Analysts from Coin Metric have examined the daily trading of Bitcoin (BTC) from the perspective of institutional investors. There are five exciting details that are also of importance for private investors.

The interest of institutional investors in Bitcoin (BTC) is constantly growing. And this trend is strengthened not least by the current monetary policy, which, in the wake of the Corona crisis, is fuelling the danger of inflation with aid packages worth billions. Based on this scenario, experts from Coin Metrics have prepared an analysis that could be a basis for institutional investors to decide whether it is worthwhile investing in Bitcoin. What they have compiled in the process should also interest you.

Background on the global market for Bitcoin

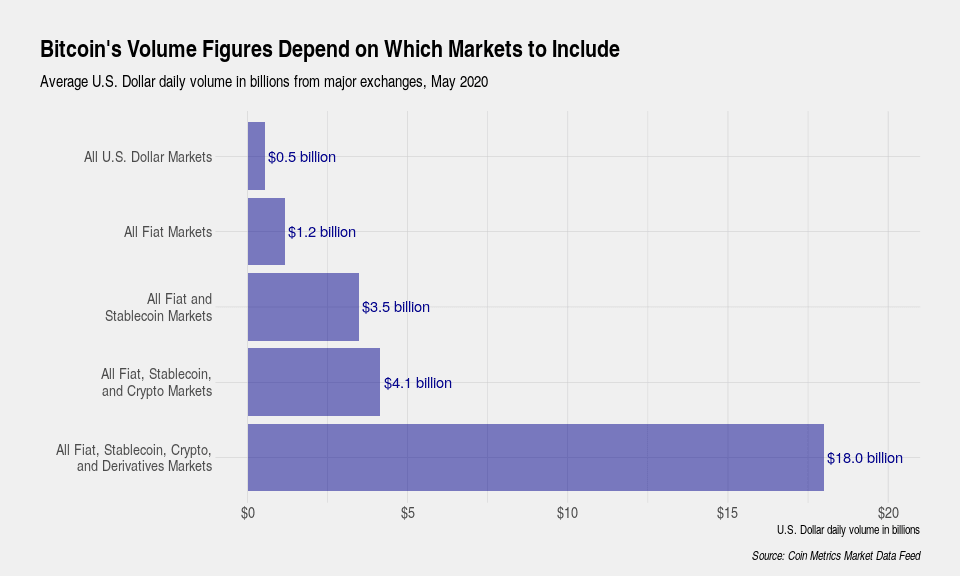

1. Investors want to know the size of a market, i.e. whether there is liquidity In the case of Bitcoin, the study comes to 0.5 billion US dollars, which are turned over daily in US dollars. If you add other fiat currencies to this figure, it is already 1.2 billion US dollars. But only with the inclusion of tether (USDT) and other stablecoins does the volume grow to USD 3.5 billion, and if we include Altcoins as a currency in Bitcoin trading, the volume increases to USD 4.1 billion. If BTC derivatives such as Bitcoin futures and options are also included, the daily market makes a huge leap to a volume of 18 billion US dollars.

