If you want to actively trade crypto currencies, you will usually end up at BitMEX. Beginners should avoid the platform, however, as it is more aimed at experienced traders. We will explain everything important about BitMEX and show you how the platform works. If you want to try BitMEX, you can save 10% of the trading fees in the first 6 months by using this link!

Table of Contents

Background to BitMEX

BitMEX is now the world’s largest trading platform for crypto currencies. Every day, positions with a total value of over 1.5 billion US dollars are traded on BitMEX. Unlike classic crypto exchanges, however, you cannot buy crypto currencies on BitMEX.

Investors can only bet on rising or falling prices with Bitcoin. They can do this not only for Bitcoin but also for a number of other crypto currencies. So with a successful trade you can “only” increase the number of your Bitcoins, regardless of whether you trade Bitcoin or another crypto currency.

BitMEX was founded in 2014 by the 3 former bankers Arthur Hayes, Samuel Reed and Ben Delo. The company is based in Hong Kong and the Seychelles. Thus BitMEX is not subject to any serious regulation. This is possible because no Fiat currencies (e.g. US Dollar or Euro) are needed when trading on BitMEX. However, BitMEX does not allow all users worldwide to trade on the platform. Americans, for example, are blocked via IP filters. Nevertheless, there are many Americans who trade on BitMEX using a VPN tunnel.

The special thing about BitMEX is that you can trade there using a lever. This differs between the different crypto currencies and ranges from 1:20 to 1:100 (for Bitcoin). You can therefore bet up to a hundred times your balance on a rising or falling exchange rate.

