The bankruptcy of the November 2022 crypto exchange FTX is probably only a profitable business for lawyers and consultants. Around 30 million US dollars they charged for their services in February and an end to their work not in sight.

Around 10 billion US dollars of customer funds are affected by the insolvency of the crypto exchange FTX and when there might be at least partial compensation remains in the stars. But the lawyers, accountants and advisors handling FTX are billing regularly. The documents sent to the court for this purpose show: In January, costs for organizational handling of FTX added up to about 38 million US dollars, and in February – the shortest month of the year – it was 30 million US dollars.

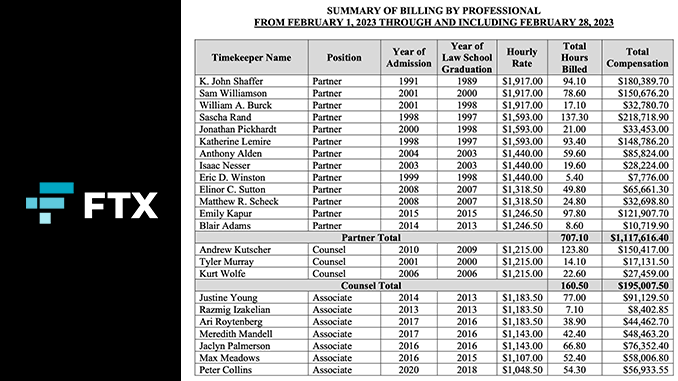

Man-hours account for the largest item. Top lawyers at the law firm Sullivan & Cromwell, for example, take $2,165 per hour. Receiver John Ray has claimed nearly 240 hours of work in the FTX case for February, charging $308,000, which works out to an hourly wage of just under $1,300. The enormous costs are justified with reference to “one of the most complicated cases (…) in all aspects of the law.” Currently, two law firms, two consulting firms, an accounting firm and the team of receiver Ray are busy with the remains of FTX.

This involves a wide range of tasks. On the one hand, efforts continue to secure remaining assets from the FTX empire. For another, documents must be compiled for the court and communication with injured parties must be ensured. Platforms such as Xclaim have opened trading in claims against FTX. There, $1 claim against FTX is currently valued at $0.19. Accordingly, the estimated 10 billion U.S. dollars in losses due to the chaos at FTX are probably only offset by 2 billion U.S. dollars in values.

Conclusion: Settlement of FTX insolvency becomes a million-dollar grave

Commentators in the U.S. recall the Enron case, which became one of the biggest economic scandals due to accounting fraud, and where the costs for the liquidation totaled about 700 million U.S. dollars. If one estimates about two years, which the FTX case is expected to take, the total costs are likely to be in similar levels. Meanwhile, FTX’s founder, Sam Bankman-Fried, remains on house arrest with ankle bracelets as the prime suspect in a criminal case. He himself had stated that he had almost no money left. Bankman-Fried is facing life imprisonment and the prospects of recovering any money from him seem vanishingly small.

Leave a Reply