Yes, Binance is one of the safest exchanges in the world. Only 2% of all credit balances are stored online. The rest is stored offline in so-called cold wallets. But of course there is never complete security. However, you can also download all your crypto-currencies from Binance and store them on your own hardware wallet.

Binance Review and Test

Whoever wants to trade crypto currencies must do so at crypto exchanges. The largest crypto exchange in the world is Binance. We show you here how to use Binance and what you need to pay attention to. You will also receive our experience report. With our Binance link you save 10% on trading fees.

If you look at the trading volume of the individual crypto exchanges, you will quickly see that by far the largest trading volume is to be found at Binance. Although the crypto exchange has only existed since 2017, it has quickly become the market leader. This is probably not least due to the fact that you can trade over 100 different crypto currencies on Binance. These include Bitcoin, IOTA, Ethereum, Ripple (XRP), EOS, Cardano (ADA) and many more. As you cannot trade with Euro at Binance, the handling of the exchange is a bit more complicated.

Exchange

Rating

Features

Link

Binance was only founded in 2017. Although the exchange is still very young, it has managed to become the new market leader among crypto exchanges within a few months. This is mainly due to the fact that Binance is technically very well positioned, there are many coins on Binance and the platform is very reliable. The project was financed by an ICO, where investors could buy BNB tokens. Initially Binance was based in Asia. However, Binance is now headquartered in Malta. Nevertheless, a large part of the team is still spread around the world.

Those who wish to trade at Binance can only do so against other cryptocurrencies. Unfortunately, it is not possible to deposit Euros or US dollars. Investors therefore usually buy Bitcoin or Ethereum on other platforms (e.g. Coinbase) and then send them to Binance. You can also buy Bitcoin and other cryptocurrencies on Binance with a credit card but the fee for it is very high (around 4%).

Inhalt

- 2. Verification is not required

- 3. Send crypto balances to the exchange to trade

- 4. Now you can already buy coins on Binance

Pro And Cons Binance

- Largest exchange globally

- Good standing in the crypto community

- More than 100+ cryptos to trade

- Multiple language support

- High liquidity

- High fees for fiat currencies

How to set up an account with Binance

Setting up an account with Binance is very easy. As you can only trade crypto currencies against other crypto currencies on the platform, you do not necessarily need to verify your identity. Only if you want to withdraw more than 2 Bitcoins per day do you need verification. Therefore, you can start trading immediately after registration.

On a positive note, the Binance website is also available in German. Furthermore, the help pages are also available in German. But if you need to contact the support, you have to do it in English. Currently, Binance does not yet have a German-language support.

