Bitcoin Transaction Fees are the fees that are charged for a transfer from BTC. Everything you need to know about them is explained here.

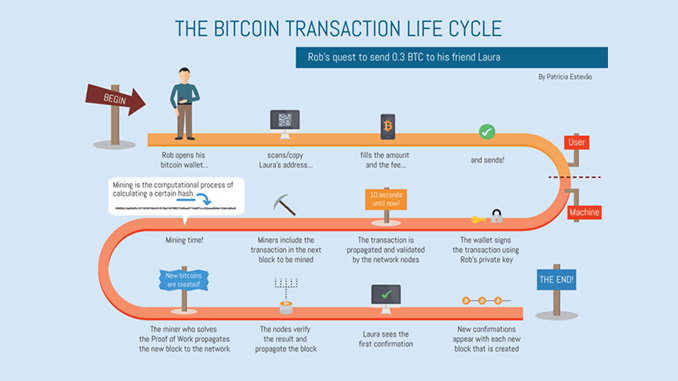

Bitcoin (BTC), historically the first crypto currency, is anchored in the concept of avoiding any influence from banks and politics. This is made visible by the fact that BTC can be sent from A to B worldwide without the intervention of a trustee. The task of handling the transfer is handled by Blockchain. In each new block, network members (miners) confirm transfers from BTC and document the transfer transparently and tamper-proof. The sender pays a Bitcoin transaction fee for this, while the recipient receives the transfer free of charge.

A block at Bitcoin has a maximum size of 1 MB, which also limits the number of transactions it contains. On average, the block chain of Bitcoin can process around 7 transactions per second and a new block is generated approximately every 10 minutes. These facts lead to the situation that there are usually more transactions waiting to be executed than there is free space in the next block. The transactions waiting for confirmation are listed in the so-called mempool. From this, miners select which transactions they want to confirm. The Bitcoin transaction fee is the decisive point here, because if higher fees are offered, miners prioritize the corresponding transfer.

Bitcoin transaction fees in practice

The principle of Bitcoin transaction fees logically means that their amount is influenced by the current network load. If many transactions are waiting for confirmation, senders are more willing to pay higher Bitcoin transaction fees to shorten the waiting process. BTC Wallets usually have a built-in mechanism that automatically takes into account the fluctuations in Bitcoin transaction fees and suggests values that are appropriate to the market situation. Often you will have the choice between a regular fee and a priority fee. With a priority fee, a transaction should be confirmed in less than 60 minutes. With a regular fee, validation can mean waiting several hours.

Current values for Bitcoin transaction fees can be found at providers like YCharts. Bitcoin transaction fees are paid in BTC, usually converted into US dollars. On normal trading days in the summer of 2020, you will have to allow for between 0.50 and 2 US dollars as a Bitcoin transaction fee for a transfer. The amount does not depend on how many BTC you want to transfer, but on the network load. When Bitcoin experienced a boom and all-time high in December 2017, Bitcoin transaction fees also shot up, reaching peaks of up to $55.

Bitcoin Transaction Fees and Block Rewards

In practice, you should rely on the bids for the Bitcoin transaction fee suggested by your wallet and not enter your own values. At Ethereum (ETH), for example, completely excessive transaction fees have repeatedly caused ridicule in the crypto scene.

Bitcoin transaction fees should not be confused with the block rewards that miners receive from BTC for a new block, which, according to the Bitcoin Halving from May 2020, currently amount to 6.25 BTC. Block Rewards are “new” BTCs that will come into circulation, while the Bitcoin Transaction Fees will come from existing credits. Block Rewards are still the main business for Miner, but the importance of Bitcoin transaction fees for their business is increasing.

So don’t be surprised if the topic of Bitcoin transaction fees is experiencing considerable momentum in boom times. Ultimately, however, these fees are also a guarantee that miners will keep BTC’s block chain active and stable and thus make transfers possible in the first place.

Best place to buy Bitcoin:

Leave a Reply