Paul Tudor Jones predicts a successful future for Bitcoin (BTC). The US-American has achieved fame as a hedge fund manager through his prediction of the “Black Monday” of 1987. Bitcoin convinces him as a protection against inflation and through clever minds in the community.

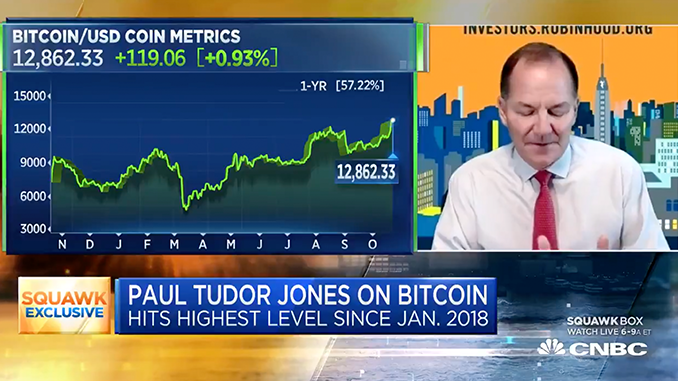

Bitcoin (BTC) finds another prominent supporter in Paul Tudor Jones. In the USA Jones is a legend because he predicted the collapse of the stock markets (“Black Monday”) in 1987 and made at least 100 million US dollars profit. Now Jones said in an interview with the television station CNBC that he was investing in Bitcoin. He had come to the decision because the monetary policy of the US Federal Reserve made inflation probable. Compared to other stores of value such as gold, BTC seems to him to be the best option to protect himself against inflation. Bitcoin is currently still in the first phase of its development and has great potential.

In this respect Bitcoin resembles investment opportunities such as Apple or Google from the investor’s point of view. Those who recognized the growth prospects there early on made huge profits. With the tech pioneers, it was individuals like Steve Jobs in whose ideas and implementations one invested. According to Jones, a large community of “very, very smart and demanding people” has gathered around Bitcoin. The “intellectual capital” of Bitcoin convinced him. He does not want to act as a “flag bearer” for BTC. But between the lines Jones gives a clear recommendation to buy Bitcoin.

Public support for Bitcoin grows

BTC is currently quoted at around USD 13,000, its highest level in the last 12 months. It is noticeable that more and more companies and managers in the USA are committed to Bitcoin, which previously had little contact with the crypto industry. Jones also dates his rethinking to this year. Most recently, for example, the NASDAQ company MicroStrategy has shifted its money reserves from US dollars to BTC, citing inflation protection and the prospect of value growth as reasons. Observers note that Bitcoin is increasingly becoming mainstream in the public debate. The announcement by PayPal to expand its services to include Bitcoin also demonstrates this development.

Conclusion: Positive prospects for BTC are accumulating

Jones does not give price forecasts, but argues basically per Bitcoin. Thus it is in pleasant company of those, which do not look at daily course fluctuations, but look on a long-term basis on BTC. While the uneasiness over possible consequences of the casual monetary policy in Corona times grows, the concept of Bitcoin blossoms as independent crypto currency. The calculation for you as an investor is quite simple: if fresh capital flows towards BTC and demand grows, the price will rise. The comparison with the innovative enterprises of the IT industry makes courage. Early investors are now well provided for.

Best place to buy Bitcoin:

Leave a Reply