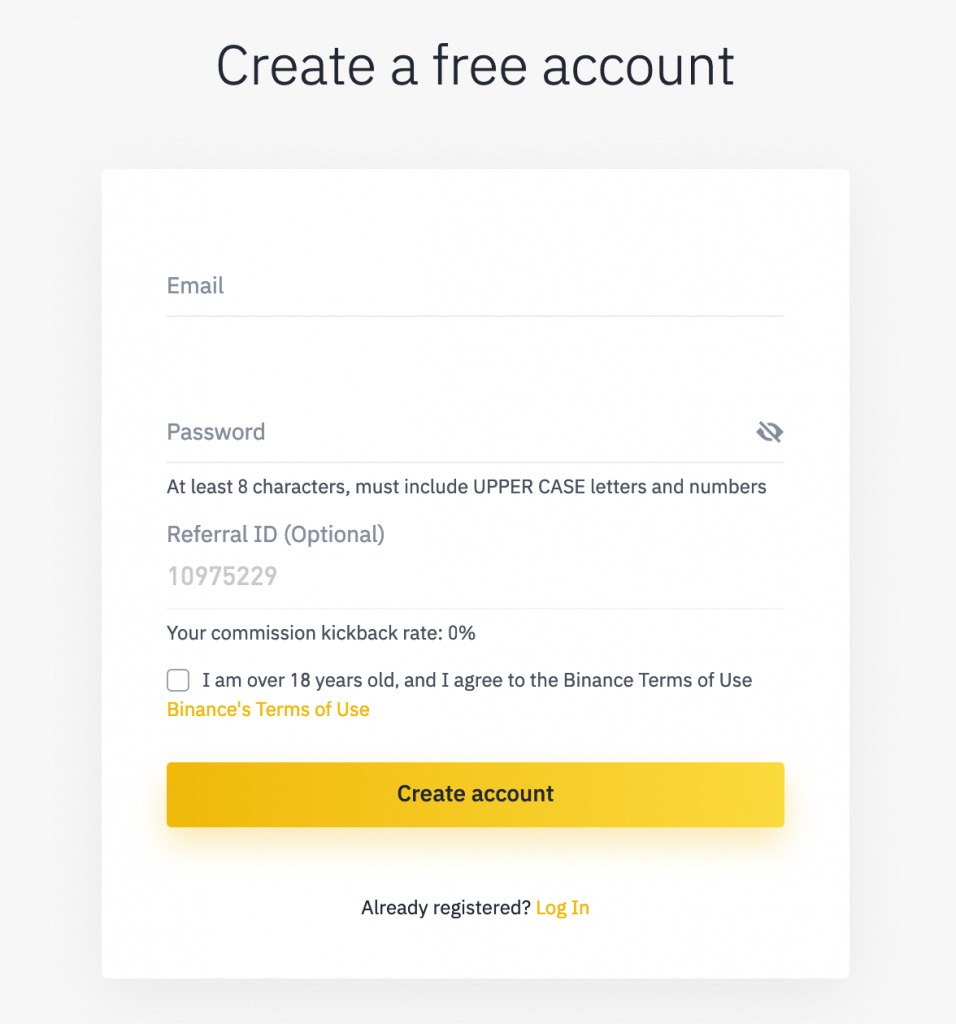

Registration with Binance is very simple. All you need to do to log in is enter your email and a password. You will then receive an email confirming your email address.

Afterwards you will have access to the Binance Dashboard. As you cannot make deposits and withdrawals in euros at Binance, no long-term verification is necessary.

Only those who wish to withdraw more than 2 Bitcoins (BTC) per day must verify their identity with Binance. If you do not want to do so, you can start trading right after registration.

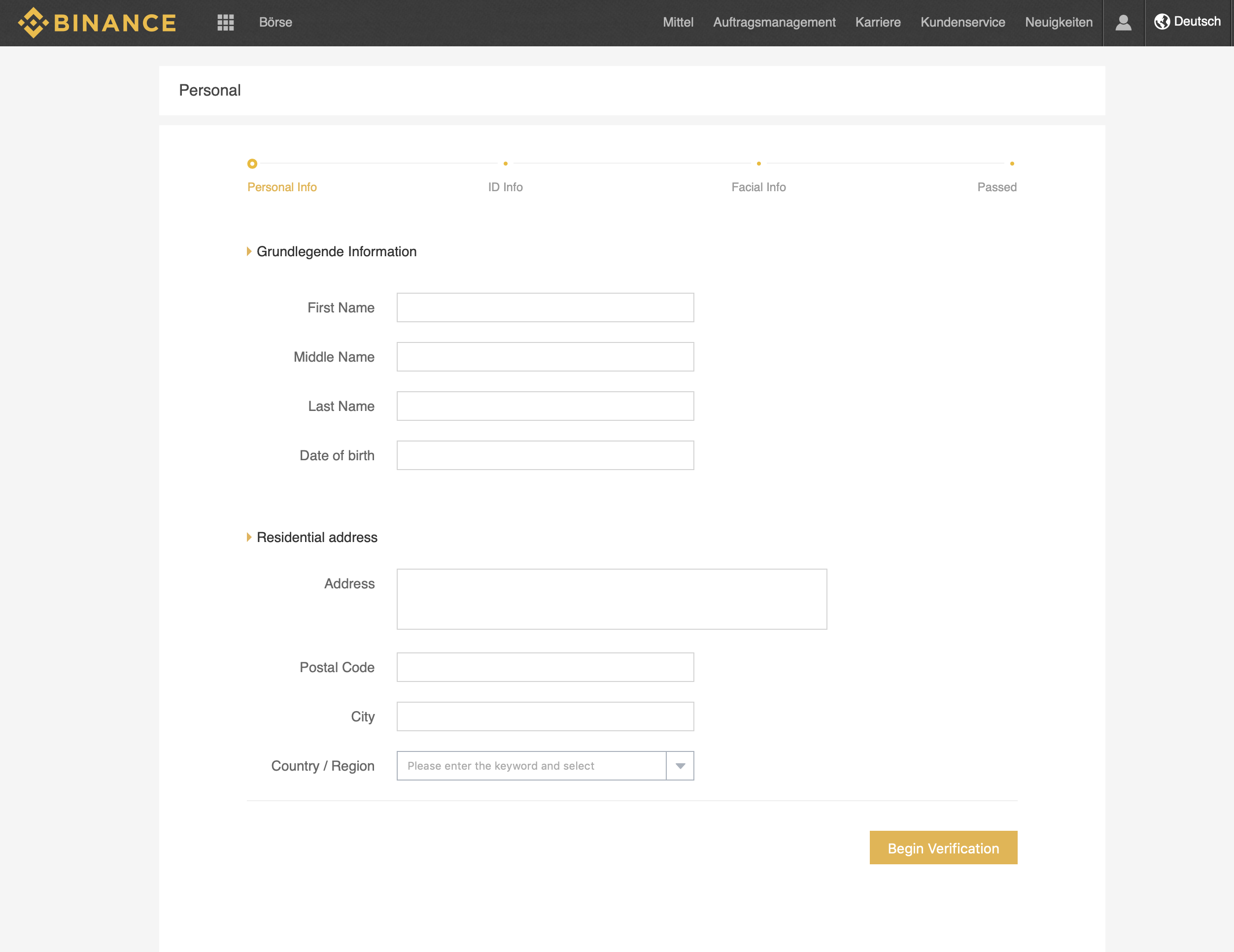

For verification you have to provide your personal data. You will also need to upload a picture of your ID or passport. Finally, you must upload a picture of yourself with a piece of paper in your hand on which Binance is written. Your data will then be checked by Binance. This may take a few days under certain circumstances.

