In Germany, some banks are already charging negative interest rates for private customers as well; in Great Britain, the central bank is considering such a monetary policy. What does it mean for Bitcoin and Co. when credit balances in euros or pounds at the bank are subject to penalty interest?

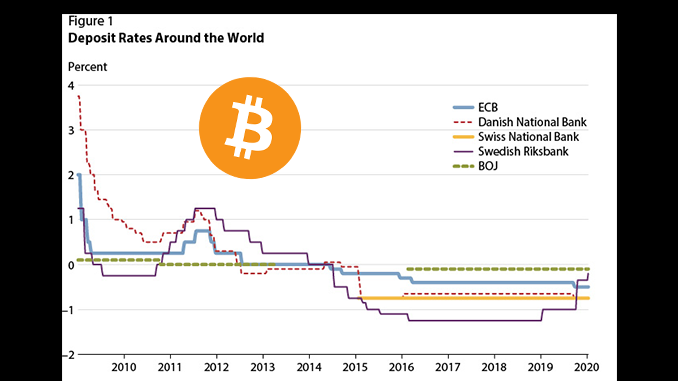

Are investments in Bitcoin (BTC) and Altcoins such as Ethereum (ETH) the best answer to the trend toward negative interest rates in the classic financial markets? The euro crisis of 2009 led to negative interest rates from the European Central Bank (ECB). With the current corona crisis, it is becoming increasingly clear that commercial banks are also starting to charge a penalty interest rate for deposits in euros. Because if they park euros safely at the ECB, they have to pay negative interest and now occasionally pass this on to customers. Even in economically insecure times, however, it is difficult to understand why no interest should be charged for private credit balances, but instead the storage at a bank even costs money. With Bitcoin and other Kryptowährungen the storage is however in principle free.

Great Britain – negative interests prepare themselves

Analysts are referring to Great Britain these days on the subject of negative interest rates. In its monthly report, the central bank there has called on private banks to prepare for negative interest rates. The overall situation, which is characterized by corona and brexite, might not allow any other step. In the euro zone, too, there are as yet no signs of moving away from zero or negative interest rates.

But those who have assets to manage do not only have to consider the loss of positive interest rates but also inflation. Then simply leaving Fiat inactive becomes even less attractive. In theory, negative interest rates should encourage consumers to use their money and thus provide an economic stimulus. However, current studies rather show a preference for saving.

Bitcoin as inflation protection

In this unusual situation in the financial markets, the advantages of Bitcoin are once again very clear. By the fixed maximum number of 21 million BTC and Bitcoin Halving as inflation brake the nut/mother of all Kryptowährungen is not directly concerned by it, which decides the monetary policy. Large corporations in the USA, led by MicroStrategy, are already shifting money reserves into Bitcoin. They cite inflation protection as the first reason and the chance to increase value as a further argument for BTC.

Experts believe it is quite possible that if negative interest rates persist, not only in Great Britain, citizens will increasingly look for alternatives to saving in Fiat. Bitcoin as world-wide spread crypto currency does not only occur to experts as “digital gold”. Optimists of the Kryptoszene hope for new capital with BTC, which should let the prices rise.

Result: negative interest an argument per Bitcoin

An investment in Bitcoin or leading Altcoins is probably more risky than the strategy of sitting out negative interest rates on major currencies such as the Euro or British Pound. But realistically speaking, Fiat is as weak as it seldom is and confidence in monetary policy is suffering; not only alarmists speak of the threat of inflation. The risk of investing in BTC also reflects the good chances of price gains. If you are interested, you will find a whole series of articles on Bitcoin and easy-to-understand instructions on how best to organize your start with Bitcoin.

Best place to buy Bitcoin:

Leave a Reply