How to Buy - Tutorial

When people talk about cryptocurrencies nowadays, they usually mean Bitcoin (BTC). Bitcoin alone currently accounts for over two thirds of the total market capitalization of cryptocurrencies. We explain here where you can buy and sell Bitcoin and what you need to keep in mind.

The invention of Bitcoin is attributed to Satoshi Nakamoto. Already in 2008 he published the whitepaper on Bitcoin. In January 2009 the first Bitcoins were mined. Until today it is not clear who is behind the pseudonym Satoshi Nakamoto. Meanwhile he is no longer active in Bitcoin because shortly after the start of Bitcoin Satoshi Nakamoto gave the project into the hands of the Bitcoin community.

Bitcoin is characterized above all by the fact that there will never be more than 21 million Bitcoins. This makes it clear that not even every millionaire will be able to own at least one Bitcoin. Bitcoin is traded on crypto exchanges. We want to show you here which possibilities you have to buy and sell Bitcoins and compare the different exchanges for you.

Exchange

Rating

Features

Link

Satoshi Nakamoto started working on Bitcoin back in 2007, but it wasn’t until 2008 that the Bitcoin Whitepaper was published and the domain Bitcoin.org anonymously registered.

Only in January 2009 the time had finally come. The Bitcoin software and code was released and the first block (called Genesis Block) was mined. This was the beginning of the further development of Bitcoin and all other cryptocurrencies. Until today Bitcoin remains by far the largest cryptocurrency in the world. Bitcoin alone accounts for more than two thirds of the total market capitalization of cryptocurrencies.

Bitcoin was first launched to revolutionize the financial system and for many Bitcoin fans this is still the main motivation to promote Bitcoin. Here we show you how you can get your first Bitcoins and what you should keep in mind. We also explain the different ways of storing your Bitcoins.

How to Buy Bitcoin – Summary

- 2. Verify Yourself on the Platform

- 3. Deposit (at least $200) e.g. via PayPal, Credit Card or Wire Transfer

- 4. Now you can buy Bitcoin directly

BTC Buy Guide and the Best Crypto Exchanges

Where can you buy Bitcoins?

Bitcoins are traded on crypto exchanges. The largest crypto exchange worldwide is Binance. However, it is important to know that most crypto exchanges do not support trading in Euro, US dollar or any other Fiat currency. You can therefore only buy and sell Bitcoins against other cryptocurrencies on exchanges such as Binance.