In order to start trading on Binance you need to deposit cryptocurrencies on Binance. You can do that in your Binance wallet when you click on deposit.

How to Trade on Binance

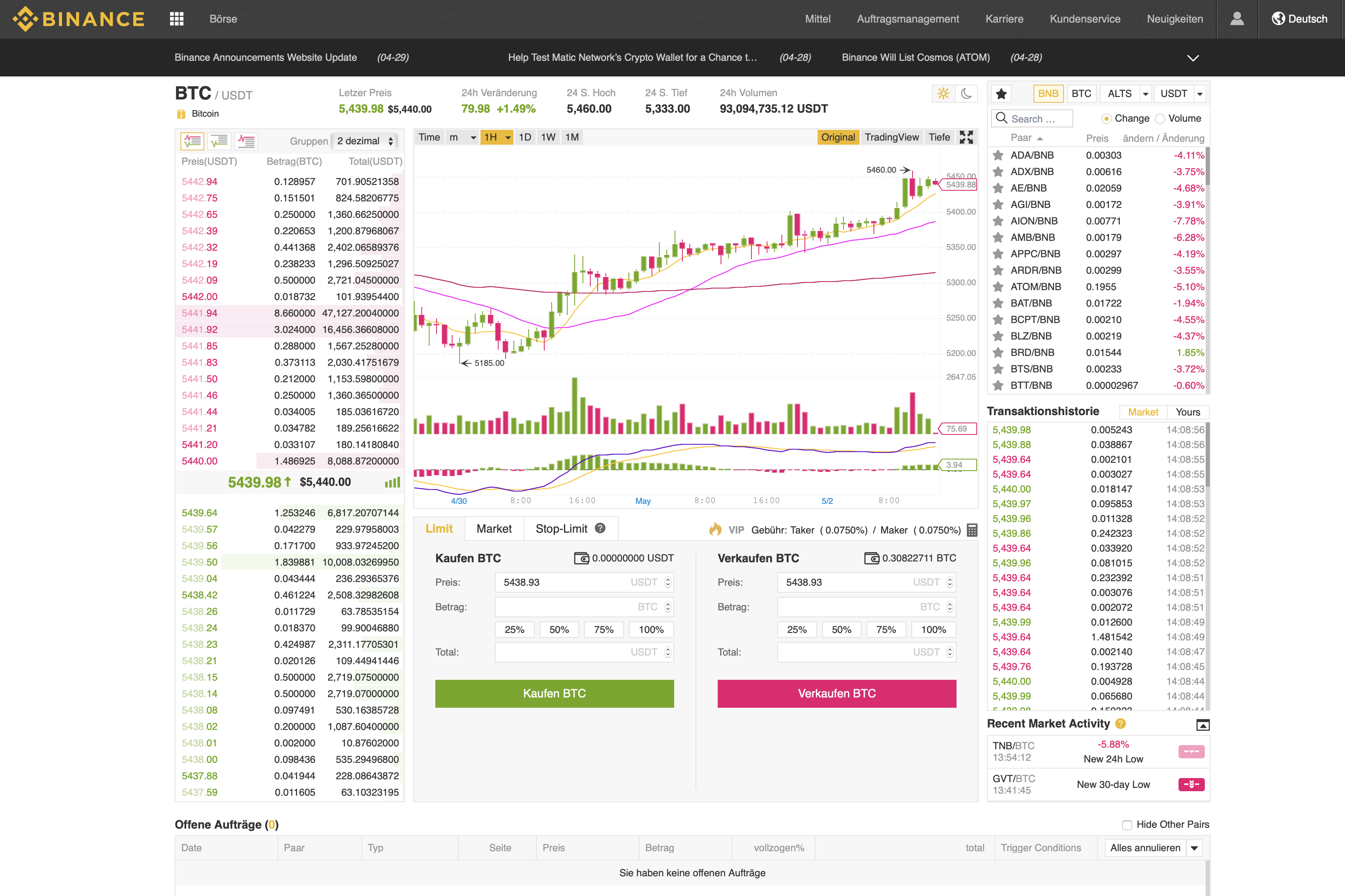

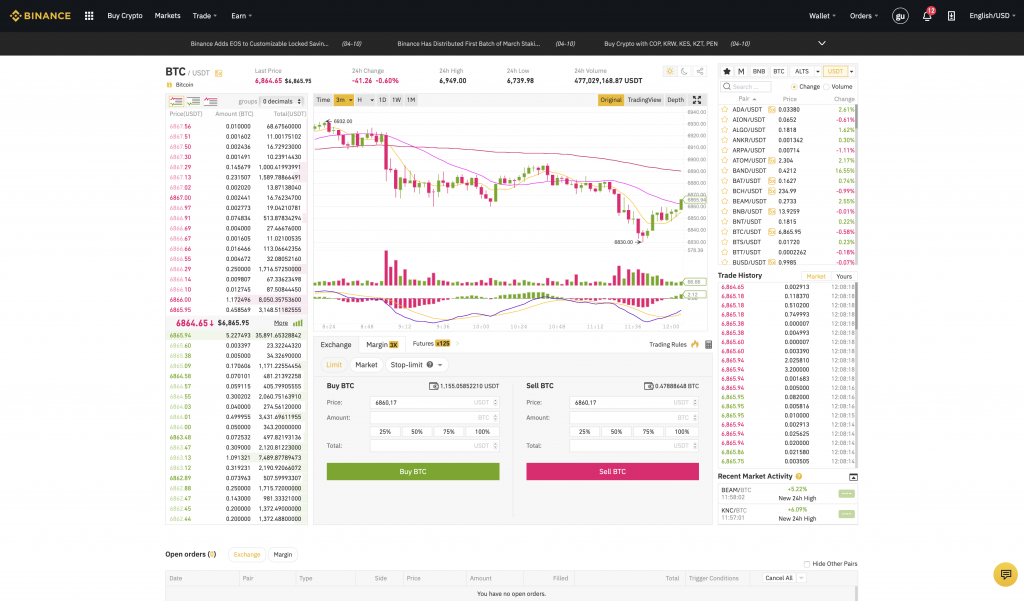

As soon as you have sent funds to Binance, you can start trading. All you have to do is click on Exchange in the menu above and you will be redirected to the appropriate page. Especially for beginners the following dashboard may look a bit confusing. Therefore we try to bring clarity into it.

Select trading pair: At the top right you have to choose which crypto currency you want to trade against which one. To do this, you have to select which pair you want to trade against. Basically, crypto currencies are traded at Binance only against BNB (Binance Coin), BTC (Bitcoin), different Altcoins (like Ethereum and XRP) and different Stablecoins (like USDT Tether, PAX etc.). You should note that not every crypto currency is traded against every crypto currency mentioned. However, almost all crypto currencies are traded against BNB and Bitcoin. Once you have chosen which crypto currency you wish to trade against, you must choose which crypto currency you wish to trade against. You can either click on one of the currencies in the list or enter its name (e.g. IOTA) in the search field. Once you have selected the desired trading pair, the chart in the middle of the screen will change and the selected trading pair will be displayed again in the top left corner (BTC/USDT in the picture above).

Chart: In the middle of the screen you will find the chart. On this chart you will see the current price of your trading pair. You can also set whether the candles should be displayed in different minutes, hours, days, weeks or monthly intervals. The default setting is always an hourly interval. Each candle represents one hour. If the candle is green, the price at the end of the hour was higher than at the beginning, if it is red, the price has fallen within this hour. At the bottom of the chart you can see the trading volume as bars, also on an hourly basis or in the form you have chosen to display the price trend. Below this you will find the MACD indicator for experienced investors. We will go into this in more detail elsewhere. This is a technical indicator from the chart analysis.

Order book: On the left side of the column you will find the order book. Here you can see all buy (green) and sell (red) orders. These were set by limit orders. The order book can be used as an indicator of the spread between the lowest sell price and the highest purchase price. In addition, you can see where there are particularly strong support (many buy orders) and resistance levels (many sell orders).

