Ethereum is an open-source block chain technology, which allows users to execute smart contracts on the block chain in addition to the crypto currency Ether (ETH). Currently Ethereum is still based on the energy-intensive proof-of-work algorithm, but in the long run Ethereum wants to switch to proof-of-stake, which does not require any mining.

Ethereum is an open-source block chain technology, which allows users to execute smart contracts on the block chain in addition to the crypto currency Ether (ETH). Currently Ethereum is still based on the energy-intensive proof-of-work algorithm, but in the long run Ethereum wants to switch to proof-of-stake, which does not require any mining.

Quick Facts

Ticker Symbol: ETH

Maximum Token Number: currently unlimited over 100 million

Protocol: Proof-of-Work (PoW) in future Proof-of-Stake (PoS)

Table of Contents

Historical Background to Ethereum

The idea for Ethereum goes back to a white paper by the programmer Vitalik Buterin, which he published in 2013. His goal was to write decentralized applications (DAPPs). Before that he had already tried in vain to argue that Bitcoin also needs a scripting language. Since his attempts at Bitcoin were in vain, it was soon clear that it was time to develop his own platform.

Vitalik Buterin found the name Ethereum while browsing Wikipedia. He liked it better than all other alternatives: Moreover, it reminded him of ether, a concept from physics. Ether should be spread all over space and thus take everything around.

One of the key moments with Ethereum was a lecture by Vitalik Buterin at the Bitcoin Conference in Miami in early 2014, where Vitalik Buterin tried to present his idea of Ethereum to the Crypto Community in a 25-minute talk. The interest in it was so great that after the lecture everybody left the room to learn more about Vitalik Buterin and Ethereum and nobody stayed to hear the next lecture. At this point the Ethereum team at that time understood that this could really develop into a big independent project.

Besides Vitalik Buterin, the Ethereum team at that time also included Joseph Lubin (today founder of ConsenSys), Anthony Di Lorio (today CEO and founder of Dezentral), Mihai Alisie (today Bitcoin Magazine and AKASHA Project), Gavin Wood (today co-founder of Parity Technologies) and Charles Hoskinson (today founder of Cardano). Even then, there were already several camps among the Ethereum founders. There was the economically driven group and the technically driven group. Among the more business-driven people were Joseph Lubin and Anthony Di Lorio. There were also founders who were more fascinated by technology, such as Vitalik Buterin and Gavin Wood. More in the middle of the two camps were Charles Hoskinson and Mihai Alisie.

A first dispute arose about the legal structure behind Ethereum. There were two approaches: either to do it like Ripple and create a for-profit company (also called Crypto Google) that can also raise venture capital, or to create a non-profit foundation (called Crypto Mozilla) that will help Ethereum’s development. Especially the more technically oriented group wanted the foundation variant, as this was the more independent variant and would probably allow Ethereum to develop more freely. In the end, the more technically oriented group also prevailed and the Ethereum Foundation was established. The differences within the group were so great that Charles Hoskinson left the team shortly after the decision was made and Anthony Di Lorio also went his own way shortly after.

Now that the legal structure with the Ethereum Foundation had been created, the financing had to be secured. To this end, Ethereum conducted an Initial Coin Offering (ICO) between 20 July 2014 and 2 September 2014. In total, this took only 42 days. During the ICO, participants could buy Ether Tokens against Bitcoins. At the beginning, investors received 2,000 ETH per 1 BTC. Later in the ICO there were only 1337 ETH per 1 BTC. Through the ICO, the Ethereum Foundation was able to collect 31,529 BTCs and sold a total of 60 million ether tokens. At that time, the BTCs collected had a value of 18.4 million US dollars. However, the value of Bitcoin dropped so much that 1 year later only about half of it was still there. Nevertheless Ethereum finally managed to develop the first version of Ethereum for 9 million US dollars. For the Ethereum ICO investors the investment was worthwhile in any case – after all, Bitcoin was only worth 600 US dollars at that time and for that there were 2,000 or 1,337 ethers.

The DAO Hack

One of the biggest events at Ethereum was the so-called DAO Hack. The abbreviation DAO stands for Decentralized Autonomous Organization. Behind the idea of the DAO is the approach to establish a decentralized venture capital fund that invests in decentralized projects. The entire project should only exist as Smart Contracts on the Ethereum Blockchain. The Smart Contracts were written by Christoph Jentzsch and Simon Jentzsch (2 brothers). These Smart Contracts have also been publicly available at Github.

In order to obtain capital for the DAO to invest, a 28-day crowdsale was started on April 30, 2016 (Ethereum Block 1428757). During the sale a total of 150 million US dollars worth of ether was collected. Over 11,000 investors have participated in the project. In the end, it resulted in 14% of all ethers existing at that time being bound in the DAO Smart Contract.

Already back then in May there was a paper that pointed out that there are security concerns with the Smart Contract Code. Investors were advised by the authors not to invest in the DAO.

On June 17, 2016 the time had come and there was an attack on the DAO and the associated Smart Contracts. A bug in the code of the so-called Recursive Call function enabled the attacker to steal 3.6 million of the 11.5 million ether collected. So almost 50 million of the total of 150 million US dollars were in danger. Strictly speaking, these had not yet been stolen at the time, because the attacker could only move them to another Smart Contract. This ensured that the 3.6 million ethers were locked in a Smart Contract for 28 days before the attacker could claim them completely.