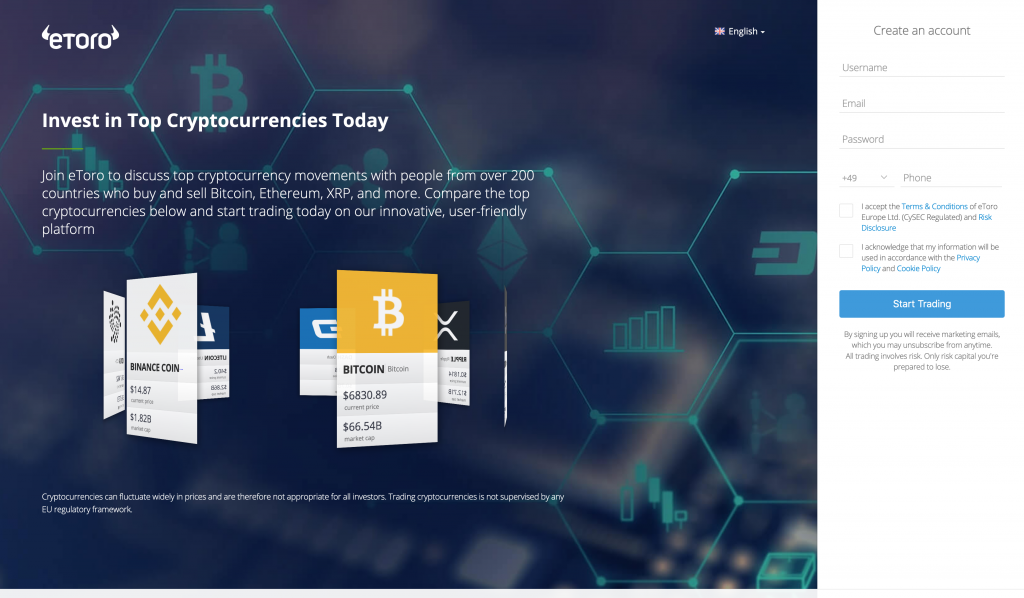

So if you want to buy Bitcoins in US dollar or any other Fiat Currency you have to pay attention where you register because there are not many providers who trade Bitcoins in US Dollar or other Fiat currencies (e.g. Euro, British Pund). Furthermore, the fees often differ dramatically. Therefore we present you here different crypto exchanges. But in the end it turned out that it’s the easiest and best way for beginners to buy Bitcoins at eToro. Because there you have low fees (0.75%) and you can use different payment methods like PayPal, credit card, bank transfer and instant bank transfer.

With the eToro wallet you can even withdraw your Bitcoins if you want to. Apart from that the storage of your Bitcoins at eToro is safe and free of charge.

Comparison and Experience of Crypto Exchanges for Bitcoin Trading

- 1st Place: eToro

- 2nd Place: Coinbase

- 3rd Place: Plus500

Buy BTC, But Where?

The easiest way to buy Bitcoin (BTC) is to buy it from eToro. There you can choose between different payment methods (PayPal, credit card and instant bank transfer), as well as an easy to use platform with great support. At eToro you can buy real cryptocurrencies.

eToro is undoubtedly one of the easiest ways to enter the coin trading world with its user-friendly design. It provides a platform of particular value for all traders who want to buy or sell BTC.

Buy BTC in 3 Steps on eToro

To trade on eToro you first need to log in to the platform. But this can be done without any problems. All you need to do is enter your name, email address and a password. After that you will get access to the eToro dashboard.

As eToro cryptocurrencies are traded against Euro, US dollar and other Fiat currencies you also need to verify your identity on the platform.

After opening an account you will also need to verify your identity with eToro. You will need to leave your personal details and upload a photo of your ID or passport. This process is required by European law for all platforms trading cryptocurrencies against fiat currencies.

If you have provided all the information, the verification may still take a few days. It is recommended that you make your deposit during this time, as this will give you priority in the verification process. But don’t worry, if something goes wrong with the verification, you will get your money back. It is a legal requirement that it must happen within 14 days. But we have never experienced this kind of problem before.

As soon as the verification is completed you will be notified by email. If you have already made a deposit at this point, you can start trading immediately.

