Ripple is a payment technology that competes with the Swift system. In the payment network the crypto currency XRP can be used as a bridge currency between different currencies. The company Ripple Labs primarily advertises the fact that international payments can be executed much faster and more cheaply through the Ripple technology.

Table of Contents

Quick Facts

Ticker Symbol: XRP

Max Number of Coins: 100,000,000,000

Protocol: Ripple Protocol Consensus Algorithm

Historical Background of Ripple

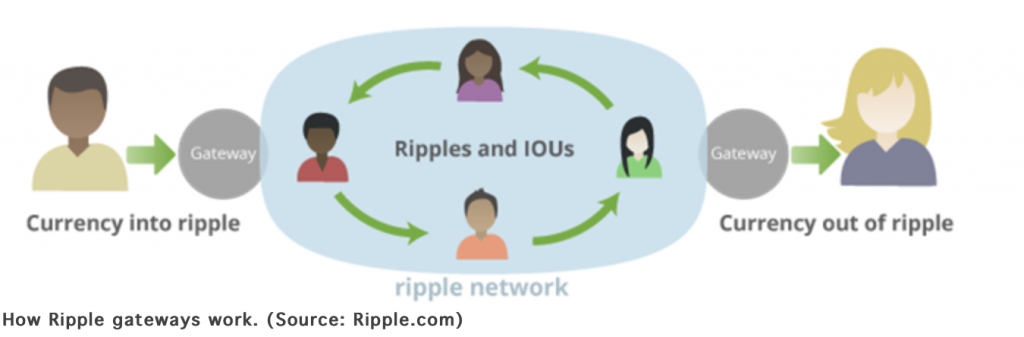

The beginnings of Ripple go back to 2004, long before Bitcoin. At that time, Ryan Fugger, a web developer from Vancouver, implemented the so-called Ripple Coin. In 2005 he started developing Ripplepay. This was initially a payment network for members of an online community. The idea behind it was that it would eliminate the need for banks in payment transactions. Because banks do nothing else but take money in (and store it with) and pay out money. So the assumption is that if someone wants to deposit money in the network, someone should be able to be found who wants to pay out this amount. In a closed money cycle, the system behind it would only have to remember who owes money and who has credit. The basic idea behind Ripplepay is very similar to today’s Bitcoin Lightning network, except that there is a mutual risk with Ripplepay.

A later version of the payment network can still be found on Ripplepay.com today. Despite its unique technology, Ripplepay never really made it to the top and always had a niche.

A certain Jed McCaleb, who had previously founded Mt. Gox but had in the meantime given up the stock exchange, finally developed his own digital money system in 2011. Transactions were verified by consensus of the members. At that time Bitcoin was already around, but what was new was that McCaleb’s digital currency did not require mining, but that the consensus was reached by the members. In August 2012 Jed McCaleb hired Chris Larsen and together they approached Ryan Fugger and presented their idea. After some discussion, Ryan Fugger handed over his project to Jed McCaleb and Chris Larsen. This should not have been difficult for him, after all the big breakthrough of Ripplepay has not yet been achieved. Chris Larsen and Jed McCaleb then founded the company OpenCoin in September 2012. Arthur Britto and David Schwartz were also involved right from the start. Both were mainly responsible for the programming.

OpenCoin then began to develop the Ripple Protocol (RTXP) and the Ripple payment network. The goal was to make international payments with the technology as quickly and cost-effectively as possible. At the beginning 100 billion XRP were generated. This number is also fixed forever and cannot be increased any more.

In April and May 2013, OpenCoin was able to announce the first financing (Angel Round). Among others, Andreessen Horowitz, Lightspeed Venture Partners and Google Ventures have participated in the company. Previously, several private individuals had already decided to invest in Ripple, including Jesse Powell, the founder of Kraken (allegedly invested 200,000 US dollars) and Roger Ver. Despite the financing, Jed McCaleb decided to leave the company in July 2013. The reason for this was probably due to differences of opinion with Chris Larsen and the investors were more in favor of Chris Larsen. Subsequently, the German Stefan Thomas took over the CTO position. He had previously founded the We Use Coins website and put the “What is Bitcoin” YouTube video online. Currently Stefan Thomas is no longer CTO at Ripple, but is working on his own project.

