Binance Review and Tutorial

Last Update:

7th February 2026

Anyone who wants to trade cryptocurrencies must do so on crypto exchanges or so-called Exchanges. The largest crypto exchange worldwide is Binance. We will show you how you can use Binance and what you have to pay attention to. In addition, you will get our experience report. With our Binance link you can also save 10% on fees for life.

The Binance platform has become very complex in recent years. In addition to the simple buying and selling of cryptocurrencies, you can now also invest cryptocurrencies and earn interest with them. Our tutorial on Binance has therefore become very comprehensive to really cover everything important.

Exchange

Rating

Features

Link

If you take a look at the trading volume of the individual crypto exchanges, you will quickly see that the largest trading volume by far can be found at Binance. Although the crypto exchange has only existed since 2017, it has quickly become the market leader. This is probably not least due to the fact that you can trade over 200 different cryptocurrencies on Binance. These include Bitcoin, IOTA, Ethereum, Ripple (XRP), EOS, Cardano (ADA) and many more. Meanwhile, Binance also allows Euro deposits and withdrawals and the trading of futures (derivatives) with a leverage of 1x125x.

The fact that Binance is so successful is mainly due to the fact that Binance is technically very well positioned, there are many coins on Binance and the platform is very reliable. The Binance platform was initially funded through an ICO, where investors could buy BNB tokens. While Binance was based in Asia in the beginning, they are now spread around the world and Germans also work at Binance.

Those who want to trade on Binance can do so against other cryptocurrencies or even fiat currencies like the euro.

- 2. Verification has recently been required for every new user.

- 3. Send funds to the exchange to trade with.

- 4. Now you can start trading.

Video: How to use Binance

Pro und Contra Binance

Binance Review

Basically, we have had many positive experiences with Binance in the past. We also receive a lot of feedback from users about Binance via our website and our Youtube channel. We have never heard anything really negative from users in the past years. During this time we have probably received and read thousands of emails and comments about Binance. If there was any criticism, it was mainly because the platform is now very extensive. This ensures that it is not always easy for beginners to understand the platform. However, the videos in this post can help you get started with Binance quickly.

If you look at the crypto ecosystem right now, there is no platform that offers users more than Binance. On top of that, Binance’s fees are by far the cheapest. If you buy a cryptocurrency on Binance, for example, you pay a maximum of 0.1% in fees (rather less). Other providers like Coinbase charge 3% and more. It is therefore worthwhile to get to grips with Binance and discover the possibilities of the platform. Especially since there are many ways to earn money on Binance, even besides pure trading.

How to create an account with Binance

Setting up an account with Binance is very simple. However, you have to verify yourself as a new user. This is the case with all platforms that accept deposits in euros and other fiat currencies. After registration and verification, you can start trading directly and the verification is usually completed within a few minutes as well.

On a positive note, Binance’s website is also available in other languages. In addition, the help pages and support are also available in other languages.

Registering with Binance is very simple. You only need to enter your email and a password to log in. After that you will receive an email with which you have to confirm your email address.

After that you will have access to the Binance Dashboard. However, you will need to verify your identity in order to trade on the platform.

Since August 2021, every new user who wants to trade on Binance has to verify himself. For the verification you have to provide your personal data. In addition, you must upload a picture of your ID or passport. Finally, you will need to upload a picture of yourself holding a piece of paper with Binance written on it. Afterwards your data will be verified by Binance. This can usually take only a few seconds or minutes. In exceptional cases, for example if the quality of the pictures (ID, passport) is not good, it can take a few hours.

After registration and verification you can fund your Binance account. Then you can already start trading. All you have to do is click on Exchange, select your desired trading pair and you can start buying and selling cryptocurrencies there.

Euro Balance Deposit and Withdrawal at Binance

Depositing money has become quite easy at Binance. While at first only purchases of cryptocurrencies with other cryptocurrencies (such as Bitcoin and Ethereum) were possible at Binance, there is now also the possibility to deposit fiat currencies such as euros and use them to buy cryptocurrencies.

