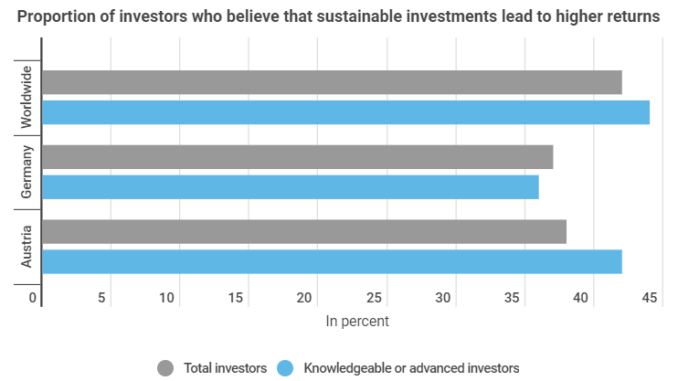

44% of informed or expert investors agree that sustainable investments lead to higher returns. A new infographic from Block-Builders.de shows that investors in America and Asia particularly are turning to sustainable investments. While Germany and Europe seem to be lagging behind, here too there is a budding trend toward social and green investments.

While 44% of financial experts worldwide believe that green investments offer the best returns, in Germany the figure is only 36%. This was revealed by data from the “Global Investor Study 2020”. A similar pattern emerges in terms of investors’ actual investment behaviour.

44% of European participants in equity markets are invested in sustainable funds. In Asia the figure is 49%, while in North and South America it is as high as 52%.

As the infographics show, well over half of financial experts (59.2%) see a greater market potential for sustainable forms of investment. In addition, the risks associated with sustainable investments are rated significantly lower than those of conventional investments.

Sustainable Investment In Vogue

The change is especially striking when looking at a broader period. As recently as 2007, 37% of financial experts were unwilling to include sustainable ESG investments in their portfolios. Today just 4.1% are opposed to this type of investment.

Private investors are increasingly keen to invest in assets that reflect their own ethical views. A large generational divide is however becoming apparent. Among investors over the age of 71, just 16% would be willing to invest in assets inconsistent with their beliefs. In the 18-37 age group, on the other hand, one in four would be prepared to forego personal convictions to invest in assets offering higher returns.

Sustainable Equities

Meanwhile, the study shows that ‘sustainable stocks’ are at a 12-month peak of interest on Google. The Google Trend Score, which indicates the relative search volume, stands at the highest possible value of one hundred.

The trend is also reflected on the trading floor. The crisis has driven a rise in sustainable investments in the form of funds and shares, which have been among the biggest winners of the day. The Global Clean Energy ETF has risen by 68.8% over the last 12 months, while the MSCI World Socially Responsible ETF also gained 4.9% in value – all in a period in which the DAX lost around 6.8%.

Leave a Reply