Until the end of August, new records were reported almost daily by the market for NFTs. But now demand for the immutable tokens is slowing down significantly, and projects like CryptoPunks are also affected.

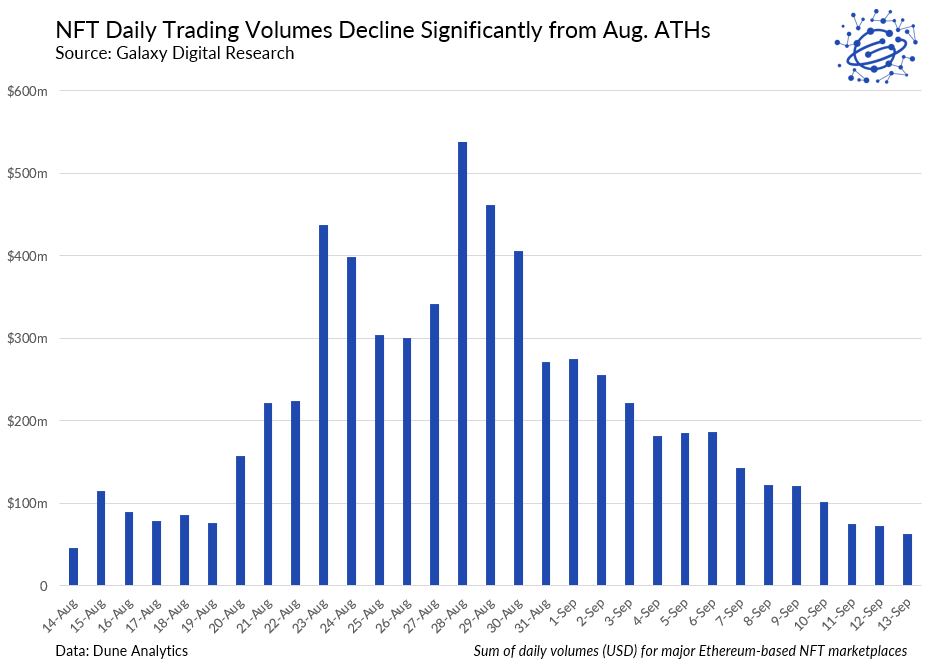

In midsummer 2021, the price curves for creative NFTs seemed to know only the upward direction. Ether Rocks, for example, changed hands for more than USD 1 million per token, while CryptoPunks saw prices of more than USD 100,000. The boom also saw the successful debut of numerous new NFT projects, one example being Degenerate Apes. But now the initial hype around NFTs seems to be dying down. Analyst Axel Thorn presents data on Twitter that shows: If in mid-August there were still trading volumes with NFTs of around 500 million US dollars on peak days, turnover has currently fallen to below 100 million US dollars daily.

The data shown by Thorn refers to marketplaces where NFTs based on Ethereum (ETH) are traded. The trend is reflected in the charts of OpenSea, which is the market leader there. But it has also become quiet around Binance’s NFT marketplace, which was launched with great effort, and it can be heard that NFT projects that are just starting now are having a hard time getting out of the starting blocks. So it can be safely stated: Quasi blind buying of NFTs is no longer the case at the moment and even peak values are not a given.

Here are two examples: According to public data, the absolute number of daily sales and the average price paid for CryptoPunks, one of the historically first NFT successes with a high profile, have fallen. Here, however, consolidation is taking place at a high level, with at least 80 ETH still due for a CryptoPunk, the equivalent of more than $200,000. The situation is similar for Ether Rock: Here, the price ticker also reports only rare sales, but they are still around 3 million US dollars with prices of around 800 Ethereum.

Conclusion: NFT boom flattens out – blue chips retain value

The overall crypto market comes into the fall anyway only with some difficulties, last week a price drop of Bitcoin (BTC) temporarily shocked the events. NFTs as the topic of the hour can’t get away from these trends either. Those who entered the NFT theme speculatively will now need patience or must be broad to sell even with losses. But blue chips like CryptoPunks and Ether Rocks, which are also noticed by the classic art market, continue to find their buyers at very high prices. Here, it is probably real collectors who are sure: Rare and special NFTs are no flash in the pan, but continue to have great potential. In summary: The market for NFTs is clearing up, collectors are choosing the objects of their desire more carefully. However, NFTs should by no means be written off, because the innovations emanating from them remain impressive.

Open a Binance Account here and save 10% on fees for a lifetime.

Leave a Reply