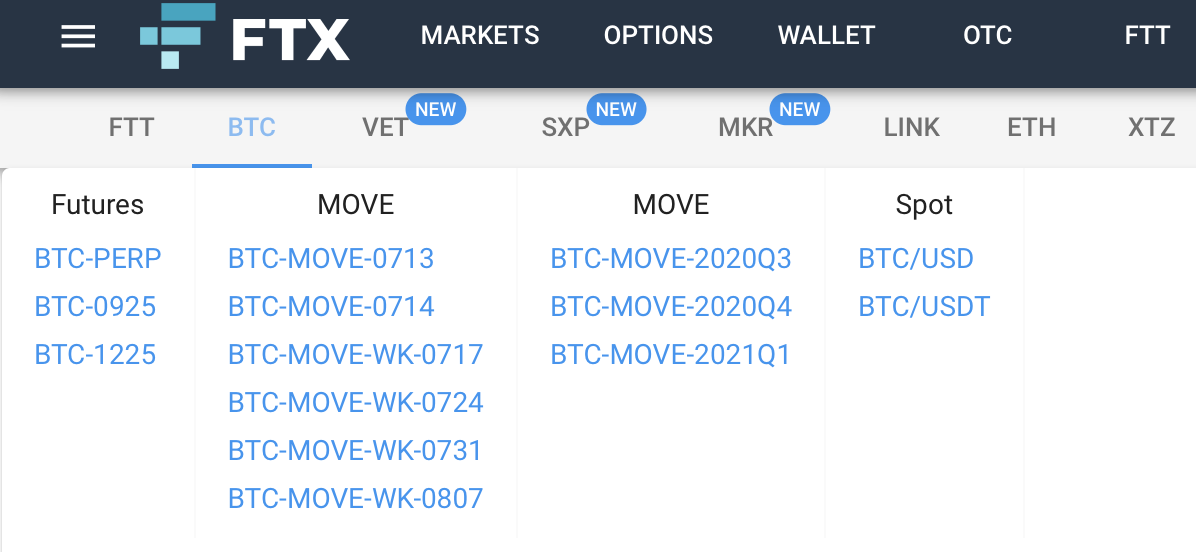

When you are logged in to FTX, you start trading either by clicking on “Markets” in the top line or by clicking on the cryptocurrency you want to trade in the line below. In the case of Bitcoin (BTC), for example, you will then immediately see which options exist in addition to the spot market.

Clicking on “Markets” will first take you to the overview of traded futures at FTX.com, sorted by volume over the past 24 hours. Here you can immediately see that Bitcoin futures are by far the most important commodity traded on FTX, followed by Ethereum (ETH) futures. In this view, you will see the ranking on the spot market under “Spot” and the other contracts that FTX offers under the other tabs. “Special” takes you here to the special offers FTX has put together, including altcoin futures that track an index of ETH, XRP, EOS, Litecoin (LTC), Bitcoin Cash (BCH and BSV), and Binance Coin (BNB), for example.

The box that triggers a trade can be found in the center of the bottom screen in the desktop version of FTX. Depending on the financial product you are trading, the appropriate options are also displayed there, such as market order or limit order, i.e. immediate execution at the market price or execution at the price you have set. Via “Buy” you buy, i.e. go long, via “Sell” you sell, i.e. go short.

A market order and a limit order differ as follows.

Market order: Here you only enter how much balance you want to invest (e.g. 1000 US dollars) and the order will be executed immediately at the best possible price.

Limit Order: With this type of order you enter not only how much money you want to invest, but also at what price. You can say that you want to buy only when the price falls to a certain level.

The bar with “Leverage” allows you to trade with leverage. FTX usually allows you to trade with a leverage of up to 101 – but this brings you closer to a casino than to serious and thoughtful trading. Margin trading is generally not for beginners, before you get involved in trading with leverage, you should definitely familiarize yourself with the details in a testnet. Because leveraged trading not only means the chances of higher profits, but also includes the risk of total loss. With a leverage of 100x, for example, you will be liquidated if the price falls by only 1%. With the maximum leverage of 101 FTX allows itself a PR stunt with regard to competitors who cap margin trading at leverage 100.

Futures trading on FTX

Bitcoin futures and crypto derivatives have established themselves on the crypto market. The trading volume of derivatives is already twice as high as the spot trading volume of cryptocurrencies.

