The recent positive price jumps of Binance Coin (BNB) came as a surprise to some. This is because one of the main reasons is the rebalancing of Binance Smart Chain, which is a technological issue.

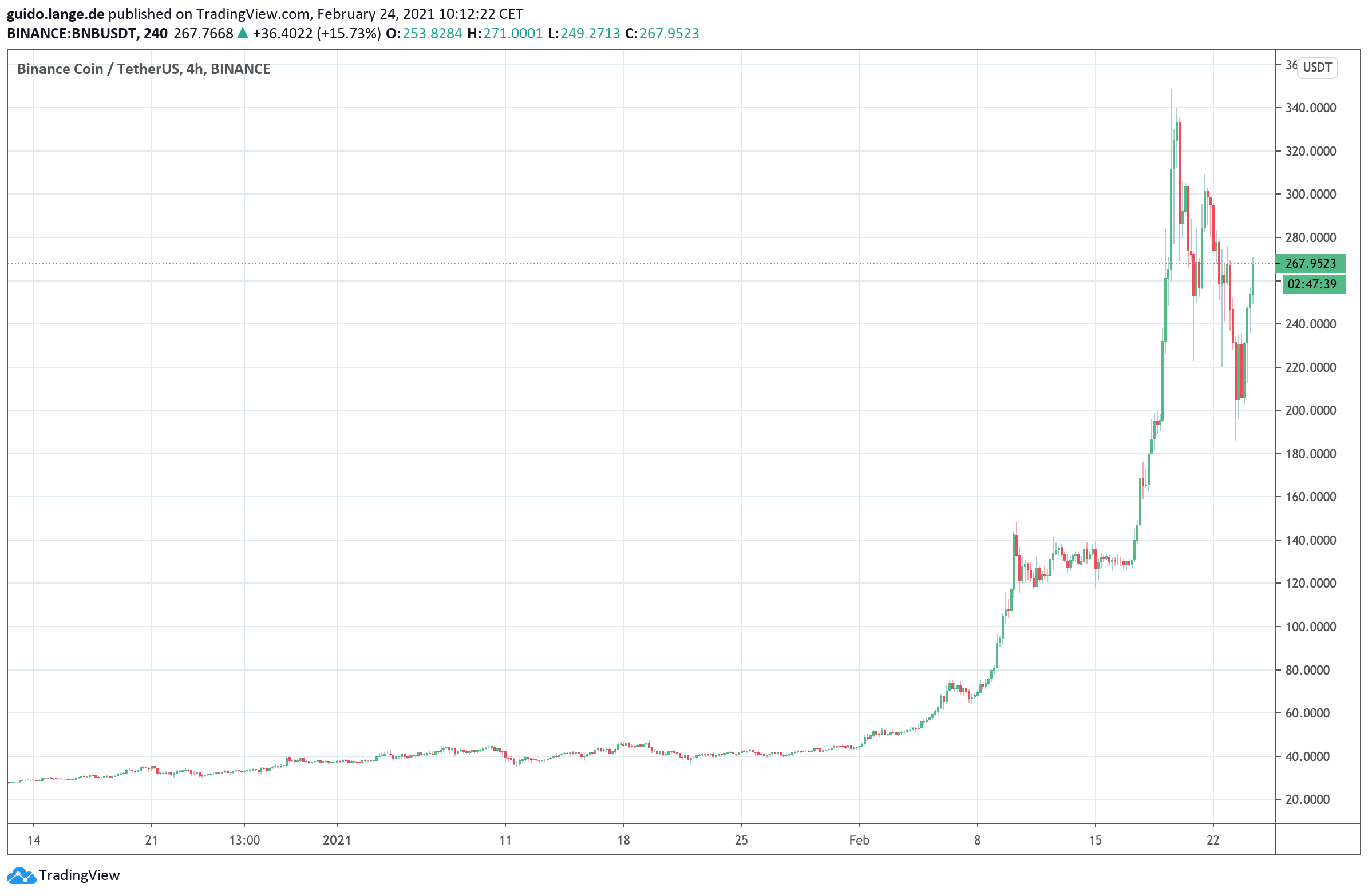

Binance Coin (BNB) is the star among major cryptocurrencies in terms of price gains in the month of February, with 600 percent gains at times and new all-time highs. Now that BNB has moved up to number three among the most capitalized cryptocurrencies, the question is: Can Binance Coin also attack number two Ethereum (ETH)? Under some circumstances, yes, is the answer, and that has crucially to do with the Binance Smart Chain (BSC).

Background on the Binance Smart Chain

Originally, BNB was an ERC-20 token and thus technologically anchored in the Ethereum ecosystem. In 2019, BNB then switched to its own blockchain, which was then called Binance Chain. Since spring 2020, the Binance Chain has been expanded to include crucial functionalities such as smart contracts and and now goes by the name BSC. The really smart, clever thing about it is that the new Binance Smart Chain can do everything that made Ethereum so great. With the big plus of relying on proof-of-stake as a protocol from the start, allowing it to push through far more transactions per second than Ethereum, where proof-of-work continues to block scalability.

When the DeFi division rapidly picked up steam in the summer of 2020, projects were still focused on the Ethereum environment throughout. But the ever-increasing turnover quickly led to DeFi losing its appeal for small investors, as transaction fees (gas fees) on ETH rose to the equivalent of $10 or more on average.

In parallel, Binance had already started actively promoting DeFi on the BSC to attract innovative developers. By now, there is basically a copy for every major DeFi project under Ethereum on the Binance Smart Chain. UniSwap and PancakeSwap, Compound (COMP) and Venus, Yearn and Autofarm are the names of the pairs, for example. The imitators of the pioneers do not even hide being largely copy-cats. They prefer to additionally point out to score by much lower fees. Moreover, BSC is also open to transactions from the Ethereum ecosystem and attracts notable capital from there.

Skeptics complain that the BSC is not a truly decentralized blockchain because the 21 nodes are operated by Binance itself or close allies. From a technological point of view, they are right – but on the other hand, Binance is certainly not interested in jeopardizing its lucrative core business by manipulating the BSC.

Conclusion: Bright prospects for DeFi in the Binance ecosystem

Sometimes underestimated in connection with the Binance Smart Chain is the capital from China. There, omens for a second giant push in terms of DeFi are accumulating and there, the young BSC projects have a completely different market presence than those from the universe of Ethereum, which often also has to do with language issues. The only known possible weakness of BSC, the lack of decentralization, does not seem to bother Chinese investors.

Thus, in principle, there are two simultaneous races between BNB and ETH:

1. Ethereum wants to convert its blockchain to the future-proof pro-of-stake protocol and has also already begun the transformation to ETH 2.0. However, no one expects a completion before the end of 2021 and it is by no means certain whether an interim solution will be accepted in order to lower Ethereum’s transaction fees in any case.

2. Binance, in turn, wants to withdraw liquidity from DeFi under Ethereum in addition to fresh capital flowing directly into BSC. Capital tied up there is currently on the order of $40 billion, which is a good 20 percent of Ethereum’s market capitalization, which currently stands at around $185 billion. By comparison, BNB is now backed by just under 40 billion US dollars.

This field of tension is likely to decide which ecosystem will take the reigns in the DeFi division. The challenger BSC is no longer an underdog. In its case, the positive side effects include Binance’s huge customer base, which often already owns BNB, and the determination with which Binance is pushing its BSC and does not have to take any miners into consideration. Ethereum, which is used to success, should be prepared for a tough competition with Binance Coin in 2021.

Open a Binance Account here and save 10% on fees for a lifetime.

Leave a Reply