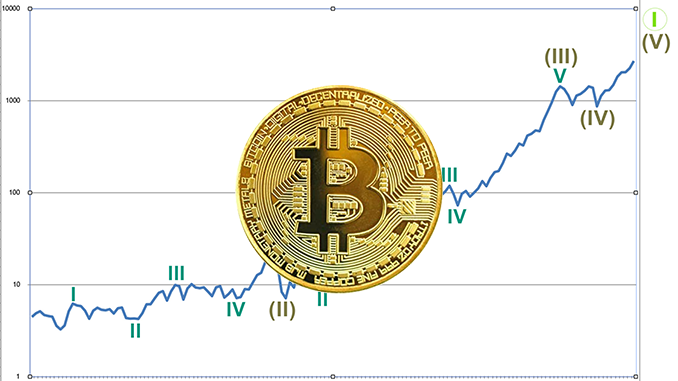

In discussions, the term Bitcoin Supercycle comes up more and more often. What this can mean for BTC and other cryptocurrencies as well as the financial sector, we explain here.

Translated, the Bitcoin Supercycle is called Supercycle, but the English version remains the most common. Economists speak of a supercycle when a market segment consistently develops positively over a longer period of time. Most recently, this was observed in the example of the shares of Facebook, Apple, Netflix and Google, in the U.S. are summarized under FANG. Since 2014, FANG has easily outperformed its competitors on the stock markets, and those who invested there were able to profit greatly from the FANG supercycle without any problems. The prerequisite, however, was to get in as early as possible. Now a supercycle is emerging around Bitcoin, which will also include some altcoins, experts believe. We would like to provide you with arguments for a Bitcoin supercycle as food for thought:

- BTC has arrived on Wall Street as a store of value and the crypto industry in general is driven by Decentralized Finances (DeFi). DeFi may prove to be a gamechanger for the financial world, building on altcoins such as Ethereum (ETH), Binance Coin (BNB), and Solana (SOL).

- As the FANG Supercycle gained momentum, many institutional investors asked, “All well and good that Facebook and Google have lots of users. But how do you make a profit from that?” Venture capital, on the other hand, used to recognize that user numbers would form the basis for successful business models. So institutional investors definitely don’t want to be late in grasping the next supercycle again.

- Communication channels have changed fundamentally in the last decade. Facebook is demonstrating how newspapers are being displaced. Today, anyone can publish online and find platforms that monetize this through advertising or subscriptions, for example. New monopolies are forming on the Internet that guarantee audience and attention. For Bitcoin and DeFi, the situation is almost paradisiacal, because users simply stay online from information to transaction in this supercycle.

- DeFi is mostly still criminally underestimated by the traditional financial world. But fintech shooting stars like Robinhood or eToro are already proving that the younger generations in particular no longer even want banks for their investment strategies. From there to decentralized platforms is only a small step and brings the plus point of being even more detached from outdated centralized ideas. Decentralized crypto exchanges like Uniswap (UNI) or PancekeSwap (CAKE) are leading the trend.

- The Bitcoin Supercycle starts as a micro, like FANG once did. Then, when mass adoption sets in and macro may be spoken of, exponential growth is unstoppable. DeFi escapes regulation anyway and Bitcoin has gained respectability despite all prophecies of doom when legal environment for BTC was created.

Dangers in Bitcoin Supercycle

Supercycle entails that developments go “super” in all respects. Those who also think of “super losses” and “super volatility” recognize risks in Bitcoin Supercycle. And looking back at the FANG Supercycle: investments in Yahoo instead of Google, studiVZ instead of Facebook and Microsoft instead of Apple, for example, would not have paid off comparably. Keeping your nerve in the Bitcoin Supercycle and identifying tomorrow’s winners early on is a challenging task. Increasing trading in crypto derivatives and the growing number of market participants complicate the analysis of the Bitcoin Supercycle. Moreover, expertise is increasing, which will feed doubts about some crypto projects.

Conclusion: bitcoin supercycle – sensible theory or risky fantasy?

Distrust in government monetary policies due to inflation is a driving element that attracts institutional and private investors towards Bitcoin. From the crypto lead currency BTC as a bridge, the rapid growth in the DeFi and NFTs divisions would have to prove sustainable for the definition as a supercycle to take hold. This is because Bitcoin on its own does not fulfill the condition for a supercycle, which precisely covers an entire market segment. Thus, it perhaps makes more sense to discuss a crypto Supercycle. The FANG Supercycle demonstrates a fundamental problem with theoretical considerations: A Supercycle proves itself only in hindsight.

The implication for you as an investor is: Take your time to do your own research and invest your strategies for the medium and long term. This will optimize your chances of being on the winning side of a Bitcoin supercycle. If you doubt the mass adoption of crypto and DeFi, the theory of the Bitcoin Supercycle will not make you happy.

Best place to buy Bitcoin:

Leave a Reply