Ethereum Classic (ETC) is a crypto currency that was created in July 2016 as a result of disagreements over how to handle a million-dollar hack at Ethereum and a resulting hard fork. Like its predecessor, Ethereum, ETC’s block chain offers the possibility of processing smart contracts and executing dapps in addition to financial transactions.

Table of Contents

Quick Facts

Abbreviation: ETC

Maximum Number of Coins: 210 million

Protocol: Proof of Work

Historical Background to Ethereum Classic

The story of Ethereum Classic (ETC) begins with a hack. In 2015, Vitalik Buterin and his team had successfully launched Ethereum (ETH) and the ecosystem there scored from the beginning with the offer of Smart Contracts. The extended team includes the German brothers Jentsch, two developers who want to use Smart Contracts to set up an investment fund in which the shareholders, rather than the management, decide which projects are invested in. The Jentsch brothers call their project the Decentralized Autonomous Organization (DAO), and DAO actually manages to collect ETH for the equivalent of around 150 million US dollars by crowd sale in May 2016. Virtually overnight, DAO becomes a project that attracts enthusiastic attention beyond the crypto scene. But the DAO also interested criminals because of the capital gathered there.

The incident, which went down in crypto history as the DAO hack, used a security hole in the programming language for Smart Contracts. As a result, the attackers initially managed to park, unnoticed, about a third of the investment sum at the DAO, ETH, worth about 50 million US dollars, on a foreign wallet. At least a second security level ensured that these assets remained frozen for 28 days. The Ethereum community was suddenly faced with the question: Do we adhere to the principle of block chains, that transactions are final? Or do we change the code in the block chain so that validated transfers can be reversed and the aggrieved investors at the DAO can return to their ETH? There is no common attitude among the investors and thus a group formation occurs. With block 1,920,000 in the ETH block chain, the paths part: those who want to turn back the DAO hack follow a modified ETH block chain. The other camp, which does not want to change any transactions, splits off into a second block chain, which is still decisive for Ethereum Classic today.

ETC still manages to establish itself in the markets in 2016. The Poloniex crypto exchange was the first to list ETC at the time, with other important platforms such as Kraken soon to follow. The confidence in Ethereum Classic, albeit modest, was helped by the fact that personalities such as former Ethereum CEO Charles Hoskinson have been strong supporters of ETC. The first and most pressing problem for ETC in 2016: due to the shared history with ETH, it was possible to store his previous credits in both block chains and thus keep them in the form of ETH and ETC. However, this was solved in 2016 through code changes and cooperation with crypto exchanges.

The first milestone in the independent further development of ETC is usually seen as the declaration of independence in August 2016, which was adopted with block 2,050,000. Here, the ETC community emphasises that it will never and under no circumstances intervene in the block chain retroactively. “Law of Code” has been the motto at ETC ever since. Ethereum (ETH), on the other hand, turned back the DAO hack as far as possible, thereby allowing investors to regain access to their ETH. Genuine and undisputed decentralization is the guiding principle with which ETC tries to distinguish itself from ETH.

However, this also entails a difficult balancing act. While at Ethereum a foundation is responsible for further development and Vitalik Buterin, the ETH inventor, is the figurehead, ETC has not created a central organisation. Development work for ETC is carried out in various groups, whose internal relationships are not always harmonious. Among the important collection points for Ethereum Classic are ETC Cooperative, ETC Labs, Ethereum Commonwealth and Charles Hoskinson’s company, IOHK. Their declared goal of keeping ETC compatible with ETH was already abandoned in early 2017 when ETC decided to update the block chain in order to independently anticipate foreseeable difficulties at ETH such as the Difficulty Bomb.

A central hope of the Ethereum Classic community has never been fulfilled, namely to outrun ETH. In November 2019, ETH gathers a market capitalization of almost 20 billion US dollars, making Ethereum the second most important crypto currency. ETC, on the other hand, ranks 24th with a market capitalization of a good 530 million US dollars, and the trend is downward. A 51 percent attack on ETC in January 2019, which was never fully resolved, has noticeably cooled the initial enthusiasm for the project.

Technology from Ethereum Classic

ETC initially took over Ethereum’s technology at launch in 2016. Since then, various updates have caused the two crypto currencies to drift apart. ETC does not want to participate in the change in protocol from proof-of-work to proof-of-state that ETH is striving for. For ETC, proof-of-work means that it will hardly be able to respond to scalability requirements. So while there are basically no technological arguments in favour of ETC, its supporters are left with at least the ideological reference to the strict rejection of influence by a central body. However, the fact that a scene of mining pools has also formed around ETC suggests that this “political” attitude at Ethereum Classic continues to attract smaller parts of the market.

Criticism of Ethereum Classic

ETC has been associated with security issues on several occasions in its short history, from hacked Twitter accounts and phishing attacks to the recent 51% attack and double spending. The absence of a universally recognised structure in ETC’s development work is a retribution even when current issues or problems cannot be resolved unanimously. As a result, there is a tendency for developers to lose interest in ETC because the user base hardly grows at all and technological progress only occurs in triple steps at best.