Buy Bitcoin from eToro

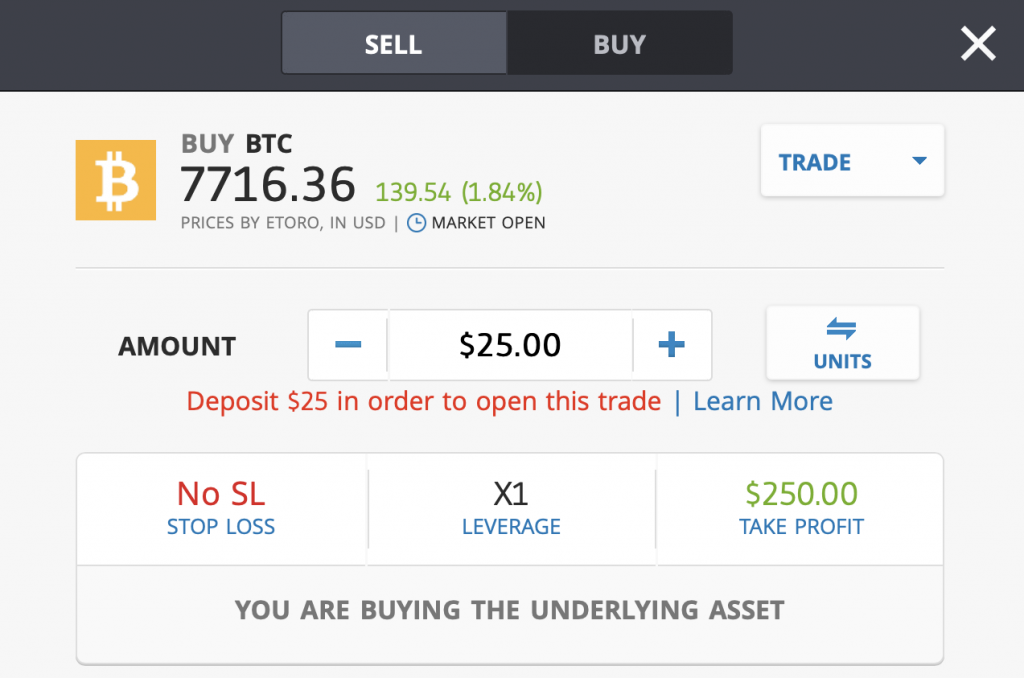

Buying and selling Bitcoin on eToro is quite simple. All you need to do is select BTC and click “Trade”.

A window will appear where you can buy BTC. All you have to do is indicate how many Euros, Pounds or US Dollars you want to invest in BTC. You can also set a stop loss, trade with a lever or enter a profit target.

With a Stop Loss, you can choose the loss at which your Bitcoin will be sold automatically, thus reducing further losses if the price falls sharply. We would not recommend trading with a leverage as this is very risky. Therefore, the lever should always be X1, then you buy real BTC. You don’t need to specify the profit target either, because you can always close the trade again manually if you have made enough profit.

When you have entered everything you need to click on “Buy”. The trade will be executed immediately and you will see your new BTC in your portfolio.