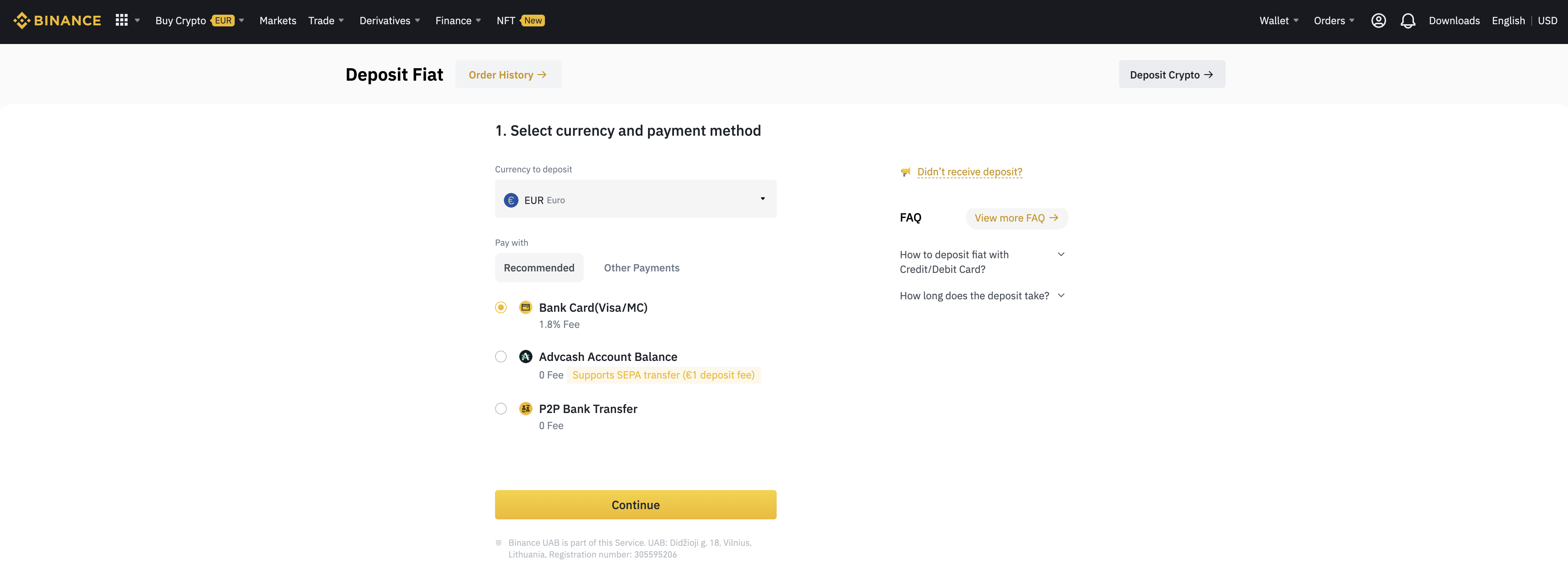

Normally, you can deposit euros at Binance via credit card and SEPA bank transfer. Currently, however, the deposit via SEPA transfer is in maintenance mode (suspended) and cannot be used. The reason for this are regulatory difficulties and Binance is currently looking for a new provider. So it is possible that SEPA deposits will be possible again soon.

Until then, you can only make deposits by credit card. However, there will be a fee of 1.8%. But there are always promotions where the fees are waived.

Of course you can not only deposit your euros, but also withdraw them. But even here, the withdrawals by SEPA are currently not possible. Here we can only hope that Binance will soon find a new alternative. However, you can still make withdrawals to your credit card. However, there are also 1% fees for this. You also need a credit card that has been issued to a German account. Cards from English banks like Revolut do not work for example.

How deposits and withdrawals currently work and what work-arounds there are we show you in the following video.

In addition, there is also the possibility to make P2P bank transfers/purchases. P2P is a marketplace principle. In principle, anyone can buy or sell cryptocurrencies. The users trade directly with each other. The disadvantage is that the prices are often higher than if you would normally trade on Binance. P2P trading is therefore not recommended.

How to Trade on Binance

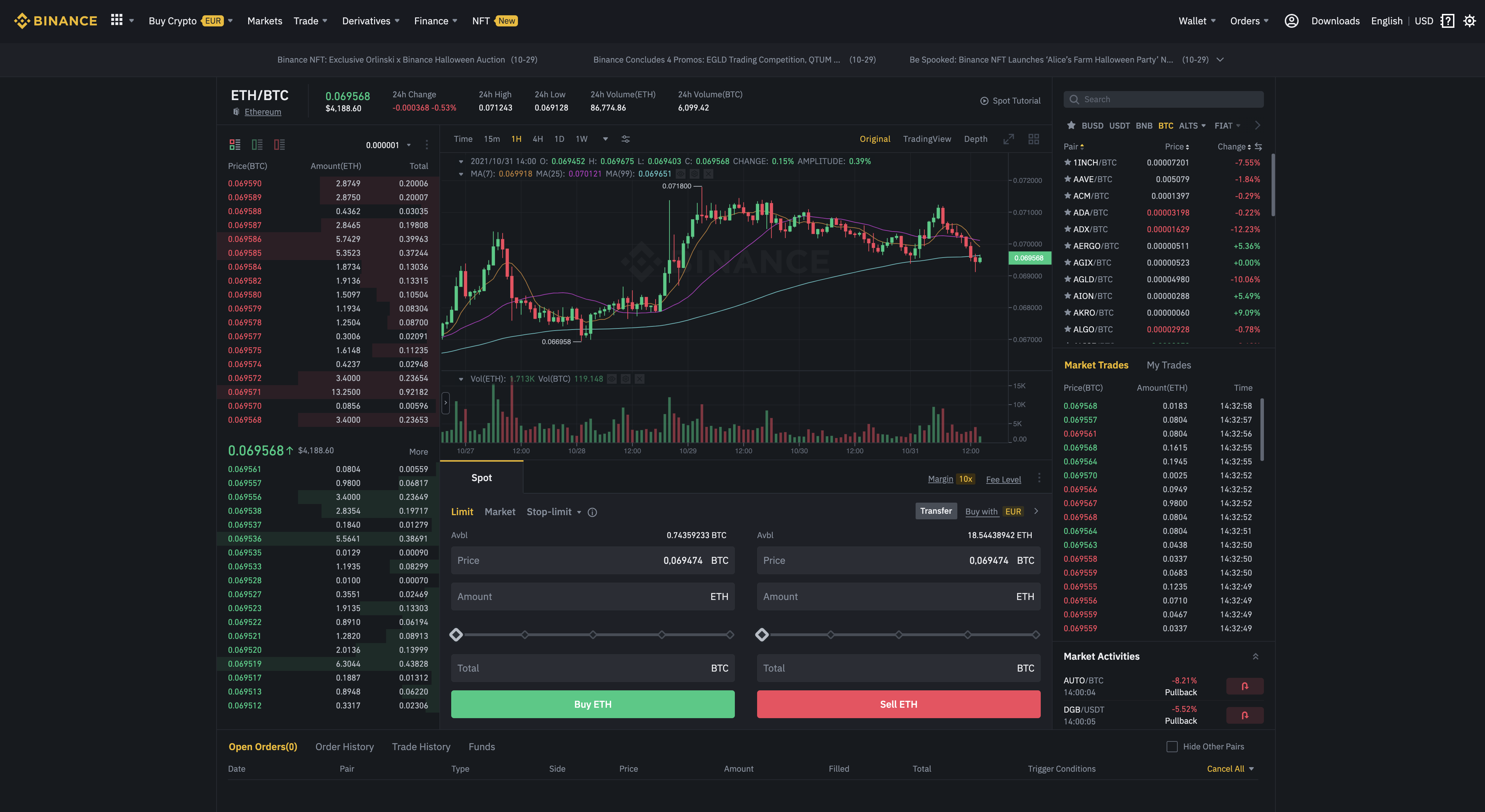

Once you have sent funds to Binance, you can start trading. All you have to do is click on Exchange at the top of the menu and you will be redirected to the appropriate page. Especially for beginners the following dashboard can look a bit confusing. We therefore try to bring clarity.