Which crypto currencies does BitMEX support

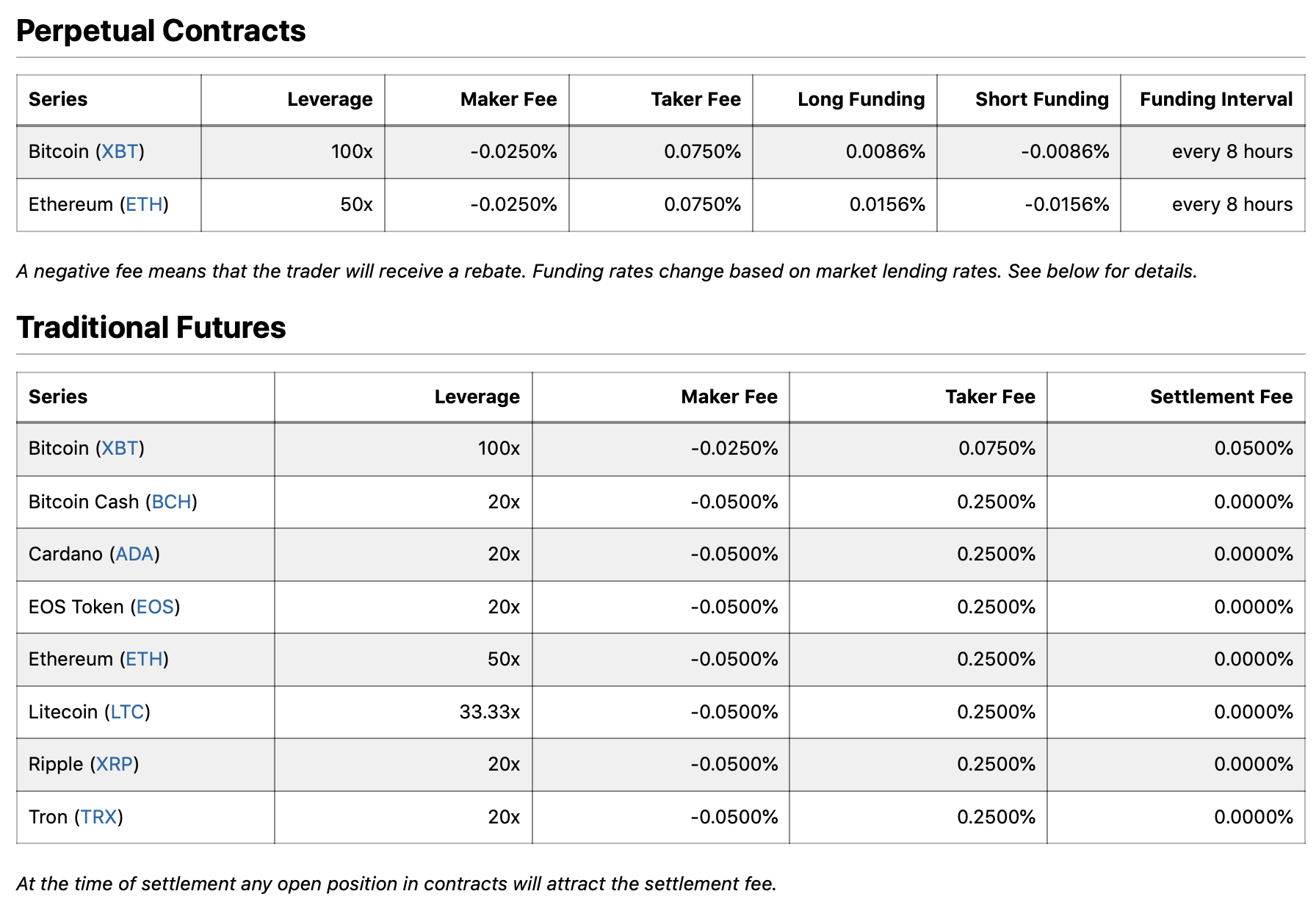

Currently, you can bet on the price rise or fall of 8 different crypto currencies at Bitmex. These differ in the leverage with which they can be traded.

The 8 crypto currencies including their levers are Bitcoin (1:100), Cardano (1:20), Bitcoin Cash (1:20), EOS (1:20), Ethereum (1:50), Litecoin (1:33), TRON (1:20), Ripple (1:20).

All of these crypto currencies are traded on BitMEX with Bitcoins. So you can only deposit Bitcoins on BitMEX and not Ethereum or any other crypto currency