The Ethereum community now had 28 days to decide what to do with the stolen ether before it was finally taken over by the attacker. A discussion then began in the community about what should happen next. Part of the community wanted to keep it that way, because the code should not be changed afterwards, because after all this is a decentralized system. As a reminder for a decentralized system nobody should be able to change the rules afterwards. Another part of the community wanted a hard fork and wanted to return the stolen ether to its previous owners (investors). The two camps were finally so disputed that it came to the Hard Fork and we have since then 2 Ethereum variants.

At Ethereum Classic (ETC) nothing was done and the attacker got the 3.6 million ether. Ethereum (ETH) was different, the stolen ethers were sent to a recovery address and the previous owners could claim them back. Until today, both crypto-currencies still exist in parallel. Whereby Ethereum (ETH) has been much larger than Ethereum Classic (ETC) since the hard fork.

The founders of the company also chose different camps. While Vitalik Buterin has supported Ethereum the whole time, Charles Hoskinson has become a strong supporter of Ethereum Classic. The two crypto-currencies also continue to develop independently of each other. While Ethereum wants to switch to Proof-of-Stake, Ethereum Classic will probably remain a Proof-of-Work platform for all eternity.

Technology of Ethereum

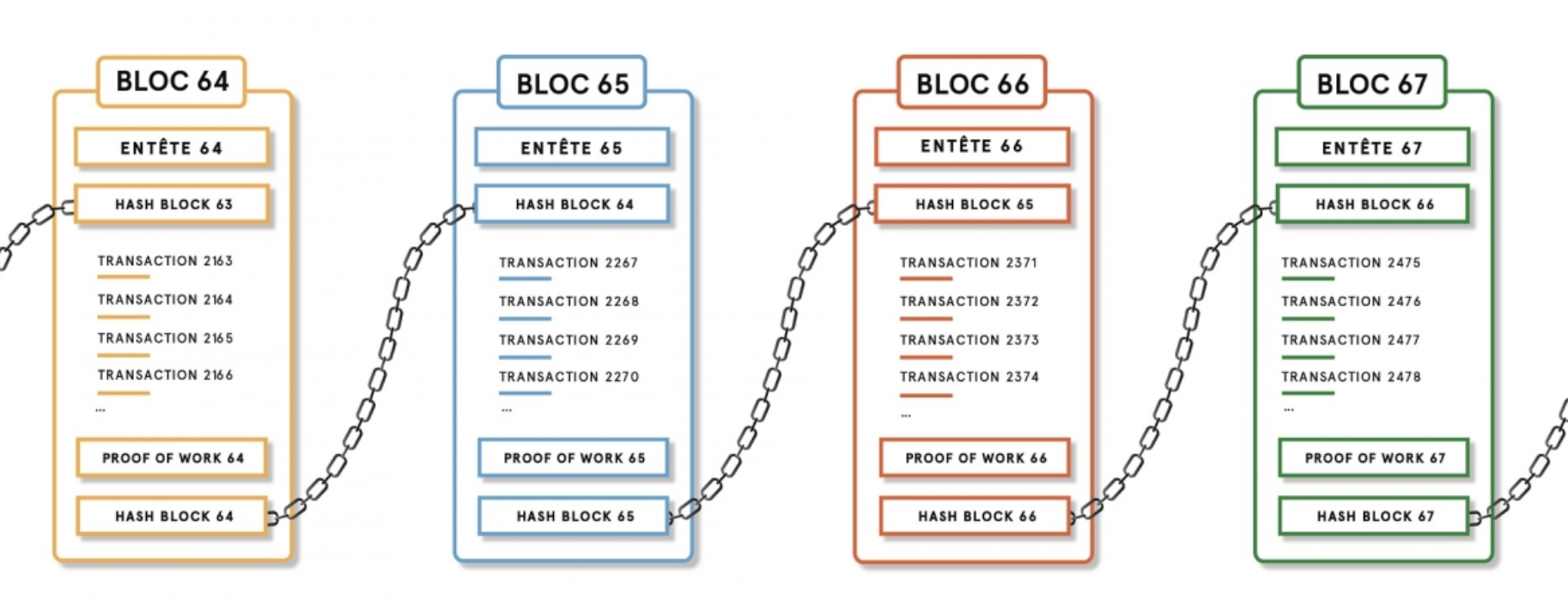

Similar to Bitcoin, Ethereum also has a block chain where miners find new blocks through mining. These blocks are then added to the block chain. In contrast to Bitcoin, Ethereum does not find a new block every 10 minutes on average, but every 15 seconds the miners find a new block in Ethereum.

All transactions that have taken place since the last block are then written to the respective block. The block is then attached to the block chain. Once a block has been added to the block chain, it cannot be changed. For the miners, this is worthwhile, because they get 2 ether for each block found (before the Constantinople Hard Fork 3 ETH). In addition, the miners also get all transaction fees from the transactions written to the blocks.

All transactions that have ever taken place are written in the block chain and can be viewed by everyone. The individual blocks are cryptographically linked to each other, so each block refers to the previous and the following one.

The special thing about Ethereum is that there are Smart Contracts in addition to the crypto currency ETH. This distinguishes Ethereum from many other crypto currencies such as Bitcoin, Ripple (XRP), Monero, Litecoin and others. With these Smart Contracts, many applications are conceivable, such as a voting system or notary functions. We have also seen games such as CryptoKitties and Fomo3D on the Ethereum Blockchain in the past.