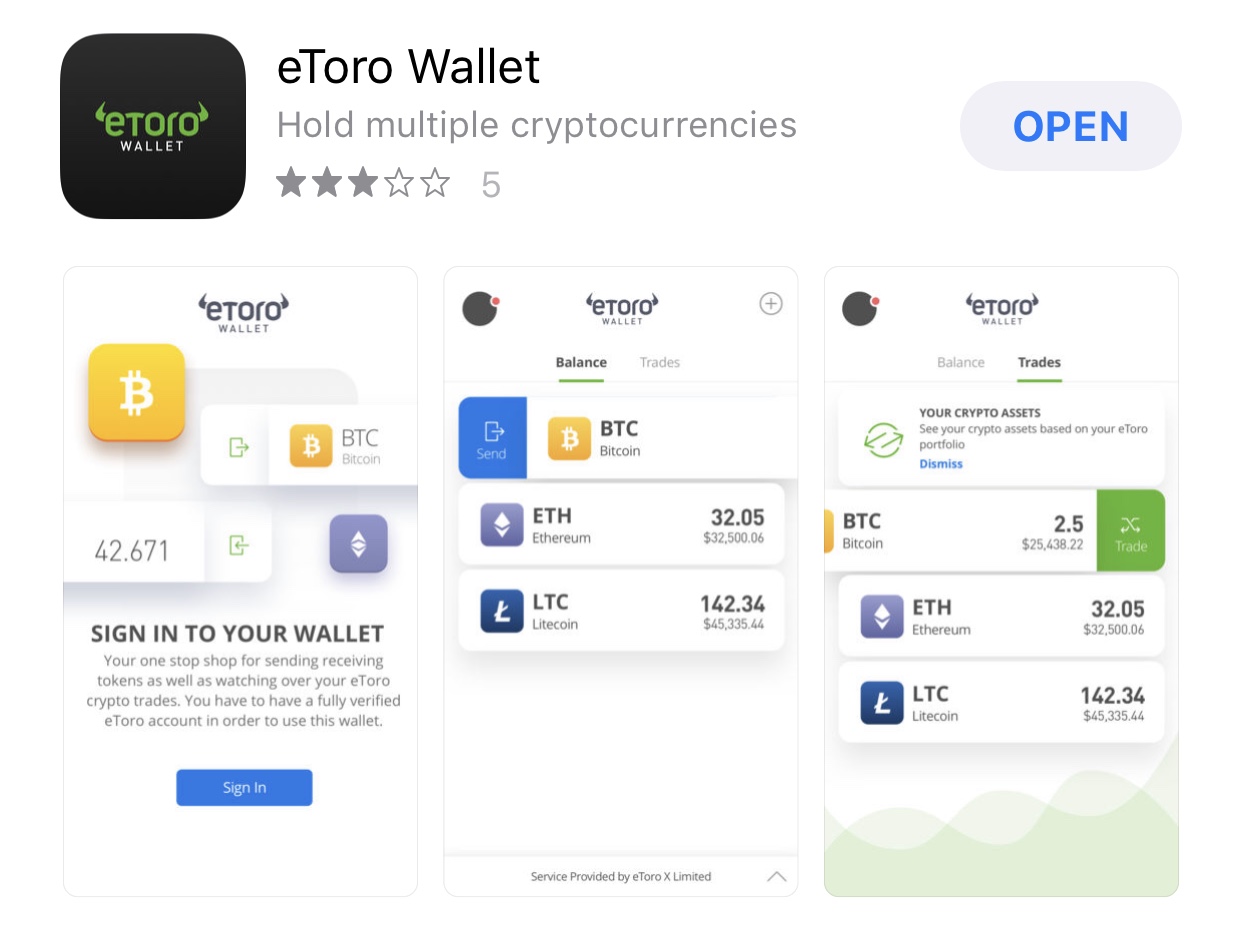

Withdraw cryptocurrencies with the eToro Wallet

In 2018 eToro introduced the so-called eToro Wallet. This is available for both Android and iOS. Now you can also use it to withdraw your crypto credits from eToro. All you have to do is install the wallet on your smartphone. You can then login to the wallet with your normal eToro login.

The wallet allows you to both receive and send cryptocurrencies.

