How to Buy Bitcoin Cash - Tutorial

Bitcoin Cash was developed from a Bitcoin Hard Fork. The idea is that with the crypto currency many problems, which exist with Bitcoin, are to be solved. Among other things substantially more transactions per second are possible with Bitcoin Cash than with Bitcoin. We show you here where you can buy Bitcoin Cash and what you need to consider.

Bitcoin Cash was created by a Bitcoin Hard Fork in August 2017, because Bitcoin had 2 different warehouses. Basically it was about whether the block size should be increased at Bitcoin. With Bitcoin, a block to which the block chain is attached can be a maximum of 1 MB in size. Since a block is only found on average every 10 minutes, this results in a limit of about 12 transactions that can be carried out at most every second. More transactions cannot be stored in the block.

Bitcoin Cash wants to solve this problem by allowing larger blocks. As the name suggests, Bitcoin Cash wants to be better suited for everyday payment needs.

Exchange

Rating

Features

Link

To understand why Bitcoin split, you need to know that most Bitcoin developers and the community are very reluctant to make changes. Many still orient themselves at Bitcoin on the original white paper by Satoshi Nakamoto and the block size was set to 1 MB at that time.

The idea of some followers was to create a new crypto currency with Bitcoin Cash, with which it should also be possible to make changes in the code faster. In addition among other things the change of the block size counts. The Bitcoin Cash project was driven at the time by Roger Ver (former supporter of Bitcoin), Jihan Wu (CEO of the world’s largest Bitcoin miner Bitmain) and Craig Wright (self-proclaimed Satoshi Nakamoto). In the meantime, however, the group has fallen out and only Roger Ver is still driving the project forward.

How to Buy Bitcoin Cash – Summary

- 2. Verify Yourself on the Platform

- 3. Deposit (at least $200) e.g. via PayPal, Credit Card or Wire Transfer

- 4. Now you can buy Bitcoin Cash directly

Bitcoin Cash (BCH) Buy Guide and the Best Crypto Exchanges

Where can I buy Bitcoin Cash?

Who would like to buy Bitcoin Cash (BCH) must announce itself with crypto stock exchanges (also Exchanges called). You should make certain however that with the crypto stock exchange also BCH is traded against euro. Not every exchange allows you to buy BCH against Euro. With the largest crypto stock exchange of the world for instance, Binance, all crypto currencies are traded only against other crypto currencies.

Beside the possibility of the deposit of euro, you should pay attention also to it like you the euro to deposit can. Some crypto exchanges only give you the possibility to transfer Euro credits to the exchange. Since transfers are however very slow, it can partly take a few days until the assets arrive. Faster is it if you can pay in the credits by credit card or PayPal at the respective crypto exchange. eToro for example gives you this possibility.

Comparison and Experience of Crypto Exchanges for Bitcoin Trading

- 1st Place: eToro

- 2nd Place: Coinbase

- 3rd Place: Binance

Buy Bitcoin Cash (BCH), but where?

The easiest way to buy BCH is to buy it from eToro. There you can choose between different payment methods (PayPal, credit card and instant bank transfer) as well as an easy to use platform with German support. At eToro you buy real crypto currencies which you can also withdraw with the eToro wallet.

eToro’s user-friendly design undoubtedly offers one of the easiest ways to enter the Bitcoin cash trade. Thus a platform with special value results for all investors, who would like to buy or also sell BCH.

Buy BCH with eToro in 4 steps

To trade on eToro you first need to log in to the platform. But this can be done without any problems. All you have to do is enter your name, email address and a password. After that you will get access to the eToro dashboard.

As eToro crypto currencies are traded against Euro you also need to verify your identity on the platform.

After opening an account you will also need to verify your identity with eToro. You will need to leave your personal information and upload a photo of your ID or passport. This process is required by European law for all platforms trading crypto currencies against Euro.

If you have provided all the information, the verification can still take a few days. It is advisable to make the deposit during this time, as you will be preferred during the verification process. But don’t worry, if something goes wrong during verification, you will get your money back. We have never experienced this kind of problem before.

As soon as the verification is completed you will be notified by email. If you have already made the deposit at this point, you can start trading immediately.

Buying and selling Bitcoin Cash at eToro is then quite easy. All you have to do is select BCH and click on “Trade”.

A window will appear where you can buy BCH. All you have to do is indicate how many Euros or US Dollars you want to invest in BCH. You can also set a stop loss, trade with a lever or enter a profit target.