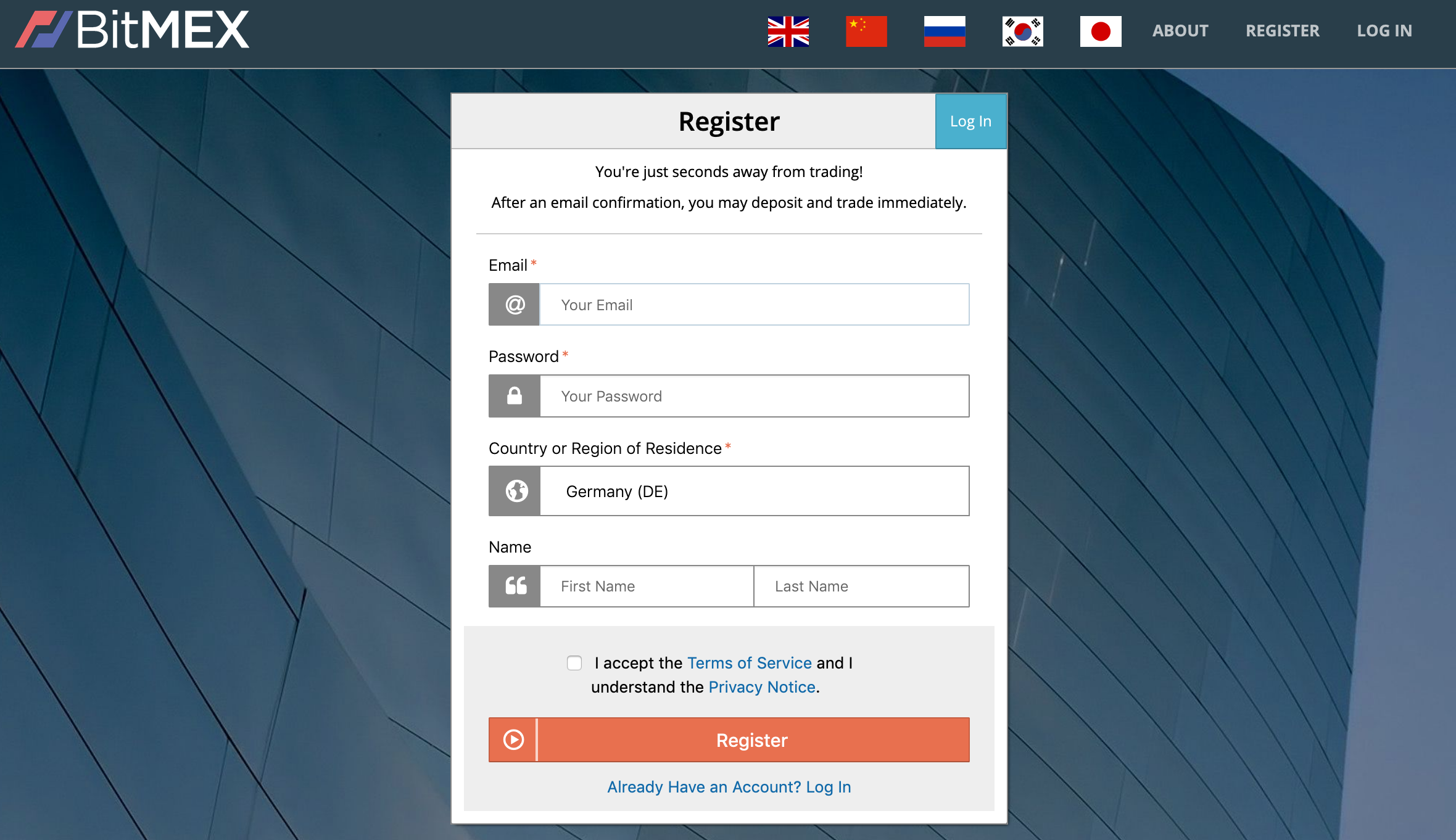

Registration with BitMEX

Registering with BitMEX is very easy. All you have to do is enter your email address, a password and your name, as well as your country of origin. Afterwards you just have to confirm your email address. Your data will not be verified, as with other exchanges. You don’t have to upload a picture of your ID or passport, but can start trading on BitMEX immediately.

For security reasons, we recommend that you activate the 2-factor authentication after the registration. This way, an attacker will not be able to log into your account with your password only.

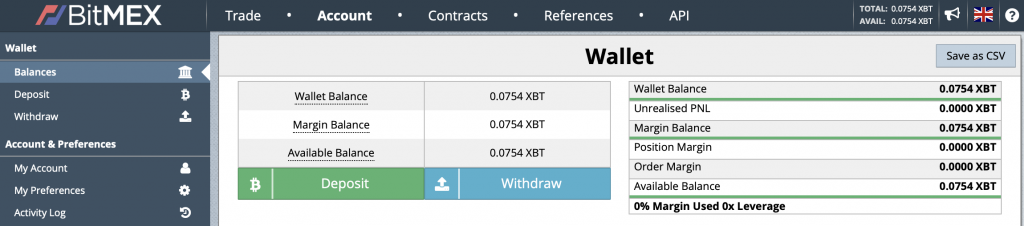

Deposits and Withdrawals at BitMEX

To trade at BitMEX you have to deposit Bitcoins. It is important to note that the official abbreviation for Bitcoin in BitMEX is XBT, not BTC. You can make a deposit by clicking on “Account” in the menu above. You will then be shown your BitMEX Wallet. To deposit funds now you have to click on “Deposit”. A Bitcoin address will then be displayed to which you can send your funds.

Payouts work similarly. You simply need to click on “Withdraw” and then specify how much of your balance you wish to withdraw. But beware, compared to the deposit, the payout does not happen immediately. The BitMEX platform only makes payouts once a day. These take place every day at noon (13:00 UTC, 14:00 German time).

