Since 2019, Initial Exchange Offerings (IEO) have often been the way for new crypto projects to raise seed capital. For investors, there are excellent opportunities for profit, whether on Binance or FTX.

When crypto exchange Binance announced in January 2019 that it would support public funding for innovative crypto projects in a new format, critics feared a bubble would form. However, Binance Launchpad quickly turned out to be a very successful format and the initial sale of new tokens by a crypto exchange was christened IEO (Initial Exchange Offering). Quickly, the idea was copied by other crypto exchanges and FTX in particular provided resources. Twitter user forecastooor has now made a comparison to IEOs at Binance and FTX and their profitability from 2020 to mid-2022. The results should be of interest to any investor:

1. IEOs were a guaranteed profit for investors if every single offering was consistently subscribed and then compounded.

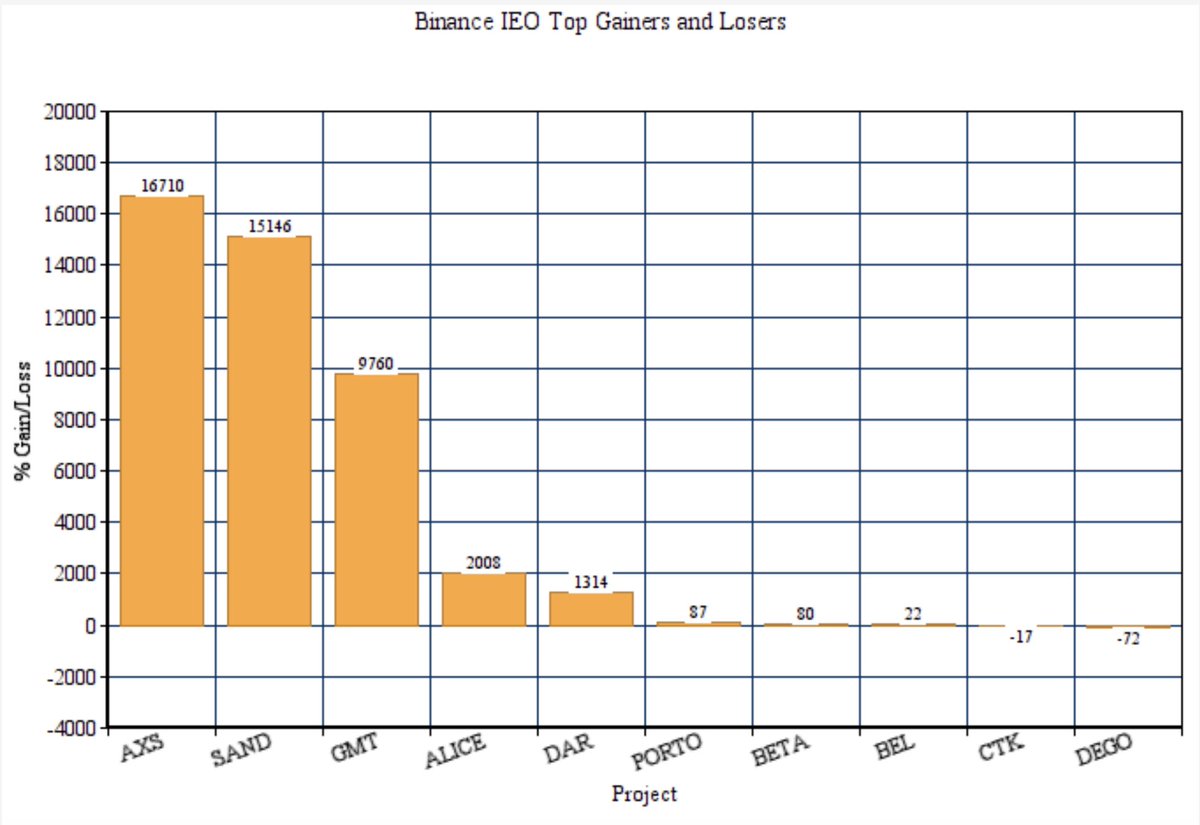

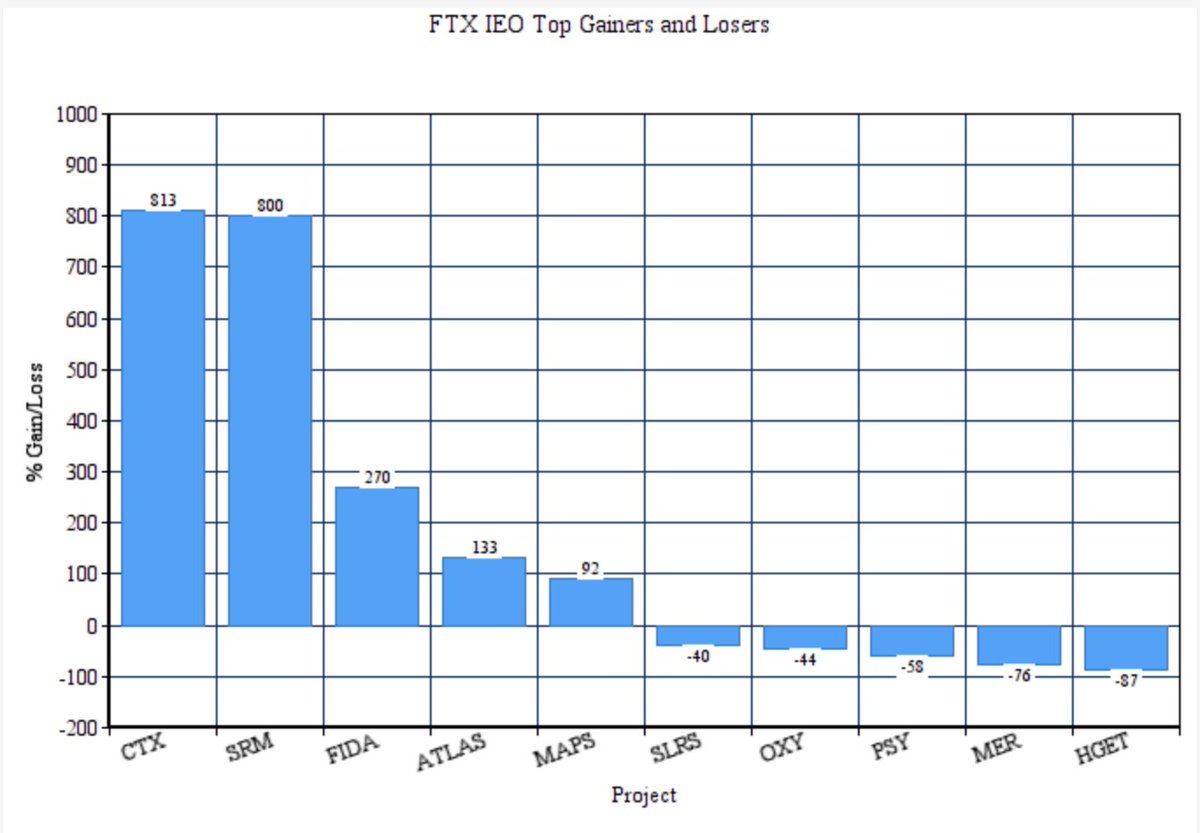

2. those limited to IEOs on Binance had a 91 percent win ratio with respect to the 22 offerings studied there. FTX’s 12 IEOs had a 50 percent win ratio.

3. in the case of Binance Launchapd IEOs, the featured tokens were able to achieve an average price gain of 22 times, while in the case of FTX it was still an average of 1.5 times the capital invested.

4. high flyers on Binance were Axie Infinity (AXS) with an incredible 16,710 percent increase between issue price and all-time high and Sandbox (SAND) with 15,146 percent. On FTX, Serum (SRM) was up 800 percent and Cryptex Finance (CTX) was up 813 percent.

5. At FTX, about half of the projects presented at IEOs slipped into negative territory right after initial listing and got stuck there. At Binance, only two such projects are identified by forecastooor. The comparison does not comment on whether an issue price that was set too high was presumably the main reason for failed IEOs or whether the projects concerned were deficient in content.

6. However, it is noted that those who took all IEOs with Binance were able to post a whopping 4,240 percent plus in 2020, 479 percent plus in 2021 and 2,582 percent plus in 2022. FTX’s balance sheet is also positive, albeit on a much smaller scale. For all IEOs at FTX in 2020, participants in 2020 result in a plus of 236 percent, for 2021 it is 13 percent plus and in 2022 so far 275 percent plus.