With a Stop Loss you can determine at what loss your BCHs should be sold automatically, thus reducing further losses if the price falls sharply. We do not recommend using leverage because it is very risky. Therefore you should always set the leverage to X1, then you will buy real BCHs. You don’t need to specify the profit target either, because you can always close the trade manually if you have made enough profit.

Once you have entered everything, you only need to click on “Buy”. The trade will then be executed immediately and you will see your newly acquired BCH in your portfolio.

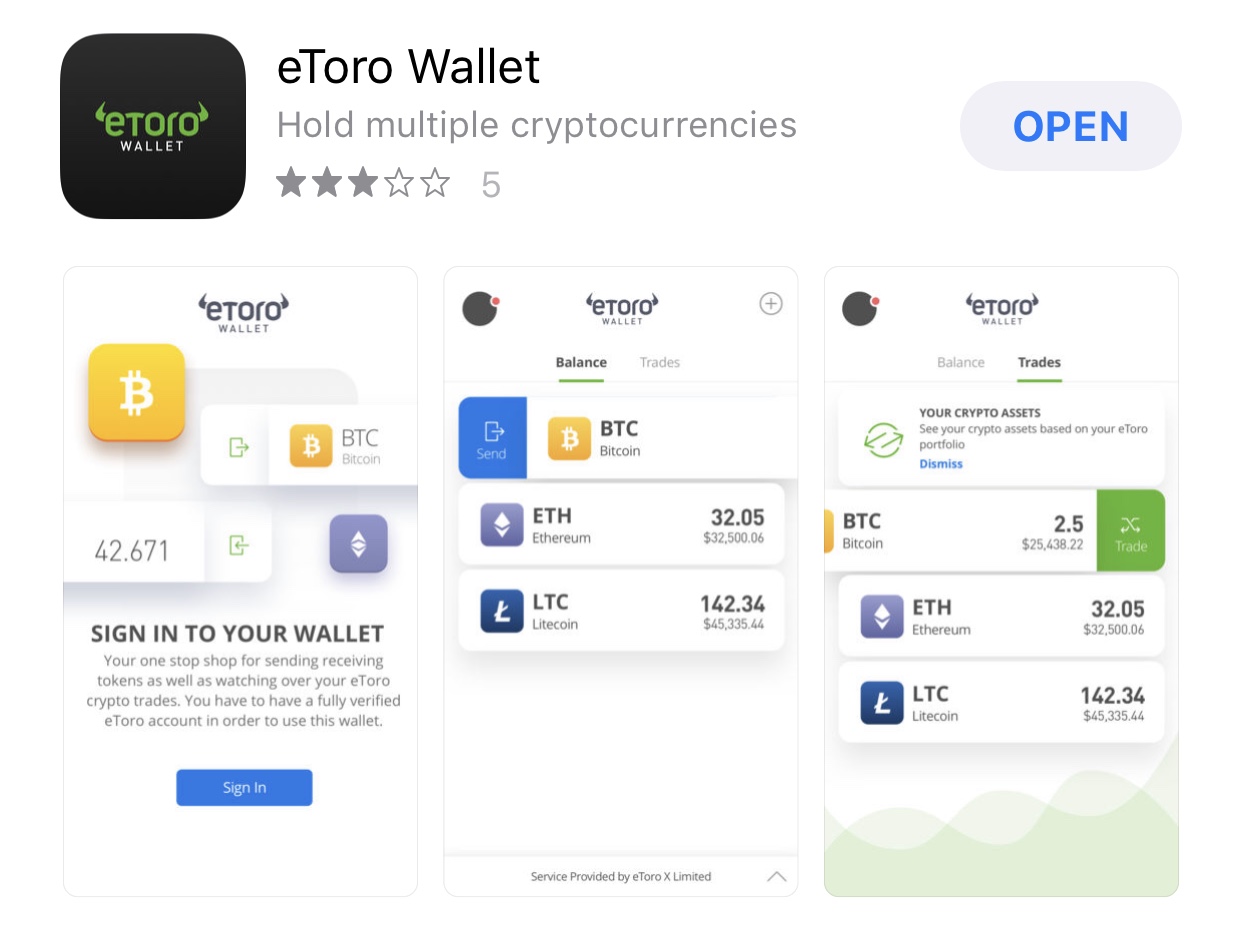

Withdraw crypto currencies with the eToro Wallet

In 2018 eToro introduced the so-called eToro Wallet. This is available for both Android and iOS. Now you can also use it to withdraw your crypto credits from eToro. All you have to do is install the wallet on your smartphone. You can then login to the wallet with your normal eToro login.

