On some stock exchanges you have the possibility to lend your crypto credits on a daily basis and risk-free. In return you will receive interest. Here we show you 3 different ways how you can get interest on crypto currencies. Please note that the interest rates listed here are also subject to fluctuations.

Table of Contents

1. Earn interest on Bitcoin and Ethereum with BlockFi

Who is BlockFi?

Until now BlockFi was only known for issuing loans. As collateral, you have to deposit crypto-currencies. The whole thing then works in such a way that you deposit a Bitcoin, for example, and get a loan in US dollars for it. Assuming the Bitcoin rate is 4,000 US dollars. Then for 1 BTC you get a loan of 2,000 US dollars. That doesn’t sound so attractive at first. Considering the fact that Bitcoin has fallen by 75% in 2018, it is easy to understand why.

Meanwhile the company has expanded its offer. You can now also deposit crypto credits at BlockFi and get interest for it. Currently BlockFi pays 6% interest per year. Since the interest is paid out monthly, there is even an annual interest rate of 6.2%, thanks to Zineszins. In order to profit from it one must deposit however at least assets in the value of 1 BTC or 25 Ether.

The disadvantage of BlockFi is that you must of course trust the company to keep your credit safely there. BlockFi uses Gemini’s Custodial Service for the storage of your crypto credits. Even if all this is set up very seriously, there is always a residual risk.

How does BlockFi work?

The use of BlockFi is relatively simple. All you have to do is create an account with the platform. To do this you also have to verify yourself. To do this you need to upload a picture of your passport or ID card. The verification is also for your protection. If you lose your account access you will still get your credits. After you have created your account you can already send Bitcoin or Ethereum to BlockFi. All you have to do is send them to Deposit. As soon as your account balance has been credited to BlockFi you will start earning interest. This will be credited to your account automatically every month.

Is BlockFi safe?

Of course there is never 100% security. But BlockFi does a lot to ensure that you can trust the company. Your crypto assets are not managed by BlockFi, but by the experts at Gemini. They have the leading custodial service for crypto currencies worldwide.

As far as BlockFi is concerned, the company is of course still very young. BlockFi was only founded in August 2017. However, the company has managed to raise more than 60 million US dollars in venture capital from prestigious investors such as Morgan Creek Capital (Anthony Pompliano), Galaxy Ventures (Mike Novogratz) and Consensys Ventures (founded by an Ethereum co-founder). The company has also attracted very experienced managers, including Rene van Kesteren, a former managing director of Bank of America.

Why can BlockFi pay interest on the crypto-currencies?

BlockFi’s business model is based on lending the stored crypto assets to institutional investors. These include traditional financial companies, trading companies, Bitcoin Futures Trader and Market Maker. However, in order to borrow crypto assets from BlockFi, the companies must deposit collateral in the form of Fiat currencies (US dollars or euros) or stable coins (Paxos or Gemini dollars). A deposit of 110-150% of the credit balance that the company borrows in crypto currencies must be made. The borrowed crypto-currencies are thereby secured. The companies pay 4-12% interest on the crypto credit from BlockFi. BlockFi itself has the right to reclaim the outstanding credit at any time with one week’s notice. In addition, the companies must deposit more collateral within 72 hours if the price of Bitcoin or Ethereum rises very sharply.

2. Margin Lending at Bitfinex

Background on Bitfinex and Margin Lending

Bitfinex was the largest crypto exchange in the world until the end of 2017. In the meantime, however, exchanges such as Binance have outstripped it. This is mainly due to the fact that Binance had much more coins from the beginning. Bitfinex is also aimed specifically at professional investors. This can be seen from the fact that investors must deposit at least 10,000 US dollars (or equivalent in crypto currencies or euros) once into their Bitfinex account (they can withdraw later) to activate their account.

In return there is margin trading on Bitfinex. This means that you can trade there with a leverage of maximum 3.3. For example, if you own a Bitcoin you can borrow two more. If the price increases by 10% you will not have 1.1 Bitcoins but 1.3 BTC. In addition to Bitcoins you can also borrow Euro, USD, Ethereum, EOS, Litecoin and many other crypto-currencies. You will pay a daily interest for the loan. The interest rate is about so that, converted to the year, an interest rate between 0.1 and 15% can result. If necessary, the interest rate can also be higher or lower depending on the current market environment.

