The IOTA Foundation could run into financial trouble in 2023. Current data shows a shrinking of the reserves. In the summer, the IOTA Foundation had already initiated a course of austerity.

In the summer of 2020, news first circulated that the IOTA Foundation was on thin ice financially. Although spokespersons repeatedly denied such model calculations, questions about the financial future security of the IOTA Foundation were not answered transparently. Now this summer, the IOTA Foundation has had to announce mass layoffs and a strict austerity program. But current discussions suggest that the financial situation is drifting into critical regions anyway.

Twitter user ThatsNotMyCode monitors wallets of the IOTA Foundation and he has noticed that large sums of IOTA are always released for sale at the beginning of the week. He sees this practice as counterproductive for the price curve of IOTA and speaks of “dumping” by the foundation. According to blockchain data, the main IOTA Foundation wallet he listed now holds only 13.65 Ti of IOTA, which would be worth about $2.8 million at current prices. Prior to the mid-year restructuring, the IOTA Foundation needed about $1.3 million per month to cover ongoing costs.

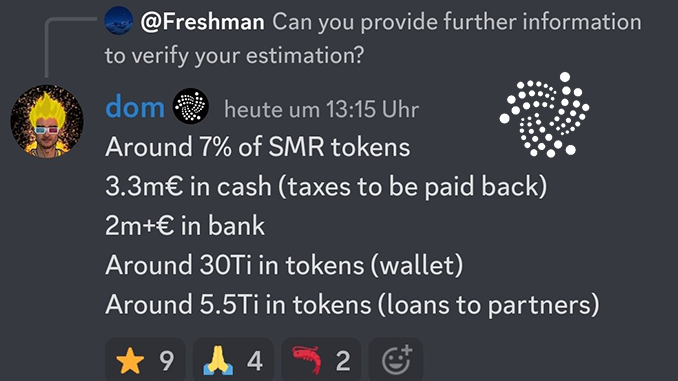

Vrom.Iota is also contributing via Twitter to get an idea of the reserves. He dug up a word post from the head of the IOTA Foundation, Dominik Schiener. In it, Schiener puts the reserves in IOTA at 30 Ti after all, well double the amount on the wallet in question. In addition, according to Schiener, there are about 2 million euros in fiat reserves at the bank and outstanding tax refunds of 3.3 million euros. On the plus side, Schiener is also booking 7 percent of all Shimmer (SMR), the side project of IOTA brought to crypto exchanges in the fall. And Schiener also counts about 5 Ti IOTA, which the foundation has extended as loans to cooperation partners, as a plus.

The problem: Even if one follows Schiener’s calculation without criticism, the IOTA Foundation could find itself in financial straits that threaten its existence in 2023. That’s because the reserves in Shimmer hit an illiquid market for SMR, where even minor sell-offs would cause the price curve to plummet. The balances in IOTA may be easier to monetize, but IOTA’s price curve is diving at around $0.20, and a quick recovery of the overall market is hardly in sight. All told, this leaves the IOTA Foundation with less than $10 million in liquid assets, which could likely be eaten up in as little as a year given ongoing costs.

Conclusion: Is IOTA Foundation facing bankruptcy? Transparency to the financial situation is demanded

Lack of transparency reports on the finances of the IOTA Foundation are a constant topic in the community, suspicion of insider trading made headlines as recently as September. ThatsNotMyCode notes that current sell-offs show overlaps with addresses that were already viewed critically at the time. From the point of view of investors, this can only lead to pressuring the IOTA Foundation to communicate openly about its financial situation. After all, significant goals in the development work, such as a decentralized IOTA 2.0 (“Coordicide”), have still not been achieved, and a foundation that has been bled dry financially could capitulate here.

Leave a Reply