About a year later, after leaving Ripple, Jed McCaleb finally founded Stellar. The company offers a similar technology to Ripple and is therefore currently Ripple’s biggest competitor. At the beginning of Stellar, they simply took the Ripple code and developed it further. In the meantime, however, Ripple and Stellar differ significantly.

In September 2013, OpenCoin decided to rename the company and from then on traded under the name Ripple Labs Inc. and later (in 2015) this name was changed again to Ripple. Also parts of the source code for Ripple were made public. In the beginning, Ripple users were able to make payments to each other. However, Ripple quickly realized that this system did not work because the users did not always trust each other. Therefore Ripple started to use large companies like banks, which trust each other.

In 2015, Ripple received its first fine from the US Treasury Financial Crimes Enforcement Network for violating the Bank Secrecy Act. Basically they offered financial services by selling XRP without having the necessary license. For this they had to pay a total fine of 700,000 US dollars. In the same year Brad Garlinghouse became CEO of Ripple, a position he still holds today.

Also in 2015, Ripple established the RippleNet Committee. This is a merger of banks such as Bank of America, Banco Santander, Standard Chartered bank and others. They have started to test the Ripple technology. In 2016 Ripple finally received the necessary license (Virtual Currency Licence) to trade virtual currencies. This made the company only the fourth company with the BitLicense.

In September 2016, Ripple finally announced the first major financing round. SBI Holdings, Accenture Ventures and SCB Digital Ventures, among others, invested a total of 55 million US dollars in the company. Together with SBI Holdings, Ripple later opened the joint venture SBI Ripple Asia. Ripple itself holds 60% of the company and SBI 40%. The company tries to promote the Ripple technology mainly in Asia.

About a year later, in September 2017, Blockchain company R3 filed a lawsuit against Ripple. In the lawsuit, Ripple is said to have given R3 the option to buy 5 billion XRP by September 2019 at a price of 0.0085 US dollars. This option was worth 16.5 billion US dollars at Ripple’s all-time high in early 2018. However, Ripple terminated the contract in June 2017, although the company allegedly had no right to do so. Ripple has itself filed a countersuit saying that R3 did not open the doors to major banks to introduce XRP to the banks as promised. So Ripple had the right to cancel the contract in their own opinion, because R3 did not keep to the contract. In September 2018, both parties reached an agreement. If and how much Ripple had to pay to R3 was not disclosed.

Ripple has been able to expand its relationships in the banking world ever since. Meanwhile many banks have pilot projects with the Ripple technology. According to Ripple’s own statements, Ripple has currently been able to win over 200 banks and payment service providers as partners. But what is still missing is the large-scale use of Ripple technology outside of smaller pilot projects. Furthermore, there is often criticism that many banks test Ripple technology for payments but do not use XRP. So banks are still very cautious in dealing with new technologies.

Ripple Technology

Anyone who makes an international payment today will find that they are still very slow to execute. Sometimes it takes 3 days until a transfer reaches the recipient. Besides the slow processing speed, another problem is that international payments are very expensive. The main reason for this is that many banks still use old technologies that are no longer state of the art. Banks are also very slow to adapt to new technologies.

