Algorand (ALGO) has made the cryptoscene sit up and take notice in 2019 with the announcement to dissolve the so-called Blockchain Trilemma as a new crypto currency. This says that block chains could at best fulfil two of the three decisive cornerstones of security, scalability and decentralisation. ALGO therefore uses a new protocol with Pure Proof-of-Stake in its own block chain and does some other things differently than popular old chains.

Algorand (ALGO) has made the cryptoscene sit up and take notice in 2019 with the announcement to dissolve the so-called Blockchain Trilemma as a new crypto currency. This says that block chains could at best fulfil two of the three decisive cornerstones of security, scalability and decentralisation. ALGO therefore uses a new protocol with Pure Proof-of-Stake in its own block chain and does some other things differently than popular old chains.

Table of Contents

Quick Facts

Ticker Symbol: ALGO

Maximum Number: 10 billion

Protocol: Pure Proof-of-Stake

Historical Background to Algorand

Algorand begins its story in the official self-portrayal in February 2018 with the receipt of 4 million US dollars in venture capital through seed funding. At that time, the Bitcoin (BTC) was quoted at around 18,000 US dollars and had also given a powerful boost to important old coins such as Ethereum (ETH) and Ripple (XRP). The great public interest in crypto-currencies had awakened and almost every day new projects were being discussed. At Algorand, Silvio Micali went on an advertising tour. The professor of computer science could point out that he has been researching in the field of cryptography for years and that he won the unofficial Nobel Prize in Computer Science with the Turing Awards in 2012. From 2017 on, Silvio Micali had been seriously engaged in developing a new crypto currency. So now, in early 2018, Micali’s idea called Algorand could take off and the team could be expanded.

Micali wanted to use Algorand to address the problem known as the Blockchain Trilemma. Because BTC and the big Altcoins all suffered (and still suffer) from at least one weakness in the three fundamental points that characterize a crypto currency. Expected from a crypto currency are security, scalability and decentralization. BTC and Altcoins like Litecoin (LTC), Ethereum (ETH) and Bitcoin Cash (BCH) weaken by proof-of-work as a protocol when it comes to scalability. Ripple (XRP) has its sore spot in decentralization. In terms of security, not only were hacker attacks on crypto exchanges worrying, but the at least equally prominent known risk of 51 percent attacks. Micali promised to resolve the block chain trilemma with an innovative protocol called Pure Proof-of-Stake.

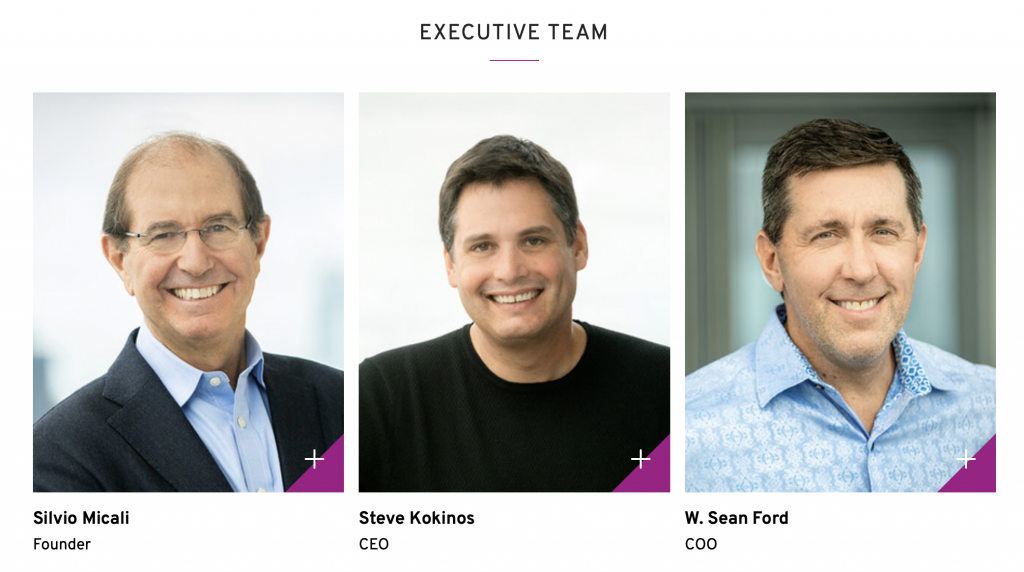

The test network for ALGO went live in summer 2018. Shortly thereafter, Algorand announced a further cash injection of 62 million US dollars and new personnel such as Steve Kokinos as Algorand CEO and W. Sean Ford as COO (Chief Operating Officer). Kokinos with his background as an expert in marketing database solutions and Ford with solid experience as a consultant and process optimizer, plus mathematical genius Micali – for this team, which Algorand still leads today, the doors in the crypto industry are open. This was clearly shown when ALGO was offered for the first time in a public sale in June.

