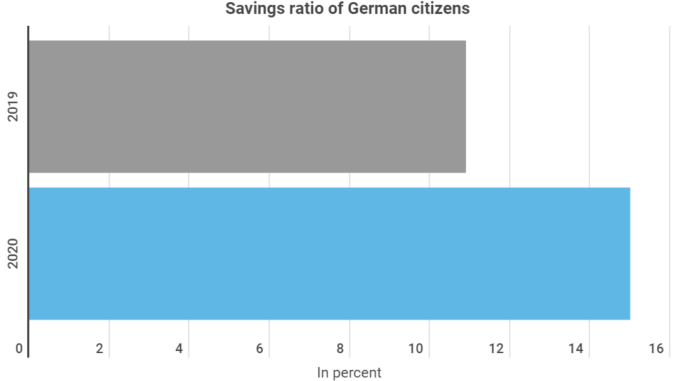

Private household savings in Germany have risen from 10.9% to 15% within the last year. Despite this, Germans are comparatively less wealthy by international standards. This is shown in a new infographic from Block-Builders.net.

The last time the rate of savings was as high as it is today was in the 1990s. The rate reflects the proportion of total income set aside. “The massive surge in saving is a phenomenon particularly related to corona”, as observed by the board of the Federal Association of German ‘Volksbanken und Raiffeisenbanken’ Cooperative Banks.

The infographic illustrates that a total of 62% of Germans regularly set part of their disposable income to one side.

There is also a change underway in the form such saving is taking. According to an “Aktion pro Aktie” survey, the proportion of share owners in Germany has risen by 6 percentage points since 2019.

Investing in Stocks – Germans Increasingly Focussed on Diversification

In addition, German citizens are increasingly turning to listed companies with headquarters outside of Germany. Today, 38% of the stocks held in German portfolios are foreign shares. Back in 2013, this figure was just 25%. By way of comparison, in France 85% of shares held by citizens are those of French companies.

According to data from the “Global Wealth Report 2020”, average per capita wealth of Germans held in financial assets amounts to €57,079. As shown in the infographic, the Federal Republic of Germany is by no means leading the way in this respect – quite the contrary. Average per capita assets are highest in the USA and Switzerland, translating into €209,524 and €195,388 respectively.

Americans still own almost half of all financial assets, or 43.6%. In contrast, the share held by Western Europeans amounts to 20.7%.

Leave a Reply