Another sword of Damocles in Ethereum Classic is the risk of another hard fork. There is a risk that the development teams and investor groups at ETC will continue to divide and that one side will force a hard fork. With the cautionary example of Bitcoin Cash in mind, such a situation is likely to lead to massive losses in value at ECH and further weaken the overall role.

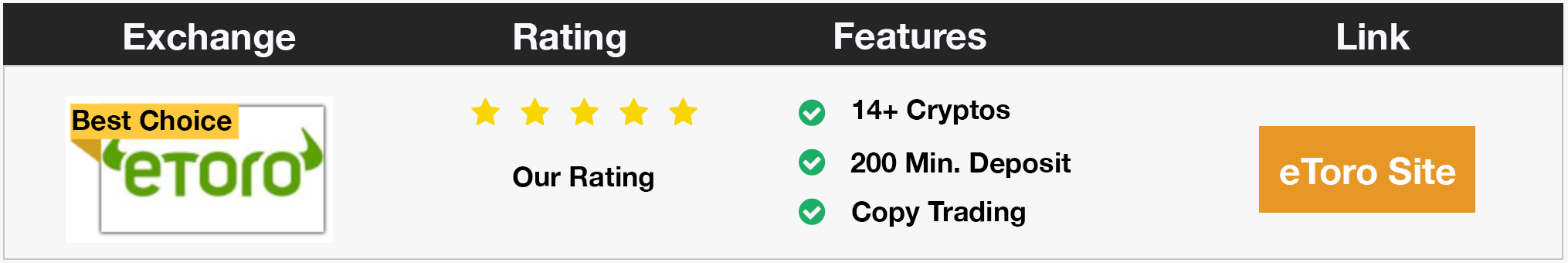

Buy Ethereum Classic

If you want to buy Ethereum Classic, you can do so at so-called crypto exchanges. Ethereum Classic is actually also listed at all major exchanges. However, investors should be careful, as very few exchanges accept Euro or US Dollar deposits. The easiest way to buy Ethereum Classic is to buy it from eToro.

All you need to do is register and verify your account with eToro and you can already buy Ethereum Classic there. You can even do this by credit card, PayPal or instant bank transfer. Storing your Ethereum Classic on eToro is free of charge.

Alternatives to ETC from an investor perspective

ETC is in danger of falling further behind in the competition of crypto-currencies, and this is not only due to its almost overpowering big brother Ethereum. With its focus on Smart Contracts and DApps, Ethereum has also found strong competitors such as EOS and TRON (TRX). Those who believe in the branding of Ethereum will find ETH the first alternative to Ethereum Classic. Those who look further into the future and see strong ecosystems around a crypto-currency as an incentive for investments will find promising options in TRX and EOS. If you prefer crypto currencies where the main focus is on the payment function, Bitcoin (BTC) or Litecoin (LTC) is a good choice (all mentioned crypto currencies can of course also be bought at eToro).

Wallets for Ethereum Classic

Crypto-currencies such as Ethereum Classic usually serve both as a means of payment and as a commodity aka speculative object. Their monetary value therefore wants to be protected by the investor and this is done by wallets. There are three possibilities for you: With a Paper Wallet you rely on analogue methods. With a Software Wallet you make the compromise of a free online solution as a wallet. The hardware wallet comes with a purchase price, but in terms of security coupled with user-friendliness it is the option that has become the standard in the crypto industry. In detail:

- With a Paper Wallet, you store your critical private keys and ETC address on a piece of paper or engrave them on a piece of metal. The advantage: The access data to your wallet is offline, so hackers don’t stand a chance. The disadvantages: If you lose your paper wallet or it is destroyed, there is no way to recover your account. And if you want to use ECT on a daily basis, for example for DApps, you will have to enter your private key every time. In practice, paper wallets are therefore not very useful for the normal user.

- With a Software Wallet, the focus changes towards ease of use. Your Software Wallet stores Private Keys and can easily forward the credit to crypto wallets or other arbitrary addresses. The Trust Wallet from Binance, for example, which also supports ETC, is popular in this segment.

- With a Hardware Wallet, you go down the path of maximum security combined with ease of use. Because in this case, the decisive private keys are stored on a security chip and shielded from the Internet. Hardware Wallets are small devices that allow you to securely organize credit in different crypto currencies. With Ledger and Trezor, two manufacturers are competing for the favor of customers, both have integrated support for ETC. From our point of view, Ledger is just about ahead.

Conclusion on Ethereum Classic: ETC threatens to miss development

ETC is a good example of how vulnerable crypto currencies are to religious wars in the community. The noble intentions of absolute neutrality and decentralization make ETC even more attractive to a certain clientele. But at the same time, current developments increasingly give the impression that nostalgia is being used to cover up the downward spiral of Ethereum Classic. Sticking with proof-of-work as the protocol makes ETC a crypto-dinosaur in technological terms and hinders progress. There is basically no sign of a change of heart in ETC’s community, so a further loss of importance of Ethereum Classic remains likely.

ETC price and price development

Here you can find the current price development of Ethereum Classic (ETC)

- Ethereum Classic

(ETC) - Price $33.09

- Market Cap

$4,400,860,564.00

Important Links for Ethereum Classic

Ethereum Classic Cooperative

Ethereum Classic Labs

IOHK

Block Explorer Ethereum Classic

Buy Ethereum Classic