Select trading pair: On the top right, you first need to select which cryptocurrency you want to trade against. Basically, cryptocurrencies at Binance are traded against BNB (Binance Coin), BTC (Bitcoin), various altcoins (like Ethereum and XRP), various stablecoins (like USDT Tether, BUSD etc.) and fiat currencies like Euro. You have to keep in mind that not every cryptocurrency is traded against euros. However, almost all cryptocurrencies are traded against BNB and Bitcoin. So it may happen that you have to exchange your Euros for Bitcoin first and then you can buy the respective cryptocurrency.

Once you have selected which cryptocurrency you want to trade against, you still need to select which cryptocurrency you actually want to trade. You can either click on it directly from the list or enter the name (e.g. IOTA) in the search field. As soon as you have selected the desired trading pair, the chart in the middle of the screen changes and the selected trading pair is displayed again in the upper left corner (in the picture above BTC/USDT).

Chart: In the middle of the screen you will find the chart. On this you get the current price trend of your trading pair displayed. You can set the chart to display the candles in different intervals of minutes, hours, days, weeks or months. The default setting is always an hourly interval. Each candle represents one hour. If the candle is green, then the price at the end of the hour was higher than at the beginning, with a red candle the price has fallen within this hour. At the bottom of the chart you can see the trading volume represented as a bar, also on an hourly basis. Below you will find the MACD indicator for experienced investors. We will discuss this in more detail elsewhere. However, this is a technical indicator from the chart analysis.

Order book: On the left side of the column you will find the order book. Here you can see all buy (green) and sell (red) orders. These were set by limit order. The order book can be used as an indicator of the spread between the lowest sell price and the highest buy price. Furthermore, you can see where there are particularly strong support (many buy orders) and resistance levels (many sell orders).

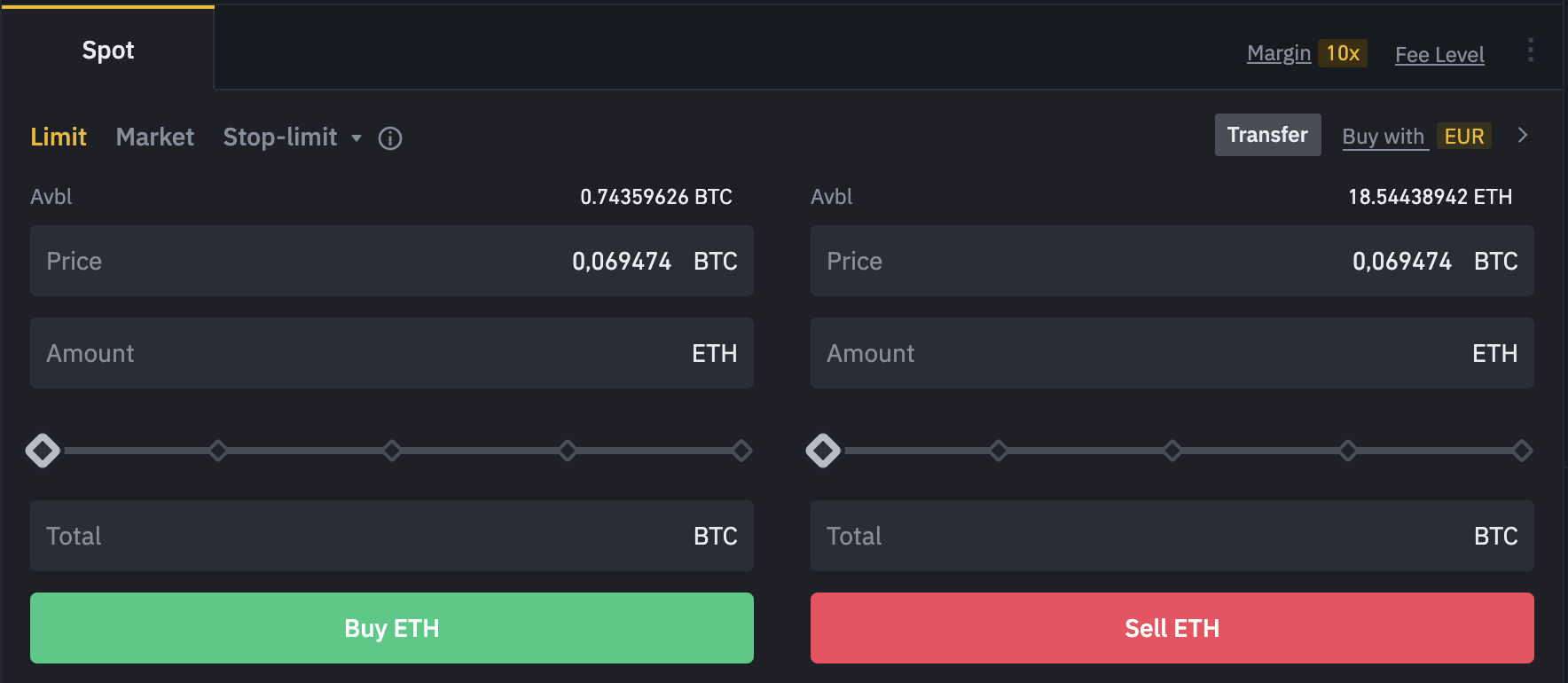

Difference Limit, Market and Stop-Limit Order

Below the price history you will find the mask where you can enter your sell or buy order. It is important to know that there are 3 different types of orders (market, limit, stop limit). You can select these via buttons.