With futures, you always trade on the price development of a standardized commodity. FTX has become one of the three most important crypto exchanges for Bitcoin futures in terms of turnover, so you can always assume sufficient liquidity at the trading venue, even for large sums. The same applies to Ethereum futures at FTX.com. Another important plus point for FTX is that futures are offered for more than two dozen other altcoins, both short and long.

It is important to know the difference between perpetual futures on the one hand, which do not have a fixed expiration date and therefore a funding rate is charged as a risk premium. These contracts are identified at FTX by the abbreviation “PERP”, e.g. for Bitcoin with BTC-PERP and for Ethereum with ETH-PERP. Please note that FTX.com charges and collects the funding rate hourly.

In addition, you can also find classic futures with an expiration date at FTX. In this case, settlement takes place on the date specified in advance and the funding rate does not apply. At FTX, the expiration date is noted in the abbreviation of the respective security in the American way, “1225” therefore means December 25. So in the example contract you could stay in until December 25th at the most. On this contract the position will be closed automatically. It does not matter whether you are in the plus or minus. No matter what kind of futures you want to trade: Especially when using additional leverage, think about the risk of loss.

Video Tutorial How to Trade Futures on FTX

Spot Market on FTX.com

Spots map the current prices on financial markets, here you buy or sell cryptocurrencies at FTX against US dollars in stablecoins. So you trade the actual cryptocurrencies here and are then also the owner of the purchased cryptocurrencies when you buy them. You can also withdraw your coins from the exchange at any time. There are no fees for holding cryptocurrencies on FTX.

Leveraged Token on FTX.com

Another way to profit from price developments of leading cryptocurrencies are leveraged tokens. FTX forms this financial instrument for Bitcoin, Ethereum, EOS and XRP, among others, you can find the complete list under “Markets” and then the sub-item “Leveraged Token”. They carry a “BULL” in the abbreviation for bull market when the price is positive and “BEAR” for bear market when you expect the price of the respective cryptocurrency to drop. FTX.com also has leveraged tokens for its own indexes such as the Dragon Index.

In simple terms, leveraged tokens are an investment in a coin with leverage automatically built in. At FTX, this is usually a value of 3, so each investment is theoretically tripled. Although FTX also has leveraged tokens with smaller leverage, these achieve little liquidity and can therefore be neglected. FTX.com manages the investments in leveraged tokens close to real time, so reduces the deposits in case of price developments that point in a different direction than in the leveraged token itself. Leveraged tokens are technologically designed as ERC-20 tokens and settled daily. In the crypto scene, leveraged tokens are controversial because of their high level of risk. But they also make it conceivably easy to be rewarded with multiple profits if you have the right nose for price developments.

OTC Desk on FTX.com

OTC stands for “Over the Counter (Desk)”, i.e. direct trading. Here, investors trade large sums of 1 million US dollars and more. This is offered because larger buy and sell orders could quickly cause the order book and thus the price to fall. To prevent these price fluctuations there is the FTX OTC Desk.

At FTX you will be forwarded to a separate webpage and can start trading there without any fees. For this purpose, your normal account at FTX.com is sufficient, with which you set up an extra wallet for trading at FTX OTC. There you can also deposit fiat. With a click on “Get Quote” you get the current prices that are currently offered for your desired trading. OTC Desk is especially worthwhile for larger trades, as there are no fees. However, a comparison with data from CoinMarketCap, for example, makes sense, since the prices at FTX.com’s OTC Desk are not formed via an exchange, but also via direct trading.