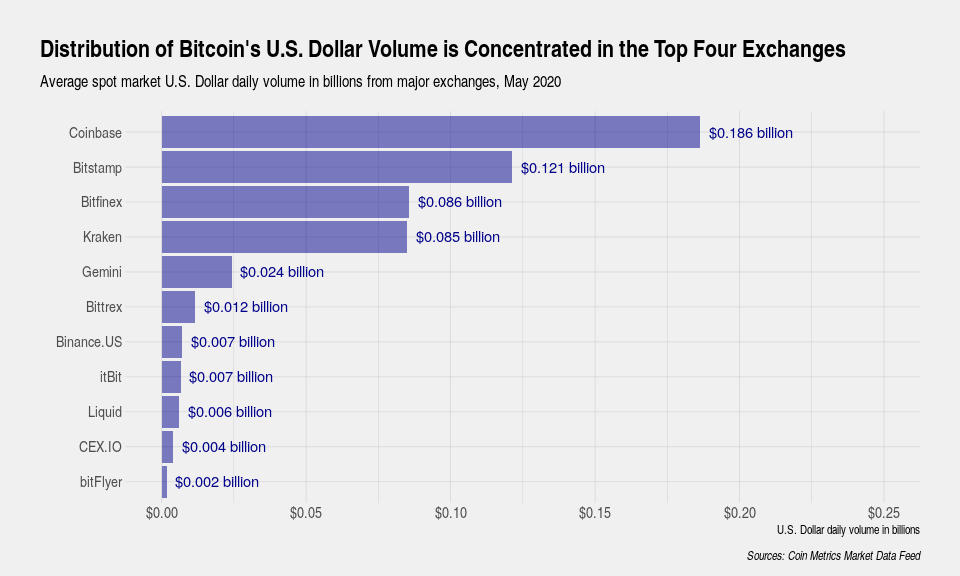

2. Thus, if institutional investors want to put US dollars into Bitcoin, avoiding to occupy more than 1 percent of the daily volume, it could just accommodate 5 million US dollars. And even that would not be easy, because there are four crypto exchanges that dominate this market BTC against US dollars in Fiat, namely Coinbase, Bitfinex, Bitstamp and Kraken.

Thus, an institutional investor wishing to swap Fiat for BTCs on a large scale, while avoiding any suspicion of dominance, would probably have to set up a new department at present, but one that would manage only relatively small volumes.

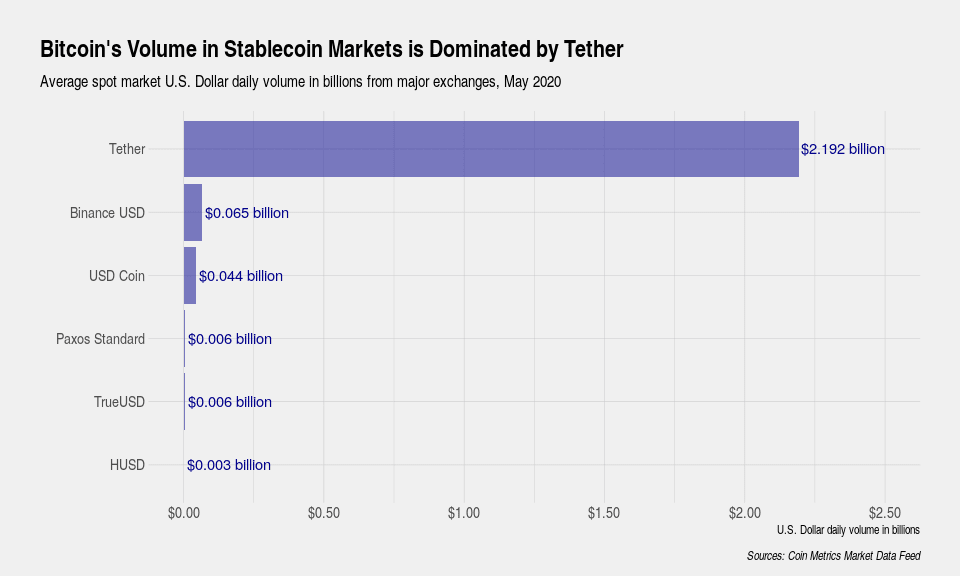

3. One way out of the predicament would be Stablecoins. Tether (USDT) dominates the scene there and brings with it the problem of being in a legal grey area. To this extent, analysts consider the use of tether for institutional investors to be virtually impossible, and other, better regulated stablecoins do not, in their view, generate sufficient volume.

4. Experts also remain very sceptical from the point of view of institutional investors with regard to the approach of switching to BTC derivatives. Although significant capital is moved there, the contractual conditions are not very comparable, do not always conform to US law and are therefore probably excluded for most institutional investors. Nevertheless, it is impressive how BTC derivatives have outperformed the spot markets in terms of volume.