Market Order: This is the easiest to understand for beginners. You simply select how much of the cryptocurrency you want to buy or sell (you can enter manually or you can select the specified percentages). After that, all you have to do is click the Buy or Sell button. Your order will then be executed immediately at the best possible price available on the market.

Limit Order: Here you choose not only how much of the cryptocurrency you want to buy (or sell), but also at what price. This has the advantage that the order is only executed when the respective price is also available on the market. Experienced investors usually only use a limit order, as this gives price certainty. This always happens when the markets do not have enough liquidity, so especially for smaller cryptocurrencies.

Limit orders that cannot be executed immediately are written to the order book and appear at the bottom of your screen under “open orders”. How long it takes until the limit order is executed depends on how the price develops. Theoretically, it is possible that an order will never be executed, in which case you can of course cancel it at any time.

Stop Limit Order: This is an order where a limit order is written in the order book as soon as a previously defined price level (stop price) is exceeded or not reached.

Binance App

If you want to use the Binance crypto exchange, you don’t necessarily have to do it via the website. In the meantime, you also have the option to use Binance via the desktop app (available for Windows and Mac) or via the iOS and Android app. The advantage of this is that the apps are usually somewhat more performant than the website itself. Especially for those who trade a lot, we recommend using the apps in any case.

Fees at Binance

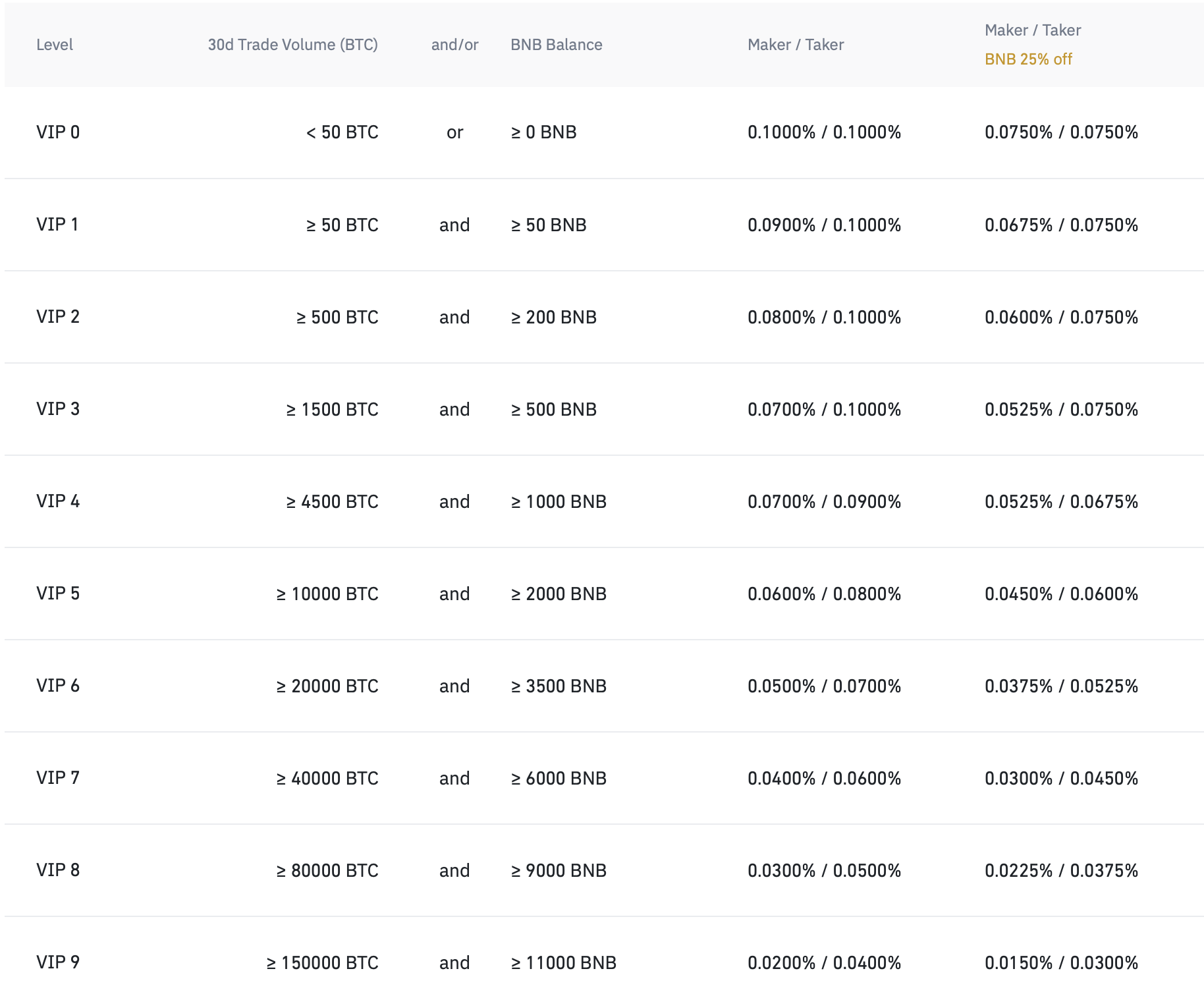

The fees at Binance depend on how much BTC you hold and how much balance you trade within a month (30 days). Since most people here will trade significantly less than 100 BTC per month, it is only worth considering this case.

