With Celsius, BlockFi and Voyager Digital, at least three crypto credit services have recently run into severe liquidity problems. Competitor Nexo is going on the offensive to show that they are managing differently.

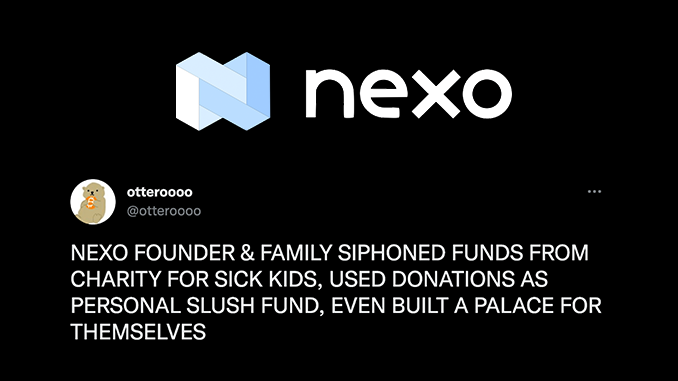

Withdrawals at Celsius have been at a standstill for over two weeks, and at BlockFi only an emergency credit line from FTX has been able to maintain operations – these are just two examples of crypto platforms that have apparently gambled themselves away in the credit services division and are having existential difficulties maintaining liquidity. Billions of US dollars of customer funds are also affected. Competitor Nexo has also been publicly ticked off, particularly harshly by Twitter account otteroooo.

With 87 percent probability, Nexo will slip into payment difficulties by the end of the year, otteroooo claims in one thread, also providing alleged evidence. In a second thread, otteroooo goes even further and accuses Nexo co-founder Kosta Kantchev of misusing funds collected from a charity organization to build a private swank villa. These accusations quickly made their way around the crypto scene and Nexo has to fear the withdrawal of customer funds.

Therefore, Nexo now feels obliged to take action against defamation and uses various channels for this purpose. A cease-and-desist letter has been sent to otteroooo, but apparently without success so far. In a long blog post Nexo tries to show in parallel that otteroooo deliberately spreads FUD. otteroooo spreads its rumors in order to attract more Twitter followers and thus sell its account for a state sum. In doing so, otteroooo is not even afraid to deliberately confuse Nexo co-founder Kosta Kantchev with the Bulgarian Constantine Krastev. It is the latter who is associated with the charity money scandal. In general, Nexo argues that otteroooo is following a classic tactic for fake news, bringing the crypto industry into disrepute.

To refute the accusation of hidden liquidity problems, Nexo first refers to the testate generated daily by the TrustExplorer service. This certificate currently confirms that more than 100 percent of the 4 billion U.S. dollars stored at Nexo are covered by reserves. In order to remove the last doubts, Nexo also turned to the crypto portal Decrypt and presented journalists there with further internal materials. They are supposed to prove that Nexo, for example, does not have to fear the decoupling of Lido Staked Ethereum (stETH) from Ethereum (ETH) because there would be sufficient collateral.

Bottom line: is Nexo really a reputable crypto interest provider?

From an investor’s perspective, the most important point in the discussion about Nexo is whether funds invested there for interest are really safe. In its defense of Nexo, Decrypt is fair enough to mention that Nexo is one of the investors at the media platform. In addition, the background to TrustExplorer’s audit is critically questioned and the difference between an audit and an audit is pointed out. This also gives us a rather positive picture of Nexo. In the story about Kosta Kantchev and allegedly diverted donations, the presented evidence for a targeted mix-up is strong. And Decrypt, which has had a deeper look into Nexo’s books, is unlikely to risk its established credibility to clear a single investor against its better judgment. Nexo advertises that while it offers slightly lower interest rates than competitors like Celsius or BlockFi, it only makes over-collateralized loans and thus never risks customer funds. Based on the information currently available, this statement seems justified and it would be wrong to automatically conclude from the deep crises at BlockFi and Celsius that the situation at Nexo is comparable.

Leave a Reply