SushiSwap (SUSHI) Purchase Guide - Tutorial

SUSHI means in the world of crypto currencies an appetizer of a different kind. With SUSHI and SushiSwap as DeFi platform behind it, a project started at the end of August 2020, which inspires investors – but has also already experienced violent ups and downs. Where you can buy SUSHI and what else you should know, we explain here. With our link to Binance you save another 10% in fees.

In the last days of August 2020 a until then unknown and until now anonymous “Chief Nomi” published a blog post about the idea of SushiSwap and SUSHI. With it he stirred up the DeFi scene overnight, because his concept promised added value to Uniswap, the previous market leader among the decentralized crypto exchanges. Beside the interest for deposits in Ethereum (ETH) and ERC-20-Token, accustomed from Uniswap, “Chief Nomi” made thereby advertisement to distribute additionally SUSHI for liquidity.

This offer made the round in the crypto scene in no time at all – capital in the order of magnitude of converted more than 500 million US dollars and secured by Smart Contracts switched from Uniswap to SushiSwap. SUSHI as coins were distributed immediately, it took another 14 days until the launch of SushiSwap. Meanwhile, SUSHI, as a participation in the project, shot up in price and reached an all-time high of almost 12 US dollars at the beginning of September 2020.

Exchange

Rating

Features

Link

But the eventful story about Japanese delicacies in the DeFi section continued. Completely unexpectedly, “Chief NomI” declared his withdrawal and before that he had transferred his shares to the safe haven Ethereum (ETH), the equivalent of 14 million US dollars. In a great hurry other shareholders voted and suddenly Sam Bankman-Fried, CEO of the crypto exchange FTX, became chief administrator of SushiSwap.

With this step, the company managed to stop the decline of SUSHI, where there was suspicion of scam. This was finally completely invalidated when “Chief Nomi” transferred the ETH in question back into the cash box of and used it for support purchases of SUSHI. However, this turbulence did not create deep trust and so SUSHI and SushiSwap will find themselves in a tough competition with other DeFi protocols in autumn 2020.

How to Buy SUSHI – Summary

- 2. Deposit via Credit Card, Wire Transfer or Cryptocurrency

- 3. Now you can buy SUSHI directly

SushSwap Buying Guide

As an investor you buy SUSHI on the free market through a crypto exchange. It is important that the provider of your choice registers as much volume as possible when trading with SUSHI, because only this guarantees you fair market prices. Furthermore, seriousness and low fees are important criteria. That is why we recommend Binance, the world’s largest and most profitable crypto exchange, as the place to go to buy SUSHI.

How to buy SUSHI

To buy SUSHI at Binance you need a customer account. This is quickly set up by entering your e-mail address and a password. Just click the link in the e-mail from Binance to confirm – done.

To trade with Binance and buy SUSHI you have to verify your account personally. With the simple account you can only handle crypto currencies and withdraw up to two Bitcoin (BTC) per day. For identity verification, also known as Know Your Customer (KYC), you simply upload a copy of your ID card or passport. To do this, Binance asks for confirmation of your residential address, which is provided by a current invoice or account statement, for example. After a few hours you will receive a confirmation from Binance to activate your account.

Pros and Cons Binance

- Market Leader

- Good Support

- Largest selection of cryptocurrencies

- Payment also via credit card and wire transfer

- Binance app for smartphone and tablet

- Cryptocurrencies remain a risky investment

What are the payment methods to buy SUSHI?

Binance supports three different ways of replenishing customer accounts with funds. In addition to deposits by credit card (Visa or Mastercard), these are bank transfer or transfer of crypto currency. Plus and minus points of these three options when buying SUSHI are available here for you:

- Credit Card

- Wire Transfer

- Cryptocurrencies

Buy SUSHI with Credit Card

Binance charges an impressive three percent fee when depositing euros into bank accounts by credit card. This is therefore the most expensive option, but also the fastest.

Buy SUSHI via wire transfer

If you transfer Euros from your bank account to Binance, the fee is only 0.50 Cent. But you usually have to wait two banking days for the credit to appear.

Buy SUSHI via Cryptocurrencies

Without an identity check, you can deposit Bitcoin and other crypto currencies into your customer account with Binance – that’s a plus. Simply scan the QR code of the destination address from Binance and initiate the transfer from your wallet. When the coins are credited, Binance will send you an e-mail.

Purchase of SushiSwap (SUSHI) from Binance

With the now deposited balance on your account at Binance you can go ahead and buy SUSHI. The fastest and easiest way to do this is to click on “Markets” and then enter SUSHI in the search field. You will then be shown the currency pairs that are traded with SUSHI at Binance. Currently (Fall 2020) Binance does not sell SUSHI directly against Euro. So you might have to make a short detour via “Fiat” and buy stablecoins like Tether (USDT) or Binance USD (BUSD) against Euro, alternatively Binance Coin (BNB) or Bitcoin (BTC).