Basically, Binance distinguishes between the so-called Maker and Taker Fee. The difference between the two is that the taker fee is applied to a market order that is executed immediately. The maker fee is applied to a limit order that is written to the order book and is therefore not executed immediately. The normal maker and taker fee at Binance is 0.1%. So if you trade crypto assets worth 1,000 euros, you pay 1 euro in fees.

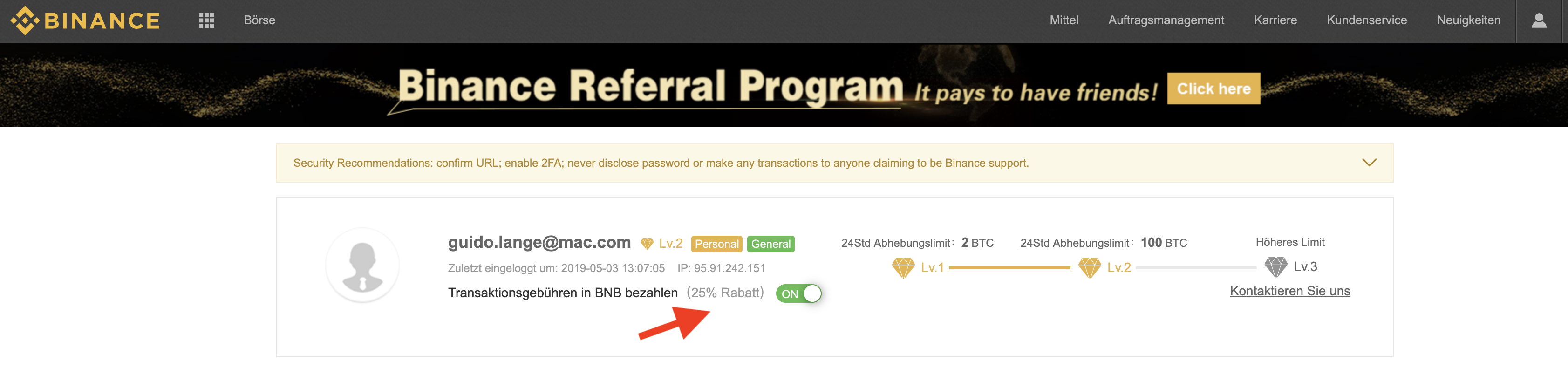

Currently, there is still the possibility to reduce the fees. For this you have to pay the trading fees in BNB. To do this you have to select in the settings that the transaction fees should be paid in BNB. This way you will currently save 25% of the trading fees. If you sign up with our link, you will also save another 10%.

So-called custody fees, as they have some share accounts, do not exist at Binance. So you can comfortably leave your funds at Binance and pay no additional fees.

In addition to the trading fees, Binance may also charge fees for deposits and withdrawals. Deposits of cryptocurrencies are always free of charge. Euro deposits are also free of charge if you make them via bank transfer (currently suspended). Only Euro deposits by credit card are subject to a 1.8% fee. For withdrawals, Binance actually only passes on the transaction fees that are due in the respective network (i.e. the respective blockchain) for a transaction. Euro withdrawals are currently only possible by credit card and cost 1% fees.

Binance does not currently charge any fees other than those listed here.

What is Binance Coin (BNB)?

In order to finance Binance at its foundation, there was an Initial Coin Offering (ICO). So-called Binance Coins, or BNB for short, were issued. A total of 200 million BNB were generated. Binance now uses a portion of the profits (presumably around 20%) every quarter to buy back BNB. The repurchased BNB are then burned. Binance will do this until there are only 100 million BNB left. The stock of BNB will therefore be successively reduced, which should have a positive effect on the value of BNB.

Binance Coin can be used, for example, to pay the transaction fees on Binance. In addition, most cryptocurrencies on Binance are also traded against BNB. Also, anyone who wants to participate in an ICO on Binance Launchpad must own BNB. Finally, Binance has found a number of other partners that accept BNB, so it is now possible, for example, to pay for flights with BNB.

However, the most important use of Binance Coin (BNB) is probably the Binance Smart Chain (BSC). This competes with Ethereum, but is currently much better performing. To interact with the Binance Smart Chain (BSC) you need BNB because all fees (for example transaction fees) are paid in BNB.

The performance of BNB has been very good so far. Therefore, it has also paid off for many investors to simply hold BNB.

Margin Trading Tutorial

Binance also offers the possibility of margin trading. However, this is no longer possible for new users from Germany since August 2021 and margin trading would soon no longer be possible for existing German customers either. Users from Switzerland and Austria are not affected by this so far.

With margin trading, you basically have the option to borrow additional funds and thus trade with leverage. So assuming you have 1 BTC credit, then you could borrow 2 more BTC and can then trade with it. For borrowing the funds you pay an interest rate, which is due every hour. The interest rate depends on the coin you borrow.

However, since you can quickly lose a lot of money if you are liquidated, margin trading is only for experienced investors. To do margin trading at Binance you have to move the funds from your spot wallet to the margin wallet. Binance distinguishes between isolated margin and cross margin. As the name suggests, Isolated Margin means that you choose how much you want to deposit as collateral for each individual trade. With Cross Margin, all of your funds in the Cross Margin Wallet are applied to all margin trades.

The dangerous thing about margin trading is that you can be liquidated if the price falls too far. For example, if you trade with a leverage of 1:2, you will be liquidated if the price drops by 50%. Isolated margin allows you to prevent your entire margin account from being liquidated (this can happen with cross margin).

Binance Futures Tutorial

On Binance there is also the possibility to trade futures (derivatives). The futures contracts give you the opportunity to bet on rising or falling prices of selected cryptocurrencies. The special feature is that you can trade with a maximum leverage of 125x (depending on the cryptocurrency).

