UniSwap (UNI) Purchase Guide - Tutorial

In the DeFi boom of the crypto industry the decentralized crypto exchange Uniswap plays an important role. Since September 2020, Uniswap also has its own freely tradable Altcoin with UNI. Buy UNI – how it works and what else you should know about Uniswap, you can find out here. With our link to Binance you save another 10% in fees.

Since 2018, Uniswap has served as the basis for innovative DeFi projects. As a decentralized crypto exchange, Uniswap (UNI) collects liquidity in Ethereum (ETH) and ERC-20 tokens so that barter transactions can be processed transparently and automatically at low fees. Inventor Hayden Adams quickly expanded the platform in the direction of yield farming, where the provision of liquidity through loan transactions generates additional interest.

Exchange

Rating

Features

Link

The ingenious idea of Uniswap quickly found imitators and in September 2020, Adams and his team witnessed a massive move of capital from Uniswap to SushiSwap. The reason: SushiSwap offered not only interest but also its own token SUSHI as an incentive for investors. But Uniswap reacted quickly and launched UNI as its own token on September 18, 2020.

With UNI, Uniswap succeeded in redirecting capital back to its own platform. In autumn 2020, the liquidity collected by Uniswap amounted to almost 3 billion US dollars. Meanwhile, UNI has now settled at around 3.50 US dollars in price, after flying high towards 7 US dollars at the start. UNI is both a governance token and a profit opportunity as a co-owner of Uniswap.

How to Buy UNI – Summary

- 2. Deposit via Credit Card, Wire Transfer or Cryptocurrency

- 3. Now you can buy UNI directly

UNI (Uniswap) Buy Guide

The first consideration when buying a crypto currency like UNI is to find a suitable crypto exchange. High trading volume in UNI should bring it with you to ensure fair market prices. Seriousness, simple user guidance and as low as possible fees are decisive for this. If you consider all this, Binance is recommended as the world’s largest crypto exchange for UNI buy.

How to buy UNI

The prerequisite for buying UNI from Binance is a customer account with the leading crypto exchange. You create this with your e-mail address and a password. By clicking on the confirmation link in an e-mail from Binance, the customer account is activated in its basic function.

To buy UNI (Uniswap) also against Euro, you need another activation from Binance. This is done after you have passed the identity check, also known as Know Your Customer (KYC). What do you need? The scan or photo of your identity card or passport, plus confirmation of your current address, for example by means of a bank statement or invoice. You upload these document copies to Binance and receive the additional confirmation a few hours later. Now Binance no longer requires you to make deposits and withdrawals in Bitcoin ( BTC) and Co.

Pros and Cons Binance

- Market Leader

- Good Support

- Largest selection of cryptocurrencies

- Payment also via credit card and wire transfer

- Binance app for smartphone and tablet

- Cryptocurrencies remain a risky investment

What are the payment methods for purchasing UNI?

You can buy UNI and other crypto currencies with credit on your customer account at Binance. There are three options for depositing the money by credit card, bank transfer and crypto currency. The advantages and disadvantages of these methods can be found here:

- Credit Card

- Wire Transfer

- Cryptocurrencies

Buy UNI with Credit Card

Binance charges an impressive three percent fee when depositing euros into bank accounts by credit card. This is therefore the most expensive option, but also the fastest.

Buy UNI via wire transfer

If you transfer Euros from your bank account to Binance, the fee is only 0.50 Cent. But you usually have to wait two banking days for the credit to appear.

Buy UNI via Cryptocurrencies

Without an identity check, you can deposit Bitcoin and other crypto currencies into your customer account with Binance – that’s a plus. Simply scan the QR code of the destination address from Binance and initiate the transfer from your wallet. When the coins are credited, Binance will send you an e-mail.