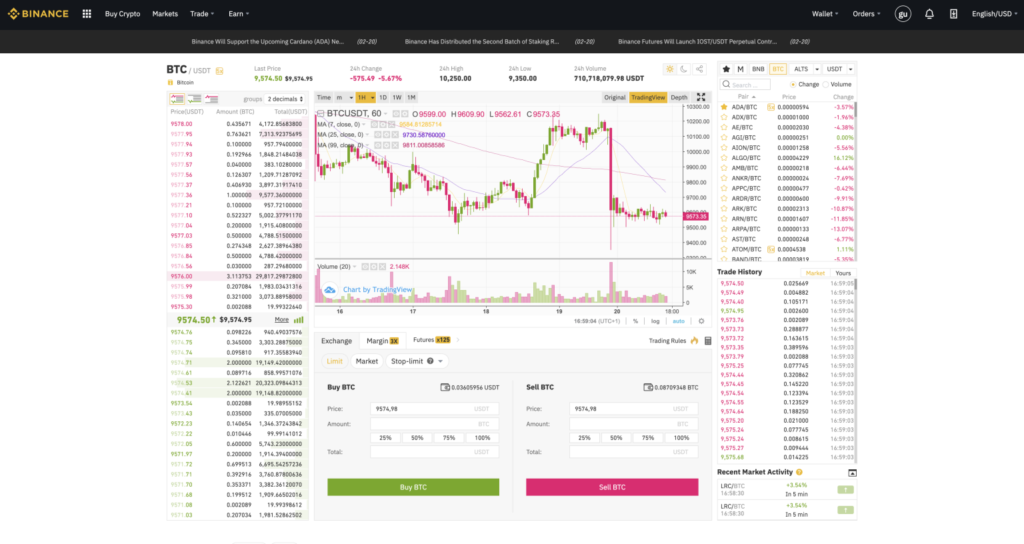

Now back to “Markets”, select the currency pair that suits you best and click on “Trade” will take you directly to the actual website where you can trade with SUSHI.

This window shows the price curve of SUSHI in the center. On the left side are the current order books, on the left side are closed deals. You are interested in the line below the price curve where “Buy” is the right field for buying SUSHI. You enter how many SUSHI you want to buy and decide whether “Market” or “Limit” should apply. “Market” means buying SUSHI at the market price from Binance, under “Limit” you link the automatic purchase with a target price you set.

Sale of SUSHI at Binance

The sale of SUSHI at Binance is proceeding in the same way as the purchase. Under “Sell” you determine the number of SUSHI you want to sell. With “Market” this happens immediately at the market price. With “Limit” you set a price at which the transaction should be executed. If you have Bitcoin or other crypto currencies on your Binance account again, you can exchange them for Euro under “Fiat” as usual and then have them transferred to your bank account.

Video Tutorial

You can find a video how you can buy and sell Sushi here.

Should I buy SUSHI (SushiSwap) now?

SUSHI marks in many ways a fundamental evolution in the still young field of DeFi for the crypto industry. Launched as a governance token for co-determination on the future course of SushiSwap, issued as an incentive for liquidity, immediately becoming an object of speculation in parallel – that is the story of SUSHI strikingly summarized.

Meanwhile Uniswap has delivered with UNI, the next competitor will surely come. On the other hand, the initial hype about SushiSwap and SUSHI has subsided, and the Altcoin is listed in realistic spheres. Its price development will directly depend on whether it succeeds in keeping SushiSwap in the top group in the hard competition for the best returns at DeFi. SUSHI is in demand as a ballot paper for joint decision-making on investment strategies and the further development of SushiSwap.

If you think of crypto-currencies as a relatively safe investment, you probably do better with Bitcoin as the leading currency or Ethereum as the top dog. SUSHI is exciting for investors, who choose SushiSwap as their preferred DeFi platform and perceive profit chances in daily volatility.

Which wallet to use for SUSHI (SushiSwap)?

Usually we recommend hardware wallets as the best solution to keep Bitcoin and Co. safe. This is because separation from the Internet ensures the best possible security against hacker attacks. You can store SUSHI as an ERC-20 token on the Ledger Nano S or Ledger Nano X, for example.

However, since SUSHI is not so much a store of value as a trading object, this is a special case. In order to trade with SUSHI on a daily basis, it is easier and faster to leave your SUSHI on your customer account with Binance and thus be able to react immediately to price fluctuations in your favor. Another alternative are software wallets like the Trust Wallwet from Binance or MetaMask, a (mobile) wallet optimized for the Ethereum ecosystem. It also brings a specialized and decentralized browser that is compatible with Uniswap and other DApps.

Conclusion

With SushiSwap and SUSHI, a revolutionary concept at the beginning has inspired the DeFi division. But DeFi also means a “war of codes”, as some analysts succinctly summarize the events. The idea of today will be copied tomorrow in a slightly improved form. What SUSHI temporarily achieved with regard to uniswap – poaching liquidity – can be repeated overnight in reverse. The big plus of SUSHI: After initial uncertainties about leadership and security, the project is now moving in a much more orderly fashion. As long as SUSHI and SushiSwap continue to accumulate double-digit percentages of the total market for DeFi, the chances for price gains are good. Otherwise, SUSHI alone is an exciting financial instrument for day traders because of its high volatility, often exceeding 10 percent during the course of the day.

Exchange

Rating

Features

Link

Copyright © 2026 | WordPress Theme by MH Themes