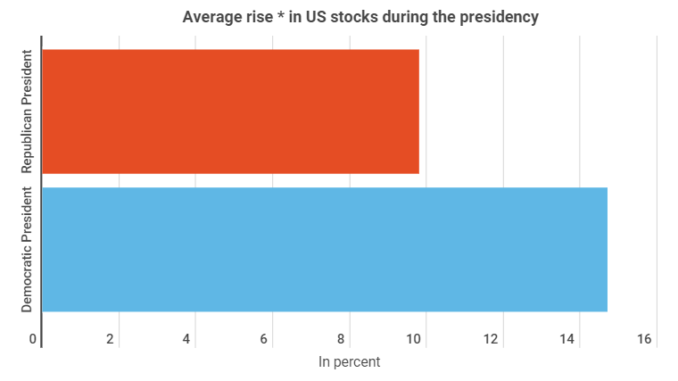

U.S. stocks climb by an average of 14.7% per year under Democratic presidencies, compared to just 9.8% with Republican presidents. This is shown in a new infographic from Block-Builders.de. Joe Biden’s election win may well have a positive effect on the stock market in numerous ways.

The above-mentioned annual growth is based on data since 1932 and reveals that these price rises are by no means linear. By far the biggest gains in the S&P 500 were under the leadership of Roosevelt and Truman – both Democrats – with share prices rising by 348% over their presidencies.

As the infographics show, the S&P 500 rose by 167% under Barack Obama, compared to a 51% rise during the Donald Trump presidency. It should however be noted that Obama was President for two terms.

Record Week for Shares

We may already be seeing the new impetus that Joe Biden is generating on the trading floor. According to a report in the Handelsblatt, the Nasdaq rose by up to 9% in the week following the US election – the best election week for stocks since 1932.

Analysts and journalists frequently point to four industries and sectors that stand to benefit in particular from a Joe Biden presidency: Technology, Health, Green Energy and Cannabis. All of these industries at least rallied from November 3 to 11, as can be seen from the development of indices and ETFs. For example, the Global Clean Energy ETF rose by 8%, while the Rize Medical Cannabis ETF increased in value by 5.3%.

Chinese Stocks

Chinese shares and their shareholders could also profit from Joe Biden’s election as US president. Some market observers believe that the trade war between the US and China could ease under Biden. This is at least suggested by the mandate from his voters. 70% of voters with a republican orientation have a negative opinion of China, while the figure is 59% among democratic voters, according to data from “JPMorgan”.

Leave a Reply