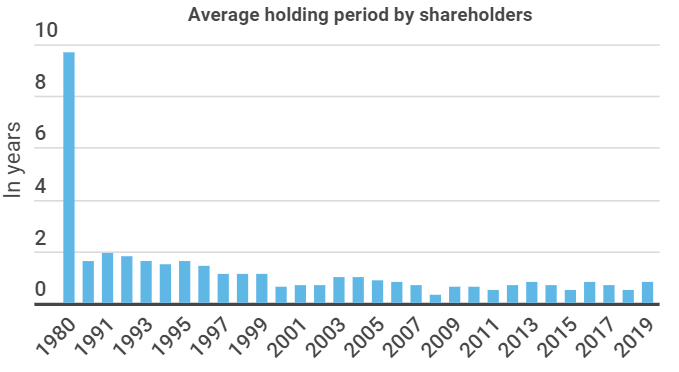

Investors are now holding on to their shares for an average of 0.8 years before selling them. In 1980, the average was 9.7 years, representing a decline of 91.75%. This emerges from a new infographic from Block-Builders.de.

At the same time global stock trading volumes are rising sharply, according to data from the “World Federation of Exchanges”. Last year, the total volume traded was $119.9 trillion US, while 40 years ago it was just $0.3 trillion. Trading on the stock exchange floor has not only become faster paced, but also takes place on an exponentially greater scale.

As the infographics show, the corona crisis has had a considerable impact on stock market turnover. This March, for example, around €31.8 billion in XTFs were traded within the Deutsche Börse Group. In the same month of last year, this figure was around €10.8 billion. Significantly higher volumes were traded throughout the other months of this crisis year as well.

Shares Experience a Boom

Meanwhile, data from search engine operator Google show that shares are becoming increasingly popular. The search volume for the term pair “buy shares” has never been higher than in 2020, with the Google trend score, an indicator of relative search volume, reaching a peak of 100.

Of all individual stocks, Biontech was the most searched for last month. The company develops Covid-19 vaccines, among other things. Wirecard took second place in the ranking, followed by NelASA, Amazon and Tesla.

Overall, we are seeing a marked change in investor behavior. The expansion of neo-brokers such as Trade Republic, which offers commission-free stock trading, could accelerate this trend even further.

Leave a Reply