Conclusion: Bitcoin only mature enough for a few institutional investors

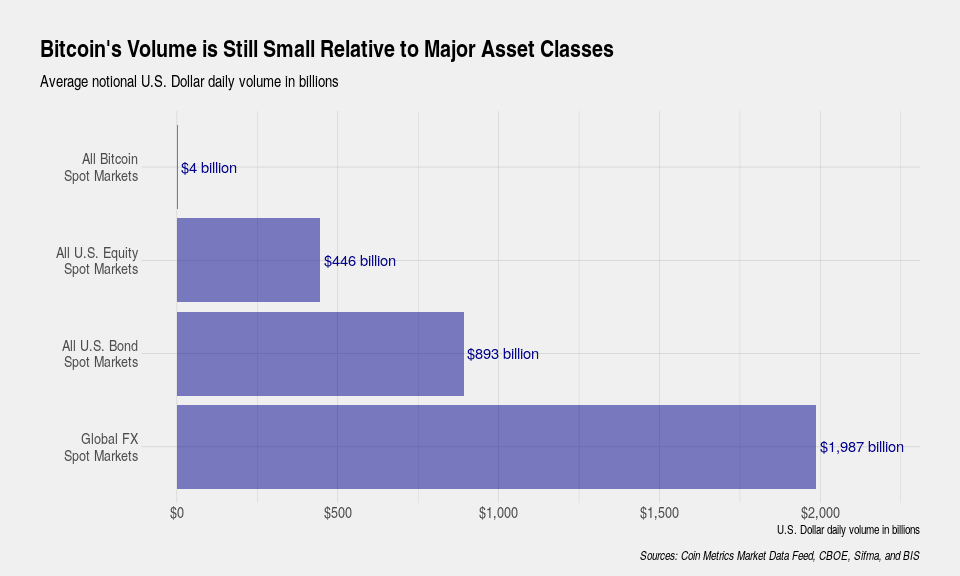

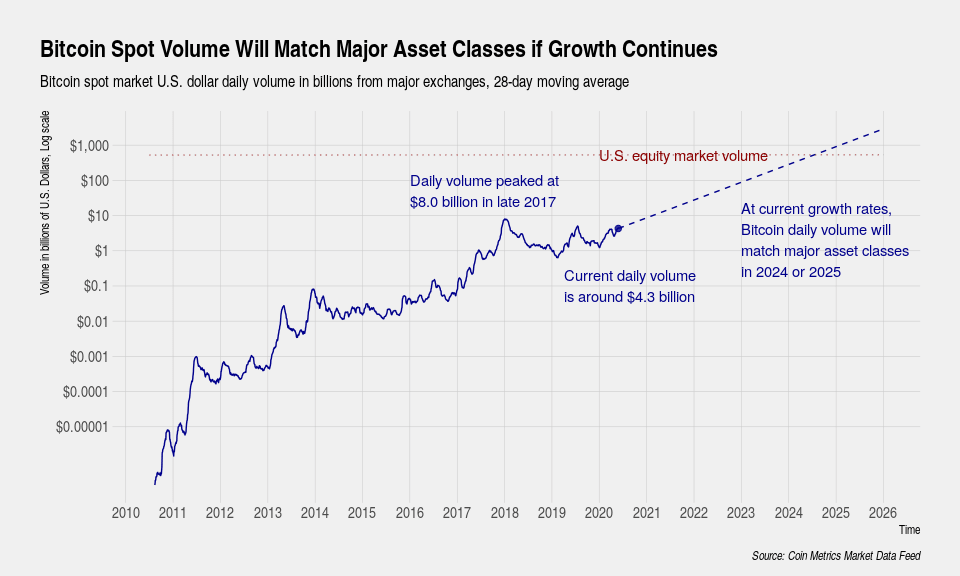

Now Coin Metrics is in principle positive towards crypto currencies and so the analysis also shows a conciliatory outlook. The authors have compared the 4.1 billion US dollars daily volume in Bitcoin (Fiat, Stablecoins and crypto currencies) with US equity markets and bond markets.

According to this, the Bitcoin Sport markets are currently in daily trading more comparable to the shares of a large company. This does not yet result in a separate asset class. But if the trends in the market for BTC are continued, it would probably be 2024 when the volumes in trading with BTC (without derivatives) would reach such a level that they could be considered a separate asset class and at the latest then also belong in the portfolios of institutional investors.

All in all, the Coin Metric study thus follows the latest assessment by Goldman Sachs, according to which Bitcoin is not yet ready for institutional investors despite all chances of profit. But it should also be noted that other experts, especially from the hedge fund sector, see this quite differently, advising their customers with a willingness to take risks to use Bitcoin in order to decouple themselves from the dangers of inflation.

Best place to buy Bitcoin:

Leave a Reply