Binance trades so-called perpetual contracts and quarterly contracts. The difference between them is as follows.

Perpetual Contracts: These have an unlimited duration and you can either go long or short. The leverage you can use depends on the cryptocurrency (e.g. 125x for Bitcoin). However, when you are in a position, you pay funding every 8 hours. If the funding is negative and you are long, you will get money every 8 hours. The funding always depends on whether most traders are long or short. Under certain circumstances it can be very expensive to stay long in a perpetual contract. Alternatively, there are therefore the Quarterly Contracts.

Quarterly Contracts: These always expire at the end of the quarter. Unlike the Perpetual Contracts you do not pay (or sometimes get) the funding every 8 hours. The disadvantage is that your position will be liquidated at the expiration date of the contract no matter if you are in profit or loss.

If you want to know more about the Binance Futures platform and how it works, here is the video tutorial.

Binance Earn Guide

Besides trading cryptocurrencies, you can also invest many cryptocurrencies at Binance. In return, you get interest on your cryptocurrencies. Why Binance can pay this interest has several reasons. On the one hand, some assets are lost to margin traders (investors who trade with leverage). Binance mediates and guarantees that you will also get your funds back.

In addition, there are also many proof-of-stake cryptocurrencies (e.g. Cardano) where Binance does the staking for you. This makes the platform so effective that you usually receive higher interest rates than if you were to stake yourself.

Basically, the Binance Earn products can be divided into 3 categories. These include products with “Flexible terms”, investments with “Fixed terms” and DeFi products with higher risk.

Flexible Terms

As the name suggests, you can invest your funds here and they remain available at all times. In plain language, this means that you can transfer the funds back to your Binance Spot Wallet within minutes and withdraw or sell them from there at any time. The downside to this is that the interest rates are usually a bit lower than the fixed term investments. In the case of products with flexible maturities, there are 3 possible investments, which we will introduce to you in more detail here.

Flexible Savings: Here you can simply invest your funds and have access to them at any time. All you have to do is click on Transfer for the respective cryptocurrency and then transfer the funds from your Binance Spot Wallet to your Savings Wallet. Afterwards, you will already receive interest on the funds. The interest is paid out daily.

Launchpool: At Binance Launchpool, there are always cryptocurrencies that are issued to investors there. Binance itself calls it mining. All you have to do is deposit cryptocurrencies there and you will automatically receive a portion of the new cryptocurrency once a day. The number of coins you get depends on the deposited balance.

BNB Vault: If you have BNB in your Binance account you should use the BNB Vault. Binance will automatically search for the best (most lucrative) investment opportunity for your Binance Coin (BNB) and will automatically deposit it there.

Fixed Savings

In contrast to flexible investments, you invest your funds for a fixed period of time. This can be between 7 and 90 days. Generally, the longer the term, the higher the interest. During this period you have no possibility to access your funds. However, you will receive higher interest rates than with flexible terms. The following products are available for Fixed Savings:

Locked Staking: With this type of investment Binance stakes the assets for you. Ultimately, Binance does this for all popular proof-of-stake (PoS) cryptocurrencies. Since Binance is very effective and does not charge any fees, you will often get higher interest rates than you would if you were staking yourself. It is therefore worthwhile to use this service. You only have to decide how long you want to invest the funds (usually between 7-90 days). During this time you can not access the credits.

DeFi Staking: Here your credits are invested for you in DeFi protocols such as Curve, Yearn or others. Here you usually get a higher interest rate. However, the disadvantage is that there is a higher risk of loss than with simple staking or flexible savings. This is because the DeFi (decentralized finance) protocols can always have potential vulnerabilities and hackers could steal funds.

ETH 2.0 Staking: By switching Ethereum from Proof-of-Work (PoW) to Proof-of-Stake (PoS), there is an opportunity to stake Ethereum and earn almost 20% interest per year. The downside, however, is that you won’t get your Ether (ETH) back until Ethereum 2.0 is live. So it may well take a few more years.

Ways to earn money on Binance without trading

Since there are numerous ways to earn money on Binance besides Binance Earn, we have summarized the most important ones in a video and explain what you have to do.

Binance Liquid Swaps Tutorial

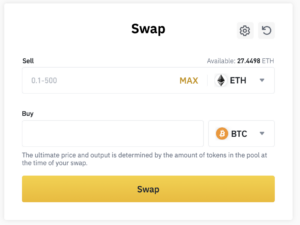

One way to exchange one token for another at Binance is Liquid Swaps. You can find the whole thing in the top menu under Finance -> Liquid Swap. You can not only swap tokens there, but also provide liquidity and provide interest for it.

The principle of Liquid Swap is similar to Uniswap. You have different pools there, such as the BTC/ETH pool. In this pool, Bitcoin and Ethereum are deposited in the same value. With Liquid Swaps, you can now deposit Ethereum into the pool and withdraw Bitcoin in exchange. This changes the ratio in the pool. So there is less Bitcoin in the pool and more Ethereum. This leads to Ethereum falling in price and Bitcoin rising.

These pools are not only available for BTC/ETH, but also for many other cryptocurrencies that are traded on Binance. The advantage over traditional trading is that there is no longer an order book and each order does not automatically have to be matched by another buy or sell order. The disadvantage is, of course, that large orders can lead to significant price changes. Therefore, the amount up to which you can exchange cryptocurrencies among themselves is limited. Thus, a maximum of exchange orders worth about 0.1 bitcoin can be carried out.

For the exchange of cryptocurrencies you pay 0.1% fees. For a 1,000 US dollar trade, this means 1 US dollar. The fees are then distributed proportionally to all who have provided liquidity in the pool. You can also provide liquidity in the pools and earn money with it. The interest that can be earned depends on the pool, but is usually between 6-30% per year. How Liquid Swaps work exactly is explained in the following video.