Exchange

Rating

Features

Link

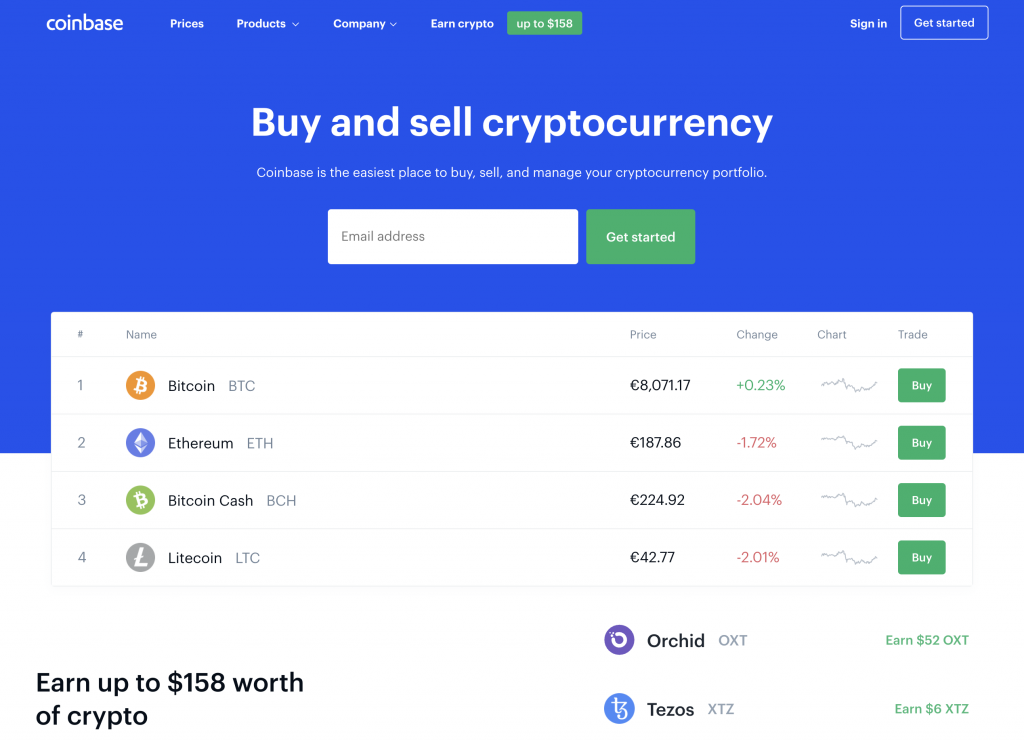

Buy Bitcoins at Coinbase

An alternative to eToro is Coinbase. Originally founded in the USA, Coinbase now has more than 30 million customers worldwide and is one of the most respected crypto companies in the world. New customers currently receive Bitcoins worth 10 US dollars for free if they buy cryptocurrencies for at least 100 US dollars.

To get credit on your account you can simply transfer fiat currencies (like Euro, US dollar or Pounds) to Coinbase or use your credit card (higher fees).

Besides Bitcoins there are many other cryptocurrencies traded at Coinbase. These include Ethereum, Ripple, Litecoin, Ethereum Classic, Stellar Lumens and many more. At Coinbase you can buy real cryptocurrencies, which you can withdraw at any time. With Coinbase Pro you also get access to a professional trading platform.

Buy Bitcoin at Plus500

At Plus500, so-called CFDs are traded. These are Contracts for Difference. You do not really buy a share, crude oil or crypto-currencies, but contracts that are tied to the price of the respective investment.

This has a few advantages, for example you don’t have to worry about the storage of the crypto currency and you can trade with a lever. This means that large profits can be made even with small capital. Furthermore, you don’t have to buy a whole share or 1 Bitcoin (you don’t have to take all of it from any provider), but you can also just buy a part of it. Finally, the advantage of CFDs is that you can trade a wide variety of assets and you can also shorten them with CFDs if you think the price is going to fall.

The disadvantage is that the CFD contract has a limited term and interest is payable daily, albeit at very low rates. However, the interest is due everywhere if you trade with a leverage.

Plus500 is aimed primarily at investors who want to trade actively. Because the platform offers all the usual investment options and you can not only go “long”, but also shorten investments, i.e. bet on a falling price. In addition, Plus500 also offers options, which you can hardly find at any other broker. So even professional traders get their money’s worth at Plus500. With the leverage you have the possibility to make big profits with small capital. The platform is fair in terms of fees.

What Payment Methods are Available to Purchase?

Buying Bitcoin - The Most Important Payment Methods

- Credit Card

- PayPal

- Wire Transfer

Buying Bitcoin with Credit Card

Many people like to buy cryptocurrencies by credit card. This is usually due to the fact that credit card payments are immediately available and the buyers do not have to wait until the deposit is there.

Unfortunately, not all exchanges support credit card purchases or charge very high fees. This is different with eToro. You can simply top up your credit card balance and start trading immediately. So you can also buy Bitcoins there immediately by credit card.

Buying Bitcoin with PayPal

Only very few crypto exchanges allow you to buy crypto currencies via PayPal. With PayPal, you benefit from the buyer protection. One exchange which I allow you to buy via PayPal is eToro.

You can simply fund your eToro account via PayPal and then you can start trading and buy Bitcoins. This makes eToro the big exception compared to other crypto exchanges.

Buy Bitcoins and Paypal Fees

Basically the use of PayPal is free for you. So you do not pay any fees for using PayPal. Also eToro does not charge you any fees for using PayPal. So if you pay 1,000 US dollar to eToro via PayPal, eToro will also receive 1,000 US dollar which you can invest there completely. So it’s worth thinking about using PayPal for the deposit, especially since you’ll get the credit immediately.

Buy Bitcoin via Wire Transfer

Another way to deposit money into your account in order to buy cryptocurrencies is via wire transfer. You don’t pay any fees in order to deposit money. However the disadvantage is that it can take up to 2 business days until your money is finally in your account. If you want to avoid that you can use Rapid Transfer for instant wire transfers. If you are using eToro you can choose if you want to do a regular wire transfer or a Rapid Transfer.

