Competing for users and future opportunities are Solana (SOL), Polkadot (DOT), Cardano (ADA), Fantom (FTM) and Telos (TLOS). We compare three technological characteristics – with surprise winners.

The crypto scene likes to discuss in detail which altcoins might have chances to become a superstar in the fast-growing Decentralized Finances (DeFi) space. Often mentioned are Solana (SOL), Cardano (ADA) and Polkadot (DOT), which have established themselves in and near the top 10 most capitalized cryptocurrencies. From the broader field of followers, the names Fantom (FTM) and Telos (TLOS) often drop. Here, we compare which of the five altcoins really has what it takes to make a splash in the future based on three crucial technological indicators. Many thanks to CodeX for the data.

Indicator number one is the transactions per second (TPS) that a network can process and thus map capacities. The second key figure is block time, which indicates how long it takes for a new block to be written to the blockchain. This is where speed can be read. The third indicator in our comparison is supported programming languages, which in turn have an impact on how fast and how flexible the ecosystems of Solana, Polkadot, Cardano, Fantom and Telos are. Here we go:

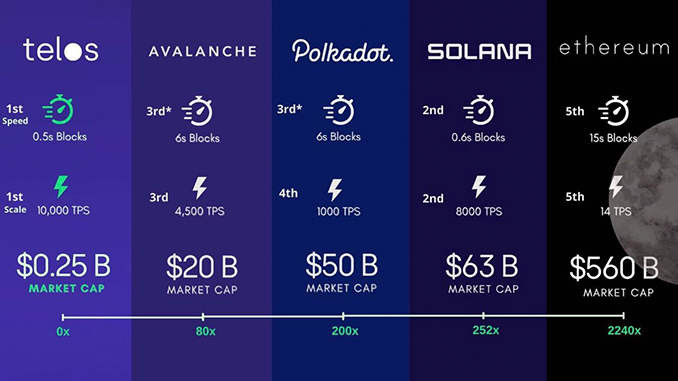

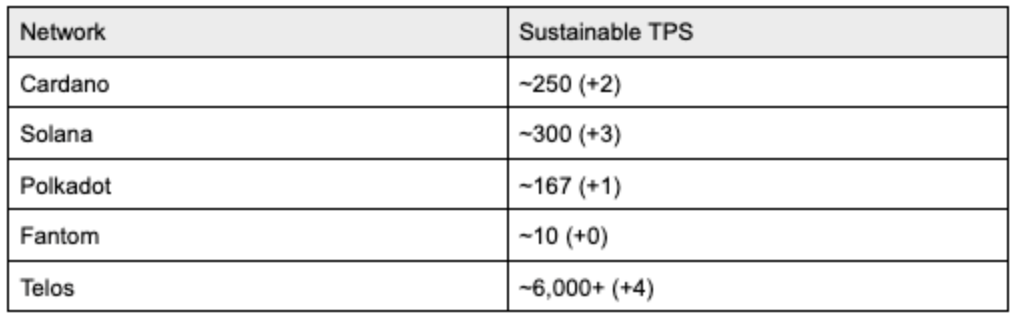

1. Transactions per second (TPS): Solana (SOL) advertises at least 50,000 TPS, but repeated network outages due to congestion cast doubt on the numbers. Data services such as Solana Beach show that 300 TPS is a realistic value for Solana. For Cardano, 257 TPS is measured as the maximum value. According to Polkascan’s data, around 166 TPS is everyday for Polkadot, and significantly higher values have only been achieved in tests so far. Fantom claims capacities for 10,000 TPS, but so far achieves more like 10 TPS in practice. Telos has achieved up to 10,000 TPS in tests, but just under 1,000 TPS have been proven under real-life conditions.