Binance Launchpad and Launchpool Tutorial

Another interesting way to earn money on Binance is with Binance Launchpad. This is Binance’s own IEO platform. As a reminder, IEOs are the successor of Initial Coin Offerings, i.e. ICOs. In principle, the ICOs take place under the auspices of the crypto exchange, in this case Binance. Among other things, this means that the coin offerings are more regulated and fairer for investors.

At Binance Launchpad, an IEO takes place about once a month, where investors can acquire new coins. The IEOs on Binance Launchpad so far have all been very promising for investors. Typically, IEO investors were able to make between 2x-30x on their investment at each IEO, provided they sold right after the token listing.

The way a typical IEO listing works is that investors are introduced to the project. Since the IEOs are all oversubscribed, there is now a process that distributes the coins based on their own BNB balances. Roughly speaking, the more Binance Coin (BNB) one holds at Binance, the more new coins one can acquire. To participate in Launchpad you have to actively register for each IEO.

In the past it has been shown that it is safest to sell the coins in the first hours after listing. Investors have always been able to make a profit on Binance Launchpad in the past. However, many coins have also developed very well in the long term, for example MATIC.

In addition to Binance Launchpad, there is now also Binance Launchpool. You can create cryptocurrencies (often BNB, for example) and usually receive new cryptocurrencies daily, which are distributed in the current Binance Launchpool program. Your deposited assets remain flexible and you can also sell them again at any time. So if you have Binance credits, you should urgently take a look at Launchpool.

P2P Trading on Binance

Since it is no longer possible to make euro deposits and withdrawals via bank transfer (SEPA) at Binance, P2P trading has become increasingly popular. This is a marketplace where you can buy cryptocurrencies directly from other users. To pay for them, you can also use bank transfers. Binance acts as an intermediary and mediates in case of disagreements.

Binance Card - the Crypto Credit Card

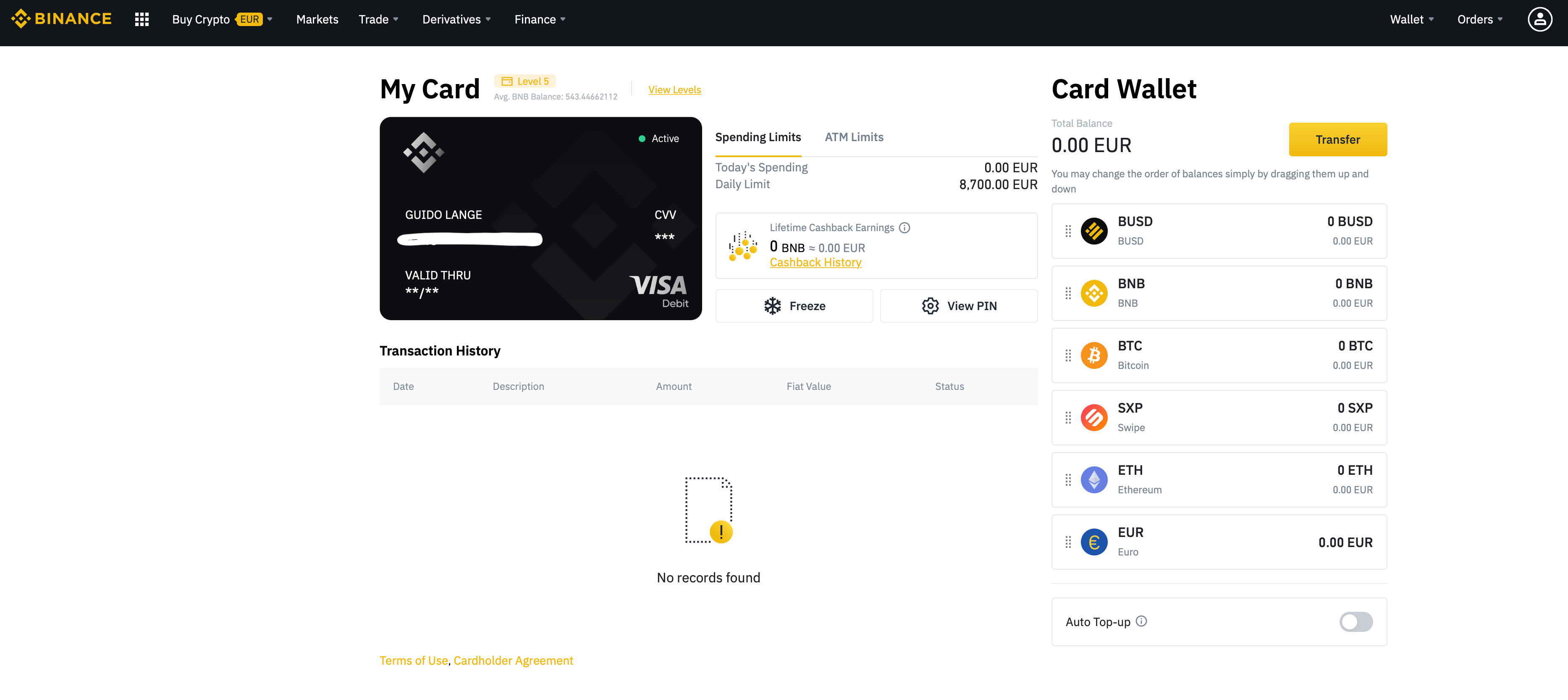

If you own cryptocurrencies and want to spend them, you can do so with the Binance Visa card. You can simply order it free of charge from Binance and it will be sent to you. Basically, it is not a real credit card, but a debit card. That is, it would simply be issued your crypto funds that you load onto the card.

The management of the card works via your Binance account. You can load various cryptocurrencies onto your Binance Card account for this purpose. Only when you spend the cryptocurrencies are they automatically exchanged for euros.