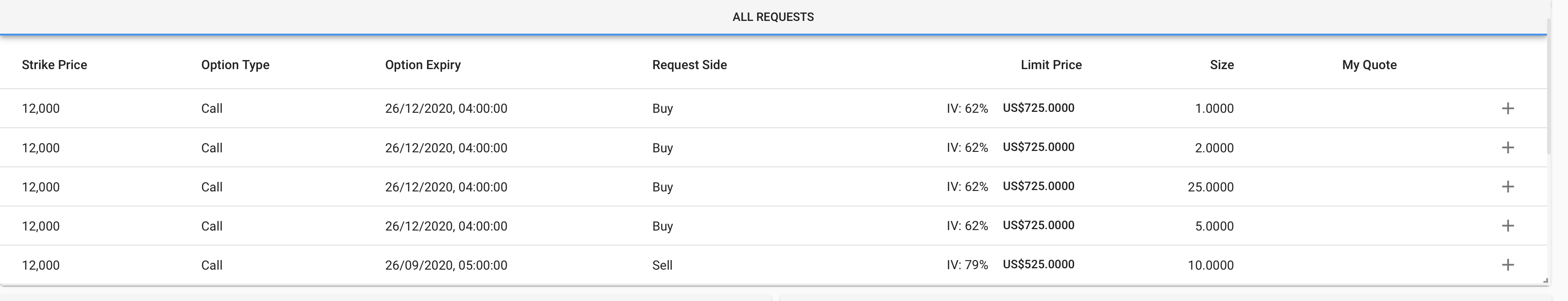

Trading at FTX with Options

Options are a financial instrument closely related to futures. The crucial difference is that options – as the name suggests – are optional. With Bitcoin options you bet on the price development of BTC. “Call” means that you assume rising prices and with “Put” you will profit from price losses. As usual, you can also trade options with leverage at FTX.com, but keep an eye on the expiration date of the options and think about the risk premium.

Stock trading on FTX

In the meantime, shares are also traded on FTX. The shares traded are mainly those of large American tech companies such as Amazon, Tesla, Google and Alibaba. The share product consists of tokens that are linked to the price of the share. The whole thing is hedged by the German broker CM-Equity AG. The special feature is that the tokens can also be traded outside of regular trading hours and on weekends. So you are no longer bound to the trading hours of the classic stock exchanges.

With the so-called tokenized stocks you have the same rights as normal shareholders. This means that if a company pays dividends, you will also receive them at FTX. In addition, you do not have to buy whole shares, you can also buy only 0.1 parts of a share. This is an advantage especially with very expensive shares like Amazon. Another advantage of FTX is that you can lend the shares for margin traders, which is relatively safe. Thereby you get partly 20% interest (p.a.) on individual shares. There is no fixed period of time. You can get your shares back at any time within one hour.

Especially interesting for investors is the possibility to buy pre-IPO tokens of shares. These were particularly popular during the Airbnb IPO, for example. There, investors were able to profit from the share price increase even before the IPO. A similar concept existed with the pre-IPO shares of Coinbase, which were also traded on FTX.

Unlike with German providers, capital gains tax is not automatically deducted when selling shares on FTX. So you have to take care of it yourself if necessary. However, this has the advantage that you can dispose of the money longer (until the next tax return) than if it were paid immediately.

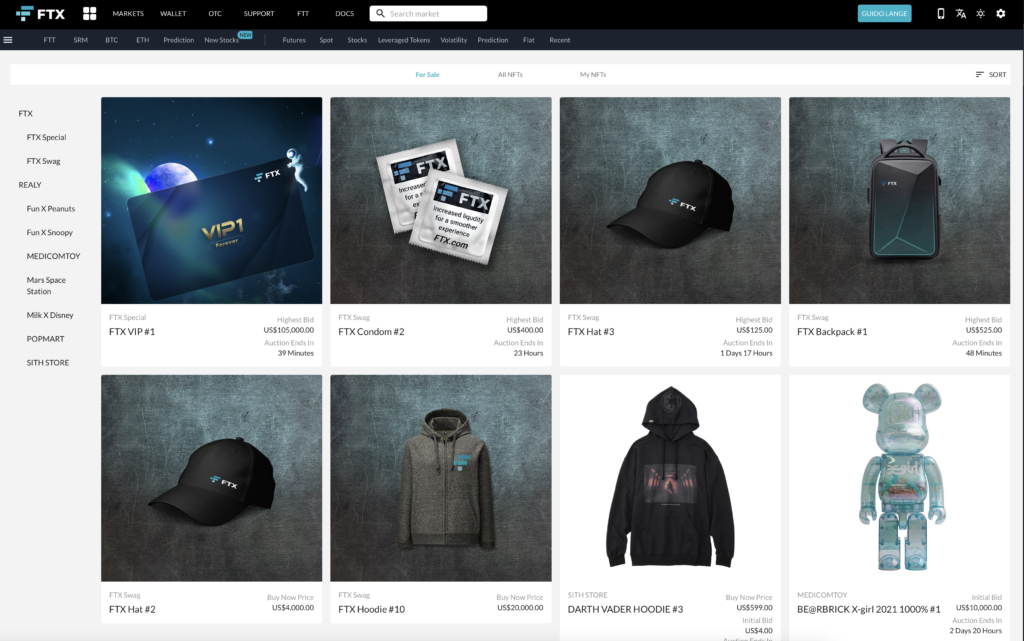

NFT Marketplace on FTX

FTX also has an NFT marketplace. NFTs are non-fungible tokens. This means that you can become the owner of digital products with them. These can now also be traded on FTX. Anyone can offer NFTs for sale on the marketplace or buy them themselves.