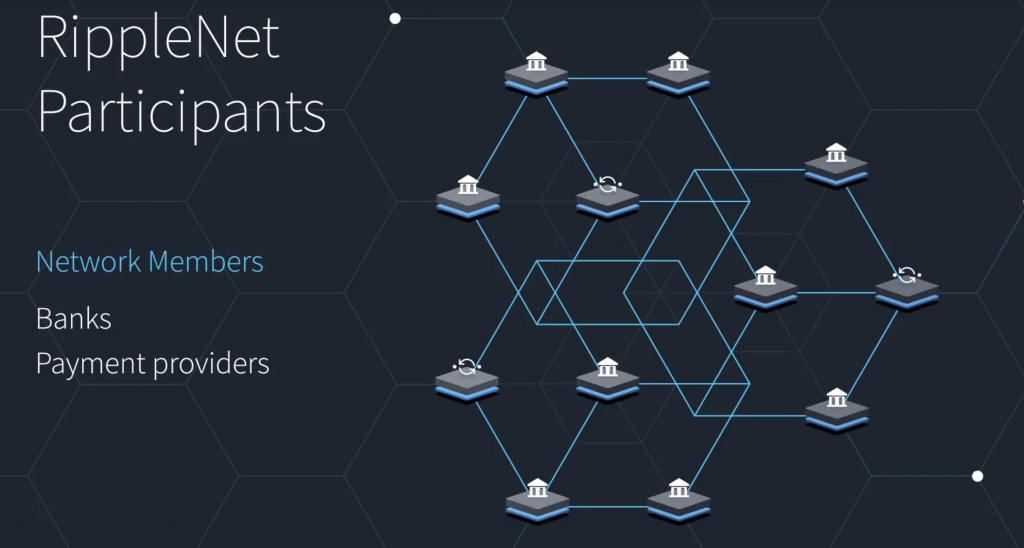

Ripple has set itself the goal of changing this. With Ripple technology, it is possible to process international payments within seconds, at a fraction of the previous costs. The core of the Ripple technology is RippleNet. All payments are processed via RippleNet. At the heart of RippleNet are banks and payment service providers that process transactions and have payment channels to each other. The prerequisite for a payment channel is that I trust my counterpart with whom I have the channel. If a payment is now sent from bank 1 to bank 2 in RippleNet, I do not need a direct payment channel between bank 1 and bank 2, because the payment can also be made through several channels. So assuming bank 1 has a channel with bank 3 and bank 2 also has a channel with bank 3, then the payment can be sent via bank 3 to bank 2. Because members at RippleNet trust each other, payments at RippleNet can be confirmed within seconds.

To achieve consensus in the network, Ripple uses the so-called Ripple Protocol Consensus Algorithm (PCA). This does not require a miner at all. This means that there is no energy-intensive mining with Ripple as with Bitcoin and other crypto currencies. To confirm transactions, all open transactions are written to a ledger. The nodes in the network must then confirm the open transactions over several rounds. Finally, 80% of the nodes in the network must confirm a transaction to make it valid. All confirmed transactions then remain in the ledger and the ledger is closed. The closed ledger is then called the Last Ledger in the network. As soon as it is closed, a new ledger is opened and the process starts again.

Since the nodes in the network are ultimately responsible for the transactions, it is also clear why Ripple is currently very restrictive about who can operate a node. With crypto currencies like Bitcoin or Ethereum it is basically possible for anyone to run a node. Currently there are 150 nodes in the Ripple network and only 10 of them are operated by Ripple, but Ripple ultimately chooses who can operate a node. Validators in the network can choose which node they trust, but by default Ripple has its own “Unique Node List (UNL)”.

One of the biggest criticisms of Bitcoin and Ethereum is scalability. Both crypto currencies can hardly handle more than 15 transactions per second. The Ripple technology is much more scalable here. Currently, 1,500 transactions per second should be handled without problems. For comparison Visa and Mastercard can process more than 50,000 transactions per second at peak times. Nevertheless, with 1,500 transactions, Ripple is much better positioned than other crypto currencies.

Around RippleNet there are 3 technologies that are used by the participants in the network. We explain how they differ.

xCurrent: The system is used by banks and payment service providers, which are at the heart of RippleNet. They are ultimately responsible for ensuring that payments can take place in the network. The xCurrent technology ensures that the banks and payment providers can communicate with the network and make payments. With xCurrent, only payments of hard currencies such as US dollars or euros can be made in RippleNet. From xCurrent 4.0, however, it is easy for xCurrent customers to switch to xRapid and thus use XRP.

