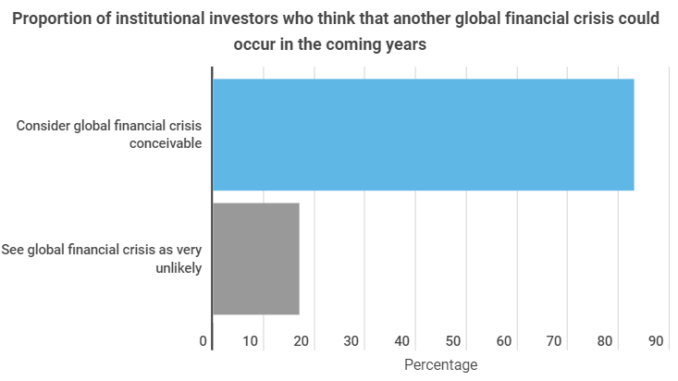

83% of institutional investors see a real possibility of a global financial crisis. In turn, 60% expect the next severe crisis to occur within the next 1 to 3 years. This is shown in a new infographic from Block-Builders.de.

Just recently, Block-Builders.de reported on the optimistic outlook of private investors for the stock market in the year ahead. Some fund managers also appear to share this view. Nevertheless, according to data from a survey conducted by “dpn”, scepticism now prevails.

As the infographic shows, around 80% of major investors are of the opinion that the markets have not yet sufficiently priced in the long-term risks posed by the Corona crisis. More than half see the wisdom in keeping portfolios defensively oriented. There is a broad consensus among institutional investors that Asian securities have great growth potential, regardless of the risks.

The reason for this focus on Asia is, among other things, the fact that countries such as China have got a better grip on the pandemic and their economies are now correspondingly growing much faster.

Liquidity Bottlenecks due to Corona Crisis

Meanwhile, the deep scars left by the pandemic on entrepreneurs’ coffers are becoming more and more apparent. The situation is at its most acute in the hospitality sector, where 19% of business owners say they have just four weeks of liquidity left. This was demonstrated by an “IAB” survey from the beginning of December. As soon as the obligation to file for insolvency comes into full force again on 1 January, such filings could surge. Across all sectors, 11% of entrepreneurs say they only have reserves for about 4 weeks.

Risky Savings Behaviour

The savings rate of German citizens has risen rapidly in the face of the pandemic. In the Eurozone, the ratio has increased by a whopping 100%. It is above all citizens’ urge to save that could increase the likelihood of a crash, as the infographic shows. This trend, if continued, threatens to jeopardise any economic recovery.

For the moment, the only way for the stock market is up. It remains to be seen whether this trajectory is about to make a U-turn.

Leave a Reply