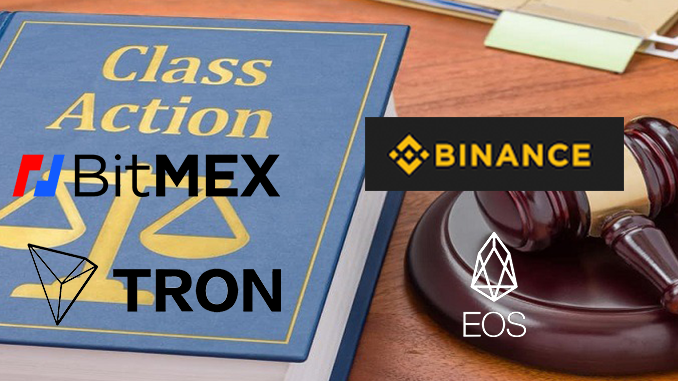

Binance, TRON, EOS, BitMEX and other leading companies from the crypto industry have to fear considerable legal problems in the USA. One law firm has filed class action lawsuits to claim damages for the unauthorized sale of security tokens.

The US media, alluding to the television series Game of Thrones, are already writing about “Red Wedding”, referring to a bloody massacre for the crypto industry. The law firm Roche Cyrulnik Freedman has filed 11 class actions against well-known names in the crypto industry. At the heart of these cases is always the question of whether companies such as Binance, Block.one and BitMEX have misinformed investors and sold them security tokens without the necessary approval from the US Securities and Exchange Commission. If the plaintiffs are proved right, damages amounting to millions of euros are threatened. The law firm has already made a name for itself in the cryptoscene by achieving legal success in the case of Craig Wright, for example.

Background on crypto class actions in the USA

US law stipulates that securities may only be offered if the Securities and Exchange Commission (SEC), as the exchange supervisory authority, has given the green light. The SEC applies the so-called Howey Test to examine individual cases. In the past, this test has already caused Altcoin to stumble in retrospect, because severe penalties and damages were imposed.

We will summarize by way of example how some of the class action lawsuits that have now been filed argue:

- In the case of Binance, the plaintiffs consider it proven in their lawsuit that the crypto exchange offered at least 12 Altcoins without the necessary approval, including EOS, Bancor Token (BNT) and Status Token (SNT). Binance CEO Changpeng Zhao (“CZ”.) Binance and CZ have so far remained silent on the allegations.

- In the case of TRON (TRX), the complaint focuses on the TRON Foundation and mastermind Justin Sun. They had launched TRX on the market and claimed against their better knowledge that TRX is not a security token, even the otherwise talkative Justin Sun has not yet commented on the allegations.

- With the lawsuit against Block.one, the situation is a bit more complicated. Block.one is the company behind EOS and has already reached a settlement with the SEC in October 2019. The plaintiffs see this as a clear indication that the ICO of EOS was not legal and investors are therefore entitled to damages. Block.one comments that it is well prepared for a court case.

- Another popular player from the crypto sector is the BitMEX crypto exchange, which is now facing a class action. One of them is the sale of Altcoins like EOS and SNT. In addition there are accusations of price manipulation at Bitcoin (BTC). According to the plaintiffs, BitMEX has bet against its own customers with customer money. More than 800 million US dollars were not paid into an insurance fund as promised, but used for speculative transactions.

Is the crypto industry threatened with an earthquake as a result of US class actions?

The price of Bitcoin (BTC), the undisputed leading currency among the crypto currencies, was unimpressed by the news of the class action lawsuits and has since risen moderately by about 4 percent. At EOS, which appears in many of the lawsuits, the latest trend is also positive. Observers and market participants therefore do not expect the new class actions to shake the crypto industry in its foundations for the time being.

To hold for you as an investor however remains: Questions about the classification of crypto currencies as security tokens can endanger your investment considerably. The Crypto Rating Council is a reputable contact point for your risk management. In the past, the majority of US courts and the SEC have taken the side of the investment protectors and, in case of doubt, decided against the issuers of Altcoins and crypto exchanges. If the scenario repeats itself, many large companies in the crypto sector are likely to face difficult times.

Leave a Reply