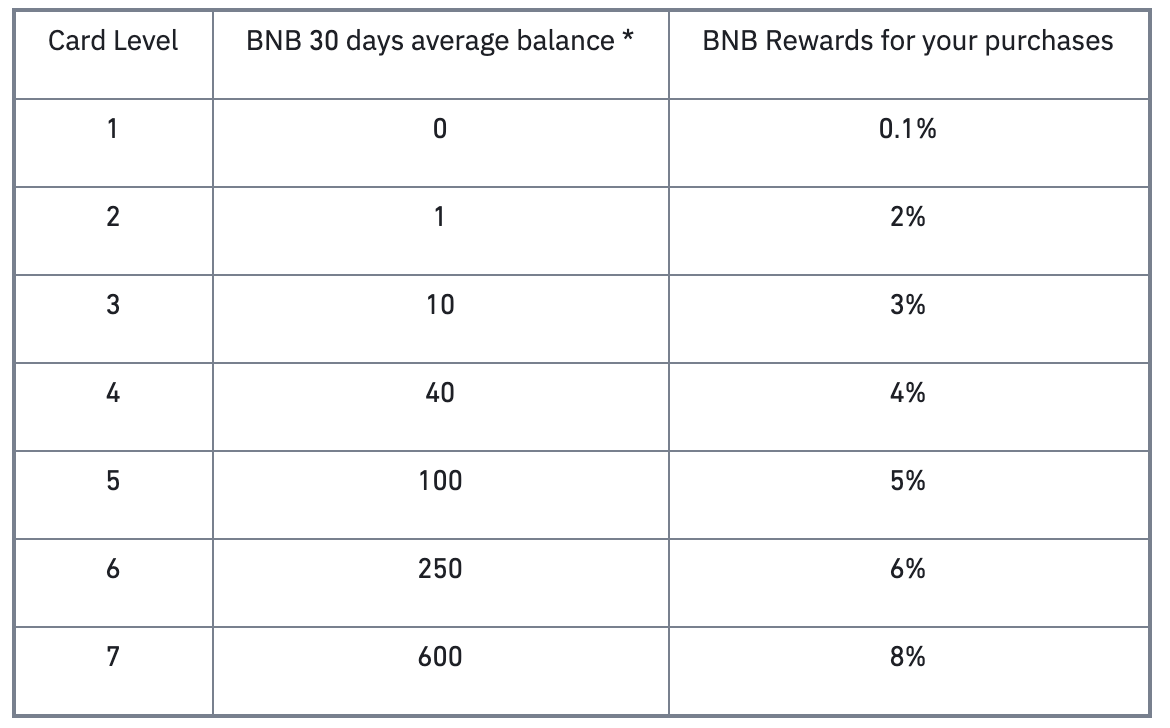

The fees with the card are quite favorable. For each transaction (i.e. payment) 0.9% fees are due. But you should not forget that there is a cashback program. You get 1% of the purchase price as BNB Coin credited to your Binance Card account. If you hold BNB you can get up to 8% cashback. But for this you need 600 BNB. A bit more realistic is to have only 10 BNB for which you get 3% cashback, for 40 BNB you get 4% and so on. There are no further fees.

The limits for the card are 8,700 euros, which you can spend per day with the Binance Card. In addition, you can withdraw a maximum of 290 euros per day from the ATM.

Binance Customer Support

If you have a problem with the Binance platform, you can of course contact the customer service at any time. The support is available around the clock and 7 days a week. Meanwhile, there is also a German customer service. You can simply ask your question in German and get an answer in German.

Besides the possibility to ask a question to the support there is also a detailed FAQ section. Many questions that arise about Binance are already answered there. To contact the Binance support you simply have to make a request here. There is no telephone support. How long it takes to answer your question depends on how busy the support is. Sometimes you will receive an answer after a few minutes and sometimes it can take 24 hours.

Store Cryptocurrencies at Binance?

Anyone who buys cryptocurrencies will often ask themselves how they are stored. In principle, you have the option to leave your coins with Binance, but some users prefer to manage the coins themselves.

As far as security at Binance is concerned, Binance has the so-called Secure Asset Fund. 10% of all trading fees go into this fund and this is to compensate for losses from hacker attacks if they happen. For example, in May 2019, there was such a hacker attack on Binance and over 7,000 Bitcoins were stolen, which at the time had a value of over $40 million US. The stolen BTC were eventually replaced to investors from this fund and no investor was harmed. Furthermore, Binance stores over 98% of all funds offline in so-called cold wallets. It is therefore only ever possible for hackers to steal a small portion anyway.

To store the coins yourself there are several possibilities. We would recommend either to use the Trust Wallet on your smartphone. This is now adopted by Binance and is technologically leading. Trust Wallet is available for iOS and Android. However, it is even safer to use a hardware wallet. The market leader in hardware wallets is the French company Ledger with the Ledger Nano S. It currently costs 59 euros. If you want a bit more comfort, you can also buy the newer model, the Ledger Nano X, for 119 euros. However, you should definitely invest the money for a hardware wallet. The new Ledger models now also support most cryptocurrencies.

Conclusion

If you want to trade more than just bitcoins, you should definitely have an account with Binance. Because the exchange is not only very secure (investors have never lost money due to a hacker attack and there is the Secure Asset Fund as a hedge), but also has the largest trading volume worldwide. Especially if you want to trade smaller cryptocurrencies it is important to have enough liquidity, which is often only the case with Binance.

Binance is suitable for both beginners and professionals. The platform is now very powerful. So if you only want to be registered on one platform, we recommend Binance. Especially since the platform also supports euro deposits and withdrawals. As a beginner, however, it can take some time until you have completely understood Binance.

Exchange

Rating

Features

Link

Copyright © 2026 | WordPress Theme by MH Themes