Sometimes there is also the possibility to exchange NFTs for physical objects. For example, you can buy merchandise from FTX. All you have to do is buy the NFT and FTX will exchange it for T-shirts, socks or hoodies.

With every sale of a NFT FTX keeps 5% fees.

Fees on FTX

The competition of crypto exchanges is reflected from the perspective of customers like you in aspects such as liquidity, range of offers and especially the fee policy. The fees, as they are called in English, are in short the processing fees that FTX.com charges for each of your orders and through which the service of FTX is ultimately paid. The platform has gained its strong position in the overall market by charging comparatively low fees and thus attracting liquidity quickly.

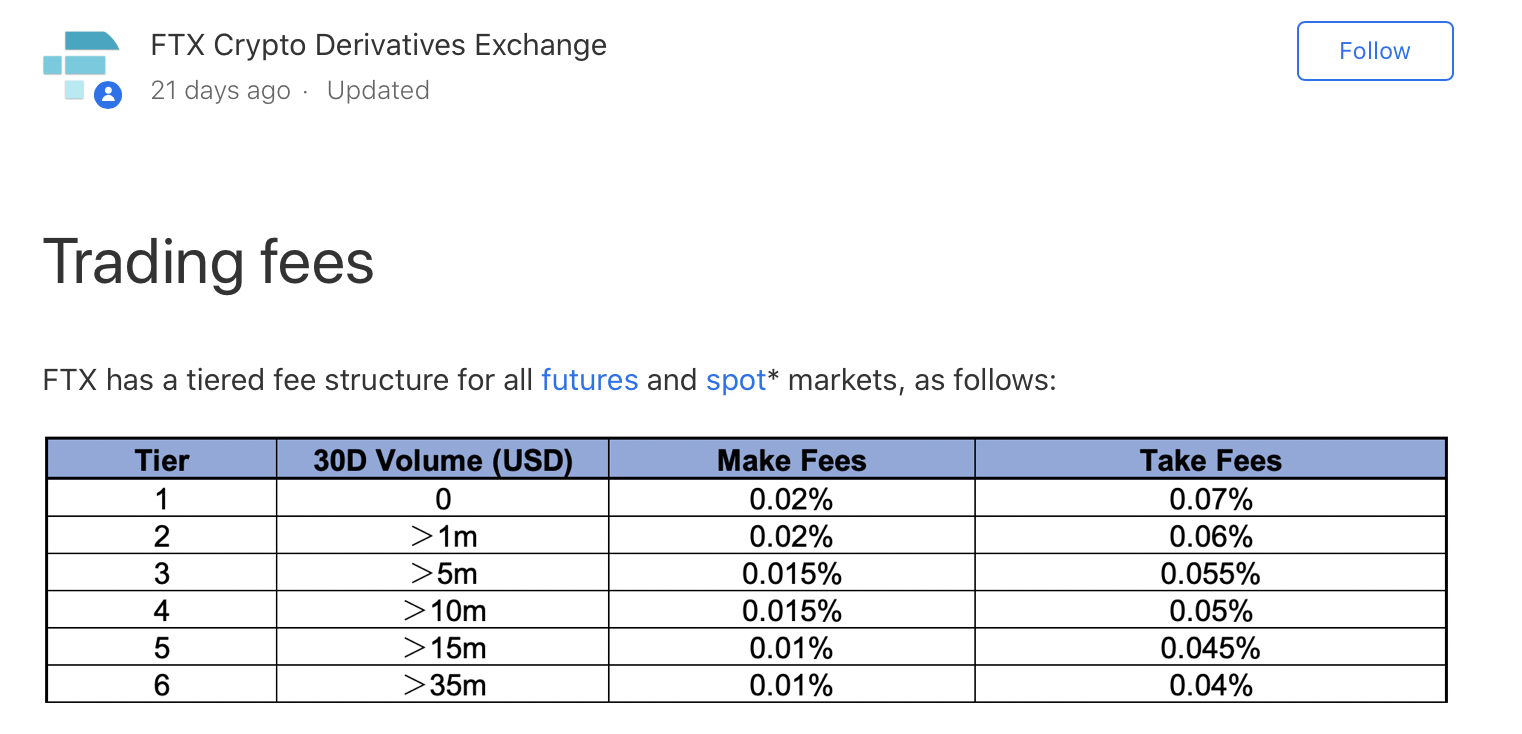

FTX – like others – generally makes a distinction between maker and taker fees, i.e. fees for those who place and accept orders. Who writes an order per limit order in the order book pays the maker fees. Accordingly, maker fees are generally lower than taker fees (paid for market orders that are executed immediately) because FTX, like other crypto exchanges, is all about attracting sellers to create liquidity. Buyers are plentiful in the crypto market as demand grows. FTX.com is not only targeting private investors, but has proven not only through its connection with the asset manager Alameda Research a focus on larger investment sums.

However, you can also profit from this as a private investor. Even with small investments, FTX charges only 0.07 percent for takers in the spot market and on futures, and 0.02 percent for makers. Sell orders at FTX are settled in US dollars or stablecoin. So if you buy by limit order (taker fee) you can save some more money.

The fee table for the most important markets spot and futures at FTX is initially defined by the monthly turnover that an individual trader moves. Up to 1 million US dollars, the already mentioned 0.02 percent for Maker and 0.07 percent for Taker apply. For monthly turnover between 1 and 5 million US dollars, the taker fee is reduced to 0.06 percent. From 5 million U.S. dollars monthly turnover, there are also lower fees on the Maker Fee, which is then only 0.015 percent.

A positive aspect of FTX is that there are actually very few hidden fees. For leveraged tokens, 0.03 percent management fees are due plus 0.1 percent for providing the offering. If margin trading, i.e. trading with leverage, is used at FTX, an additional 0.02 percent is due on the trading fees from a leverage of 50 and at the maximum leverage of 100 + it is 0.03 percent. These fees go into FTX’s own insurance fund.