7. forecastooor notes that, from his perspective, IEOs at Binance have often been harbingers of trends in entire divisions of the crypto industry and that is why they have been so successful. Whether Metaverse with Sandbox, GameFi with Axie Infinity, or DeFi with Polygon (MATIC), these IEOs at Binance were indeed just ahead of their time. FTX could hardly attract or identify such spectacularly igniting projects for IEOs with them.

IEOs at Binance and FTX – our experience

We have not checked the numbers presented by forecastooor in detail, but tendency and also magnitude coincide with our experience. IEOs at Binance have consistently become a safe bank, here a careful selection process in advance seems to pay off. The quality of IEOs at FTX, on the other hand, fluctuates and there are cases where there was probably a green light for a launch too early.

One factor that forecastooor does not explore in detail is very important: in order to even get a shot at IEOs, you need to hold Binance Coin (BNB) or FTX Token (FTT) in advance. The rule of thumb is that the larger your balances in BNB or FTT, the more of the new tokens sold at the IEO you will receive. But these coins from Binance and FTX are themselves subject to large price fluctuations, and this impact on the overall calculation is not included in the model presented. It assumes that BNB and/or FTT are stored in HODL mode by participants in IEOs anyway and volatility would therefore be negligible.

Otherwise, however, forecastooor is right: for Binance IEOs, it has been absolutely advisable to mark the dates in the calendar and strike. Even a sale immediately after the initial listing of the coins issued at the Binance Launchpad usually paid off in many hundreds of percent profit. At FTX you should look a little closer at the IEO projects, there was also scatter hidden between some wheat.

Conclusion: IEOs – also in the future financing model for start-ups in the crypto industry?

Examples such as ApeCoin (APE) have also recently re-entered the market with models other than IEOs and have not exactly shone with transparency and fairness. Despite all the initial prophecies of doom, IEOs still seem to be the ideal way for start-ups in the crypto industry to collect seed capital and raise their profile at the same time. For the crypto exchanges (here: Binance and FTX), customer loyalty is also the desired side effect in the form of BNB or FTT, in the best case a win-win situation for all parties involved. In the pre-selection of projects suitable for IEOs, Binance Launchpad continues to be ahead of its competitors, as the figures from the period since the beginning of 2020 clearly prove.

Leave a Reply