How Margin Lending works at Bitfinex

For margin trading to work there must of course be people who lend Bitcoin, Ethereum, Euro, USD and so on. Lending is called funding or margin funding. Basically anyone can fund and lend money on Bitfinex. The risk is manageable. As a rule, the assets are lent for 1-2 days. After that you get them back. If you have lent 1 BTC, you will get 1 BTC + interest back. There is no risk of default. If at all, the risk is that you will have to leave your credit on the exchange (in this case Bitfinex). Assuming you lend BTC, you will still benefit from the increase in price, because you will get the same amount of BTC back plus interest. The interest is paid out on a daily basis.

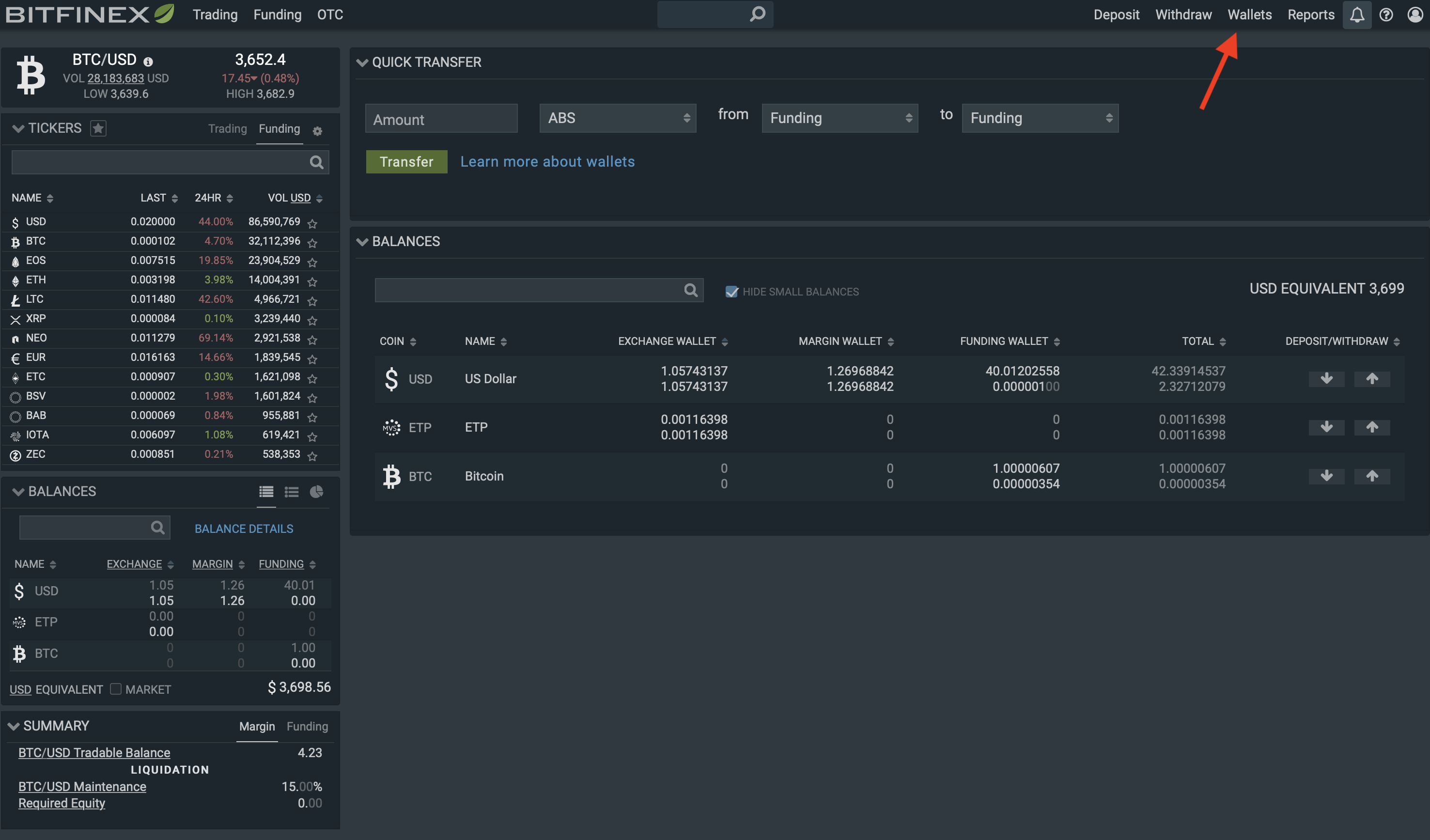

To invest your money at Bitfinex you first have to log in to the platform. If you don’t have an account yet, you can create one, but you should be aware that it will only be unlocked after you have deposited at least 10.000 US Dollar (or equivalent in other currency). After that you have to go to your wallets.