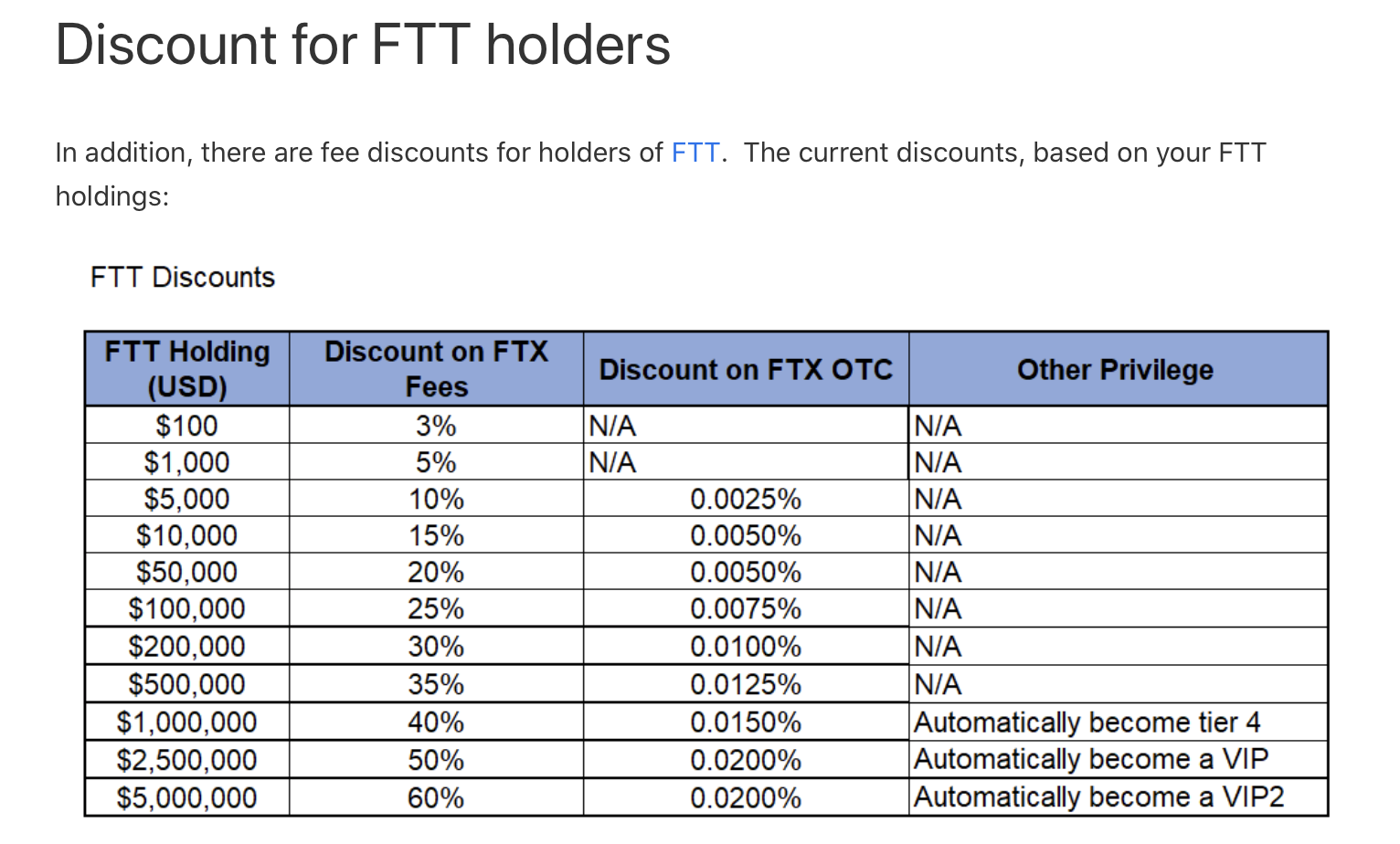

The smart approach to further reduce fee expenses at FTX.com is to hold FTX Tokens (FTT). After Binance came forward with its Binance Coin (BNB), many crypto exchanges followed the idea of retaining customers through a discount token. Below you can see how much percentage fees you can save if you hold the FTT token. Furthermore, it should be mentioned that the token has also developed very positively in terms of price and has thus largely outperformed the market.

FTT Token Explained

The FTX Token (FTT) is a discount token modeled after the Binance Coin (BNB). It was created to finance the further development of FTX and at the same time to bind customers more closely. Because with FTT in your wallet at FTX you get discounts on trading fees. Currently, FTX offers a three percent discount for customers who hold at least $100 worth of FTT. For FTT worth 1,000 US dollars there is already a 5 percent discount on fees and for FTT worth 5,000 US dollars there is a 10 percent discount. You can find the current list for the discounts after clicking on “FTT” in the top line of the desktop version of FTX.com.

The FTX token has made its way into the TOP 50 most important cryptocurrencies by market capitalization and is also traded on other crypto exchanges such as Binance, Huobi, Bitfinex, BitMax, CoinEx and WazirX. This proves that it is viewed by many investors not only as a discount token, but also as an indirect way to invest in FTX’s positive business performance. In order for FTT to increase in value, FTX promises to buy back FTT on a weekly basis and then burn it (“burn”), i.e. liquidate it. The size of this buyback program is based on weekly numbers and is expected to equal 33 percent of all fees collected, 10 percent of deposits into FTX’s own insurance, and 5 percent of revenue from other business lines. Thus, the total number of FTT available is continuously reduced, which usually leads to price increases in a game between demand and supply.

You as a crypto investor are definitely well off with FTT making FTX the number one crypto exchange of your choice. The savings on fees are noticeable and in its young history, FTT has also actually managed the hoped-for upward curve in price performance. FTT is traded at FTX.com against US dollars, Tether (USDT) and BTC. If you are not an FTX.com customer yourself, FTT is a good option to profit from as FTX continues to become one of the largest crypto exchanges.