Exchange

Rating

Features

Link

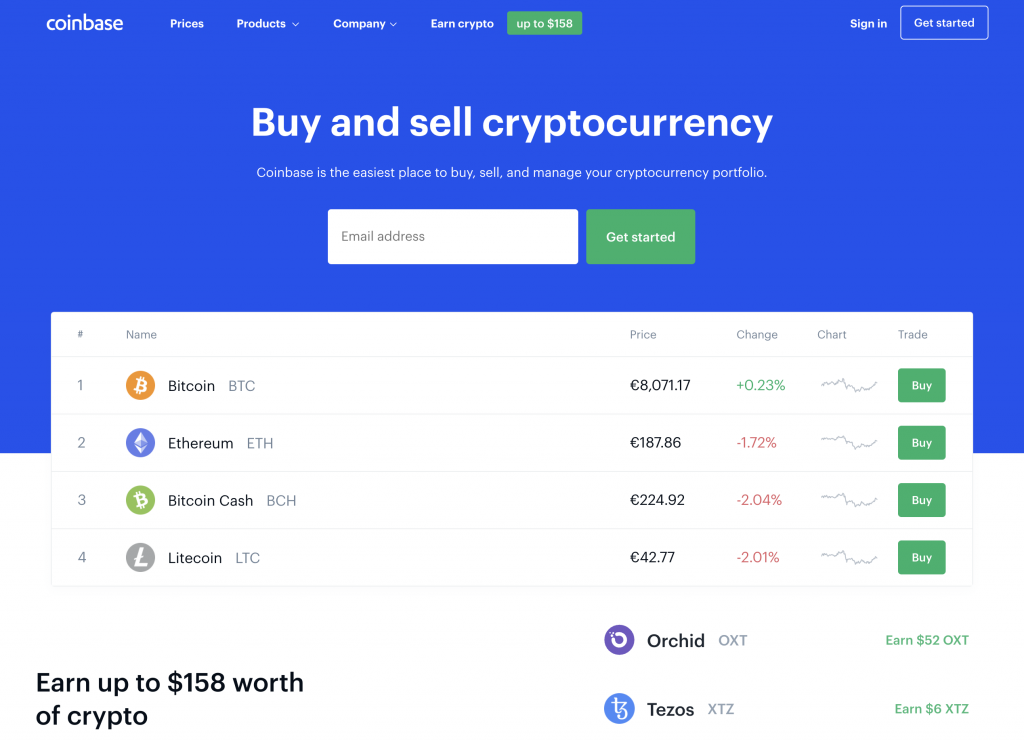

Coinbase

Likewise a good possibility to buy Bitcoin cash gives it with Coinbase. The American stock exchange has meanwhile over 20 million customers world-wide and also many German customers rank among them. Coinbase is very easy for beginners to understand and on the platform numerous crypto currencies (BTC, ETH, BCH, EOS, XRP, etc.) are traded. With Coinbase Pro Coinbase customers also get access to a professional trading platform.

The disadvantage compared to eToro is that deposits can only be made by bank transfer. Payouts can also be made via Paypal. New customers at Coinbase get BTC worth 10 US dollars for free if they buy crypto currencies for at least 100 US dollars (or equivalent in Euro).

Buy Bitcoin Cash (BCH) from Binance

The largest crypto exchange in the world is Binance. The disadvantage is however that with Binance only crypto currencies are traded against other crypto currencies such as Bitcoin, Ethereum and BNB. You can buy there thus only BCH against other crypto currencies. Many users buy therefore first Bitcoins against euro with Coinbase and send these then to Binance.

What Payment Methods are Available to Purchase Bitcoin Cash?

Buying Bitcoin Cash - The Most Important Payment Methods

- Credit Card

- PayPal

- Wire Transfer

Buy Bitcoin Cash with credit card

Credit cards are convenient and payment is available immediately!

Many people like to buy crypto currencies by credit card. This is usually because credit card payments are immediately available and buyers do not have to wait for the deposit to arrive.

Unfortunately, not all exchanges support credit card purchases or charge very high fees for them. This is different with eToro. You can simply top up your credit card balance and start trading immediately. So you can also buy BCH there immediately with your credit card.

Buy Bitcoin Cash (BCH) with Paypal

Paypal has the advantage that you will be credited immediately and you have the buyer protection.

