At Terra (LUNA), a proposal was approved in a vote to try a post-crash revival of the ecosystem. This will involve abandoning the stablecoin UST that started the disaster.

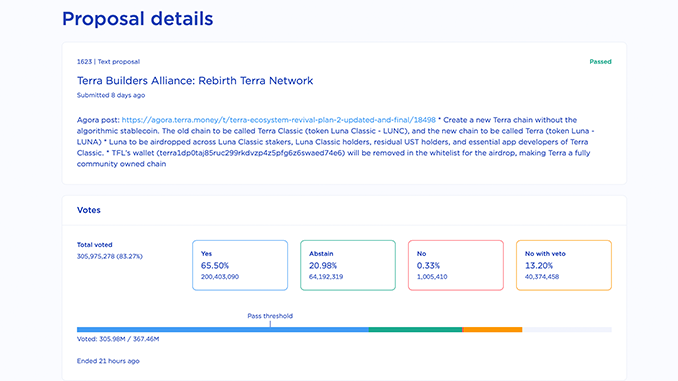

The voting community at Terra (LUNA) has decided: 65.5 percent voted to initiate a “rebirth” of the ecosystem. Terra founder Do Kwon had put forward this proposal a week ago. The stablecoin UST (TerraUSD), which is algorithmically linked to LUNA, had lost its 1:1 peg to the U.S. dollar in the second week of May, triggering a disastrous chain reaction. Therefore, the new Terra deliberately does without UST. From a technological point of view, the new start will be implemented by a hard fork scheduled for Friday.

Whether afterwards the previous Terra with UST still finds enough supporters to maintain its network is open. LUNA has fallen in value to fractions of a cent and UST is listed at just under 10 cents. In total, at least $40 billion in capital has been sunk in a few days in the crash, the shockwaves of which have rippled throughout the crypto market.

Does the new Terra have a realistic chance?

According to the resolution document, a snapshot will be taken on Friday before the launch of the new Terra 2.0. A second snapshot taken on May 7 will provide evidence of the situation before the downward spiral. These two snapshots are the basis for how LUNA 2.0 is distributed via airdrop. 35 percent will go to those who held LUNA before the crash and 10 percent will go to anyone who still has LUNA now. Those who had created UST before the crash via the DeFi Protocol Anchor will be in the pool that is entitled to 10 percent of all new LUNA. Another 10 percent is distributed among those who still hold UST. The remaining 30 percent of all new LUNA goes into a “community pool” from which incentives for developers in particular are to be created.

The distribution scheme places an emphasis on favoring LUNA and UST wallets with smaller balances and giving proportionately less to so-called whales with large balances. A second rationale is that the new LUNA will only enter the open market in manageable tranches from the start, and the majority of allocations will be tied to holding periods, or will only happen over the next two years. The approach seems sensible to avoid flooding the open market with the new LUNA.

Several dozen developer teams that previously operated under LUNA have expressed support for the relaunch attempt and now want to anchor their projects in the new Terra ecosystem. Thus, the new LUNA will be able to feature various DApps right from the start and may also refer to a proven blockchain. But whether this will be enough to attract fresh capital to the heavily burdened Terra brand name is the existential question. It can probably only be answered when major crypto exchanges list the new LUNA, thus creating a free market.

Conclusion: LUNA tries comeback – experiment of the extra class

Critics in the discussion on LUNA 2.0 may also see the plan as an attempt to cover up the background of the billion-dollar crash. Do Kwon denies such accusations via his Twitter account and instead invokes again and again that Terra was much more than just UST. However, there are signs of a legal review of the incidents in Korea and the US anyway. In the meantime, investors and the crypto industry will be eagerly waiting to see whether Terra will actually succeed in rising from the ashes like a phoenix or end up as a lame pipe burst.

Leave a Reply