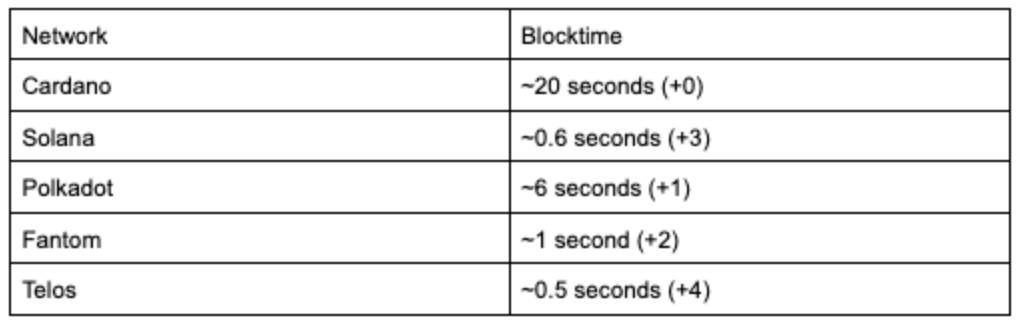

2. Block time: There are often significant differences between the theoretical values and those measured by data services for this indicator as well. We refer to real verifiable times and see: Cardano has 20 seconds between new blocks, while Polkadot has around 6 seconds. Really fast are Fantom with blocktime of 1 second, Solana with 0.6 seconds as well as Telos with 0.5 seconds.

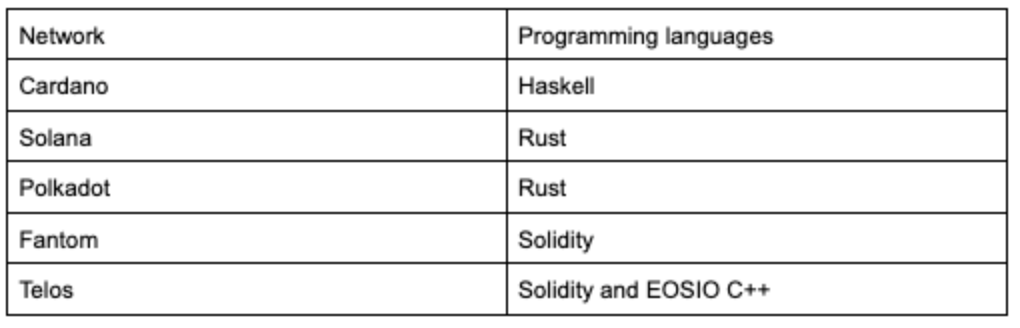

3. Programming languages: Solana and Polkadot alone support Rust directly as a programming language. Cardano has settled on Haskell and Fantom on Solidity. Telos has directly integrated C++ in addition to Solidity. C++ has been used since the 1980s and plays an important role away from the crypto industry. Therefore, there are probably by far the most programmers and developers for C++ in this competition, but they do not necessarily focus on smart contracts and DApps. Solidity is the most important programming language here for the crypto industry because it is also the standard for Ethereum (ETH). Rust is gaining followers, Haskell is considered more of a niche product. Tested with standard computational tasks, C++ is by far the programming language that produces the fastest results. Rust follows in second place, Solidity and Haskell are close together in a shared third place.

Result of technological comparison SOL, DOT, ADA, FTM and TLOS

If points were awarded for the stage winner in each of the three disciplines, Telos (TLOS) would be the surprise winner. Telos can score points in all characteristic values and leaves its competitors behind. Solana and Polkadot perform at least averagely on all three indicators. Cardano’s slow block time is a big minus point, and Fantom’s Achilles’ heel is its few transactions per second. It remains to be considered: Depending on the application, the three indicators examined are of different importance and our comparison refers to the situation in January 2022. Updates and external further developments can change the characteristic values in the future.

Conclusion: Technological practice text for DeFi Coins shows clear differences

It is striking that there are basically gaps between self-representation and actual measurable performance for all DeFi Coins examined here. Especially in the case of Solana (SOL), questions are allowed as to whether the rapid expansion of the ecosystem does not lead to a tendency to constantly overload the network.

In the case of Cardano, the very limited possibilities for smart contracts have been known since the Alonzo upgrade. Polkadot, on the other hand, is currently losing momentum for various reasons.

Fantom, on the other hand, is currently growing at an above-average rate and FTM could soon make the leap into the top 20 most capitalized cryptocurrencies. Telos is far from that, behind TLOS gathers just $150 million in market capitalization, which means around 300th place in the crypto rankings. If Telos succeeds in making its technological strengths better known, the TLOS price curve could also benefit significantly.

You can buy Telos at Bitfinex and KuCoin. All other cryptocurrencies can be bought at Binance and FTX.

Leave a Reply