Algorand took a special path in its sale of tokens. Instead of a typical ICO, a so-called Dutch Auction was held in June2019. In this auction, starting from a maximum price, offers to buy are registered and at the same time the price falls continuously. As soon as supply and demand match, the price valid at that time is determined. In Algorand’s first public offer in June 2019, 25 million ALGOs were sold to investors at a price of 2.40 US dollars each for a total of 60 million US dollars. Algorand hopes that this procedure will enable it to determine a realistic market price for the ALGO by means of Dutch auctions and combines this with a second special feature: Algorand guarantees a buy-back programme for investors who bid in public sales. This works as follows: One year after each auction, Algorand opens its buyback program for seven days. In this program, buyers of ALGO can demand that Algorand buy back ALGO for US dollars. For ALGO’s first-time investors, this means USD 2.40 minus 10 percent, resulting in USD 2.16. The first buyback programme is expected to take place in June 2020. It remains interesting to see whether ALGO will be able to compensate for significant exchange rate losses by then, which have meanwhile pushed it down to around 0.70 US dollars. The idea behind Algorand’s buyback programme is not to combat inflation, as is the case with the Binance COIN (BNB), but to provide investors with more security than usual, as they are protected against major losses.

Of the total of 10 billion ALGOs generated, which also represents the maximum number, Algorand intends to bring 3 billion ALGOs to market through its auction system over a period of 5 years until 2024, distributed in tranches of 600 million ALGOs annually. 25 percent of all ALGOs are reserved for the Algorand Foundation and Algorand Inc. Likewise, 25 percent of all ALGOs are distributed as rewards to node operators, plus 17.5 percent for other participation programs. 250 million ALGO are reserved for Airdrops and other gifts to end users.

ALGO is backed by Algorand Inc., a company led by Silvio Micali and the Algorand Foundation, which is headed by two women, Fangfang Chen and Tal Rabin. As in the case of Algo Inc., they divide the commercial (Fangfang Chen) and development (Tal Rabin) areas among themselves. In the medium term, according to the roadmap, ALGO will focus on topics such as Atomic Swaps, compressed nodes and better Smart Contracts from a technological perspective. In addition, the creators are likely to concentrate on helping ALGO to become better known and on finding cooperation partners from business and industry.

Technology behind Algorand (ALGO)

The linchpin of Algorand is its own Pure Proof-of-Stake (PPos) protocol. Inventor Silvio Micali himself sheds light on it in a readable summary, highlighting how it is designed to meet scalability, decentralization and security at the same time. PPoS thus assumes that in every block chain, as in human society, there are dishonest participants, but that these are not in the majority. To transfer this to the creation of new blocks and thus the validation of transactions, PPoS at Algo uses a two-tier system.

Each ALGO represents a possible participant in the block chain. In the first step, an ALGO is randomly assigned to propose the next block. In the second step, a committee of 1,000 randomly selected participants decides by majority vote whether this block is to be valid. This concept is intended to eliminate known weaknesses of other protocols. In order to demonstrate the readiness for active participation in PPoS, it is sufficient to solve a cryptographic puzzle, which should take less than one second even on standard computers. This is the aim of broadly distributed hash rates at ALGO. The random selection ensures that potential attackers do not even know which nodes they are supposed to occupy or attack in the Algorand network. This makes 51 percent attacks statistically almost impossible, says Micali. Another side effect of PPoS: A hard fork seems extremely unlikely.

According to Micali, PPoS fulfills all the requirements to finally send the block chain trilemma into the past. Scalability is achieved through extremely fast and easy participation in the validation process and increases automatically with the number of ALGOs in circulation. The majority principle instead of consensus also contributes to speed and thus scalability. Security is also guaranteed by the broad and constantly changing distribution of validators. The randomness principle does not provide attackers with predictable points, every second the composition of the committee of 1,000 participants changes and for each new block a different ALGO is responsible for the proposal. Finally, decentralization results from the combination of randomness, 1,000 participants and constant changes in the players in PPoS.

Criticism of Algorand

Pure proof-of-stake at Algorand – too good to be true? Admittedly, the question which experts at ALGO are concerned with is a pointed one. But when a crypto-currency like ALGO boasts of leaving established and proven blockchains like Bitcoin (BTC), Ethereum (ETH), TRON (TRX) or EOS technologically behind from zero, this raises doubts. ALGO has not yet had to prove in practice that it is stable, fast and safe. Even though ALGO achieves considerable daily turnovers on crypto exchanges, these are still far from the volumes that the top dogs can handle. Viewed positively: Algorand is young and so far has not had to admit to any security gaps or other technical problems. Whether this will always remain so, however, is open.