Purchase of Uniswap (UNI) from Binance

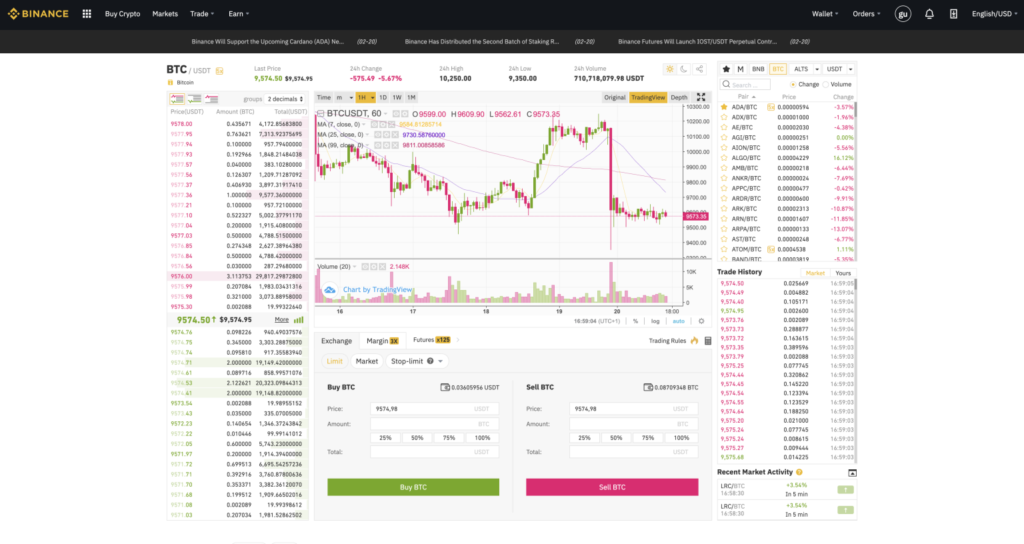

To find out which currency pairs are traded for uniswap at Binance, click on “Markets” and enter UNI in the search field. You will then see that (as of October 2020) UNI cannot yet be bought or sold directly for Euros at Binance. Therefore you have to make a small detour and buy Bitcoin (BTC) or the Stablecoin Tether (USDT) for Euro under “FIAT Markets”. Now you can click the selected currency pair for UNI under “Markets” and you will be redirected to the trading screen.

At the center of the screen is the UNI price curve. You can see the open order books on the left and the closed trades on the right. To buy UNI, click on “Buy” below the price curve. There you enter the number of UNI you want to buy. Now you have to decide if you want to buy UNI at the current market price with “Market” or if you want to wait for a target price under “Limit”.

Sale of UNI at Binance

Buying or selling UNI works basically the same way at Binance. To sell Uniswap, you go to “Sell”, set the amount and choose between the current market price or a price you set individually (“Limit”). Once the trade is completed, you will have Bitcoin or Tether back in your account. If you sell them for Euro, you can then have the Euro amount that your UNI paid transferred to your normal bank account.

Video Tutorial

You can find a video how you can buy and sell UNI here.

Should I buy Uniswap (UNI) now?

The concept of decentralized finance business booms under the keyword DeFi in the crypto industry. Uniswap as a platform with UNI as token is without doubt one of the most popular representatives of the DeFi sector, because there is a demand for its clearly defined use cases.

The maximum amount of all UNI is set at 1 billion, and they will be gradually introduced to the market over the coming years, for example through bonus campaigns. This means that certain inflation risks must be taken into account when buying UNIs.

On the other hand, the demand for UNI demonstrates that investors believe Uniswap can continue to innovate and that they want to have a say in decisions about its direction. There are signs of an upward trend for UNI.

Which wallet to use for Uniswap (UNI)?

UNI is an ERC-20 token and can therefore be stored on any software wallet compatible with Ethereum (ETH). If you choose Binance as your crypto exchange, the Trust Wallet from Binance is a good software wallet. An alternative would be MetaMask, where you get a software wallet and a browser specialized in the Ethereum ecosystem, including uniswap and DApps.

The safest way to store your UNI and other crypto currencies is to use a Hardware Wallet. The big advantage is that a hardware wallet is not directly connected to the Internet, thus preventing attacks and hacks by cyber criminals. Currently, however, the hardware wallets of the leading manufacturers Ledger and Trezor are not yet specially prepared for UNI and thus require some manual work. For daily trading with UNI, it is currently recommended to leave the UNI with Binance or on a software wallet in order to be able to react quickly to price fluctuations. Answers and instructions for the use of hardware wallets can be found in our special here.

Conclusion

DeFi is in all probability not a temporary phenomenon, but secures relevant market shares in the crypto industry. Uniswap as a pioneer has created UNI, a token that enables direct participation in this project. There are many indications that UNI will show a positive price curve if Uniswap continues to be successful. Competition is still threatened by imitators such as SushiSwap (SUSHI) and perhaps comparable projects that have not even been launched today.

Exchange

Rating

Features

Link

Copyright © 2026 | WordPress Theme by MH Themes