xRapid: This is the newer system from Ripple. Also with xRapid, payments can be made in RippleNet between banks and payment providers. Compared to xCurrent, the xRapid system also allows the use of XRP as a bridge currency. In this way, banks should save liquidity, as they do not need any or smaller nostro accounts. Nostro accounts are accounts that banks hold abroad to hold foreign currencies. Suppose I make a dollar payment from Germany to the USA. Then I pay Euros to my bank in Germany and they pay US dollars from their nostro account in the USA to the recipient. Instead of the nostro account, the bank could simply exchange Euros for XRP and send it to the USA. In the USA XRP would then be exchanged again by a liquidity provider into US Dollar. The whole process would only take a few seconds. Therefore there is hardly any risk of price fluctuations during the process, as XRP is only held for a very short time.

xVia: Not only banks can use the advantages of RippleNet but also smaller companies and service providers can connect to RippleNet via xVia. They too can then use RippleNet to make international payments within seconds. The payments are routed via the banks that are connected to RippleNet via xCurrent or xRapid. With xVia, companies still have the opportunity to make payments much faster and cheaper than they could at their own bank.

So let’s keep in mind that when people talk about Ripple, they are usually talking about the company or the technology. The crypto currency XRP can be used in the Ripple network as a bridge currency, but it does not have to be. With XRP, banks only have the opportunity to save liquidity, but if they don’t want to, they can take advantage of the Ripple technology without XRP.

XRP – The Crypto Currency

In January 2013, the company also generated 100 billion XRP, as Ripple’s own crypto currency is called. Already at this point it was clear that these XRPs were not absolutely necessary, because the Ripple technology works well without XRPs. One idea back then was that XRP could be used to pay transaction fees. So that with the help of the Ripple technology currencies such as US dollars are sent but the transaction fees are paid in XRP.

The 100 billion XRP were then distributed as follows. Ripple itself got 80 billion XRP. The other 20 billion XRP went to the founders. Chris Larsen received 9.5 billion XRP, Jed McCaleb 9.5 billion and Arthur Britto 1 billion. Also David Schwartz (who is also called JoelKatz online) was always said to have 1 billion XRP, but it is unclear from which pot they came. Ripple was not very transparent from the beginning regarding the exact distribution of XRP and remained intransparent in the following years. In addition, the first 32,570 blocks from the beginning of the ledger are damaged and therefore individual transactions from the early days can no longer be traced.

Besides the distribution of XRP to the founders and the company Ripple, there were also numerous giveaways and airrops, among others to individual Bitcoin Talk Forum users.

Of the 100 billion XRP generated, just over 41 billion are currently in circulation. The rest is still held by the Ripple company. The majority of this is in the so-called Escrow Fund, i.e. it is managed in trust. Every month, 1 billion XRP are released, which the Ripple company can spend. If not all of the XRP are spent, they are returned to the escrow fund. This process takes place until all XRP have been issued. So it will still take a few years until all XRPs are in free circulation. Investors should be aware that there will be high inflation at Ripple in the next few years.

The Founders’ dispute over their XRP

There was a dispute about the high XRP shares of the founders from the beginning. The investor and Kraken founder Jesse Powell sums it up like this: “The founders took XRP from the beginning without getting the approval of the investors”. While Jed McCaleb would have been willing to give back his XRP, Chris Larsen insisted that they were entitled to it. Only later did Chris Larsen announce to transfer 7 billion XRP into his own charitable foundation and to keep only 2 billion XRP.

An agreement was also reached with Jed McCaleb. This became necessary when he left the Ripple company and there was a concern that he might “dump” his XRP and cause the price to collapse. The 2014 agreement with Jed McCaleb was as follows:

- He was only allowed to sell XRP for a maximum of $10,000 a week.

- In the second, third and fourth year this value increased to 20,000 US dollars.

- In the fifth and sixth year he was only allowed to sell a maximum of 750 million XRP.

- In the seventh year he may sell a maximum of 1 billion XRP.

- In the 8th year then maximum 2 billion XRP per year.

But the agreement between Ripple and Jed McCaleb did not last long. Already in 2015 there was the next dispute. In addition one must know that there is a so-called “freeze feature” at Ripple. With this feature Ripple is able to freeze assets (XRP or Fiat currencies) in RippleNet. This feature can also be deactivated but most partners leave it on by default. The idea is that the company is thereby legally compliant and confiscated assets can be handed over to the law enforcement agencies.

