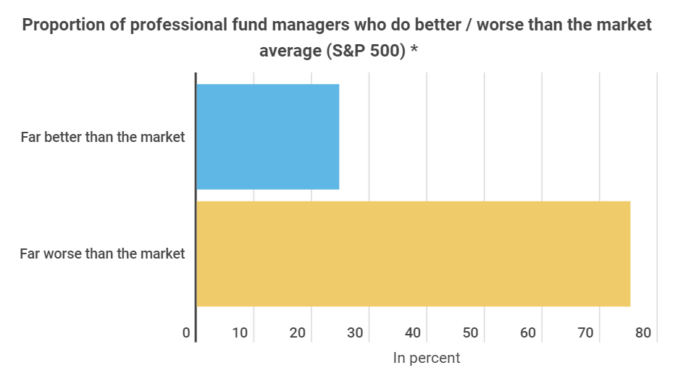

75.27% of professional fund managers have failed to generate better than average market returns (S&P 500) over the past 5 years. This is revealed in a new infographic from Block-Builders.de. The chart also sheds light on other interesting facts on stock market success and timing.

Fund managers have also failed to outperform the S&P 500 over a shorter period of time. According to “spglobal”, only 39.67% of professional investors outperformed the index over the last 365 days.

Meanwhile, the infographic illustrates that despite all the volatility, investments in indices such as the DAX have paid off handsomely in the long term. With a 10-year investment period, average annual returns amount to 9.2%, according to the “Deutsches Aktieninstitut” (German Equities Institute).

Timing the Market

Investors are often confronted with the question of whether they should invest all their capital in the stock market in one go, or instead invest steadily in instalments. An analysis of data covering the period from 1926 to the end of May 2020 shows that in 73% of the past 1,133 months, investing the full amount currently available in one go would have led to a higher return.

Savings plans are nonetheless very popular in Germany. As of last December there were 2.03 million active savings plans (shares/ETFs) in the Federal Republic, compared to only 0.25 million 5 years ago, placing the total number of shareholders and equity fund investors at an historic high.

Leave a Reply