How BitMEX Works

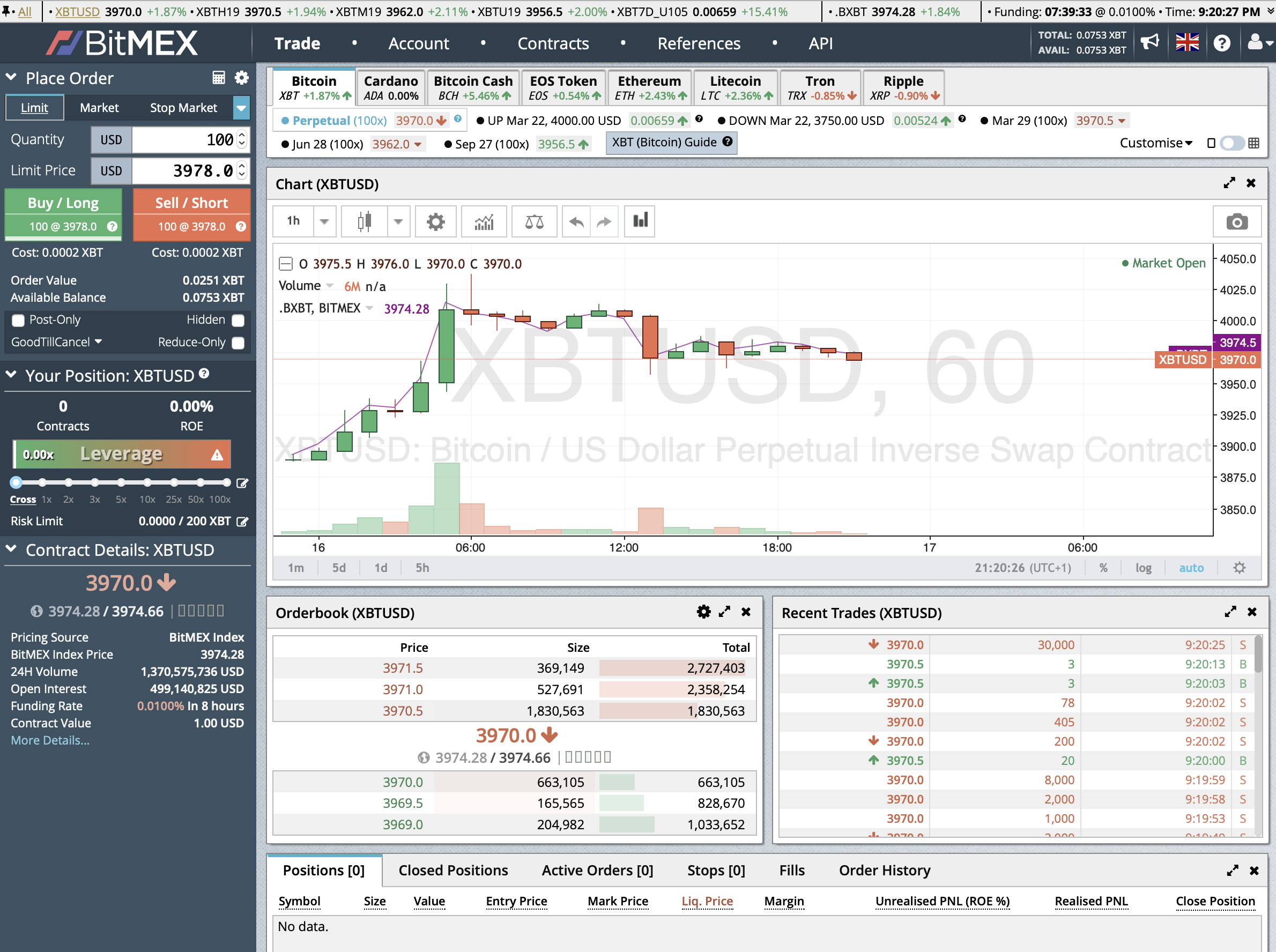

After you have logged in, you can already see the BitMEX Dashboard. Now at the latest it becomes clear why BitMEX is aimed more at experienced investors than at beginners.

To help you find your way around quickly, here is a short overview of the BitMEX Dashboard. Above you can see the different tabs of the crypto currencies. If you click on a tab, the price history of the respective crypto currency is displayed below it, as well as the order book and the last trades that were executed. We will come back to what the individual contracts listed directly under the names of the crypto-currencies say later. You should have noticed that Bitcoin in BitMEX is not abbreviated as BTC, but as XBT, which may be important for getting started.

On the left side you have the possibility to place an order. There are the following order types:

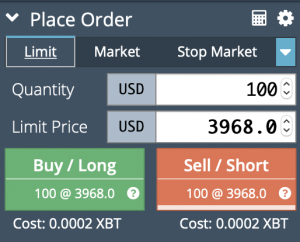

Limit Order: With this order you have to set the minimum price at which you want to buy or sell and only when the price is available will the order be executed.

