At the IOTA Foundation under head Dominik Schiener, financial decisions could mix private with official. One critic has compiled findings that are hard to ignore.

In the past crypto year 2022, the IOTA Foundation’s finances and possible insider trading were in the spotlight more often than those involved would have liked. Promises by foundation head Dominik Schiener to ensure transparency remained unfulfilled. This is one of the reasons why long-time IOTA critic “Buffy” is not letting go of the issue, and she published an infographic via Twitter that reinforces the impression that Schiener and the foundation have no problems with questionable financial transactions. “Buffy” also hints very clearly at thinking Schiener is a liar by now. So let’s take a look at what’s going on:

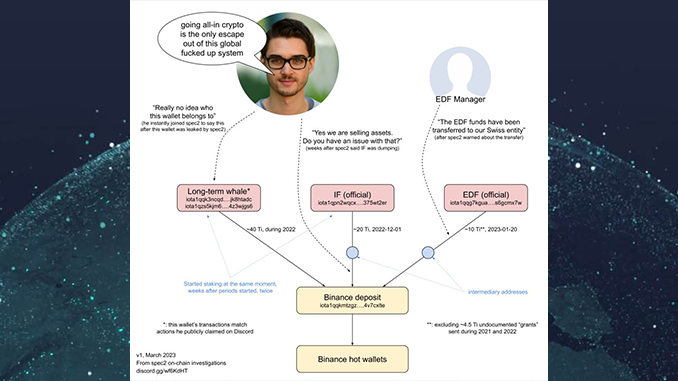

- it was known that in 2022 an anonymous major investor sold off at least 40 Ti of IOTA with a market value at the time of well over $10 million. The timing of the IOTA sales suggested the suspicion of insider trading and there was also speculation as to whether the sales could not be attributed to Schiener. However, Schiener denied it and, according to his own statement, was also later unable to find out who was actually behind the actions.

- It also became known at the end of 2022 that the IOTA Foundation was turning at least parts of its reserves into money at a high rate, apparently also to ensure liquidity. Here, Twitter user “ThatsNotMyCode” was the person who did not let up and pointed out possible conflicts of interest. He has now republished the chart from “Buffy” and predicts a continuing decline for IOTA in light of the latest information.

- less known until now was that the IOTA Ecoystem Development Fund (EDF) also liquidated at least 10 Ti of reserves in early 2023 and generally shifted its financial fortunes to a Swiss foundation. This was likewise confirmed only when critical investors inquired.

What is new and quite alarming is that all three strands, which are actually separate from each other, from which the sales originated, used the same customer account at the crypto exchange Binance. Thus, the claim made by Schiener that the sales criticized by “Buffy” cannot be assigned can hardly be upheld. Also, his motto “Everything in crypto, because that’s the only escape route from this crappy global system” is not exactly supported by the massive sell-offs of IOTA.

Reactions from the IOTA community to the conflation of the three strange processes are typical: One part resorts to calling “Buffy” names and wants to ignore the findings reached through blockchain analysis. One part wants to clarify more details. And a part is just as dogged as the IOTA Maxis and scolds Schiener and the foundation with “Scam” (fraud or cheating).

Conclusion: IOTA is dumped from the inside – beginning of the end?

Not exactly to the delight of some commentators, we have regularly reported on the financial conduct of the IOTA Foundation and the strange behavior of Dominik Schiener. This is another reason why we allow ourselves to draw conclusions. Stocks are being sold off by the official IOTA bodies (Foundation and Development Fund) as well as by the mysterious Whale, behind whom Schiener could be hiding. None of this helps the price curve of IOTA and also indicates little confidence in the future. It is also suspicious that the IOTA Foundation and Schiener are driving a “salami tactic” and at best react when research comes close to them. Significant here is a statement from the foundation, who seeks more answers, must take the legal route. As a reminder, the Berlin-based IOTA Foundation is registered as a non-profit organization, and Swiss foundation law is a topic in itself. In the interest of investors and IOTA’s future prospects, it is long overdue for Schiener to come clean, even if it means admitting mistakes. After all, people have long been asking whether the financial future of the IOTA Foundation and thus the achievement of critical development goals is still secure.

Leave a Reply