Difference Limit, Market or Stop-Limit Order

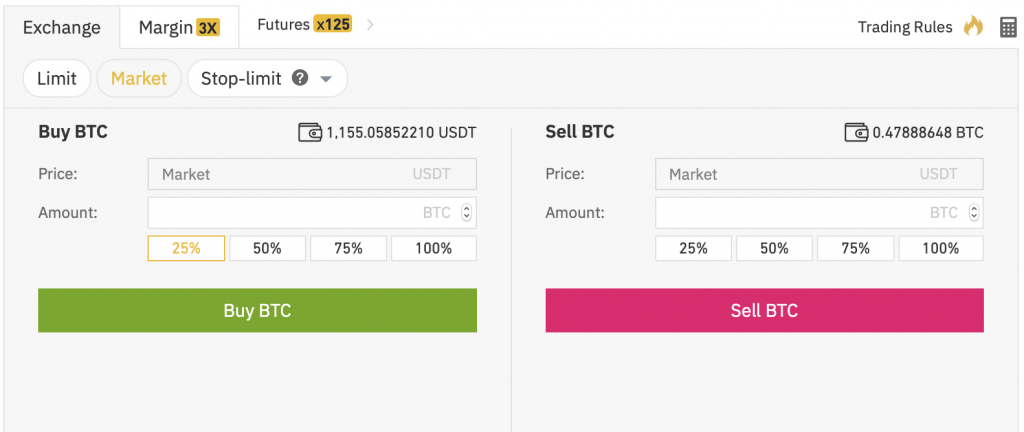

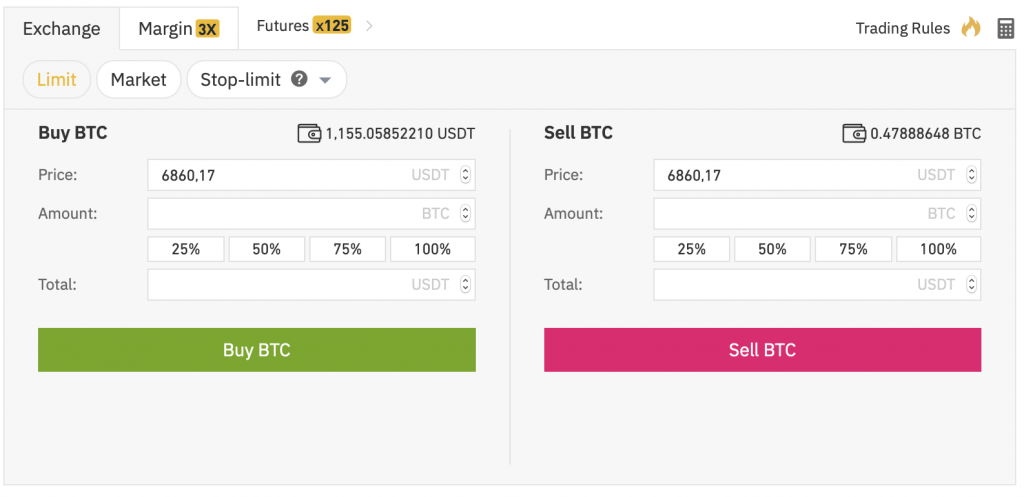

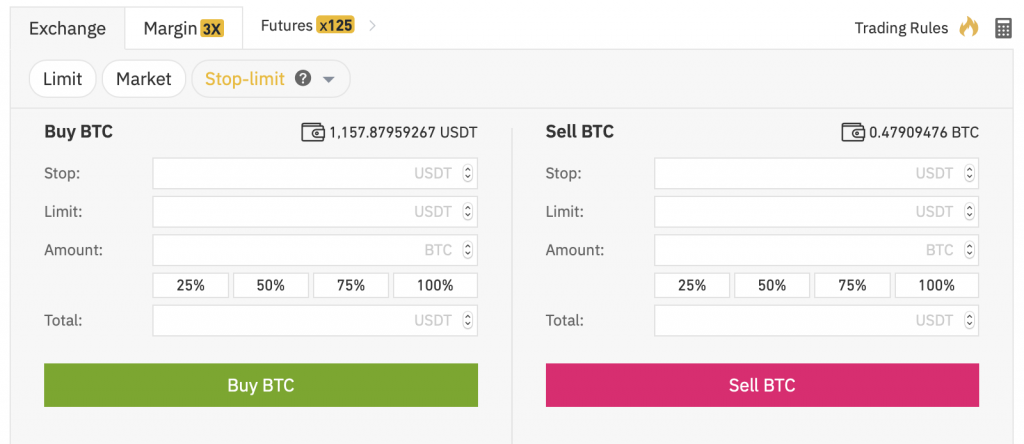

Below the price history you will find the mask in which you can enter your sell or buy order. It is important to know that there are 3 different types of orders (Market, Limit, Stop-Limit). You can select these using the tab at the top of the screen.

Market Order: This is the easiest to understand for beginners. You simply choose how much of the crypto currency you want to buy or sell (you can enter this manually or you can choose the percentages). Afterwards you just have to click the buy or sell button. Your order will then be executed immediately at the best possible price available on the market.

Limit Order: Here you not only choose how much you want to sell (or buy) of the respective crypto currency, but also at what price. This has the advantage that the order will only be executed when the price is available on the market. Experienced investors usually only use a limit order, as this prevents you from selling (or buying) the crypto currency too cheaply. This happens whenever the markets do not have enough liquidity, especially with smaller crypto currencies. Limit orders that cannot be executed immediately are written into the order book and appear below under “open orders”. How long it takes to execute the limit order depends on how the price develops. Theoretically it is possible that an order will never be executed, in which case you can cancel it at any time.

Stop-Limit Order: This is an order to sell or buy a certain coin when a certain price is reached. This can protect you from excessive losses or allow you to take profits when prices jump suddenly.

Binance App

Whoever wants to use the Binance crypto exchange does not necessarily have to do so via the website. Meanwhile you have the possibility to use Binance via the desktop app (available for Windows and Mac) or via the iOS or Android app. The advantage is that the apps are usually a bit more powerful than the website itself. Especially for those who trade a lot we recommend to use the apps even if they do not cover 100% of the website’s functions. But you can also use both at the same time.