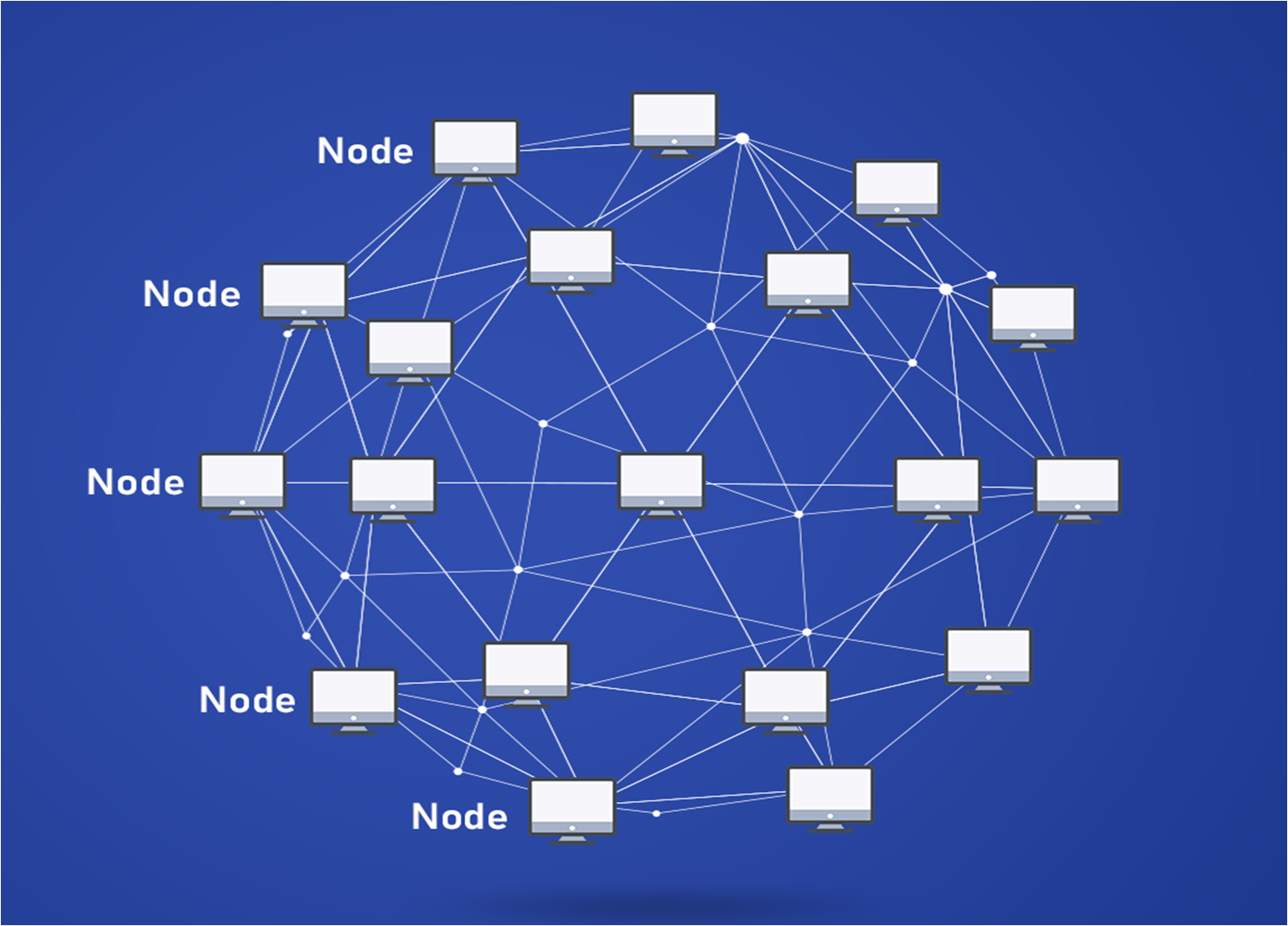

The Ethereum Blockchain is not stored centrally, but on so-called nodes. Anyone can operate one node. A distinction is made between a Light Client and a Full Node. As the name suggests, the Light Client does not store the complete block chain from the beginning. This is done because the Ethereum block chain is very large and it is much more difficult to operate a full node. With the Light Client everyone has the possibility to run a node. Basically the more nodes are in the network the more secure the network is. Since the nodes synchronize with each other it becomes much harder for attackers if there are more nodes. There are currently well over 100,000 nodes in the Ethereum network.

ERC-20 Tokens

One of the main reasons why we have several thousand crypto currencies today is the Ethereum ERC-20 standard. This is a Smart Contract variant, with which anyone can set up their own crypto currencies within a few minutes. Many crypto currencies (e.g. EOS, BNB, TRX) were initially based on this ERC-20 standard before they switched to their own block chain variant.

Whoever generates an ERC-20 token can also trade it immediately at decentralized exchanges. This also eliminates the hurdle of trading to a large extent. Furthermore, these tokens are based on the Ethereum block chain and are therefore almost as secure as Ethereum. The disadvantage of an ERC-20 token is that the transaction fees still have to be paid in Ethereum. So if you want to send an ERC-20 token you need Ethereum in your wallet.