Anyway, in 2015 a family member of Jed McCaleb sold 96 million XRP to Ripple for 1 million US dollars. But there were complications and Ripple paid 75,000 US dollars too much. As a result, Ripple demanded that they get the overpaid money back. Since this did not happen immediately, Ripple finally froze the US Dollar balances in RippleNet. Ripple was assisted in the freezing by Bitstamp, the exchange that was involved in the transaction.

Besides the dispute with the frozen assets, Jed McCaleb was also accused of violating the 2014 agreement. A new agreement was reached and Ripple and Jed McCaleb signed a new agreement in 2016. This agreement is as follows:

Each McCaleb must contribute two billion XRP to charity.

In return he may keep 5.3 billion XRP. But these remain under the control of Ripple.

McCaleb and the charity can sell XRP under the following conditions:

- 0.5% of the daily volume for the first year

- 0.75% of the daily volume in years two and three.

- 1% of the daily volume in year four.

- After that, up to 1.5% of the daily volume.

The agreement is still valid today.

Ripple Partnerships

There are now over 200 banks and financial service providers with whom Ripple works. Well-known partner banks are for example the Spanish Santander Bank, Union Credit, UBS and Standard Chartered.

It is fundamentally important to know that almost all partners have only pilot projects with the Ripple technology in use. There are a few exceptions like Santander, where there is the mobile app One Pay FX, which uses the Ripple technology, but otherwise the Ripple technology is almost only used for test projects.

Another complicating factor is that most partners only test the xCurrent system at Ripple. For this system no XRP is used at all. Only less than 10 partners test the xRapid system at all, where XRP can be used as a bridge currency. One of the partners who test xRapid is the company Mercury FX.

If you take a look at the current status of the pilot projects, you will quickly realize that it is a conceivable scenario that the Ripple technology can be used worldwide without the need for XRP.

Criticism of Ripple

A sword of Damocles hovering over Ripple is the discussion whether XRP is a security token and not a utility token. A security token is more comparable to a bond, while a utility token has many of the characteristics of bonus points. Especially the American stock exchange supervision SEC (Securities and Exchange Commission) deals from time to time with the question whether XRP is a security token. Since security tokens are comparable to investments, they are also much more strongly and strictly regulated, the protection of the investors is in the foreground. If the SEC were to determine that XRP is a security token, XRP could no longer be traded on crypto exchanges such as Coinbase and Binance. Instead, XRP would then have to be traded on special exchanges where users would have to verify themselves completely, similar to stock trading.

Another important factor in the classification of XRP is the fact that XRP is very centralized, which speaks more for a security token. After all, the Ripple company still holds the majority of all XRP generated, even if they are managed in escrow. Currently not even half of all XRP are in circulation. So we will continue to see significant inflation in XRP in the coming years.

In addition, the consensus process is also centralized – after all, the company Ripple decides on the nodes and provides a list. Although this can be changed manually, it is to be assumed that only a few node operators do this.

The company Ripple does a lot to demonstrate to the outside world that XRP is decentralized, to prevent it from being classified as a security token. In addition, there is now a clear demarcation between Ripple and the crypto currency XRP. In the beginning, XRP was called Ripple and XRP was simply the abbreviation for the crypto currency similar to Bitcoin and BTC.

Besides the problem that XRP can be a security token, investors should also know that the success of the Ripple company is completely independent of the XRP price. It is quite conceivable that RippleNet will become the worldwide standard for international payments, but XRP is not widely used. The Ripple technology also works very well without XRP.

Ripple itself always talks about XRP being a bridge currency for international payments. This means that banks have to keep less liquidity in nostro accounts. Nostro accounts are accounts that banks hold with foreign partner banks. For example, a German bank has a nostro account with a Mexican bank where Mexican pesos are held. Ripple’s argument now is that banks with XRP would have to hold significantly less foreign currency. But experts are partly critical of this. As a rule, only amounts that are expected to be paid in the next 30 days are held in nostro accounts. Even without the nostro account, the bank would have to hold this amount. This would then be in its own currency, but the FX markets are usually much more liquid than EUR/XRP, for example.