Binance Fees

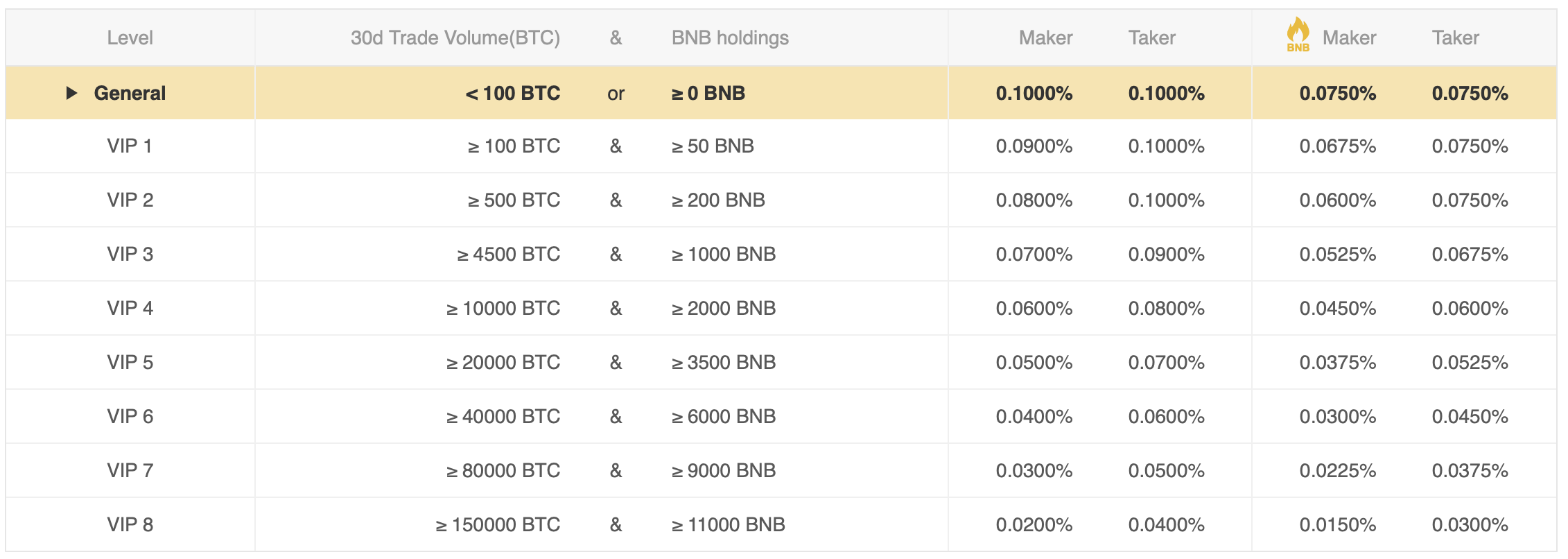

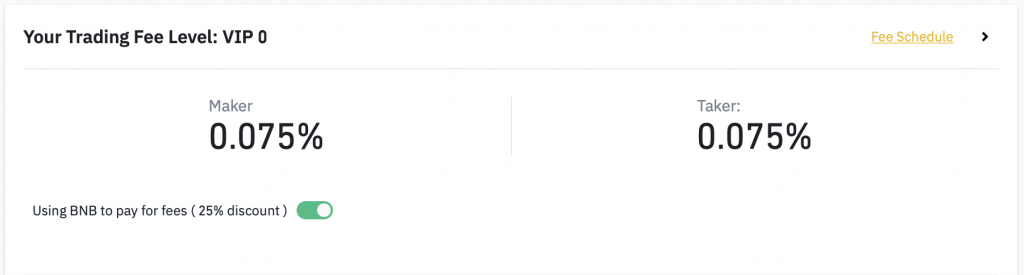

The fees at Binance depend on how much BNB you hold and how much credit you trade within a month (30 days). Since most people here will trade significantly less than 100 BTC per month, it is worth considering only this case.

Basically Binance distinguishes between the so-called Maker and Taker Fee. The difference between the two is that the taker fee applies to a market order that is executed immediately. The maker fee is applied to limit orders that are written to the order book and are therefore not executed immediately. The normal maker and taker fee for BInance is 0.1%. So if you trade crypto balances worth 1,000 Euros, you will pay a fee of 1 Euro.

Currently there is still the possibility to reduce the fees. For this you have to pay the trading fees in BNB. To do this, you have to select in the settings that you want to pay the transaction fees in NBB. This will save you 25% of the current trading fees.

What is Binance Coin (BNB)?

In order to finance Binance during its foundation, an Initial Coin Offering (ICO) was made. In this case, there were so-called 100 million BNB left over. The NBB’s portfolio will therefore be gradually reduced, which should have a positive effect on the value of BNB.

