The year of crisis that has been 2020 has fundamentally changed shareholder structures, as can be seen in a new infographic from Block-Builders.de. While the number of securities accounts being opened is reaching new highs, it is mainly young adults who are discovering this form of investment and gaining influence as a result.

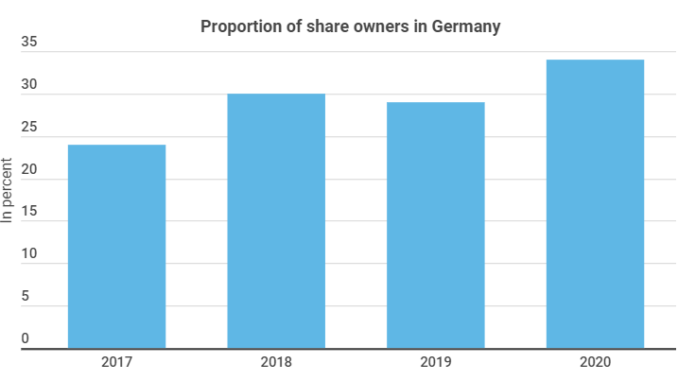

Data from the “Aktion pro Aktie” survey indicate that 34% of Germans now hold shares. This was just 24% as recently as 2017. The increase is strongest among 18-24 year-olds, where the shareholder ratio climbed from 24% to 39% over the period.

Although the shareholder structure is becoming more heterogeneous, it is still predominantly men who are opting for shares as an investment. The median share owner is male, around 40 years old, has a university degree and earns around €4,000 after tax each month.

Young Shareholders With Increasing Influence

In Germany as well as in the United States of America, more and more young people are choosing to invest in shares. They often use neobrokers, with the provider Robinhood in particular enjoying great popularity. A look at the number of users underlines this rapid growth. There are currently 13 million people already using the online broker. Just 4 years ago the number of users was still one million. The fintech company’s turnover increased correspondingly from $9.3 to $180 million US. In Germany, however, it is Trade Republic, among others, that is on the rise.

However, other service providers operating in Germany are also experiencing impressive growth. A banker from ING reported that “never before have so many new securities account customers been acquired in such a short time”.

The current run on securities shows some curious traits, as can be seen in the infographics. For example, the price of Codak shares rose by more than 1,000% within a few days because “Robinhood investors” rushed into the security en masse. Similar episodes also occurred in the case of car rental company Hertz – which had at the time already filed for bankruptcy – again showing the influence of groupthink on the part of small investors.

Leave a Reply