The fact that international payments take a very long time is often not due to the payments themselves. This is because systems are already in use (CLS and RTGS) that execute international payments immediately. The bottleneck then often lies with the processes of the banks. These also have to comply with money laundering laws and therefore have to check payments very carefully. This is often the reason why international payments take a few days. XRP would not accelerate this process either. Rather, the banks have to work on their own systems and processes so that international payments can be executed faster. So far, however, the demand for this has been rather low and customers have accepted that payments take a few days.

Another point that can be criticized is the fact that Ripple claims to have over 200 partner banks, but the question is how sustainable these partnerships are. On its own website, Ripple openly communicates that new partners are reimbursed up to 300% of their original costs. So assuming a bank pays 10 million US dollars to set up a Ripple pilot project, the bank can receive up to 30 million US dollars from Ripple for this. So Ripple is effectively paying for the banks to do these pilot projects. The company can do this because every month 1 billion XRP are freed up, which they can also invest in such partnerships. Ultimately, it can also be financially worthwhile for partner banks to set up a pilot project even if they have no increased interest in the Ripple technology.

We had already discussed another point of criticism during the founders’ dispute, namely that Ripple is able to freeze assets in RippleNet. This completely contradicts any decentralization. RippleNet is therefore hardly better than conventional banks.

All in all XRP still faces many challenges and whether the crypto currency will ever be accepted may not be considered secure.

XRP Wallet

If you don’t want to leave your XRP on a crypto exchange you can save it on your own wallet. This often has the advantage that you do not have to trust the wallet. In the past, there have been cases where users’ credit balances on wallets have been stolen or have fallen victim to hacker attacks (for example Mt. Gox and QuadrigaCX). There are basically 3 different ways to store your XRP including Paper Wallets, Software Wallets and Hardware Wallets. The safest way to store your XRP is to use a hardware wallet like the Ledger Nano X. But for the sake of completeness we want to introduce all 3 variations to you.

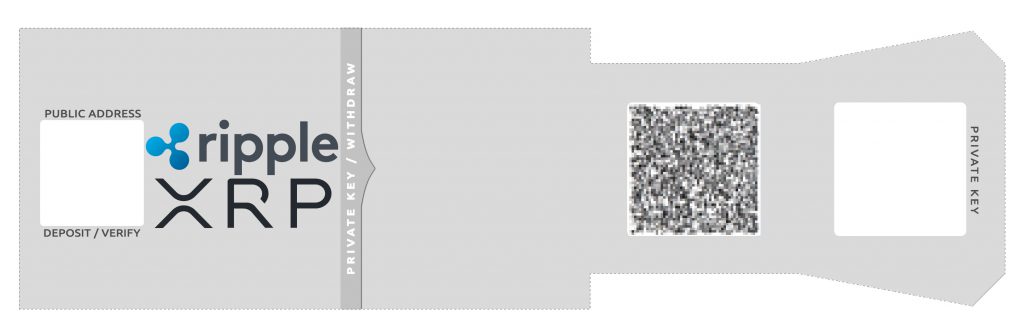

Paper Wallets

As the name suggests, this variant simply writes the private and public key on a piece of paper. You have to keep this paper safe. There are some sites on the internet where you can create a Ripple XRP Paper Wallet. Please remember that these pages are only serious if the code is open and you can create the Paper Wallet offline. It’s no use creating the Paper Wallet directly on the page, because then it’s not a real secure Paper Wallet. Because we don’t trust the Paper Wallet 100% we will not recommend any site here. We just want you to be aware that this possibility exists.