The Binance Coin can, for example, be used to pay the transaction fees on Binance. In addition, most crypto currencies on Binance are also traded against NBB. Anyone wishing to participate in an ICO on Binance Launchpad must also own BNB. Finally, Binance has found a number of other partners who accept BNBs, for example, it is now possible to pay for flights with BNB.

The performance of BNB has been very good so far. Therefore it has paid off for many investors to simply keep BNB.

Margin Trading

Recently, Binance has also introduced the possibility of margin trading. Basically, you have the possibility to borrow further credit and thus trade with a leverage. Assuming you have 1 BTC balance, you can borrow 2 more BTC and trade with them. You pay interest on the loan of the credits, which is due hourly. Over the year, the interest rate is currently just over 7%.

Since you can also lose a lot of money in margin trading if you are liquidated, it is only for experienced investors. To make margin trading with Binance you need to move the funds from your Exchange Wallet to the Margin Wallet, after which you can borrow more funds. I will explain how this works exactly in the following video.

Binance Futures

On Binance you now also have the opportunity to trade Future Contacts. This makes Binance a direct competitor for BitMEX. Unlike BitMEX, however, Binance relies on Tether and not on BTC. In other words, with a successful trade on BitMEX you can increase your BTC holdings. In contrast, on the Binance Futures platform you increase your USDT (Tether) position with a successful trade.

With Future Contracts you can not only go long on Bitcoin, i.e. bet on a rising price, but you can also shorten and earn money. Binance offers a maximum leverage of 1:125. You can therefore trade with 1,000 USDT (Tether) Bitcoin worth up to 125,000 USDT. Access to the futures platform is via your normal Binance account. If you use our referral code (blockbuilders) you will save 10% of the fees. The referral code is: blockbuilders

In the following video I will explain how the Binance Futures platform works exactly.

Binance Lending

Besides trading crypto currencies there are of course other ways to make money on the Binance platform. One of them is lending. This means that you lend your funds to other traders who can use them for margin trading. Since the lending is handled by Binance, you don’t have to worry about not getting your money back. It is therefore a safe way to earn interest on your funds. To understand how this works you need to know how margin trading works. Basically, in margin trading, a trader borrows funds. Assuming he has 1 Bitcoin, he can borrow 2 more. He pays hourly interest, which is very low. He borrows the Bitcoin from Binance but Binance also has to get the credit from somewhere. This is where lending comes into play, because you can make the credit available.

Binance offers two types of lending. You can either make Fixed Deposits or Flexible Deposits. As the name suggests, fixed deposits have a fixed term of 2 or 4 weeks, for example. This means that during this time you will not be able to access the borrowed funds. In addition, there are only a very limited number of Fixed Deposit options that are activated irregularly and are usually full within seconds. The advantage of this is that you will receive higher interest rates than with Flexible Deposits.

As you can already guess now, the Flexible Deposit balances are available for you to use at any time. Furthermore, there are more places for the Flexible Deposits. As already mentioned, the interest rates are much lower. As a comparison, recently you had the possibility to invest NBB. For the fixed deposits with a 28-day term, there was 10% interest per year and for the flexible deposits only 0.35% per year. But at least this is still more than just leaving the credit balances with Binance.

The risk with lending is actually only that you have to trust Binance, that the stock market will not be hacked and that all credit balances will be stolen. However, this is extremely unlikely, as 98% of the credit balances are stored offline anyway. Furthermore, especially with fixed deposits, you cannot get your funds back at any time. If you already have your credit balances with Binance, we recommend that you take a look at lending. You can find this item in the menu under “Earn” at the top of Binance.

Binance Staking

In addition to lending, there is also the opportunity to earn money by staking with Binance. Staking goes back to so-called proof-of-stake (PoS) coins such as TRON, Tezos or Algorand. There are validators in the network that can store coins and thus confirm transactions and generate new blocks. In the case of TRON, for example, the so-called Super Representatives can be selected by each TRON owner by staking. Binance itself actively participates in the staking process and uses the credit balances deposited with Binance for this purpose. 100% of the proceeds from this are for the benefit of Binance investors.

This means that if you have Tezos with Binance, for example, you automatically participate in the staking program and Binance will pay you the monthly proceeds. With Tezos, this is about 6% per year in XTZ. It is the same with other crypto currencies. It is important to know that you will receive the same amount of money from Binance as if you were staking yourself. Binance does not charge a fee for this. All you need to do is to have your staking-capable balance in Binance and you will automatically receive interest. A list of all crypto currencies that are staked at Binance can be found here.

How to make Money on Binance

Since there are now numerous ways to earn money on Binance, we have summarized the most important ones in a video and explain what you need to do.

