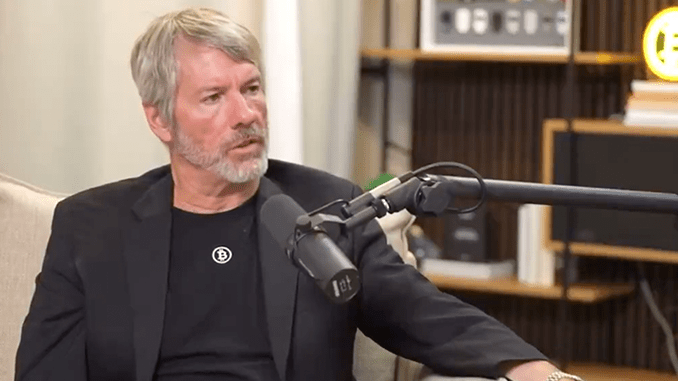

Bold Bitcoin Tactic by Michael Saylor – Strategy Raises Money Again

MicroStrategy, led by Bitcoin advocate Michael Saylor, has announced a new financing round. The company plans to raise up to 750 million US dollars, among other things, to buy more Bitcoin.

MicroStrategy remains a persistent driver in the Bitcoin ecosystem under the leadership of Michael Saylor. In its announcement to the U.S. Securities and Exchange Commission (SEC) yesterday, it was stated that they are considering the issuance of shares worth up to 750 million US dollars. As is already clear from the summary, the company intends to use parts of the money for further acquisitions of Bitcoin. In Germany, MicroStrategy is known in particular to those who closely follow the Bitcoin market, as shares in the company can also be traded on various German platforms.

MicroStrategy currently holds a proud 152,333 units of Bitcoin, according to their last public presentation. Whether Saylor’s bold tactic will pay off in the long run is being closely observed by many in the market. The company had long ago opted for a strategy where Bitcoin forms both an asset and a capital reserve. In recent months, however, the stake had lost value in the face of a bearish market. Saylor had faced criticism from some shareholders for sticking to his rather risky plan.

In contrast, Saylor remains confident that Bitcoin has a decisive future ahead of it as a form of money. In his view, the current phase of the market is merely a transitional phase. This bold announcement by MicroStrategy has given a small boost to the morale in the Bitcoin ecosystem. The fluctuations in price that Bitcoin has experienced over the last few months did not seem to deter Saylor. Instead, he is betting that more people and institutions will view Bitcoin as an invaluable reserve.

MicroStrategy’s new financing round comes at a time when cryptocurrencies are still putting up with price resistance. Yet, the belief in Bitcoin’s value is seemingly unshakeable. For many, Michael Saylor has become a symbol of steadfastness. Whether this risky move to invest large sums in Bitcoin will be rewarded, however, remains to be seen. What is certain is that this announcement has once again brought attention and discussions back to the camp of Bitcoin advocates.

Leave a Reply