SEC relaxes crypto exchange Justin Sun aims for settlement in Tron case, Gemini released from investigation

The regulatory authority SEC is taking a more conciliatory stance on the crypto market and has suspended an investigation into the Gemini crypto exchange. Justin Sun, CEO of Tron, is seeking a settlement in his case with the SEC.

The US Securities and Exchange Commission (SEC) has recently surprised the crypto industry with several constructive signals. Most recently, the suspension of an investigation into the Gemini crypto exchange, which primarily revolved around the business model of the Gemini Earn program. The program allowed Gemini customers to invest their cryptocurrencies in third parties for interest rates; this aspect is once again soaring in popularity, especially with Bitcoin and Ethereum.

It is becoming clear that the SEC intends to allow the crypto market some freedom to experiment without immediately intervening with sanctions and bans. This could bring a noticeable revival of DeFi (Decentralized Finance) projects back to the US market and significantly influence the current market landscape.

Tron and Justin Sun are also affected by these SEC measures

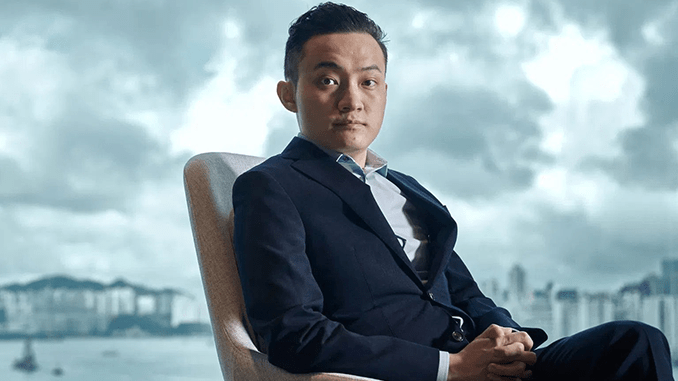

Justin Sun, founder of the Tron (TRX) blockchain, is currently very active and has in the past repeatedly faced accusations of unregulated trading in securities by the SEC. In a high-profile case from March 2022, Justin Sun signaled his willingness for a settlement and publicized his collaboration with the SEC. Sun wants to avert a costly trial and the possibly hefty penalties that might follow a court decision.

His strategy is aimed at finally normalizing Tron in the US and further expanding the reach of his ecosystem. Avalanches of lawsuits could often be avoided in the past with similar deals in which accused individuals or companies acknowledged part of the allegations in order to pay a fine to the SEC.

Gemini and the crypto market in view

The fact that the SEC has paused its investigation into the Gemini Earn program is being evaluated as a significant relief to the crypto industry. This is interpreted as a signal that allows digital financial transactions structured more freely in the future and could thus provide an entire class of services with new momentum.

Gemini had already began winding down its respective activities in 2022. The SEC’s green light could reopen some revenue streams that Amazon and Coinbase, as well as traditional financial institutions, have been eyeing with new interest.

The crypto market reacted positively to the SEC’s softer stance, with Bitcoin and other digital currencies showing solid price gains. Observers assume, however, that a true breakthrough in the USA can only be achieved if other top projects like Coinbase get a similarly small concession from the SEC.

Leave a Reply