Ethereum Public and Private Keys

A central component of Ethereum and other crypto currencies are the public and private keys. The public keys always start with 0x followed by a combination of letters and numbers. A typical Ethereum public key could be this one: 0x47C6C9BA3F41A0683B044c2DD84FA3d88B49896F

In principle, a public key at Ethereum is a public wallet address. This is similar to an account number in a bank account. However, at ethereum, this address is not assigned to a name. Through so-called Block Explorer, everyone can see all transactions of each address and the credit balance that the address contains.

Besides the public keys (addresses), there are also private keys. Each public key is assigned a private key. Basically the private key is needed to transfer credit from an address. So only who is in possession of the private key can dispose of the respective credits. A typical private key at Ethereum looks like this: fd20677133322c13eaf5e15783450d41012b69ddf9ae208e04345ff11d0ea886

By the way, it is enough if I own a private key because from each private key the corresponding public key can be read. The other way round is of course not possible. When we talk about a paper wallet in this context we only mean that the private key is on a sheet of paper. It is not stored on a computer, but only on the paper.

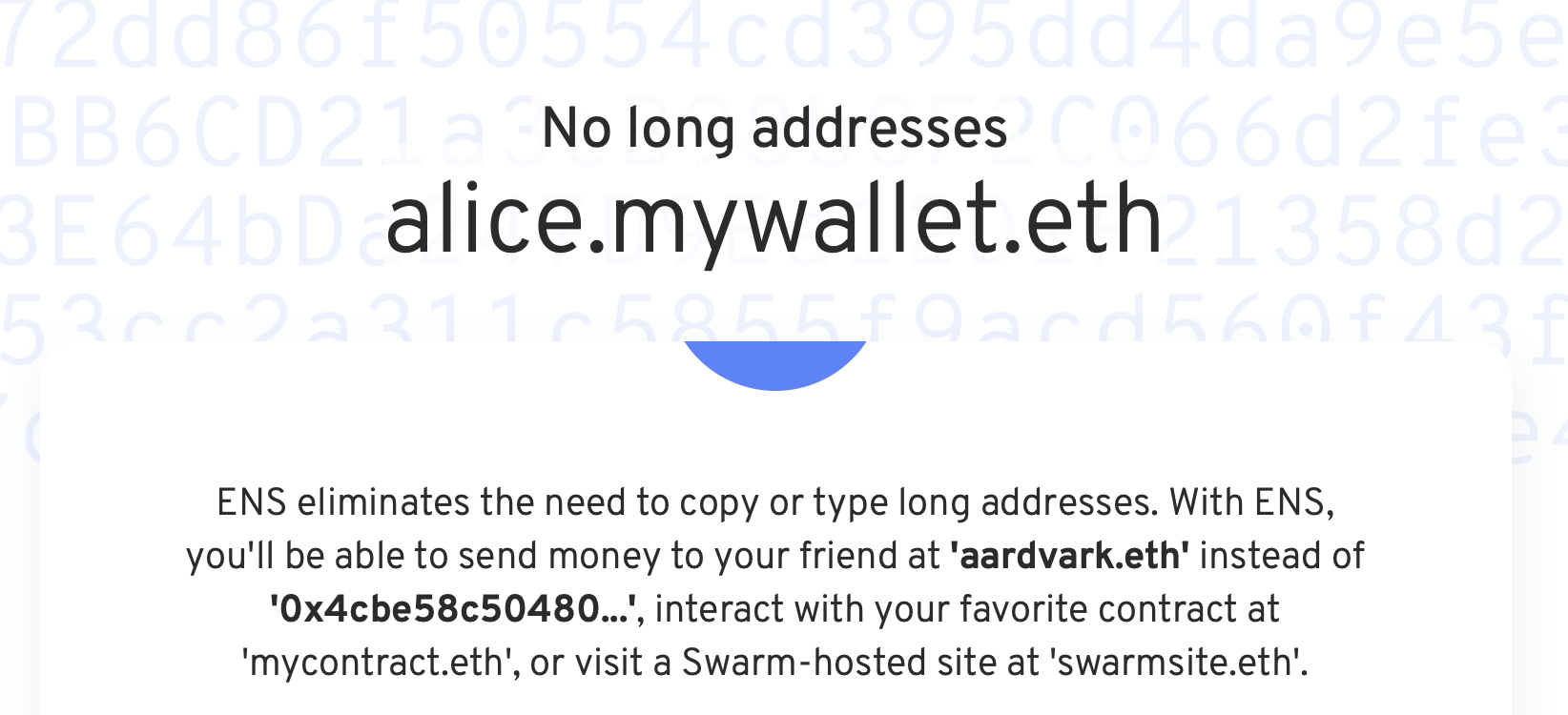

Ethereum Name Service

A problem with Ethereum and many other crypto currencies is the fact that the public addresses (public keys) are very long and consist of difficult to remember combinations of numbers and letters. Therefore, users usually have to copy the address from somewhere if they want to send credit to another address. This is because errors can quickly occur when writing down a public key.

Since 2017, Ethereum’s so-called Ethereum Name Service has been providing a remedy. Users have the opportunity to bid for more legible addresses and link them to their public address. The so-called Ethereum Domains are very similar to Internet domains. A typical Ethereum name could be Block-Builders.eth, for example. So instead of sending the credits to 0x3e3e73e7… address, we can also give users the option to simply use Block-Builders.eth as their address.

