In the fast growing division DeFi plays Curve Finance as decentralized crypto stock exchange an important role, approximately 1.5 billion US Dollar are converted there up-to-date put on. Curve Finance concentrates on Stablecoins. Why this is important for you is explained here.

DeFi in the crypto industry means, from the point of view of investors, basically the hunt for the best possible return. Chances of winning shift within minutes, depend on the tokens used and last but not least the DeFi protocol, which processes the deposits automatically. Curve Finance takes on two basic tasks: On the one hand, the platform is used for the inexpensive exchange of stablecoins such as tether (USDT) or USD coin (USDC) among each other. In addition, Curve Finance offers the possibility of making credit balances available for so-called liquidity pools, where they are lent on and thus earn interest. CRV in turn is the governance token for Curve Finance, which guarantees a democratic say in strategic issues and allows additional bonuses. In this respect, the price of CRV is also the measure of success for Curve Finance.

Curve Finance in practice

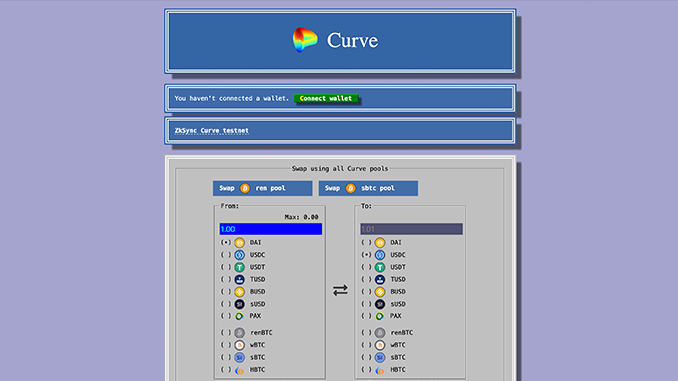

When you visit the Curve Finance website, you may be surprised by the retro design. It’s unusually pixelated, but don’t worry – all important functions are visible at a glance.

First of all, Curve Finance as an exchange office: Here, the platform actually does the same thing as Uniswap. It forms liquidity for barter transactions and can exchange Coins so directly against each other, which creates fees compared with centralized crypto stock exchanges. But while Uniswap focuses on Ethereum’s ecosystem with ERC-20 tokens, Curve Finance focuses on Stablecoins and Bitcoin images. In the fall of 2020, Curve Finance will support the DAI, USD Coin (USDC), Tether (USDT), True USD (TUSD), Binance USD (BUSD), sUSD and Paxos Standard (PAX) stablecoins – i.e. all major stablecoins based on US dollars. In addition, there are the Bitcoin depictions rentBTC, Wrapped Bitcoin (wBTC), sBTCn and Huobi BTC (HBTC), which underline the importance of BTC as a lead currency for the crypto industry.

Now Curve Finance for investors: The liquidity pools further down on the webpage show which stablecoins or BTC images are accepted for yield farming. These deposits are linked to Compound (COMP), iEarn.finance and other DeFi protocols and are automatically placed in the loan market. Whoever participates in these transactions almost always receives CRVs in addition to interest as a further incentive to provide liquidity. Forecasts for annual interest rates are available for both the liquidity pools and CRVs provide clues as to where it is particularly attractive to invest credit balances. Curve Finance’s exchange market, in turn, makes it easier to transfer into currently demanded coins at low fees.

Risks with Curve Finance

Curve Finance has been and continues to be audited for security issues by well-known companies such as Trail of Bits. Since its inception, Curve Finance has not been found to have any code gaps that would provide a gateway for hackers or fraudsters. But remember, Curve Finance’s one-time, one-time barter deals are largely unproblematic, and the platform is always in control. The situation is different with the Liquidity Pools for Field Farming, because of the link to other DeFi protocols. Here, even errors in foreign codes could affect all but Curve Finance. It is therefore recommended that only experienced investors use this function and also keep an eye on the foreign protocols such as Compound, Synthetix or iEarn.

CRV as the Governance Token reflects both profit opportunities and risks. If, for example, Curve Finance loses its leading role as DEX for stablecoins or if errors are found in the lending protocols, CRV will also predictably lose value. If Curve Finance continues on its successful course, CRV will also increase in value.

Conclusion: Curve Finance – the uniswap for stablecoins

Curve Finance is not to be excluded from DeFi in the Kryptobranche at present. With CRV as a governance token, it was early on compared to Uniswap, and with its focus on stablecoins, the project has occupied a market in demand. For you as an investor, Curve Finance is the first port of call when it comes to exchanging Stablecoins (and BTC images) with each other at low fees. Price and expected fees are displayed transparently, and the connection to your wallet is easy.

With a little more knowledge, participation in liquidity pools at Curve Finance is also attractive, but not without residual risks and with competition from other platforms. CRV as a governance token has the potential to evolve and not just as a speculative object. After all, the pace of innovation is high throughout the DeFi division, and Curve Finance is one of the major projects that understood and implemented this early on.

CRV is traded on Binance. Open a Binance Account here and save 10% on fees for a lifetime.

Leave a Reply