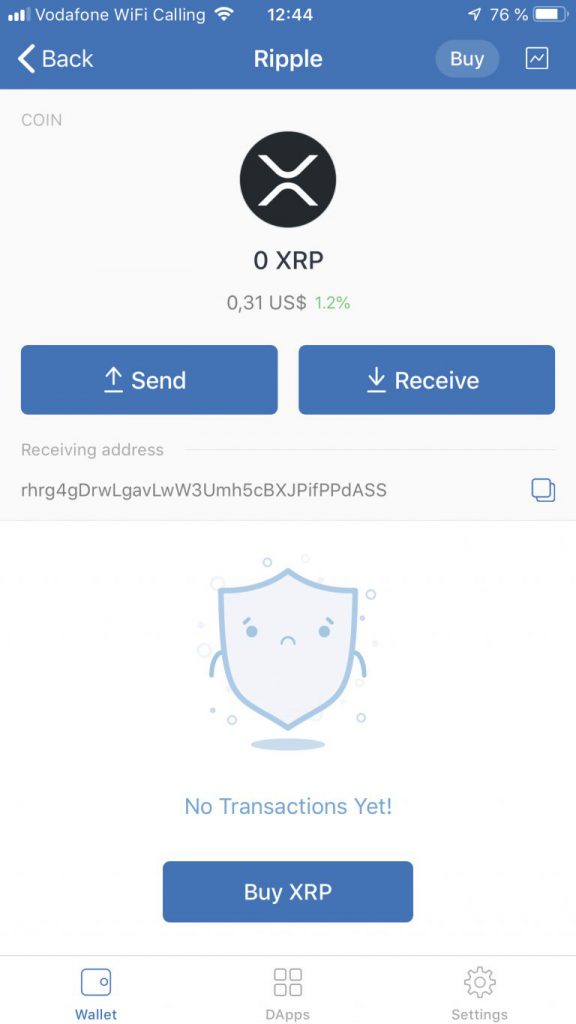

Software Wallets

Somewhat easier to use than paper wallets are so-called software wallets. They are available for Windows, Mac and Linux as well as for iOS and Android. So you can decide for yourself if you want to use the wallet on your computer or your smartphone. We personally have made very good experiences with the Trust Wallet. It is now part of Binance, the world’s largest crypto exchange and is very easy to use. The Trust Wallet is available for iOS and Android, so you can only use it on your smartphone.

With the wallet you can receive, store and send XRP. Meanwhile the Trust Wallet also allows you to buy XRP in the Wallet by credit card. But beware, if you buy XRP in the wallet by credit card, you will have to pay at least 3.5%. If your smartphone is stolen or lost it is no problem. With the Recovery Phrase you can restore the wallet at any time.

If you prefer to keep your XRP on your computer, you can do so as well. For example, there is the Toast Wallet. This is available for Windows, Mac and Linux.

Hardware Wallet

Still the safest way to store your XRP (ripple) is with a hardware wallet. Market leader in hardware wallets and also our test winner is the Ledger Nano X.

The advantage of hardware wallets is that your private keys always remain on the device. So it is not possible that your credit can be stolen. Even if you lose the hardware wallet, you can restore the credit via the recovery phrase. You can access your crypto credits at any time via the Ledger Live app. So if you have a lot of XRP we recommend to buy a Hardware Wallet. While the Ledger Nano S is already available for 59 Euro, the Ledger Nano X costs 119 Euro.

XRP Buy and Sell

There are several ways to buy XRP. You should note that not every stock exchange trades XRP against Euro or US Dollar. We therefore recommend you buy XRP from eToro. Alternatively you can buy XRP at Coinbase.

XRP Price and Current Price

Here you can find the current XRP price and the price development of the last months.

- XRP

(XRP) - Price $0.835

- Market Cap

$40,001,176,056.00

Conclusion

Anyone who wants to invest in Ripple should be aware that Ripple and XRP are two different things. Ripple has a payment technology that enables international payments to be made very quickly and cost-effectively. XRP can be used for these payments but does not have to be. So far Ripple has many partners who are testing XRP, but the system is not yet widely used. In addition, only very few partners are testing xRapid, Ripple’s system where XRP is also used.

In order for the price of XRP to rise in the long term, Ripple has to make RippleNet a standard that many bankers and payment service providers use. In addition, they must not only use RippleNet, but also xRapid, where XRP can be used. Also the ambiguities about the status of XRP must be removed, that it is not a security token.

Finally, it should also be mentioned that the inflation at Ripple will be very high in the next few years, as the company Ripple still holds most XRP and 1 billion XRP are released every month.

Ultimately, Ripple can overcome all the problems but it will not be easy. So everyone should be aware that XRP is a risky investment.