In the beginning, users could only bid for addresses with at least 7 digits. From mid-2019 it will also be possible to bid for addresses with less than 7 digits. If the address is linked to the respective public key, users can simply enter the .eth address instead of the public key. But be careful, not every wallet or exchange supports this service so far.

Now there are also marketplaces where the Ethereum names already auctioned are traded.

What is Ethereum Gas

In connection with Ethereum and the transactions, gas or Ethereum Gas is often referred to. Because if you want to execute something on the Blockchain, you have to pay for it. Ethereum Gas (translated as fuel) is the amount that the user has to pay for the respective action on the Ethereum Blockchain. Even though the fees are called gas, they also refer to the amount of ether (ETH) that the user has to pay for each action on the Ethereum Blockchain. Ethereum Gas therefore only refers to the amount of fees in ETH.

For the calculation of the fees the gas limit and the gas price are important. These two terms are to be understood as follows:

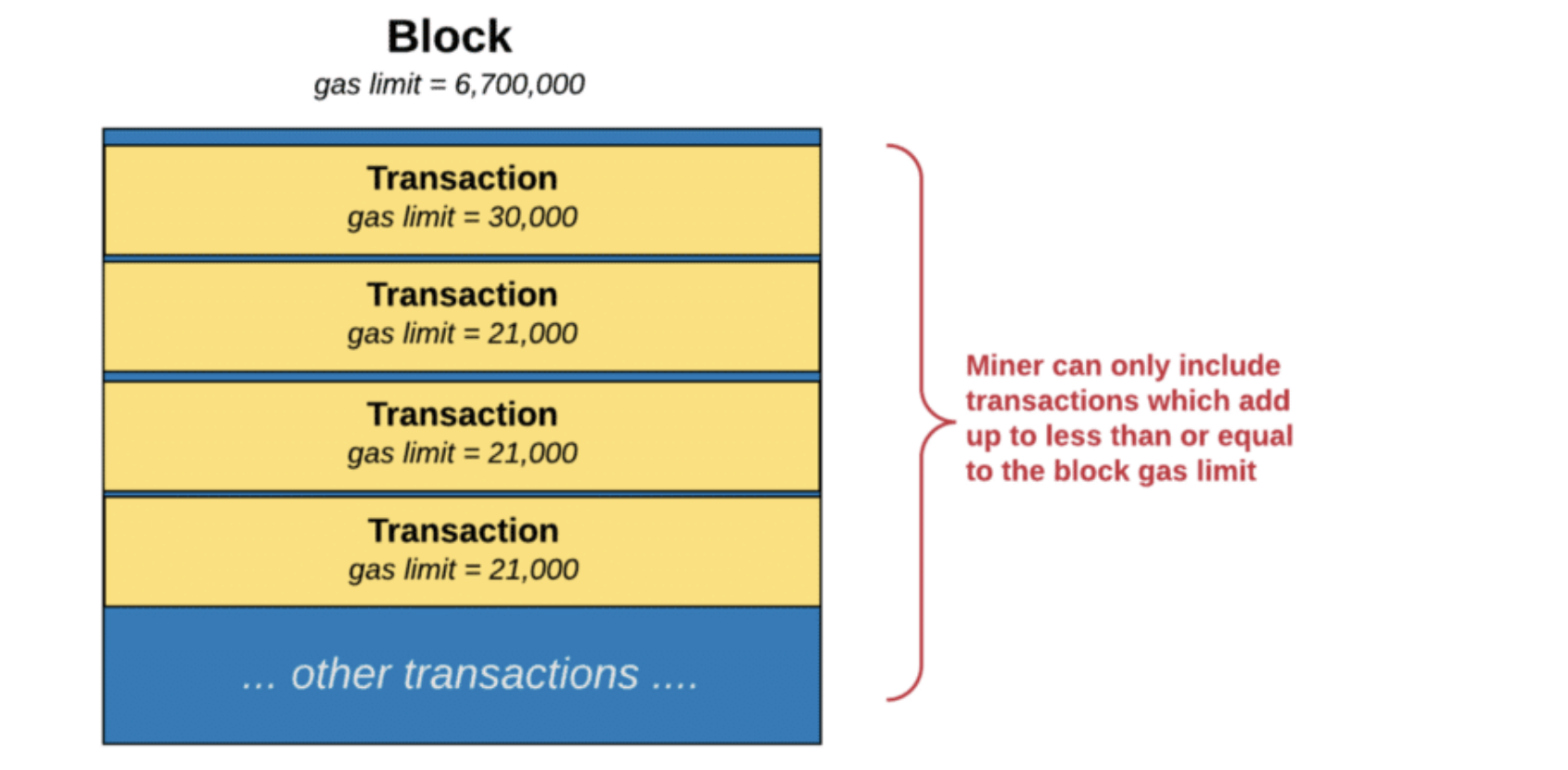

Gas Limit: This indicates how many different steps must be taken in the code. For example, a transaction is much less complex than executing a Samrt contract. In comparison, a transaction involves about 21,000 steps, while a Smart Contract may require 52,000 or more steps. The number of steps thus describes the gas limit in each case.

Gas Price: If we have the number of steps it is important to know how much each step costs and this is exactly what the gas price describes. The gas price is measured in Gwei (9th decimal place) a very small unit at Ethereum. You can find out the current gas price for example at ethgasstation.info.

