BitMEX has been regarded by investors as the most important crypto exchange for trading in Bitcoin Futures and similar financial instruments. New figures suggest that Binance, OKEx and Huobi have now overtaken BitMEX in terms of turnover.

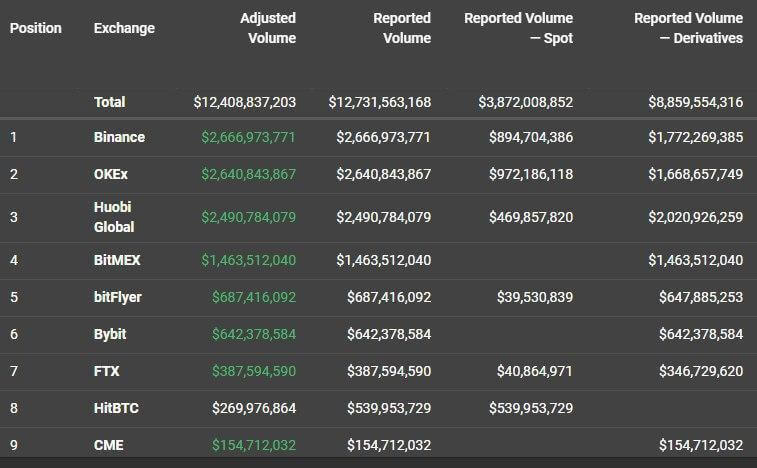

March 12, 2020 marked a huge break for Bitcoin (BTC), with the market value and market capitalization almost halved within 24 hours. At the same time that Thursday four weeks ago was a decisive day for the BitMEX crypto exchange. Until then, BitMEX had usually been the first port of call for day traders when it came to Bitcoin Futures and related financial products, even for many old coins. BitMEX was able to advertise itself with high leverage, low fees and great liquidity. But now figures show that BitMEX is no longer the market leader in the specialized trading of crypto derivatives, but has lost importance in the wake of the market shakeout on March 12. The naked data illustrates how three competitors, Binance, OKEx and Huobi, have left BitMEX behind:

What led to the sudden loss of importance of BitMEX?

Experts name several factors that BitMEX had to contend with on March 12 and afterwards:

- BitMEX experienced two DDoS attacks on March 12 or 13 (depending on local time) and had to admit in a blog post that this led to delayed deal execution. In the middle of a situation where the crypto market was highly volatile and masses of money were burned, such an event is of course damaging to trust.

- In a job ad BitMEX is looking for a manager to deal with KYC processes among other things. KYC stands for “Know Your Customer” and means that BitMEX probably wants to collect detailed personal customer data in the future in order to avoid coming into conflict with money laundering laws. Some traders see this development as a reason to look for other trading platforms.

- In line with this, the figures show that capital was also withdrawn on a large scale from BitMEX on March 12, a total of at least 400 million US dollars, mainly in BTC.

- After all, a number of prominent crypto traders, who can certainly be compared to influencers, have publicly renounced BitMEX and are now advertising for competitors. Public support for BitMEX is thus waning.

Not to forget: The spot market for BTC accounted for only about 3 percent of the daily turnover in Bitcoin trading until “Black Thursday”, and that share has now grown to over 8 percent. So trading in derivatives is losing importance, at least temporarily, and this hits BitMEX as a specialized platform harder than others.

Should I as an investor still trust BitMEX now?

In an analysis last summer we already found that Binance is increasingly copying BitMEX’s offerings and thus becoming a full-fledged competitor. The trend has continued and is also being followed in practice by other providers. BitMEX has lost unique selling points and must also deal with a class action suit in the USA. So there are good reasons to move his account to Binance for daily trading, for example. On the other hand, BitMEX has so far been largely spared scandals and will work hard to restore liquidity.

Open a Binance Account here and save 10% on trading fees. If you want to trade Futures on Binare use the Code “BlockBuilders” and save 10% as well.

Leave a Reply