The money you want to invest you have to move from your Exchange or Margin Wallet to the Funding Wallet. Only amounts that are also in the Funding Wallet can be used to lend them and earn interest on them.

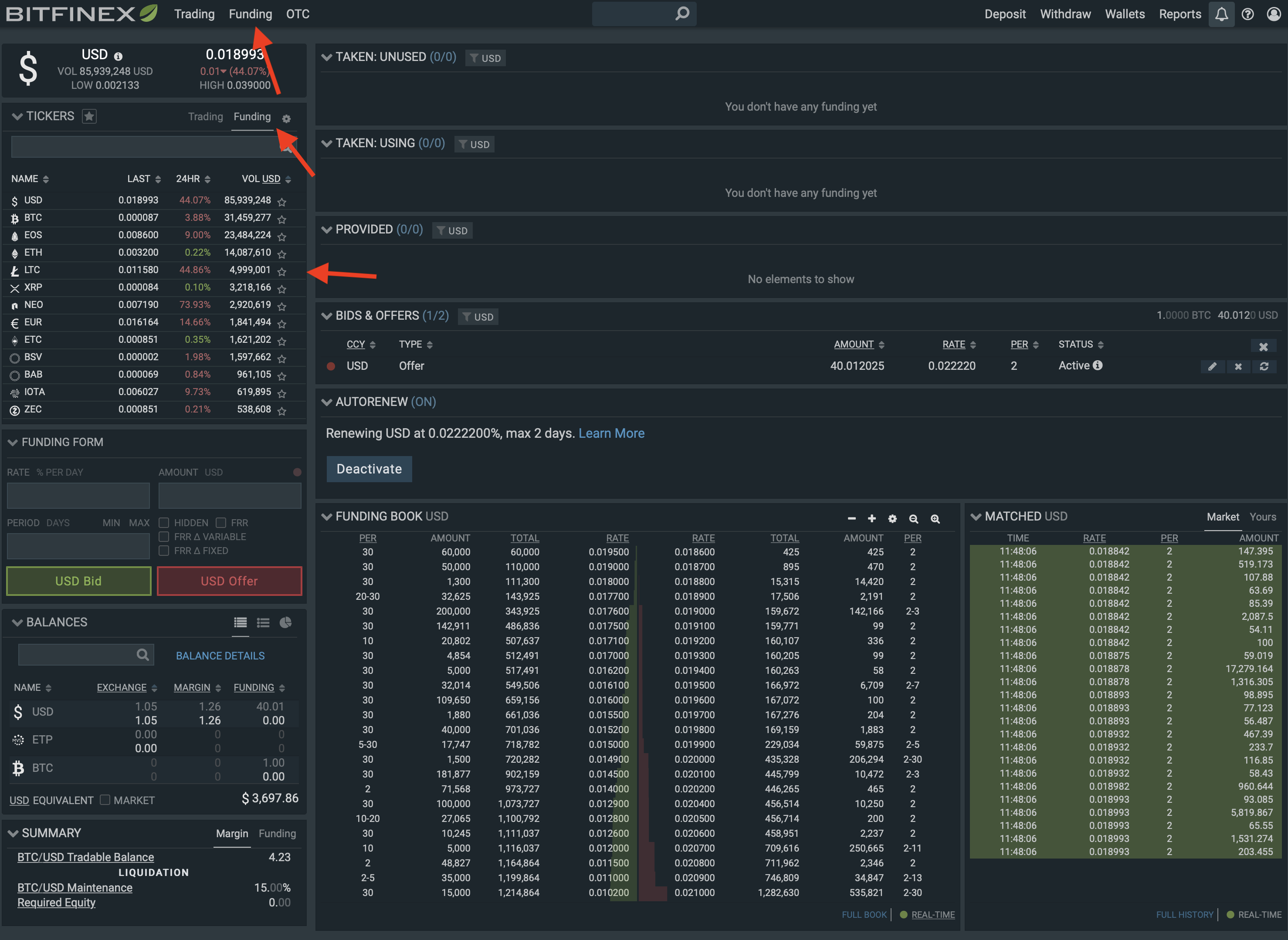

Once you have moved the funds into the Funding Wallet, you can click on Funding in the top bar and select the crypto or Fiat currency you wish to lend in the ticker box.