If we have the gas price and the gas limit we can easily calculate how much an action on the Ethereum Blockchain costs us. The price is calculated by multiplying the gas limit by the gas price.

It is important to know that you can often set the gas limit yourself. But you should be careful not to set the limit too low. If you set a Gas Limit of 18,000, but the transaction requires a Gas Limit of 21,000, the following will happen. The miner will attempt to include the action in the current block. However, the transaction cannot be completed because the gas limit is reached before the transaction is complete. What happens now is that the miner keeps the gas limit of 18,000 (he has already done some work). For you, the transaction will fail and you will lose the gas limit. You will then have no choice but to repeat the transaction and pay a higher gas limit.

It is safer to set a slightly higher limit from the beginning. It is important to know that each block has a maximum gas level of 6.7 million. A miner can only collect as much Gas Limit per block.

Units at Ethereum

Ethereum can be divided to 18 decimal places. So you don’t always have to send at least 1 ETH, but you could also send 0.0000043. The same applies to the purchase of Ethereum on the stock exchanges (Exchanges). Users can also buy less than 1 ETH and even non-round sums are no problem.

| Unit | Wei Value | Wei |

|---|---|---|

| Wei | 1 wei | 1 |

| Kwei (babbage) | 1e3 wei | 1,000 |

| Mwei (lovelace) | 1e6 wei | 1,000,000 |

| Gwei (shannon) | 1e9 wei | 1,000,000,000 |

| Microether (Szabo) | 1e12 wei | 1,000,000,000,000 |

| Milliether (finney) | 1e15 wei | 1,000,000,000,000,000 |

| Ether | 1e18 wei | 1,000,000,000,000,000,000 |

Smart Contracts

Ethereum differs from other crypto-currencies such as Bitcoin mainly through the Smart Contracts. For these Smart Contracts a new programming language, called Solidity, has been specially developed. The Smart Contracts are executed in the Ethereum Virtual Machine (EVM).

Basically, a Smart Contract can be explained in such a way that something happens as soon as a first interaction is performed. A typical example of a Smart Contract is that a payment is automatically executed as soon as condition XY is met. The advantage is that two parties can interact with each other in this way without the need for a 3 party that both parties must trust. The two parties do not necessarily have to trust each other either, since all interactions can also take place using Smart Contracts. In this context, the term “trustless systems” is often used. It is conceivable, for example, that Smart Contracts could take over notarial tasks in the long term. Smart Contracts are also applicable in many areas in the financial sector.

DAPPs

Decentralized Applications or DAPPs for short are also an important part of Ethereum. These are based on Smart Contracts and are basically small programs that are executed on the Ethereum block chain. Externally, DAPPs are often comparable to websites. Unlike Web pages, however, they are not located on a central server, but are executed on all nodes simultaneously. This has some disadvantages. DAPPs are much slower than central programs, since interaction with the Ethereum block chain is slower than with a central server. In addition, each action also costs Ether, which must be paid by the user or the DAPP operator.

