Strategy wants to raise another 2.1 billion US dollars for Bitcoin purchases

Strategy has filed documents with the US Securities and Exchange Commission (SEC) to raise additional liquidity of up to 2.1 billion US dollars through share sales, which will be used for Bitcoin purchases.

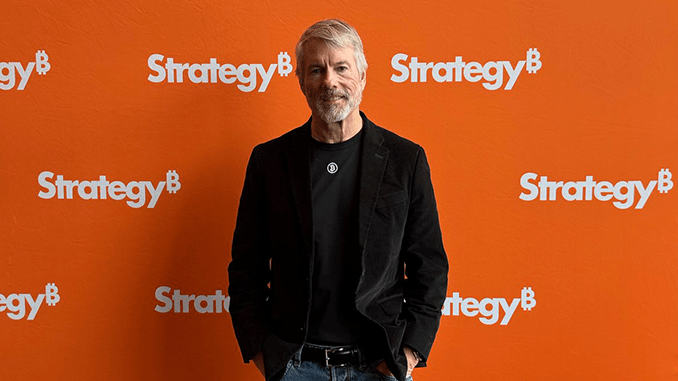

Strategy remains one of the largest and most well-known Bitcoin investors worldwide. Both Bitcoin enthusiasts and the business world follow closely what Strategy founder Michael Saylor is doing. Now, new documents from Strategy reveal, submitted to the SEC, that the company plans to raise up to 2.1 billion US dollars through a stock offering. Strategy wants to use much of this additional capital for further Bitcoin purchases, the filing documents state.

Will Strategy’s Bitcoin strategy continue to pay off?

Already in Fall of 2022, Strategy had made a similar plan public and in the end, reportedly raised about 1.4 billion US dollars. This Figure exceeds the 640 million US dollars Strategy had previously raised in 2021. Currently, the company’s Bitcoin treasury is approximately 158,000 BTC, with a stated purchase price of just under 29,700 US dollars per Bitcoin. After a brief dip below this mark in Summer 2023, Bitcoin is now trading again at around 26,000 US dollars, meaning Strategy is sitting on potential losses.

However, Strategy is known to pursue a long-term strategy for Bitcoin. Saylor is convinced that Bitcoin will become an even more valuable asset in the future that cannot be manipulated by central banks. That’s why Strategy continues to accumulate Bitcoin, even though it has already spent nearly 5 billion US dollars on it so far. If the full 2.1 billion US dollars are raised as planned, Strategy could be approaching the 200,000 BTC mark. By comparison, there are currently just over 19.5 million Bitcoins in circulation, meaning Strategy alone owns a significant fraction of all BTC.

Conclusion: Strategy sticks to its Bitcoin plan

With Strategy amassing another financial reserve of up to 2.1 billion US dollars, it demonstrates confidence in Bitcoin’s future. The company believes in a concept that has already made headlines: over several years, Bitcoin will establish itself as a digital version of gold, becoming a stable store of value thanks to built-in control mechanisms. This view and Strategy’s clear financial commitment could also be a signal to all those observing development in cryptocurrency markets.

Leave a Reply