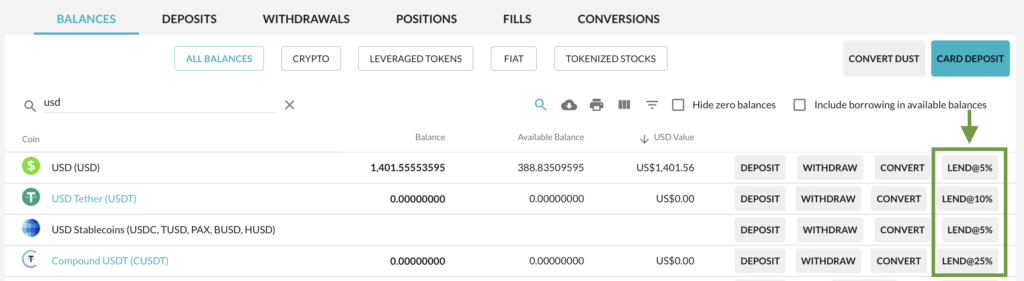

Earn money with Lending on FTX

What makes FTX unique is the possibility to lend your assets. Whether you hold stocks, cryptocurrencies or currencies like dollars at FTX, you can easily lend them to margin traders. FTX handles the lending process for you and makes sure that you get your funds back. For lending you receive interest, which is paid hourly. A good example of this is the demand for US dollars and USDT (Tether). Especially in times when the exchange rates are rising sharply, you can get 100% interest per year on your funds if you lend them. You can stop the lending process every hour.

You can also lend shares well at FTX and also receive hourly interest. The same is true for cryptocurrencies. So if you have assets at FTX lend them quietly and thus earn not only on the price increase, but also on the interest. The risk is manageable and no higher than simply leaving the funds on the exchange.

The Apps from FTX

In the meantime, there are several FTX apps. The formerly used FTX App was discontinued sometime in 2021. Since then there is the FTX Pro App and also the former Blockfolio App was renamed to FTX. So if you have an FTX.com account you should use the FTX Pro App. For the former Blockfolio App, which is now called FTX, you need a separate account. So you have to register for it again.

So in the end the app situation at FTX is a bit confusing as the normal FTX app (formerly Blockfolio), which can be found under this name in the App Store, has nothing to do with the actual FTX.com platform. So you won’t see your balances there. Both the FTX Pro app and the regular FTX app are available for iOS and Android.

Is FTX.com safe?

Unfortunately, we are regularly amazed at how carelessly individual investors handle security with regard to their cryptocurrency assets. To be fair, FTX points out that customers should keep their Bitcoin and Co. on their own wallets, i.e. hardware wallets. So you only transfer your coins to the FTX.com wallet at times when you are also trading with them.

FTX has so far – as far as known – not been affected by successful hacker attacks. But no one can give a guarantee that this will always be the case. FTX talks about working non-stop with experts in its statements about security. FTX does not disclose details like its competitor BitMEX about its security precautions. It can be assumed that customer balances that are not traded are stored on cold wallets.

When it comes to security, the stability factor is also important. So far FTX.com has consistently performed well, we are not aware of any longer interruptions. Nevertheless, there is of course this risk, FTX describes this vaguely as “sophisticated attacks”. Deposits at FTX are not insured by the EU rights and therefore once again: Use the two-factor authentication and the additional password for withdrawals. Besides, store funds, if not currently used, on a hardware wallet. We recommend the Ledger Nano X for this purpose. The company is also the market leader for hardware wallets.

Customer Support at FTX

FTX.com is primarily an English-language platform for trading Bitcoin and Co. – although there is the option to change the language.

FTX offers direct customer support via email and chat, there is no telephone support (other crypto exchanges do not have telephone support either). On the presences in social networks such as Twitter, Facebook and YouTube, English is spoken at FTX.

Conclusion

FTX is a real Binance alternative. Hardly anywhere else is there such a wide range of financial instruments to bet on price developments. In addition, the fees at FTX are low and can be reduced even further by holding FTT. Deposits and withdrawals in fiat via SEPA transfer and in euros are another plus point for customers from Europe.

The operation of FTX is user-friendly. Here, experienced traders have thought along and ensured that the design remains tidy and relevant data remain in the foreground. Especially when trading futures, FTX is strong due to great liquidity.

The bottom line remains our assessment: FTX.com has developed within a short time to a platform where futures play the main role. The security concept of FTX is coherent and has proven itself in practice. The fee policy is fair (probably FTX is the cheapest platform) and setting up an account is easy. To take full advantage of FTX, you should have a solid knowledge of typical financial instruments and hold FTT to take advantage of the benefits.

If you sign up with our link you will save another 5% fee at FTX.com.

Exchange

Rating

Features

Link

Copyright © 2026 | WordPress Theme by MH Themes