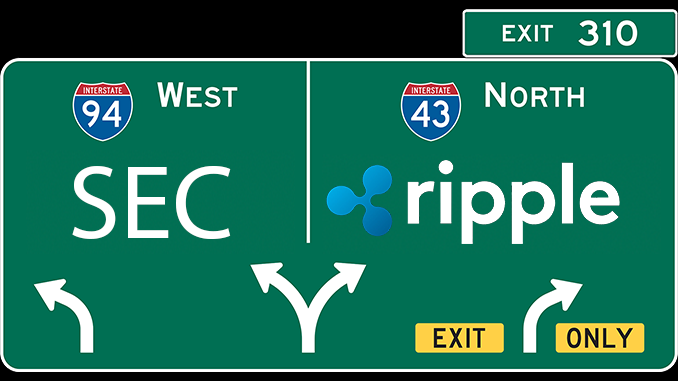

Since December 2020, Ripple has been on trial for XRP, sued by the US Securities and Exchange Commission (SEC). Now the verdict is due. In the waiting period, prominent representatives of the crypto scene are considering what the case could entail.

When the power-conscious U.S. Securities and Exchange Commission (SEC) filed suit against Ripple (XRP) two years and three months ago, the demanded damage payments of at least 1.3 billion U.S. dollars already made it clear: This is not a dispute about trifles, but an example is to be made. With XRP, the SEC took on a cryptocurrency that is one of the ten most important worldwide in terms of market capitalization. The SEC’s reasoning for wanting to classify XRP as a security could generally apply to most cryptocurrencies. However, Ripple did not agree to an out-of-court settlement and decided to seek a court ruling. Evidence gathering and submissions have now been completed and the judge in New York is working on her ruling, which is expected in Q2 2023. But what will happen afterwards?

The U.S. trade portal “The Block” has interviewed half a dozen independent experts who venture a view on the consequences of SEC vs. Ripple. If the SEC gets its way, it will likely target other cryptocurrencies, expects Aaron Kaplan, co-founder of crypto firm Prometheum, for example. Crypto exchanges, too, would then have to increasingly worry about falling under SEC regulation simply by offering trading in controversial altcoins. Gary DeWaal, a lawyer at crypto law firm Katten, takes a somewhat more nuanced view of the situation. He points to the LBRY case, where a court on appeal found the initial sale of the token illegal but ruled resales on secondary markets such as crypto exchanges permissible, even if the SEC protested.

Of course, there were also questions about what might be on the horizon if Ripple emerges victorious in the mammoth trial. Agnes Gambill West, a visiting researcher at the Mercatus Center think tank, sees one detail in particular as groundbreaking. That’s because Ripple is invoking the right of fair defense (“fair notice”) and believes the SEC took action far too late. West believes that if Ripple scores with this argument, other cryptocurrencies and projects will also benefit from it in the future. Because in fact, the SEC has so far failed to present clear regulations for Bitcoin and co. and does not cut a particularly good figure when digging up procedures from years ago. Teddy Ty Gellasch, who used to work at the SEC himself, believes it is quite possible that only a legal success of Ripple with XRP will ensure that U.S. policymakers, SEC and other authorities enter into a constructive dialogue with the crypto industry to develop meaningful and practical legislation.

Bottom line: Ripple and XRP in a clinch with the SEC.

XRP has seen a positive price curve in 2023 and even managed to stage its own rally recently. Here, investors are apparently speculating that Ripple will outdo the SEC with its defense strategy and that XRP will make a comeback in the US. In addition, it is becoming increasingly clear how the crypto industry is longing for at least a partial success for XRP, so that the SEC does not start a round robin. But it is impossible to predict which of the two parties will finally rejoice – even an appeal is not excluded.

Leave a Reply