In the Funding Ticker Box under “Last” you can see the last interest rate at which the respective currency was lent. It is important to know that the interest rate displayed is a daily interest rate. This means that you will receive this interest daily.

To lend an amount you have to fill out the “Funding Form” on the left or the field “Autorenew” both lead to the desired result. It is much easier to fill in the “Autorenew” form.

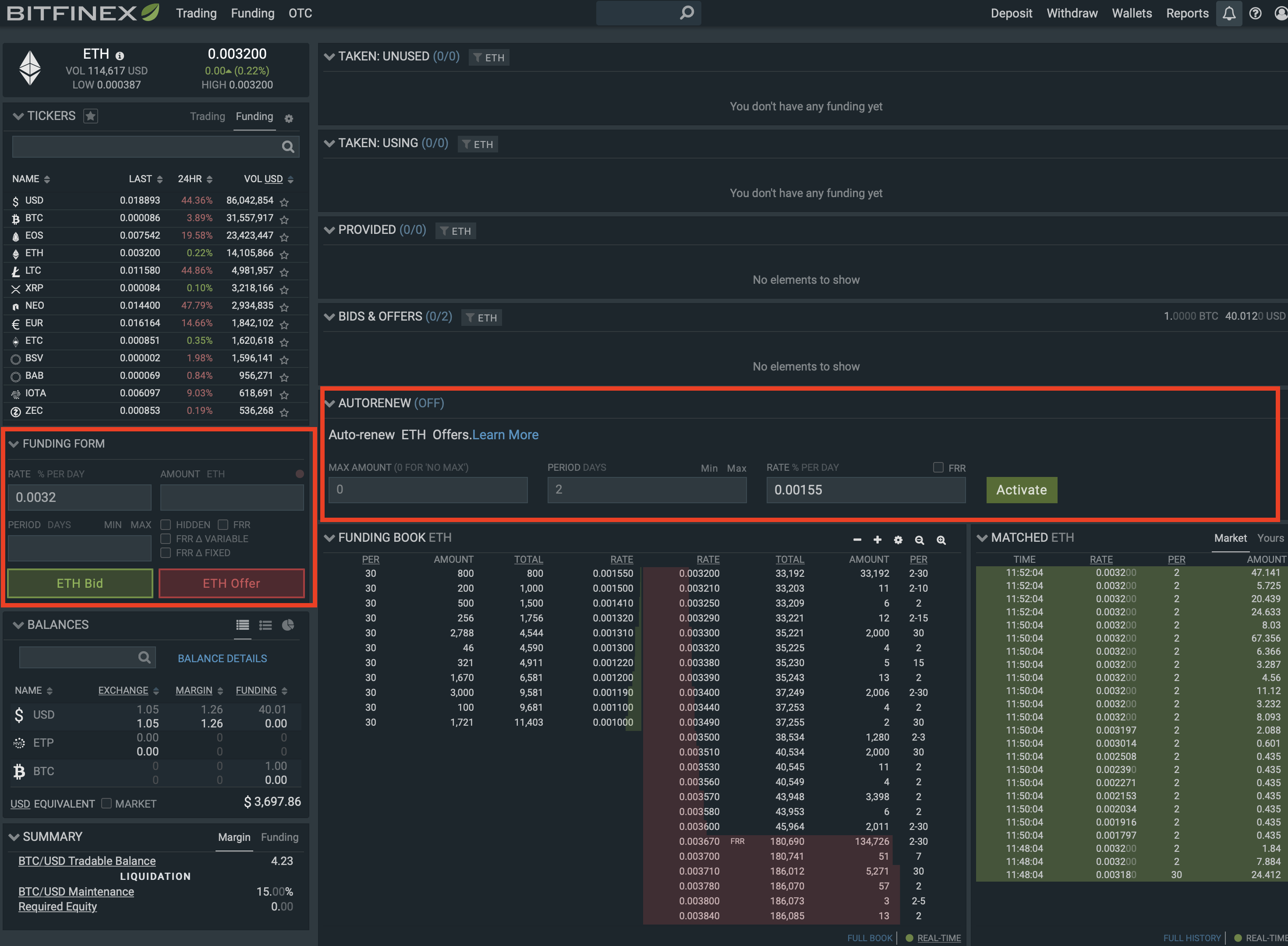

In the field “Max-Amount” you can leave the 0. This means that your entire balance in the Funding Wallet can be lent. At “Period” you usually enter a 2. This means that the credit can be lent for a maximum of 2 days. At “Rate” you can then take the suggested rate or enter an interest rate you want to receive. Of course this is the daily interest rate again. Afterwards you only have to press “Activate” and your offer will be adjusted. If you do it this way, “Autorenew” is activated and the