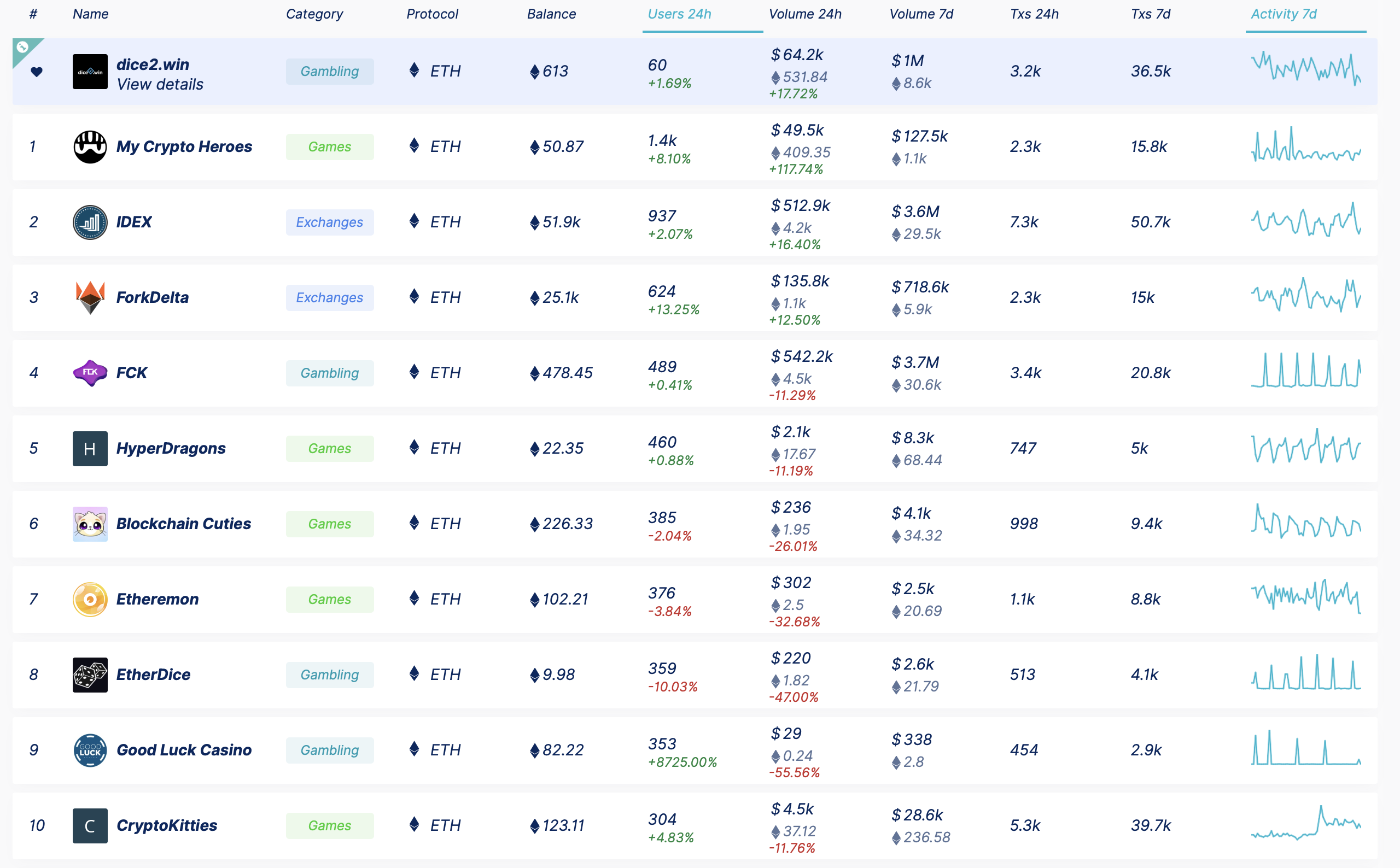

Of course, DAPPs also have advantages, since they are executed in a decentralized way it is not possible to forbid or manipulate them, as it would be possible with a central server. So far, DAPPs have not been able to achieve a major breakthrough. Although there have been DAPPs that have caused a stir from time to time, including CryptoKitties and Fomo3D, DAPPs have not managed to get more than 1,000 users a day. To find out which are the most popular DAPPs and how many users they have, visit Dappradar.com.

Decentralised Exchanges (DEXs) are also a popular application of DAPPs. These are crypto exchanges that are based entirely on Smart Contracts. The two major DEXs are IDEX and ForkDelta. The advantage of a DEX is that investors do not have to send their crypto balances to the exchange, but can trade directly from their wallet. This also makes DEX much slower than centralized exchanges such as Binance.

Further development of Ethereum

Ethereum is not in itself a ready-made crypto-currency or a ready-made system that was once created and then remains as it is. On the contrary, the development of Ethereum is very dynamic. In principle, anyone can make suggestions for the further development of Ethereum. This is done via so-called Ethereum Improvement Proposals (EIPs). The submitted EIPs are then discussed and voted on whether they should be implemented. The further development of Ethereum is mainly driven by programmers. Therefore, most EIPs are very technical and difficult for the normal user to understand.

Ethereum Hard Forks

Major updates at Ethereum are always implemented via so-called hard forks. Basically, a distinction can be made between soft fork and hard fork. The difference is that the soft fork is downward compatible, but the hard fork is not. This means that with a hard fork, all node operators and miners must accept the changes in order to remain in the network. If they don’t, it can happen that a split occurs and we have 2 crypto currencies from then on.

Ethereum 2.0

Like the entire crypto sector, Ethereum is developing very fast. Two problems in particular are frequently mentioned in Ethereum that need to be solved in the long term. First, the Ethereum block chain is not very scalable so far. Currently, only a maximum of 15 transactions per second can take place. In comparison Visa and Mastercard can easily handle more than 50,000 transactions per second. The other problem with Ethereum is the high power consumption caused by mining.

To solve these two major problems, Ethereum wants to change completely in the long run. These changes are summarized under the name Ethereum 2.0. Even though many updates and changes at Ethereum are summarized under Ethereum 2.0, this mainly refers to the implementation of Casper and Sharding. These two technologies will be the new main part of Ethereum 2.0.

Casper

Casper is about the change from proof-of-work to proof-of-stake. Currently, Ethereum Miner is trying out mathematical variations to find the next block to which the block chain can be attached. This mining process is very energy-intensive. The Proof-of-Stake (PoS) protocol called Casper should help here. With PoS there are no more miners. Instead, anyone can “stack” a certain amount of ether and then confirm transactions. If you do this in a defective way, you lose the ether you have stored.

Sharding

Sharding is intended to solve the scaling problem of Ethereum. The idea is that there is no longer one central block chain, but many block chains that exist parallel to each other. These are called shards. Nodes no longer have to store and synchronize the entire block chain, but only individual shards. This also makes it easier to operate a node in the network. The current plan is to have 1024 different shards, which also synchronize with each other.

The changes to Ethereum 2.0 will not be rolled out on a specific date. It is rather planned to integrate the updates successively over several years. First of all, a test beacon chain will go live. On this beacon chain we will test successively if Casper works as expected. In the course of time more and more functions will be activated for the Beachon Chain, such as Smart Contracts. In the long term, the current Ethereum Blockchain is to be integrated as a sidechain of the Beacon Chain, thus bringing everything together.

When everything is rolled out, Ethereum will be completely switched to Proof-of-Stake and will consist of several chains. Ethereum will then be completely different from what we know now. But to be competitive in the long run this will also be necessary.

