Bitcoin and MicroStrategy: Daring Bet on MSTR Stock

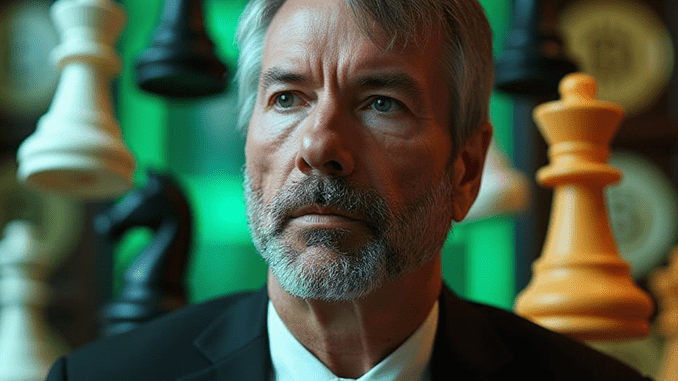

MicroStrategy is known in the crypto industry as a heavyweight in Bitcoin investments with vast BTC reserves. CEO Michael Saylor has made the company a world-renowned name. Now, MicroStrategy wants to revalue itself with a new business idea.

MicroStrategy focuses on buying BTC

MicroStrategy, America’s largest listed intelligence software company, received worldwide attention with the announcement in August 2020 that it will make investments in Bitcoin. Since then, MicroStrategy has become one of the largest Bitcoin holders – with a BTC treasury worth over 5 billion US dollars at current market valuations. Michael Saylor, the CEO of MicroStrategy, has been the driving force behind these trillion-dollar Bitcoin investments.

A Bitcoin investment thesis from Michael Saylor

Saylor explains the strategic decision for Bitcoin investments with the expectation of impressive growth potential, which he believes is not achievable with any other asset class such as equities. As a long-term investor, Saylor pursues a buy-and-hold strategy for Bitcoin, which he justifies by stating that Bitcoin is – in his opinion – the digital embodiment of absolute scarcity. Additionally, it offers unrivaled protection against inflationary tendencies in fiat currencies. For MicroStrategy, this is an admission that Bitcoin represents the superior alternative to saving in dollars.

Developing new business areas

Initially, MicroStrategy was primarily buying Bitcoin for long-term holding. However, there are plans to tap into new business areas as well. Already for October 2021, MicroStrategy announced it was exploring plans to wrap Bitcoin reserves into financial products and launch them on the market. Part of these ideas has already been realized.

Ideas for Bitcoin-backed financial products

Such newly invented financial products could allow other investors to benefit from MicroStrategy’s expertise in Bitcoin and market size while diversifying the company’s revenue streams. Though details are still sparse, MicroStrategy aims to issue formal and tradable securities based on Bitcoin under the name “Bitcoin Money.” CEO Michael Saylor explicitly names the goal to bring even more investors into the Bitcoin ecosystem through innovative financial products.

MicroStrategy stock – a business opportunity?

While MicroStrategy activates its Bitcoin holdings for new financial products, Michael Saylor is actively promoting the company’s stock itself. The stock – tradable on the NASDAQ under the ticker symbol MSTR – is increasingly viewed by some investors as a way to expose themselves to Bitcoin without directly holding BTC. The MSTR stock is considered more volatile for this very reason. Over the past months, its performance has correlated with that of Bitcoin. In personal financial statements, Saylor has announced that a significant portion of his private capital is also invested in MSTR shares.

Conclusion: Through Bitcoin and MicroStrategy to a gain

Critics of MicroStrategy’s investment strategy warn of high risks due to the volatility of Bitcoin, and it is true that the company’s shares have already seen significant swings in price. However, with Michael Saylor as CEO at the helm, MicroStrategy aligns itself as Bitcoin-focused in the sense that the company clearly defines its activities by engaging with the world’s leading cryptocurrency. Thus, specializing in Bitcoin constitutes the overarching corporate strategy. Investors in the stock market should therefore strongly consider whether and how they are prepared for exposure to the cryptocurrency, as MicroStrategy turns its corporate shares into a daring bet on Bitcoin.

Leave a Reply