DeFi is in the crypto scene the topic of the hour, here investors smell large profit chances. Yearn.finance has developed into one of the leading DeFi platforms and the associated token YFI benefits from it. So how does Yearn.finance work in practice?

A good one billion US dollars in crypto-currencies counts Yearn.finance as tied up capital these days and thus proves impressively that this platform plays a major role in the DeFi sector. Parallel to this, YFI, as the Governance Token of Yearn.finance, has experienced a rapid price development and is actively traded on the major crypto exchanges. Yearn.finance (YFI) is committed to making DeFi (Decentralized Finances) as easily accessible as possible for investors. The tidy homepage shows six different points, which we will explain to you here:

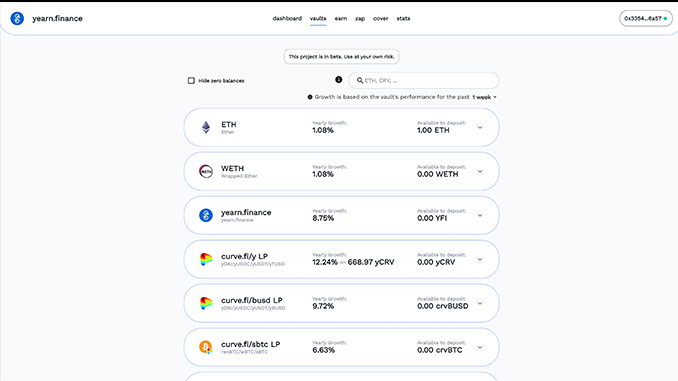

1. Dashboard: Here Yearn.finance shows you clearly how your investments are developing.

2. Vaults: This is the heart of Yearn.finance. Here you can store balances in different crypto currencies like Chainlink (LINK) or Ethereum (ETH). The protocol of Yearn.finance uses this liquidity to generate the highest possible return through automated strategies. For this purpose, not only yield farming (https://block-builders.de/was-ist-yield-farming/) is operated, but capital is also invested for example for the staking of new tokens, which in turn are sold profitably. Depending on the amount of your investments with Vaults you will receive your profit share, which will be distributed in the inserted crypto currency.

3. Earn: Is the strategy that yearn.finance started with. Stablecoins like Tether (USDT), DAI or USD Coin (USDC) are accepted as deposits and invested in lending projects like Compound (COMP) or Aave (LEND). Yearn.finance constantly considers where the highest interest rates can be achieved and how the addition of substantial liquidity can affect the market. Compared to Vaults at Yearn.finance the risk is lower, but the chances of winning are also lower.

4. Zap: This is where Yearn.finance connects to the Curve platform, enabling you to exchange crypto currencies or shares in Vaults without high fees.

5. Cover: Is the insurance section of Yearn.finance, where you can insure investments or provide capital for insurance against interest.

6. Stats: Here you can get a quick overview of how the Vaults and other programs of yearn.finance are developing and what amounts are deposited as liquidity. So you will find clues about which offers might be of interest for you.

What role does YFI play in yearn.finance?

YFI is designed as Yearn.finance’s governance token and allows you to participate in the platform’s course. 30.000 YFI were originally generated and it is not planned to increase the absolute number. The team around YFI inventor Andre Cronje has not reserved any YFI for itself and there was no pre-sale of YFI. These details have increased confidence. Those who hold YFI as a governance token and participate in voting are rewarded with a dividend. At the same time, YFI is also traded speculatively. Basically, YFI is your chance to participate in Yearn.finance’s success.

Risks with Yearn.finance

The protocols in DeFi are based on Smart Contracts. If errors creep in, it may not be possible to correct them. This is a major risk when investing in Yearn.finance. A second risk is associated with the complex investment strategies of the Vaults in Yearn.finance, which can also slide into the red in case of market turbulence.

The price YFI reflects the developments at Yearn.finance. Should technological flaws in the platform become apparent, YFI is also likely to come under pressure. Another risk for YFI is that liquidity will migrate from yearn.finance to other DeFi protocols that promise higher returns.

Conclusion: Yearn.finance and YFI as your entry into DeFi?

Yearn.finance and YFI scores against competitors such as Uniswap (UNI) or SushiSwap (SUSHI) with a wider range of DeFi instruments. Second advantage of yearn.finance is that winnings are paid out in the deposited crypto currency. With YFI as a positively developing governance token and dividend payer, yearn.finance has a further flagship. The complete package makes it really easy for you to decide which field you want to enter into with yearn.finance (YFI).

You can buy YFI at Binance. Open a Binance Account here and save 10% on fees for a lifetime.

Leave a Reply