Enterprise Ethereum Alliance

One reason why the Ethereum course exploded in the first half of 2017 was the Enterprise Ethereum Alliance. This has merged in March 2017. This is a merger of several hundred companies that want to jointly develop the Ethereum Blockchain. This includes the development of common standards and the integration of features that are essential for companies. Among other things, the standards should make it possible for applications based on the Ethereum Blockchain from Company A to be compatible with applications from Company B.

Members of the Enterprise Ethereum Alliance include Commerzbank, ConsenSys, Deloitte, Henkel, Microsoft, Shell, UniCredit and many more. Just like the Ethereum Foundation, the Enterprise Ethereum Alliance is non-profit.

Criticism of Ethereum

Besides the many positive aspects of Ethereum, there is also a lot of criticism of the technology and the makers behind it. We summarize the most important points here for you.

- Pre-mining: At the time of the ICO of Ethereum, there were already at least 72 million ethers. 60 million ETH were then sold at the ICO and 12 million were kept by the developers themselves. This makes Ethereum the first major crypto currency that managed to start with a significant number of previously mined ETH. Until then, this approach was always despised in the crypto scene. This is because it gives the developers an unfair advantage in terms of the number of coins they can use. Vitalik Buterin announced in a tweet that he owned 0.9% of all ethers at peak times. Depending on the current exchange rate, some of these may have been worth several hundred million US dollars. Currently, 350,000 ETH are still lying at his ETH address.

I never had 900k ETH. When I had 0.9% of all ETH, the supply was ~75 million. When the price hit $1250, I had considerably less than 0.9%.

— vitalik.eth (@VitalikButerin) October 10, 2018

- Another problem is scalability. Credit card companies like Visa or Mastercard currently process several thousand transactions per second. At peak times they also manage to process more than 50,000 or 60,000 transactions per second. Ethereum with its 15 transactions per second is far from that. Sharding is intended to provide a long-term remedy. So far, however, sharding is still in an early test phase and it is not clear whether the idea can ever be implemented in this way.

- Only a few people decide on the future of Ethereum. In theory, anyone can submit an Ethereum Improvement Proposal, but the development of Ethereum is only driven by the selected number of people. To be fair, these people regularly exchange information for further development and these calls are also streamed on Youtube.

Ethereum Buying and Selling

If you want to buy Ethereum, you have to do so on so-called crypto exchanges. There are cryptoexchanges such as Binance, where crypto currencies are only traded against Bitcoins. It is therefore advisable to use an exchange that also offers euro payments and withdrawals. Two major providers are eToro and Coinbase. Here you can make Euro deposits and withdrawals and then buy and sell Ethereum against Euro.

Ethereum Wallet

If you don’t want to leave your Ethereum (ETH) on a crypto exchange, you can of course withdraw it and store it on your own wallet. A distinction is made between software wallets, hardware wallets and so-called web wallets. What the differences between the individual wallets are we want to show you here.

Web Wallets

The so-called Web Wallets are websites where you can generate your own Ethereum Wallet and then access it via your browser. You do not need to install any software on your computer, all you need is an internet connection and your browser. The best known and probably the most secure web wallet is MyEtherWallet.com. The advantage of the site and this online wallet is that you can also easily manage ERC-20 tokens with it. Alternatively there is also MyCrypto.com. The site was created by former team members of MyEtherWallet.com. Both sites are considered very secure. I would rather not entrust my credit to other sites.

Software Wallets

Besides the Web Wallets there are also the Software Wallets. This is software that you can easily install on your computer. Besides the computer there are Software Wallets as apps for your Smartphone. Software Wallets are divided into Full Clients and Light Clients. Full Clients usually require you to download the complete Ethereum Blockchain to run the wallet. Since the Ethereum Blockchain is very large, this option is not necessary for most users (over 1 TB). If you still want to try it, you can use the Mist Wallet for example. This is available for Windows, Linux and Mac.

Much more user-friendly are the Light Clients. A popular Ethereum Wallet is the Exodus Wallet. This is also available for Windows, Linux and Mac.

Besides Ethereum you can also store other crypto currencies like Bitcoin, EOS, Litecoin and many others. The Exodus Wallet is also available for your Smartphone. Another popular Smartphone Wallet is Jaxx. The popular software wallet is available for Android as well as for iOS.

Another important difference between the wallets is the fact that it can be a custodial or non-custodial wallet. With Non-Custodial Wallets you keep the Private Keys and only you can control the credits. However, you also bear the risk that you may not lose the Private Keys. In the case of Custodial Wallets, you do not directly own the Private Keys. However, if you are verified by the service, you can get your credits back even if you lose access.

Hardware Wallets

The most secure way for private investors to store crypto currencies is with a hardware wallet. The market leader in hardware wallets is the company Ledger with the popular Ledger Nano S. The successor Ledger Nano X also has many fans.

The special thing about a Harware Wallet is that your Private Keys always stay on the wallet and cannot leave it. If you make a transaction, it will only be signed on the wallet and can be used for the transaction. So it is not possible to read your Private Keys. Using the Recovery Phrase, which every ledger has, you can recover all your credit even if you lose the Hardare Wallet. So you should really consider using a hardware wallet.

Ethereum Course and Current Price

Here you can find the current price development of Ethereum.

Links

Block Explorer: Etherscan.io

Website: Ethereum.org

Exchange: eToro