Market Order: The order is executed immediately at the best possible price currently available in the market.

Stop Market Order: This is an order that will not be placed in the order book. Only when the stop price is reached does the order appear in the order book and is executed.

Stop Limit Order: This is a stop order, but users can specify the minimum price at which the order will be executed after the stop price is reached.

Trailing Stop: Here you have the possibility to set a flexible Stop Market Order. It will be executed when the price changes and the specified amount decreases or increases depending on whether you are long or short.

Take Profit Limit Order: This order is the opposite of the Stop Limit Order. It is executed when a certain target value is reached. This way you can be sure that you make a profit if the price rises only for a short time. You can of course set at what price you want to buy or sell, again depending on whether you are long or short.

Take Profit Market Order: This is where your position will be unwound when you reach a certain price target. However, a market order will be used for this. So you cannot set the minimum price you want to sell at.

A detailed explanation of the individual positions at BitMEX can be found in this video.

In addition to the different types of orders, you have the possibility to bet on a rising or falling price. You can do this by clicking on either “Buy” or “Sell” at the bottom of the order box. As you already guessed correctly, if you click on “Buy”, you bet on an increasing price and are thus long in the position. A “Sell” is a bet on a falling price. So you are short in the position. The name “Sell” comes from the fact that you sell your Bitcoins and have to buy them back at a later date. If the price has fallen in the meantime, the Bitcoins that you have to buy back become cheaper.

BitMEX Leverage

As already mentioned, BitMEX is so popular with traders because you have the possibility to trade with a lever. Many crypto currencies on BitMEX can be traded with a leverage of 1:20, Bitcoin itself can even be traded with a leverage of 1:100.

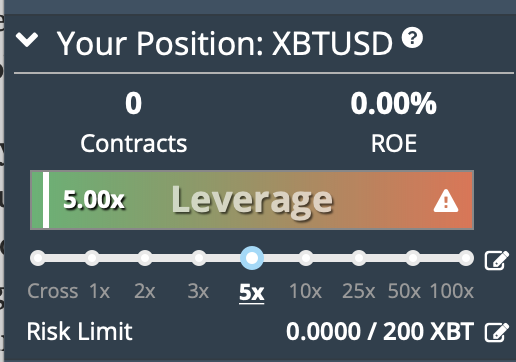

This is the theory, but if you are new and inexperienced in this area, you should never trade with a leverage of more than 1:5, no matter what crypto currency you are trading. You can set the leverage in the field below the order box.

A lever allows you to trade a position that is larger than your actual balance. So assuming you have 1 Bitcoin, with a leverage of 1:5 you can virtually trade with 5 BTC (called XBT in BitMEX). If the Bitcoin price increases by 10%, you will not make a profit of 0.1 BTC, but 0.5 BTC.

The problem is that you can be liquidated much faster. To stick with our example with the leverage of 1:5, we would lose our entire stake if the price drops by 20%. Our used Bitcoin is then gone. Now it should also become clear why you should not trade with a leverage of 1:100, because you will be liquidated if the price drops by only 1%.

Perpetuals, futures and other contracts at BitMEX

The most popular instruments for trading at BitMEX are the perpetuals. These are basically Bitcoin contracts that have an unlimited term. You could theoretically stay in one position forever, but you pay (or get) funding every 8 hours. How this is exactly composed we will explain later in the fees section.

The Bitcoin Perpetual contracts are traded on BitMEX in US dollars. So you have to specify how much US Dollar you want to invest in a position. The smallest value is 1 US Dollar. Although we are talking about US Dollars, all balances on BitMEX are backed by Bitcoins, so please don’t be confused by that.

To determine the current Bitcoin price, BitMEX uses an index price that is made up of the BTC price of Bitstamp, Kraken and Coinbase Pro. This ensures that we also have a fair market price for BitMEX.

Example calculation for a perpetual contract:

Assuming a trader goes long with 10 XBT at a Bitcoin price of 4,000 US dollars (no leverage). Then the trader buys 40,000 contracts. Because 1 contract is equal to 1 US Dollar with Bitcoin. If the price of Bitcoin now rises to 5,000 US dollars, the trader makes 2 BTC profit. So from now on he has 12 BTC. In the end, not only could he profit from the Bitcoin price increase, but he could also increase his number of Bitcoins.