lending of the credit is automatically renewed every 2 days. So it is not very maintenance-intensive. However, you should check regularly if you can achieve a better interest rate or if your set interest rate is too high.

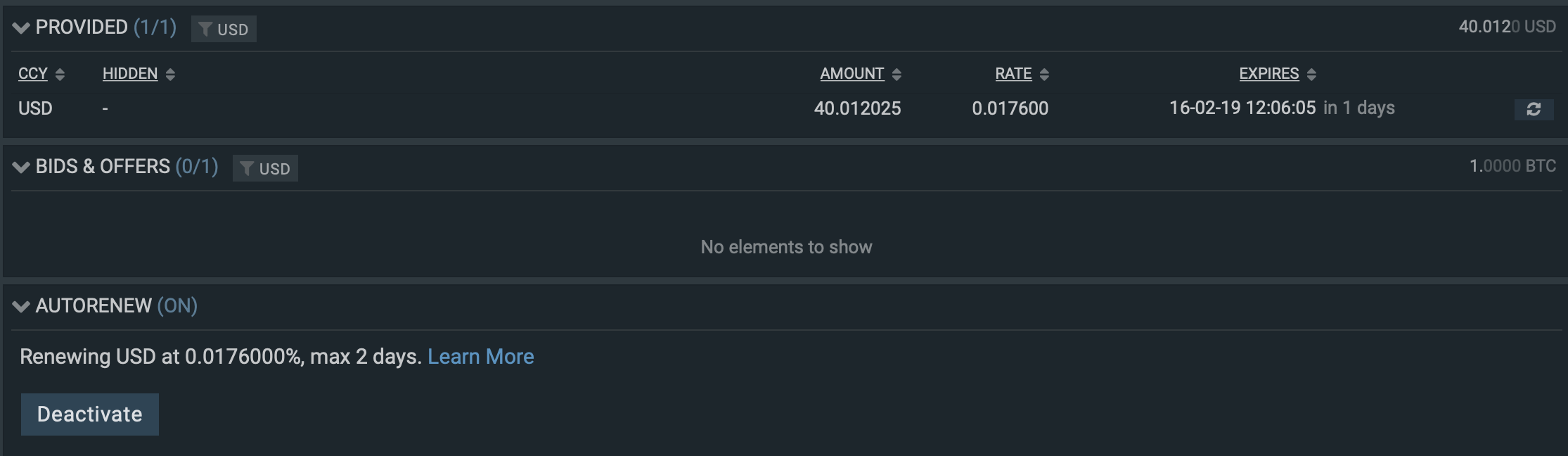

It is also important to understand that your offer usually ends up in the order book first. You will then see it under “Bids&Offers”. Only when it has been accepted by someone else does it appear under “Provided”.

Alternatives to Bitfinex

Besides Bitfinex there is also Poloniex. Margin funding is also practised on the Exchange, but there it is called “lending”. In contrast to Bitfinex, the volume on Poloniex is much lower and it is more difficult to get into a position. Another alternative is BitMEX. There funding takes place every 8 hours but you have to be in a position “long” or “short” and only one side receives the funding. Always depending on whether there are more “Longs” or “Shorts”.

