CZ at TOKEN2049: Europe Lacks a Global Crypto Reserve Strategy

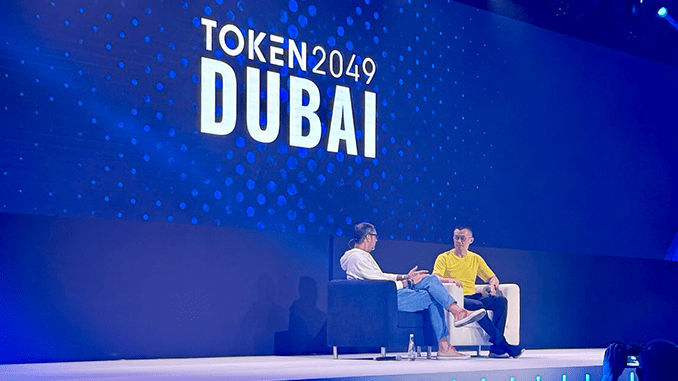

Binance founder and CEO Changpeng Zhao (CZ) used his appearance at the TOKEN2049 conference for an overview of the crypto industry, where he noted, among other things, the lack of a European strategy for potential global crypto reserves.

The Vision: Crypto as a Global Reserve System

Two hot topics currently occupy the crypto industry: the increasing assertiveness of regulators and the debate over possible global crypto reserves. If one listens to the keynote speech of Changpeng Zhao (CZ) at the TOKEN2049 in Singapore, it becomes clear that these topics are interconnected. TOKEN2049 is one of the prestigious international events that bring together important players and thinkers from the crypto scene.

In Singapore, CZ advocates the vision of using crypto as part of a global reserve system. The goal is to reduce dependency on the US dollar (USD) and US financial institutions. CZ sees Bitcoin and stablecoins for this purpose as a suitable means, and believes that well-capitalized cryptos could make state-controlled central bank digital currencies (CBDCs) redundant.

Europe Falls Behind in Crypto Strategy

However, something is completely missing from CZ’s vision: Europe. Neither the European Union nor European countries in general have their own clear strategy on how to integrate crypto as a reserve system into their financial structures. In contrast, countries like Hong Kong and Singapore, as well as developing regions such as South America and Africa, seem actively engaged with the opportunities offered by crypto.

Canada, the United Arab Emirates, and the UK, according to CZ, are the Western countries that are currently leading the way in terms of understanding and supporting the idea of crypto. To achieve global consent in the medium term on how crypto can be embedded into economic systems, CZ advocates greater cooperation between states, and not just through regulators, but also with the private sector.

Europe Still Hesitant on Crypto Regulations

Europe could become a pioneer in global crypto regulation by implementing MiCA, the so-called Markets in Crypto-Assets Regulation. But it will likely be another year before MiCA becomes effective and put into practice by those involved – until then, it is often difficult to define what exactly distinguishes good and bad from regulatory perspectives. For larger innovations and projects like CZ’s vision of a coordinated global reserve strategy, it is hoped that the framework conditions will provide more legal certainty for companies.

And as the events surrounding PayPal and other leading international payment processors are showing, the major tech companies in Europe are, at best, paying lip service to cryptocurrencies. PayPal has launched its own crypto service in the US and UK but considers Europe a secondary market. This is another reason why the crypto industry has its eye on other regions: they not only keep up with the discourse but have the uprising challenge of sometimes less powerful economies to evolve and increase financial inclusivity.

Conclusion

CZ at TOKEN2049 found telling words for European ears. It seems Europe is missing a great opportunity by hesitating too long to consider the possibilities of cryptocurrencies as a reserve system. Countries such as France and Germany, as leaders within the EU, must step up to the plate. Only through a coordinated effort will Europe be able to play a leading role in the global evolution of cryptocurrencies.

Leave a Reply