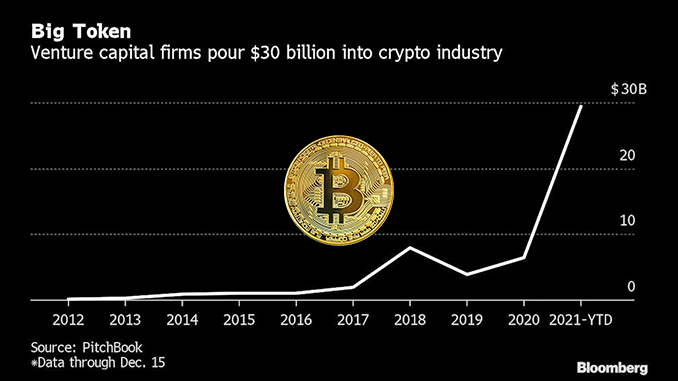

Around $30 billion in venture capital was injected into crypto industry projects in 2021, more than in the previous ten years combined. Investors don’t want to miss out on future opportunities.

“Investors finance anything and everything,” the financial news agency Bloomberg sums up the situation in the crypto industry at the end of 2021, citing stakeholders. About $30 billion has been injected into the industry as venture capital this year, according to the report. After the initial boom for bitcoin (BTC) in 2017/18, that figure was about $8 billion, and this year’s cash flow exceeds all the base investments combined made in the 2010s. “We’re further along than just digital gold now,” a spokesperson for investment firm Blockchain Capital LLC, for example, said, explaining the development.

Investors now recognize topics from DeFi to NFTs and blockchain games to Web 3.0 and Metaverse as future opportunities. Startups in the crypto industry are benefiting from this. Among the largest deals in the last twelve months was almost USD 1 billion for the crypto exchange FTX in preparation for a possible IPO. Companies and projects such as Dapper Labs (CryptoKitties and NBA Top Shots) and Axie Infinity (AXS) also received riches in funding rounds of $350 million and $150 million, respectively. Even the dubious celebrity platform BitClout was able to raise fresh capital.

However, according to the market report presented by Bloomberg, two FinTech companies, Robinhood and Revolution, secured lion’s shares of total investments in 2021, where cryptocurrency trading is only part of the offering to customers. Nevertheless, the trend is clear: There is more venture capital available than ever before for projects that are at least partially linked to the crypto industry. If one takes into account how broadly the investments are spread, it is easy to see that capital providers such as Coinbase Ventures or Polychain Capital prefer to bet on several horses rather than commit to one branch of the crypto industry in a dynamic environment.

Conclusion: will growth in the crypto industry continue in 2022?

In the crypto scene, we speak of FOMO (Fear of missing out) when an atmosphere arises where investors fear missing out on opportunities. The massive flows of money and unequivocal comments point to FOMO , but that doesn’t have to mean anything negative. Rather, from an observer’s perspective, 2021 actually marks a year in which the crypto industry demonstrates diversity and moves away from a “Bitcoin only” image. In the outlook for 2022, a trend reversal is hardly to be expected – because there are many fields in which blockchain solutions show their strengths.

Best place to buy Bitcoin:

Leave a Reply