Financial issues continue to cause turmoil at the IOTA Foundation. First, reserves in IOTA are being turned into cash at a rapid pace. Secondly, transactions are being observed that arouse suspicion of insider trading.

The financial situation of the IOTA Foundation seems tense: Already earlier this week, we reported that reserves may be exhausted as early as 2023. In the IOTA community, skeptics are shifting to checking the situation themselves because of the lack of transparent financial reports from the foundation. And so, once again, there are references to transactions that are out of line and can be linked to the IOTA Foundation.

Twitter user ThatsNotMyCode meticulously counts the amounts of IOTA the foundation brings from its reserves to crypto exchanges to turn them into money. According to the data, it continues to sell around 800 gi of IOTA each day, worth around 160,000 euros, and the blockchain data also reveals that there are only 12 ti left on the foundation’s main wallet, which translates to around 2.4 million euros at current rates. If the foundation maintains its pace of IOTA sales, this account would be drained by early 2023 at the latest.

In his data analysis, ThatsNotMyCode also came across a transaction that cries out for explanation. He recalls via Twitter that this year IOTA sales in the volume of just over 10 million euros caused suspicion of insider trading. IOTA boss Dominik Schiener wanted to investigate the matter, but remained guilty of resilient answers. However, his statement that the wallets involved in the suspicious sales could not be attributed to the foundation or its employees is cracked. Because at least one transaction (here) shows that at the end of November, 20 Ti IOTA (worth around 8 million euros) flowed to the IOTA Foundation, and from precisely one of the wallets that was known through possible insider trading. Neither Schiener nor the foundation have commented on this transaction now, leaving speculation to run wild.

EVM for smart contracts in the IOTA ecosystem delayed.

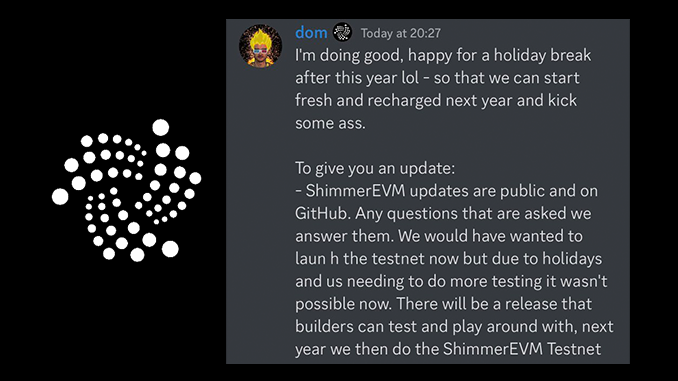

Elsewhere, the IOTA Foundation is also disappointing with unfulfilled promises. As reported by IOTAPoet via Twitter, Schiener has admitted that the integration of the Ethereum Virtual Machine (EVM) is significantly delayed. The EVM is an established standard for smart contracts in the crypto industry and was supposed to be incorporated into the ecosystem promptly via the IOTA side project Shimmer (SMR). But now a test run on the testnet is not targeted until early 2023, making a launch on the mainnet not realistically possible until mid-2023.

The EVM integration, which the IOTA Foundation said was imminent as recently as September, is central to the strategy of opening up the ecosystem to use cases in areas such as decentralized finance (DeFi). For this reason, the delays provoke significant criticism from investors, who also find fault with the communication policy of Schiener and the IOTA Foundation.

Conclusion: IOTA loses ground to competitors

IOTA’s recent incidents and delays fit with a messed-up year. In January, IOTA was trading above $1 and has now fallen back to levels below $0.20. Of course, the environment must also be factored in; crypto markets have suffered losses across the board in 2022. However, IOTA has also fallen out of the list of the 50 most capitalized cryptocurrencies this year and is currently struggling to at least remain in the TOP 70. This development shows how other projects are passing IOTA by. One reason for this is that when Aptos (APT) or Apecoin (APE) were launched, for example, the projects were able to rely on hundreds of millions of venture capital. The IOTA Foundation does not have such well-filled coffers for advertising and further development and therefore has a hard time competing – regardless of whether the competition is really further ahead in terms of content and technology.

Leave a Reply