Only very few crypto exchanges allow you to buy crypto currencies via PayPal. You profit with PayPal particularly by the buyer protection. One exchange which I allow you to buy via PayPal is eToro.

You can simply fund your eToro account via PayPal and then you can start trading and buy Bitcoin Cash. This makes eToro the big exception compared to other crypto exchanges.

Buy Bitcoin Cash via Wire Transfer

Another way to deposit money into your account in order to buy cryptocurrencies is via wire transfer. You don’t pay any fees in order to deposit money. However the disadvantage is that it can take up to 2 business days until your money is finally in your account. If you want to avoid that you can use Rapid Transfer for instant wire transfers. If you are using eToro you can choose if you want to do a regular wire transfer or a Rapid Transfer.

Should I buy Bitcoin Cash now?

When is the right time to buy BCH? No one can predict. But the fact is that the BCH development is only just beginning. Bitcoin Cash with its larger blocks has a clear advantage over Bitcoin. Whether this is sufficient however around itself against Bitcoin to intersperse nobody can say. Bitcoin itself is trying to solve the scaling problem with the Lightning network. Not all transactions take place on the block chain.

Which one is the better approach will only become clear in the course of time.

Pro and Contra Bitcoin Cash Investment

- BCH is still at the beginning of development

- Some advantages over Bitcoin

- Well-known brand

- Cheaper transactions than with BTC

- Investments in crypto currencies are highly speculative

Is the technology the purchase argument for Bitcoin Cash

Credit card companies such as Mastercard and Visa easily process a few thousand transactions per second. At peak times, this can be as high as 50,000 or more transactions per second. This shows how well payment systems must work to be used for payments worldwide. What is sobering, however, is the fact that Bitcoin can only execute a maximum of 12 transactions per second. Since more information does not fit in the block limited to 1 MB in size. Because only every 10 minutes on average a new block is found at Bitcoin.

Bitcoin Cash tries to solve this problem by allowing a much larger block size from the start. Hence the name Bitcoin Cash. The idea is simply to use the crypto currency for everyday payments. Whether this approach will be successful is not yet clear. It remains to be stated however that it is a clearly different approach than that of Bitcoin.

Invest in Bitcoin Cash (BCH) or not?

Whether an investment in Bitcoin Cash is worthwhile is difficult to predict. Because all crypto investments have an increased risk, since the crypto market is still at the very beginning. Compared to many other crypto currencies Bitcoin Cash has however a clear field of application as digital currency. Generally applies who in crypto currencies invested should its Investment on a longer period put on (a few years) and not by the fact that the course rises or falls also already times 10% or more on the day be made crazy leave themselves.

Store Bitcoin Cash (BCH) in a separate wallet

When you buy Bitcoin Cash (BCH) you can either leave it at the stock exchange (eToro, Binance etc.) or store it on your own wallet (depending on where you bought it). Basically there are 3 types of wallets that you can use to store BCH. These are Paper Wallets, Software Wallets and Hardware Wallets.

With the so-called Paper Wallets you simply write your Private Key on a piece of paper. With this Private Key you can access your credit balance. If you lose the sheet of paper or it is stolen, your credit will be lost. For normal investors Paper Wallets are not really practical.

Much better are the software wallets. You install it on your desktop computer or smartphone and can manage your assets. With a so-called recovery phrase (usually consisting of 24 words) you can restore your credit if you lose the device. If you want to use a software wallet, we recommend the official Trust Wallet for your smartphone. This is available for both iOS and Android.

However, the safest place to keep your Bitcoin Cash is a Hardware Wallet. The market leader for Hardware Wallets is the French company Ledger. We therefore recommend that you use either the Ledger Nano S or the Ledger Nano X. With a Hardware Wallet, your private keys always remain on the wallet and cannot be stolen. Even if you lose the hardware wallet, you can still recover the credit via the recovery phrase. The ledger also supports the storage of Bitcoin Cash.

Conclusion

Bitcoin Cash has stepped in to solve the scaling problem with Bitcoin. It is not clear whether larger blocks in the block chain are sufficient in the long term. Who would like to invest in Bitcoin Cash should not only hold Bitcoin Cash, but also Bitcoin for security. Because both crypto currencies are in direct competition with each other. A scenario in which only Bitcoin Cash becomes successful and not Bitcoin is currently difficult to imagine.

Exchange

Rating

Features

Link

Bitcoin Cash Price and Price Development

Here you can find the current Bitcoin Cash price and see how the price has developed.

Copyright © 2026 | WordPress Theme by MH Themes