One open flank in Algorand is certainly the dependence on Silvio Micali as technical mastermind. At Ethereum and TRON such one-man-shows have already ended in violent price swings, at Bitcoin Cash ego games led to a bitter hard fork from an investor’s point of view. Algorand and ALGO face the difficult task of winning over not only investors, but also developers and a community that are fascinated by PPoS and use this protocol or help with its further development.

A certain uneasiness creeps into ALGO, especially when looking at the price development. The initial 2.40 US dollars could not be kept. Despite being listed on major crypto exchanges, ALGO’s share price will move well below 1.00 US dollars in late summer 2019. Algorand has not scheduled another public sale at that time and is thus away from its plan to launch 600 million ALGO per year. In this situation, the promise of a possibly intensively used buyback programme seems like a sword of Damocles. After all, any public sale with values significantly below USD 2.40 would signal that the market is not accepting ALGO as hoped. The financial obligations could quickly eat up the cushion that is supposed to serve the development of ALGO.

How to Buy Algorand (ALGO)

Unfortunately there is no crypto exchange where Algorand is traded against Euro. So if you want to buy Algorand you have to do it for example against Bitcoin or Tether. A good place to do this is at Binance, the world’s largest crypto exchange. You first have to buy Bitcoins at another exchange (e.g. Coinbase) and then you can send them to Binance. Once the Bitcoins have arrived there you can use them to use Algorand.

Alternatives to Algorand from an Investor Perspective

Those who invest in ALGO are betting that PPoS will establish itself as the advanced protocol in the competition of block chains at the leading position in the crypto industry. In this respect EOS and TRON are natural competitors. ETH, too, with the prospect of Ethereum 2.0 and the associated switch to proof-of-stake, is an option for all those who are convinced that crypto currencies with highly scalable block chains will prevail in the medium and long term. If you believe in principle that block chain and protocol issues will determine the chances of success of newer old coins, it is worthwhile to take a look at projects like Perlin (PERL). Bitcoin (BTC), Litecoin (LTC) and other crypto-currencies that stick to proof-of-work are not very comparable to Algorand and ALGO, but have a reputation that ALGO still wants to achieve.

Wallets for Algorand

Algorand emphasizes the trilemma at Blockchains. Crypto investors know a second trilemma when it comes to choosing the best wallet. After all, the (digital) wallet should combine user-friendliness, security and future-proofing. There are three different methods for storing and using your ALGO and other crypto currencies. The Paper Wallet as the most original way of doing this is simple: private and public keys are written on a sheet of paper as passwords for the wallet and are therefore secure against online attacks. But in daily use, this approach proves to be extremely cumbersome, not only for ALGO – constantly typing long chains of letters and numbers is annoying. In addition, a piece of paper is quickly lost or becomes illegible. In any case, it is better for Paper Wallets to engrave your codes on a metal plate.

Software wallets are much more elegant than paper wallets. Here you can manage the access to your credit in a desktop program, in an app or at a crypto exchange. The Algorand Foundation refers to its ALGO Wallet, which is available as a software wallet for Android and Apple’s iOS for free download. Many other software wallets are also compatible with ALGO. For the added convenience of a software wallet, however, you are prepared to accept that the idea of security suffers. Because the end devices of software wallets are online and therefore in principle a target of criminal attacks on the Internet.

ALGO hardware wallets are not the only ones that stand for the optimum in user-friendliness and security. Here the public and private keys are stored separately from the Internet on an extra chip that guarantees security. The online connection of the hardware wallet thus offers attackers no gateway. Two large, established manufacturers dominate the market: Ledger and Trezor. Testers see the hardware wallets of Trezor and Ledger almost at eye level. The Ledger Nano S as entry-level model and the Ledger Nano X as top model achieve slight advantages due to their operating system, which easily allows new crypto currencies like ALGO to be fully implemented.

Conclusion on Algorand: ALGO – the breakthrough will not be easy

ALGO has started quite successfully in the crypto year 2019 with high hopes. However, significant price losses since then indicate that investors are increasingly critical of Algorand. The PPoS, which is advanced on paper, must find a broader user base if it is to really show its advantages. But that is precisely what ALGO might lack: the first public sale with hyped prices is a heavy burden for Algorand, especially because of the buyback programme. If you consider investing in Algorand, you should keep this in mind: Only ALGOs purchased at public sale qualify for the guaranteed buyback. The clearest indicator of where Algorand’s path will lead is expected to be the second, as yet unannounced public sale of ALGO and the target price then determined by the market.

Algorand Price and Price Development

Here you can find the current Algorand (ALGO) price and see how the course has developed.

- Algorand

(ALGO) - Price $0.944

- Market Cap

$6,244,722,562.00

Important Links to Algorand

Website Algorand

Website Algorand Foundation

Algorand on Twitter

Algorand Foundation on Twitter

Block Explorer ALGO

White Papers Algorand