This March, more Google users worldwide searched for the term “inflation” than at any time in the last 5 years. Interest in bitcoin and gold is also on the rise, as shown in a new infographic from Block-Builders.net.

Google searches for the search term pairs “inflation bitcoin” and “inflation gold” also hit new highs. Both of these assets are considered safeguards against declining purchasing power, not least due to the limited supply of the commodities.

As the infographic shows, prices have been rising sharply recently. For example, soybeans cost 61% more today than they did a year ago. On top of that, certain services have also become more expensive. Take hairdressers for example: some salons raised their prices by up to 31.3% after reopening at the start of March. While this example is neither representative nor a reliable measure of inflation, such changes have the potential to fuel fears of rising prices.

Inflation in View

In Germany, the inflation rate was 1.3% in February. In January it was still at 1%, while in December it was minus 0.3%, according to data from the Federal Statistical Office. However, according to a number of market experts, the rate of inflation could approach 2 to 3% in the not too distant future.

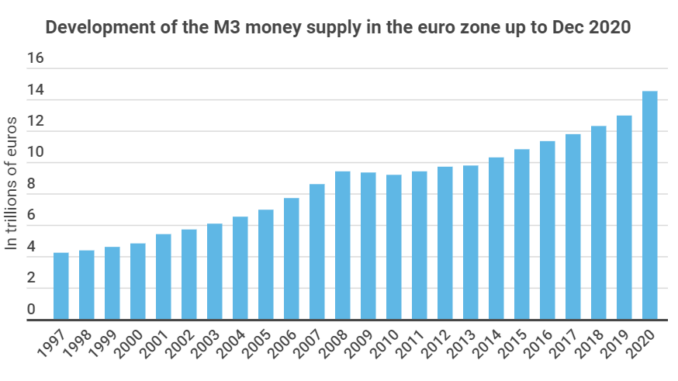

Central banks have injected large quantities of money into circulation in response to the pandemic – a likely driver of inflationary scenarios, argue some market observers. As you can see in the infographic, the eurozone’s M3 money supply stood at €14.5 trillion in December, up from just €13 trillion a year earlier. The total money supply has increased by 245% since 1997.

Leave a Reply