Canary Capital Submits 19b-4 Application for Hedera HBAR ETF

US investors may soon be able to participate in Hedera (HBAR) via ETF. Canary Capital has submitted a formal application to the US Securities and Exchange Commission (SEC) and aims to obtain approval as soon as possible.

Canary Capital’s plan to introduce an ETF (Exchange Traded Fund) based on Hedera (HBAR) is progressing. The crypto company has now submitted its filing to the SEC under the identifier 19b-4 – a document that is required for the registration of ETFs and other complex investment products. Canary Capital wants to issue the first US ETF for Hedera.

If Canary Capital receives the green light from the SEC, the Hedera ETF would be launched on the American stock exchanges. This would offer institutional and private investors an easy way to invest in HBAR without having to purchase the digital currency directly. ETFs for Bitcoin and Ethereum already exist on the US market, but not yet for Hedera.

Canary Capital for a Hedera ETF: An Opportunity for Investors?

For Hedera, this could open up new opportunities for growth. As an investment product, the Hedera ETF would give investors confidence, thereby potentially driving up demand for HBAR. Additionally, trading in ETFs is much more straightforward and distinctly cheaper than dealing with cryptocurrencies, which is often complex and costly.

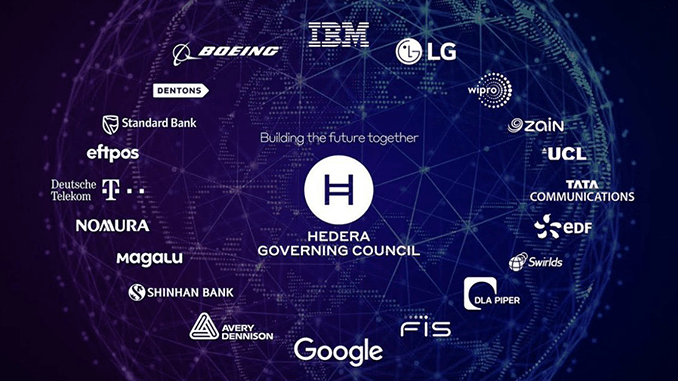

Canary Capital emphasizes that the basis for the Hedera ETF would lie in the novel consensus mechanism, and excellent acceptance in industry and digital payments that Hedera arranges. A collaboration with the technology company IBM should be emphasized here.

The precise schedule for when the Hedera ETF will be available crucially depends on the SEC’s decision. Generally, the SEC takes a few months to give the green light for such projects. In the case of other crypto ETFs, their filings have been debated by the SEC for years. A fast decision for the Hedera ETF is anything but certain.

Leave a Reply