Binance Launchpad

Another interesting way to earn money on Binance is with Binance Launchpad. This is Binance’s own IEO platform. As a reminder for IEOs, this is the successor of Initial Coin Offerings, i.e. ICOs. In principle, ICOs are held under the auspices of the crypto exchange, in this case Binance. This leads, among other things, to Coin Offerings being more regulated and fairer for investors.

At Binance Launchpad, an IEO takes place about once a month where investors can acquire new coins. The previous IEOs on Binance Launchpad have all been very promising for investors. As a rule, the IEO was able to offer investors between 2x-15x at each IEO with their investment, provided they sold immediately after the token listing.

A typical IEO listing is a presentation of the project to investors. Since the IEOs are all oversubscribed, there is a lottery to decide who can buy how many coins. Preference is given to investors holding the BNB. The maximum number of tickets is given to investors who own at least 500 BNB (Binance Coin) for the respective holding period. The lottery takes place after the end of the holding period. Whoever holds a ticket that has won will automatically receive the new coins. The money for the coins is automatically deducted from your Binance account. Approximately 1-2 days after the lottery, the new coins will be credited to your Binance account. From this moment on your new purchased coins are tradable.

In the past it has been shown that it is safest to sell the coins in the first hours after the listing. In the past, investors have always been able to make a profit with Binance Launchpad.

Should you store cryptocurrencies at Binance or in your own wallet?

Whoever buys crypto currencies will often ask himself the question how to store them. You can leave your coins with Binance, but some users prefer to manage their coins themselves.

As far as security at Binance is concerned, Binance has the so-called Secure Asset Fund. 10% of all trading fees go into this fund, which is intended to compensate for losses from hacker attacks. In May 2019, for example, there was a hacker attack on Binance and more than 7,000 Bitcoins were stolen, which were worth more than 40 million US dollars at the time. The stolen BTCs were eventually reimbursed to investors from this fund and no residents were harmed. In addition, Binance stored 98% of all balances offline in so-called cold wallets. This means that it is only ever possible for hackers to steal a small amount.

There are various ways to store the coins yourself. We would either recommend using the Trust Wallet on your smartphone. This is now being taken over by Binance and is a technological leader. The Trust Wallet is available for iOS and Android. However, it is even safer to use a hardware wallet. The market leader in hardware wallets is the French company Ledger with the Ledger Nano S. This currently costs 59 euros. Those who want a little more comfort can also buy the newer model, the Ledger Nano X, for 119 euros. You should definitely invest the money for a hardware wallet. The new Ledger models also support most crypto currencies.

Conclusion

Anyone who wants to trade more than just Bitcoins should definitely have an account with Binance. Not only is the exchange very secure (investors have never lost money due to a hacker attack and there is the Secure Asset Fund as a hedge), but it also has the largest trading volume worldwide. Especially if you want to trade smaller crypto-currencies it is important that there is always a seller or buyer for your coins. When it comes to security, Binance sets new standards. So far, there have been no anomalies at Binance or reports of stolen credit balances.

Exchange

Rating

Features

Link

Binance – FAQs

Binance DEX is the decentralized exchange/stock exchange of Binance. The word decentralized does not mean that the exchange is not controlled by anybody, but that you never have to leave your balances on the exchange to trade there. You can therefore trade directly from your Trust Wallet or your Hardware Wallet Ledger Nano S, without the risk of your assets falling victim to a hacker attack. This is intended to make the Binance DEX particularly secure.

You do not need to create an account with the Binance DEX, but simply connect your Trust Wallet or Ledger Nano S to the Exchange. So far only 3 crypto-currencies are traded on the exchange and those against Binance’s own Coin BNB. The trading volume is also still very low. For most investors the Binance DEX is therefore not yet a real alternative.

Binance Jersey is the Fiat Exchange of Binance. So you can buy and sell Bitcoin and Ethereum for Euro. The name Jersey comes from the fact that the exchange is based on the English island of Jersey.

If you want to trade at Binance Jersey, you have to create your own account on the platform, your normal Binance account will not work as a login. You will also need to verify your identity in order to deposit and withdraw funds from Binance Jersey.

The disadvantage of Binance Jersey is that only 2 crypto currencies (Bitcoin and Ethereum) are currently traded against Euro. If you want to trade other crypto currencies you have to buy Bitcoins or Ethereum from Binance Jersey and then transfer them to Binance.

So far, the price of Binance Coin (BNB) has developed very positively. As the stock market continues to grow and the BNB’s holdings are further reduced, there is no end in sight to the growth.

Theoretically, you can also leave your credit balances with Binance. The only important thing is that you have activated the 2 factor authentication. Basically, the stock exchanges are now quite secure. After all, they store more than 95% of their balances offline to protect them from hacker attacks. Binance also has its own insurance fund to build up credit reserves in case of a catastrophe.

You can of course also withdraw your assets and store them in your own wallet.

Yes Binance now also has an app for iOS and Android. More information about the app can be found here. By the way, you can also download the app for your computer (Windows and Mac).

Copyright © 2025 | WordPress Theme by MH Themes