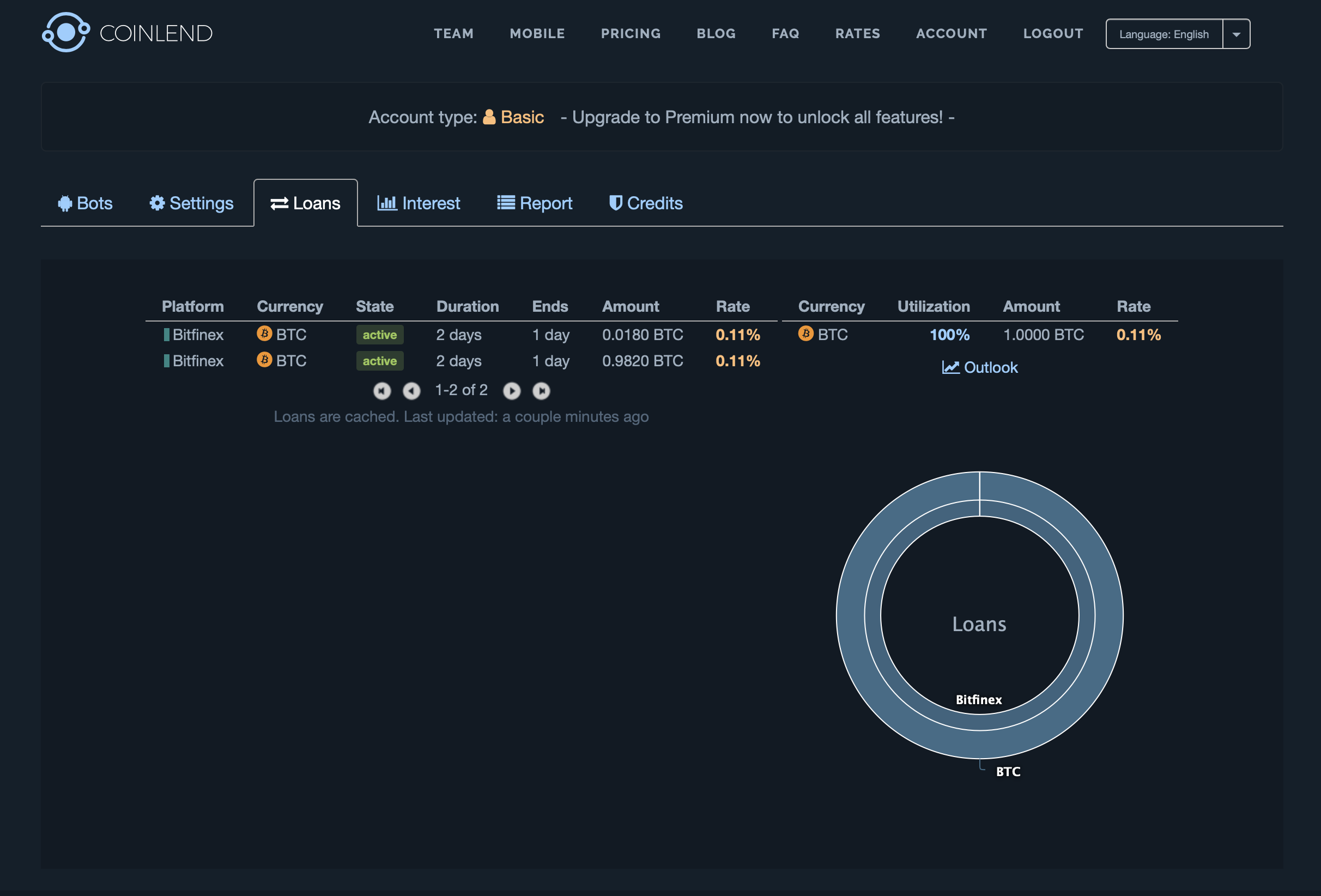

3. Margin Lending with the help of Coinlend

If this is too complicated for you on the platforms themselves, you can also use a bot, which creates your credits independently. You connect the bot via API (it is relatively easy and does not require programming skills) to the platforms. It then renews the funding automatically every 2 days at the best price. I myself use Coinlend in the meantime and have made good experiences with it. You can also set the API so that the bot only has access to it to create your credits in the funding. That means the bot can neither trade nor withdraw funds.

The Coinlend Bot is in the basic version, which is completely sufficient, completely free.

I personally have been using Coinlend for several months now and can only recommend the service. I first did the margin lending on Bitfinex manually, but as this is very time consuming, Coinlend has proven to be a better alternative.