Should I Buy Now?

No one can say for sure when exactly the best time to buy Bitcoin is. The fact is, however, that the value of Bitcoin has increased significantly in recent years and many experts agree that this is just the beginning.

There are now many other cryptocurrencies besides Bitcoin, but to this day no cryptocurrency has even come close to overtaking Bitcoin in terms of market capitalisation. Experts assume that this will not happen anytime soon. Because there are still many innovations around Bitcoin (e.g. the Lightning network) that will ensure that Bitcoin will retain its dominant position in the long term. A scenario in which another cryptocurrency becomes successful and Bitcoin disappears is currently not conceivable. Thus Bitcoin is currently probably the most secure investment in cryptocurrencies.

Pro and Contra Bitcoin Investment

- Bitcoin is still at the beginning of development

- Most secure investment in the crypto sector

- Low inflation rate

- Most known cryptocurrency

- Investments in crypto currencies are highly speculative

When people talk about cryptocurrencies at the moment they usually mean Bitcoin. No other crypto currency is better known than Bitcoin. So if you are thinking of investing in cryptocurrencies, you should definitely have a significant Bitcoin share on the list. If Bitcoin is too expensive for you, you don’t have to buy a whole Bitcoin, you can even buy just 0.01 Bitcoin (BTC).

It is also important to know that many other crypto currencies are much cheaper but there are more coins or tokens available. Ethereum for example has more than 100 million ETH in circulation. With Bitcoin there will never be more than 21 million and this number will not be reached until 2140. So you should not only compare the price, but also the number of coins.

Bitcoin soon at $90,000 through Bitcoin Halving?

Currently is a very good time to buy Bitcoin. Because on May 12, 2020 we will experience the next Bitcoin Halving. Behind the Bitcoin Halving is a process that takes place every 4 years. This process halves the block reward that miners receive for finding a new Bitcoin block. Currently, when a miner finds a new block, he receives 12.5 Bitcoins. On average, a new block is found every 10 minutes. So the total Bitcoin circulating supply increases every 10 minutes with 12.5 Bitcoins (BTC). Before the last halving, there were even 25 Bitcoins that a miner got for finding a new block. Since there will only be a maximum of 21 million Bitcoins, inflation must be reduced. Therefore there is the Bitcoin Halving about every 4 years where the block reward is halved. This happens until we reach 21 million Bitcoins (in the year 2140).

In the past we have seen that the prices before and after the Bitcoin Halving have risen sharply. Because after the halving, inflation will be significantly reduced. In an analysis, the German Bank BayernLB even assumes that the Bitcoin price will rise to USD 90,000 after the halving. So now is a good time to invest in Bitcoin and benefit from the price rally before and after the next Bitcoin halving. Because all experts agree that there will be a strong price increase.

Is the Technology the Purchase Argument for Bitcoin

Meanwhile, there are many cryptocurrencies that promise to do more than Bitcoin. But this impression is often deceptive. There are many features that other cryptocurrencies have, but they are often not as secure and well tested as Bitcoin. A good example is IOTA. The technology of IOTA promises a whole series of innovations but also leads to the fact that IOTA sometimes breaks down and users can’t do transactions for sometimes days in a row. Here Bitcoin is already much further ahead and with new technologies such as the Bitcoin Lightning Network Bitcoin is also constantly being developed. This is where investors should really watch out and not just invest in promises of other cryptocurrencies, but rather invest a significant amount in Bitcoin. Bitcoin is the only cryptocurrency that has managed to continuously increase in value over the last 10 years (no crypto-currency is older) and we are still at the very beginning.

Invest in Bitcoin or Not?

Nobody can tell you for sure how lucrative an investment in Bitcoin will be. But it is a fact that the cryptocurrency is continuously increasing in value and for the period from 2010 to the end of 2019 Bitcoin was even the best investment of the decade. In the long run, cryptocurrencies are expected to have a significant share in the financial world and there is no way around Bitcoin.

