MicroStrategy Wants More Bitcoin – Convertible Bond for 2 Billion US Dollars

MicroStrategy, the business intelligence company, has announced its intention to issue convertible bonds totaling 2 billion US dollars. The proceeds are to be used to purchase Bitcoin (BTC).

MicroStrategy is once again focusing on Bitcoin (BTC) as a form of investment and wants to raise fresh capital for this. On Monday, MicroStrategy announced that it would issue convertible bonds amounting to 2 billion US dollars. According to information from the business intelligence company, these bonds are to have a term until 2028. What makes this type of bond interesting from the investor’s point of view is the possibility to exchange them for shares under certain conditions, i.e., to “convert” them.

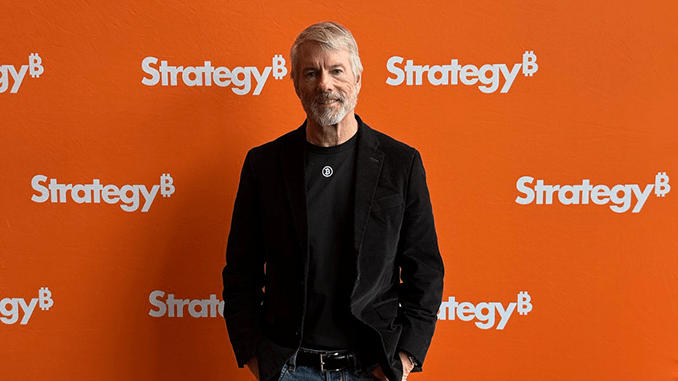

The proceeds from these bonds flow into a subsidiary specifically created for the planned Bitcoin purchases called MacroStrategy. MicroStrategy has been a constant companion in the Bitcoin scene since its CEO Michael Saylor announced in 2020 that Bitcoin should be a component of its corporate reserves.

MicroStrategy as a Bitcoin Whale

According to the latest reports, MicroStrategy currently holds at least 152,800 Bitcoins and has therefore become a veritable whale in this market segment. There is continuous discussion within expert circles about whether MicroStrategy is excessively dependent on Bitcoin; the company itself sees things differently.

For MicroStrategy, all signs point to growth based on a sharp increase in financial power and the assumption that Bitcoin will increase in value in the long term. Outsiders note that MicroStrategy is not speculating with Bitcoin on short-term profits but is betting on a significant increase in value over the next few years. When the US Securities and Exchange Commission (SEC) approved the first Bitcoin spot ETFs, MicroStrategy undoubtedly wants to be on board as a solid partner for institutions interested in Bitcoin.

It seems probable that the new convertible bonds will also find their buyers since they certainly promise an attractive return with Bitcoin in focus. MicroStrategy distinguishes itself as a company with the courage to link its success even more closely to the performance of Bitcoin through this move and Saylor’s immediate influence.

Leave a Reply