Future contracts

In addition to the perpetuals, BitMEX also trades futures with a limited maturity. The futures contracts usually expire at the end of each quarter. This means that when you buy a future contract, your position is automatically closed at the end of the term. In the end, you make a bet on the futures on what the price will be at the end of the contract. Here you can also go long or short. In contrast to the perpetuals contracts you do not pay (or receive) funding every 8 hours for the future contracts. So it is usually more lucrative to hold them for a longer period of time.

BitMEX Fees

Of course, trading at BitMEX is not free of charge, you pay fees here as well. However, what is free of charge at BitMEX is the deposit and withdrawal of credits and the storage of your Bitcoins. However, BitMEX will charge you a fee if you enter into a position. These are broken down as follows.

BitMEX basically distinguishes between a Maker and Taker Fee. You pay the maker fee for a market order and the taker fee for a limit order. It is therefore cheaper to place a limit order that is not executed immediately than to use a market order.

In addition to the maker and taker fees, perpetuals also have a funding fee that is due every 8 hours. However, this is not necessarily the amount shown in the table, but depends on whether more investors are long or short. So it can happen that in a long position you get or pay fees every 8 hours. Depending on the current market situation. The current funding rate is always displayed in the upper right corner of the dashboard in the perpetuals. There you can also see when it is due.

For futures contracts, a settlement fee is due at the end of the term (only for BTC). A video with the necessary explanations of the fees and funding is available here.

If you want to save fees you can register with this link and save 10% of the trading fees in the first 6 months.

BitMEX App

Unfortunately there is no App for BitMEX yet. However, the website is optimized so that you can use it on your smartphone without any problems. Basically you can do everything you can do on your computer and your smartphone. Only the chart is a bit less visible on the smartphone and not necessarily suitable for important investment decisions.

BitMEX Testnet (Demo Account)

If all this is too complicated for you, you can first open a Testnet account with BitMEX. You do not yet do live trading with this account, but trade with Testnet Bitcoin first. This will help you to become familiar with the platform. You can find the BitMEX Testnet under: Testnet.Bitmex.com

BitMEX Bot

In the context of BitMEX, bots are also frequently mentioned. There are also countless of them. In addition, anyone can easily access the BitMEX API and thus easily connect a bot to BitMEX. We have already tested countless BitMEX bots, but so far we have not been able to find one that has managed to deliver continuous profits. Many bots are dependent on prices falling or rising over a longer period of time. However, if the price remains at a similar level (flat) for a long time, the bots no longer work. Also, you do not need to assume that there are good arbitrage bots available to the general public.

BitMEX Alternatives

Currently BitMEX is the largest platform worldwide for trading Bitcoin Futures. This point should not be underestimated. As the largest platform in the world, BitMEX also has the highest liquidity and this makes it easier for traders to trade there. Nevertheless, there are other platforms that are now trying to compete with Bitcoin Futures. The Binance Futures platform in particular is to be taken really seriously. Anyone who has a Binance account can also use the Binance Futures platform. In contrast to BitMEX, trading here is only possible with a leverage of 1:20. However, we already mentioned that such large levers should not be used anyway. Another important difference is that Binance currently only offers Bitcoin Futures. Other crypto currencies are not traded there yet.

Is BitMEX Secure?

Before you send your funds to BitMEX you should of course ask yourself whether the platform is secure. Given that over $1 billion worth of crypto currencies are traded on BitMEX every day, BitMEX does a lot to protect investors’ assets. The majority of the assets traded on BitMEX are stored in cold storage and therefore cannot fall victim to hacker attacks. In addition, funds are sent out only once a day. You not only have to confirm the transfer on the platform, but also by sending an email confirmation. So it is not enough if someone only has access to your BitMEX account. Nevertheless you should activate the 2 factor authentication. Then you can not only log in with a password, but also need the Google Authenticator Code.

Until today BitMEX has not been hacked. This is of course very positive but does not 100% exclude that something can happen in the future, even if the risk is very low.

Video

In the video we explain you once again exactly how BitMEX works. You can see there how you can enter and leave a position.

If you don’t have a BitMEX account yet, you can create one with the link and save 10% trading fees in the first 6 months.