Potential to Become the Leading Value Investment of the Next 10 Years

After Bitcoin was already the best investment of the past decade, there are many indications that this will also be the case in the next decade until 2030. Many financial economists now assume that the continuous money printing of the central banks can no longer function in the long term. Bitcoin offers a real alternative here. Because the total amount of Bitcoin cannot be regulated by central banks or governments. Rather, there is a maximum supply of 21 million that can never be exceeded.

How to Store Bitcoins Safely

After you have bought your Bitcoins, the question of storage arises. You can either leave them at the exchange (e.g. eToro) where they are relatively safe and the storage is free or you can use one of the 3 types of storage: Paper Wallets, Software Wallets and Hardware Wallets. We have listed paper wallets and software wallets only for completeness. If you want to store your Bitcoins yourself, you should definitely use a hardware wallet. This already makes sense if you only have a few hundred dollars or pounds in Bitcoins.

With the so-called Paper Wallets you simply write your private key on a piece of paper. With this Private Key you have access to your Bitcoins. If you lose the paper or it is stolen, your Bitcoins will be gone. Paper Wallets are not really practical for normal investors.

The Software Wallets are much better. You can install it on your desktop computer or smartphone and use it to manage your balances. With a so-called recovery phrase (usually consisting of 24 words) you can restore your Bitcoins if you lose the device. If you want to use a software wallet, we recommend the Trust Wallet for the Smartphone. This is available for iOS and Android.

The safest place to store your Bitcoins is a Hardware Wallet. The market leader for hardware wallets is the French company Ledger. We recommend you to use either the Ledger Nano S or the Ledger Nano X. Your Private Keys always remain on the wallet and cannot be stolen. Even if you lose the hardware wallet, you can still recover the credit via the recovery phrase. Hardware Wallets are also easy to understand.

Conclusion

2020 will be a decisive year for Bitcoin with Bitcoin Halving and we can expect to see another Bull Run on Bitcoin before and after the halving. This has been the case with all Bitcoin Halvings in the past. So if you want to invest in Bitcoin, now is a good time to do so, which only happens every 4 years.

The long-term prospects for Bitcoin are also excellent. Many people agree that cryptocurrencies will play an important role in the long run and there is no way around Bitcoin as it currently looks. You should also not make the mistake and invest in another cryptocurrency because you believe that the hype at Bitcoin is over and other cryptocurrencies will run out of Bitcoin’s rank. No other cryptocurrency has done that in the last 10 years and no other cryptocurrency will do that in the next 10 years.

To buy Bitcoins, eToro is a very good place to go, because the fees are cheap and the platform is easy for newbies to understand. Furthermore you can buy Bitcoins with credit card, PayPal and wire transfer transfer. With the eToro wallet you can also withdraw your Bitcoins.

Exchange

Rating

Features

Link

FAQs

For beginners the easiest way to invest in Bitcoin is to open an account with eToro and buy Bitcoins there. The whole process takes a few minutes and the platform is easy for newbies to understand.

Yes providers like eToro allow you to deposit funds by credit card and then use them to buy Bitcoin and other cryptocurrencies.

Yes, that is also possible. You can simply deposit funds into eToro via PayPal and then you can use them to buy Bitcoin and other cryptocurrencies.

I’m sure no one can tell you that. The fact is that Bitcoin has great potential and is only just beginning to be developed. It is currently unimaginable that cryptocurrencies will prevail and Bitcoin will not play a central role in this.

Depends on where you buy your Bitcoin. If you buy it from eToro you don’t need your own wallet. If you prefer to keep your Bitcoins in your own wallet, you can of course send them from eToro to your own wallet. Or you can use eToro’s own wallet for your smartphone.

Bitcoin Price and Price Development

Here you can find the current Bitcoin price and see how the price has developed.

Copyright © 2025 | WordPress Theme by MH Themes