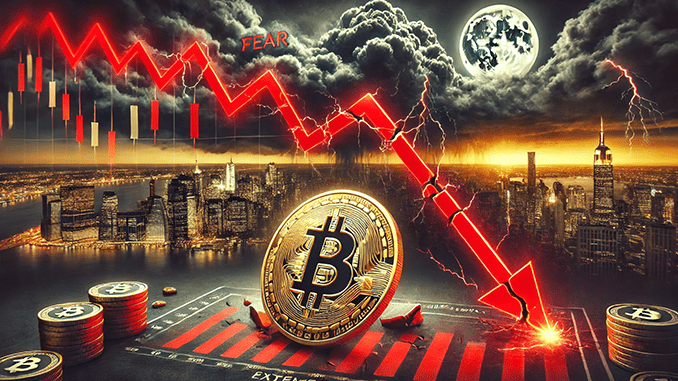

Bitcoin below 80,000 USD – Sentiment indicator shows extreme fear

Bitcoin is currently experiencing turbulent times and has fallen below the 80,000 USD mark. The market sentiment is at extreme fear according to a commonly used indicator.

Fear and Greed Index at extreme fear

The Fear and Greed Index, a measure that indicates the overall sentiment on the market, has hit a new low. At a value of 18, it shows extreme fear among investors. This index is calculated based on various factors, including volatility, market momentum, and social media trends. Experts often see such an environment as a potential time to buy, going against the prevailing market sentiment.

Bitcoin’s current price trend

Bitcoin’s current valuation of under 80,000 USD is causing unease among investors. However, it is important to note that Bitcoin has historically experienced significant price fluctuations and market corrections. Despite the short-term negative sentiment, many believe that Bitcoin will rebound in price due to its long-term potential as a store of value and investment vehicle.

How to react to extreme fear

For investors, the current extreme fear in the market could present an opportunity to accumulate Bitcoin or other cryptocurrencies at a lower price. However, it is crucial to remain cautious and not make impulsive decisions based solely on emotion. A well-considered strategy and long-term perspective are advisable in the volatile crypto market.

Market experts remain optimistic

Despite the current downturn, several market analysts remain optimistic about Bitcoin’s future. They point to the growing acceptance of Bitcoin as an investment class and its potential to serve as a hedge against inflation. Thus, the extreme fear in the market could be seen as a temporary phase that offers opportunities for strategic investment moves.

Leave a Reply